Pool products retailer Leslie’s (NASDAQ: LESL) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 8% year on year to $397.9 million. Next quarter’s revenue guidance of $172.5 million underwhelmed, coming in 3.4% below analysts’ estimates. Its non-GAAP profit of $0.02 per share was 82.1% below analysts’ consensus estimates.

Is now the time to buy Leslie's? Find out by accessing our full research report, it’s free.

Leslie's (LESL) Q3 CY2024 Highlights:

- Revenue: $397.9 million vs analyst estimates of $405.2 million (8% year-on-year decline, 1.8% miss)

- Adjusted EPS: $0.02 vs analyst expectations of $0.11 (82.1% miss)

- Adjusted EBITDA: $42.97 million vs analyst estimates of $57.53 million (10.8% margin, 25.3% miss)

- Revenue Guidance for Q4 CY2024 is $172.5 million at the midpoint, below analyst estimates of $178.6 million

- Adjusted EPS guidance for Q4 CY2024 is -$0.21 at the midpoint, below analyst estimates of -$0.19

- EBITDA guidance for Q4 CY2024 is -$28 million at the midpoint, below analyst estimates of -$21.65 million

- Operating Margin: 6.6%, down from 8.9% in the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 16.1% in the same quarter last year

- Locations: 1,000 at quarter end, down from 1,008 in the same quarter last year

- Same-Store Sales fell 8.3% year on year (-11% in the same quarter last year)

- Market Capitalization: $589.9 million

Jason McDonell, Chief Executive Officer, said, “Our fourth quarter results were in line with our revised expectations on the top-line, and we saw strong performance in our Pro segment with some continued softness in store traffic and larger-ticket and discretionary categories. Profitability was affected by deleverage from the sales decline and a one-time contract item, though we have remained disciplined on SG&A expenses.”

Company Overview

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ: LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Leslie's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

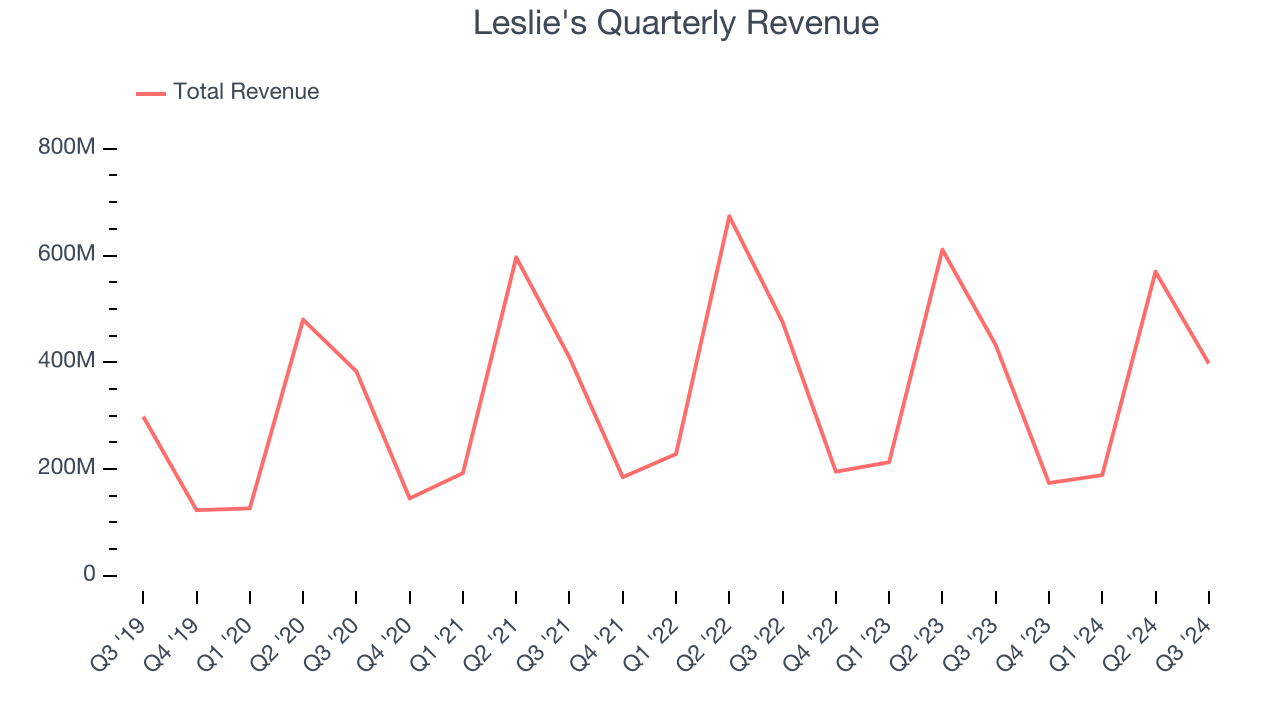

As you can see below, Leslie’s 7.5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid.

This quarter, Leslie's missed Wall Street’s estimates and reported a rather uninspiring 8% year-on-year revenue decline, generating $397.9 million of revenue. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a slight deceleration versus the last five years. This projection is still commendable and implies the market is baking in success for its products.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

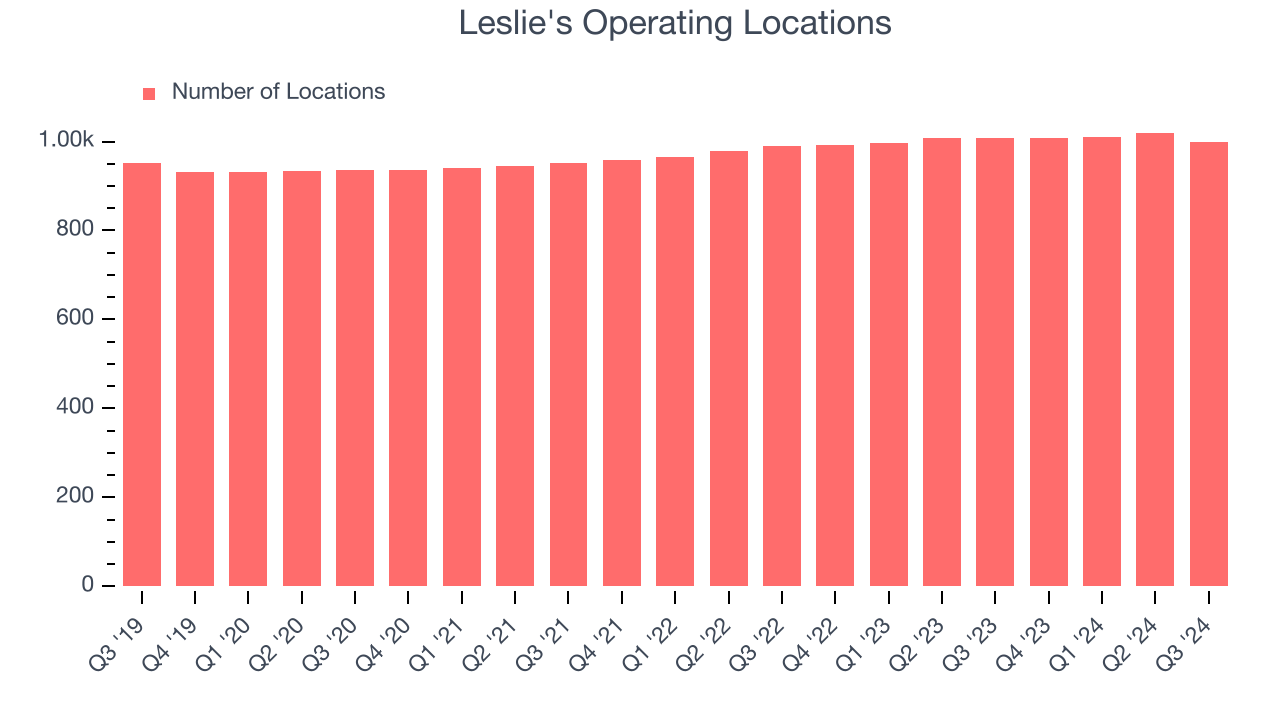

Leslie's sported 1,000 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 1.8% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at shops open for at least a year.

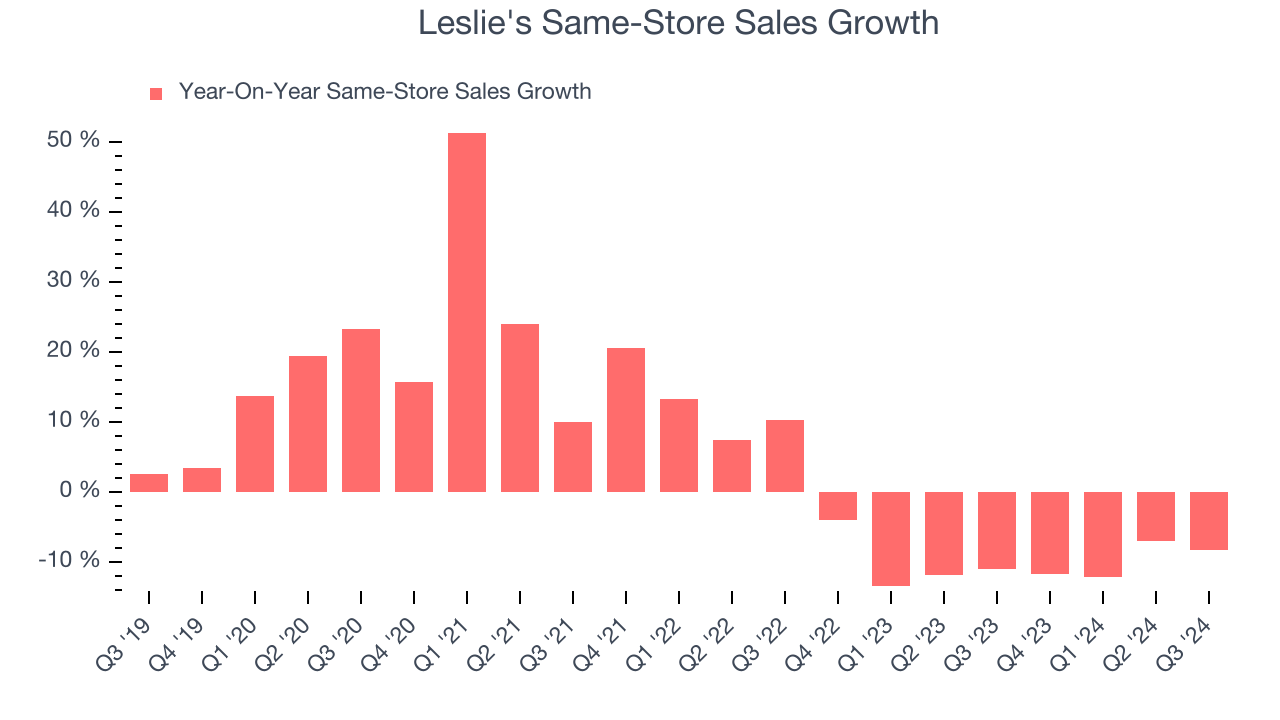

Leslie’s demand has been shrinking over the last two years as its same-store sales have averaged 9.9% annual declines. This performance is concerning - it shows Leslie's artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Leslie’s same-store sales fell by 8.3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Leslie’s Q3 Results

We struggled to find positives in these results as all key metrics along with its outlook missed Wall Street’s estimates. The stock traded down 19.9% to $2.82 immediately following the results.

Leslie's may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.