Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Delta Air Lines (NYSE: DAL) and its peers.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 16 travel and vacation providers stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.9% below.

Luckily, travel and vacation providers stocks have performed well with share prices up 13.9% on average since the latest earnings results.

Delta Air Lines (NYSE: DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

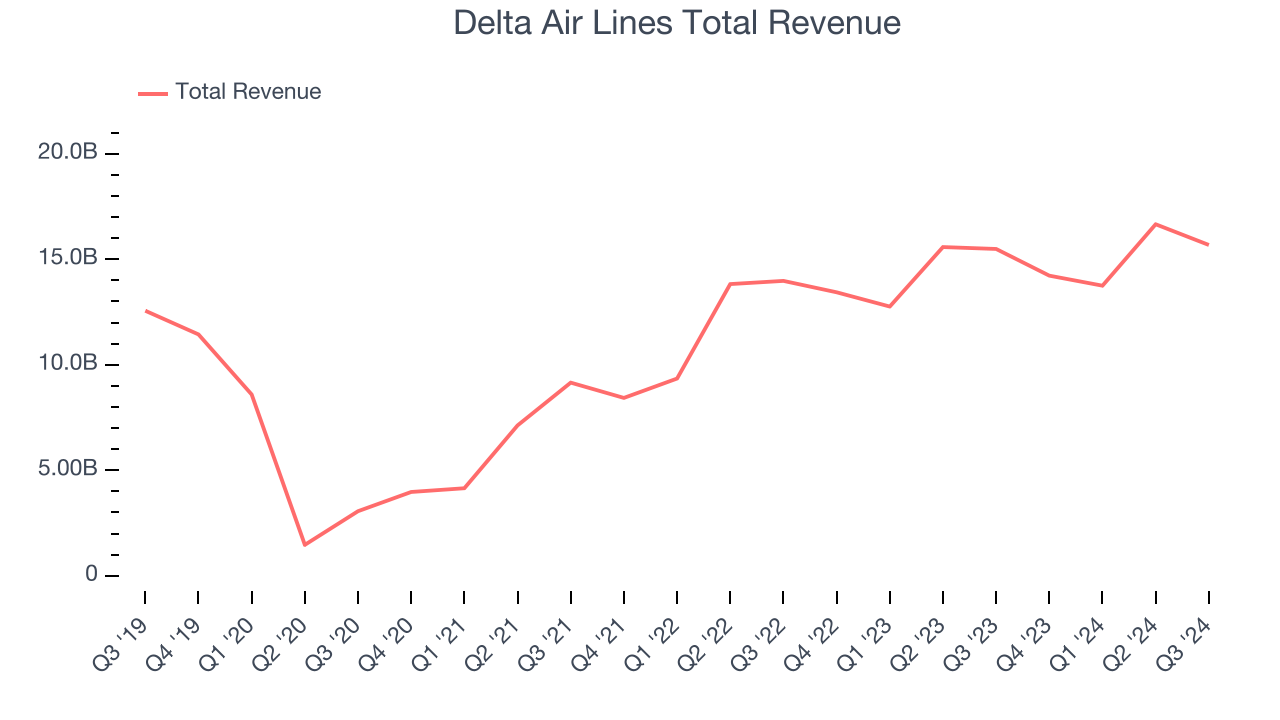

Delta Air Lines reported revenues of $15.68 billion, up 1.2% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was an ok quarter for the company with a miss of analysts’ non-GAAP EPS.

"Thanks to the exceptional work of the entire Delta team, we continue to lead the industry operationally and financially, with a double-digit operating margin and nearly $3 billion of free cash flow generation year-to-date. In recognition of the outstanding efforts of our employees this year, we have accrued almost $1 billion of profit sharing towards the upcoming February payout," said Ed Bastian, Delta's chief executive officer.

Interestingly, the stock is up 26.9% since reporting and currently trades at $64.73.

Is now the time to buy Delta Air Lines? Access our full analysis of the earnings results here, it’s free.

Best Q3: Playa Hotels & Resorts (NASDAQ: PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ: PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $183.5 million, down 13.9% year on year, outperforming analysts’ expectations by 4.1%. The business had a stunning quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $9.74.

Is now the time to buy Playa Hotels & Resorts? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sabre (NASDAQ: SABR)

Originally a division of American Airlines, Sabre (NASDAQ: SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $764.7 million, up 3.3% year on year, falling short of analysts’ expectations by 1.4%. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates. In addition, EBITDA guidance for the next quarter missed analysts’ expectations.

Sabre delivered the weakest full-year guidance update in the group. As expected, the stock is down 10.4% since the results and currently trades at $3.69.

Read our full analysis of Sabre’s results here.

Norwegian Cruise Line (NYSE: NCLH)

With amenities like a full go-kart race track built into its ships, Norwegian Cruise Line (NYSE: NCLH) is a premier global cruise company.

Norwegian Cruise Line reported revenues of $2.81 billion, up 10.7% year on year. This result topped analysts’ expectations by 1.4%. Overall, it was a strong quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates.

The stock is up 15.5% since reporting and currently trades at $27.55.

Read our full, actionable report on Norwegian Cruise Line here, it’s free.

Lindblad Expeditions (NASDAQ: LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $206 million, up 17.1% year on year. This result surpassed analysts’ expectations by 6.3%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

The stock is up 42.1% since reporting and currently trades at $13.28.

Read our full, actionable report on Lindblad Expeditions here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.