Shareholders of Wayfair would probably like to forget the past six months even happened. The stock dropped 45.2% and now trades at $39.09. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Wayfair, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the more favorable entry price, we're swiping left on W for now. Here are three reasons why you should be careful with W and one stock we like more.

Why Do We Think Wayfair Will Underperform?

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

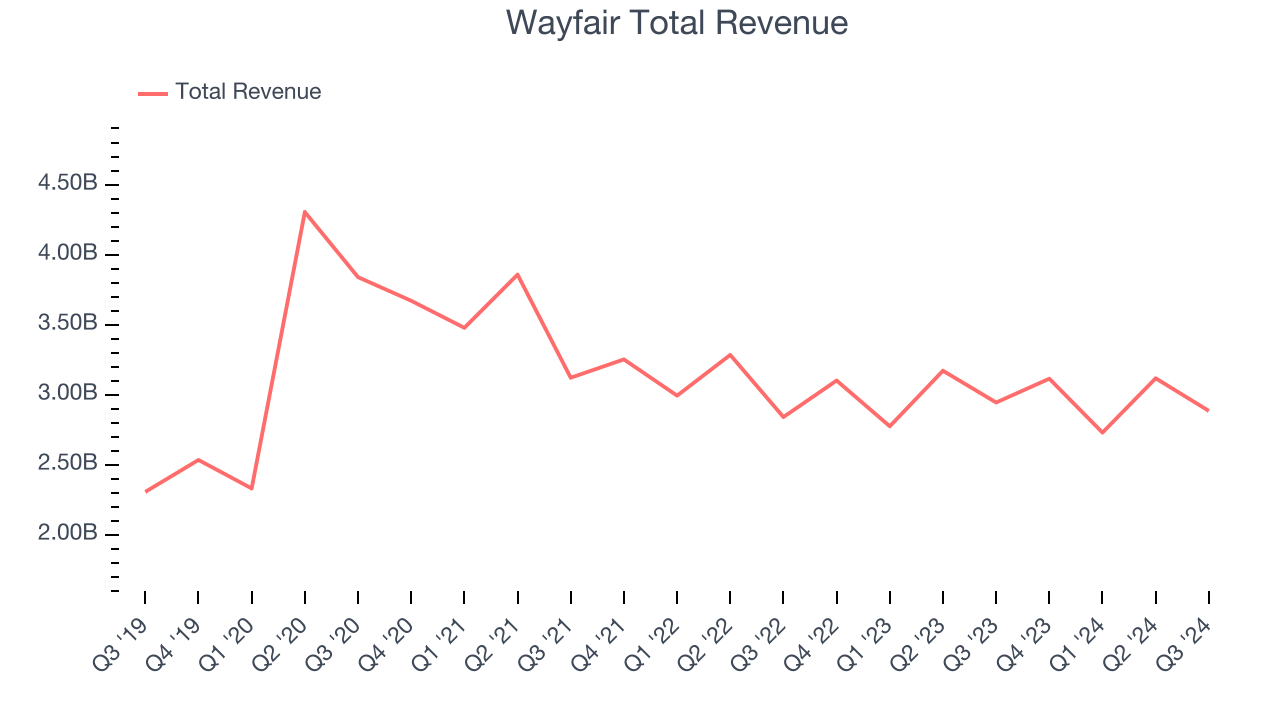

1. Revenue Spiraling Downwards Over the Long Term

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Wayfair struggled to generate demand over the last three years as its sales dropped by 5.7% annually.

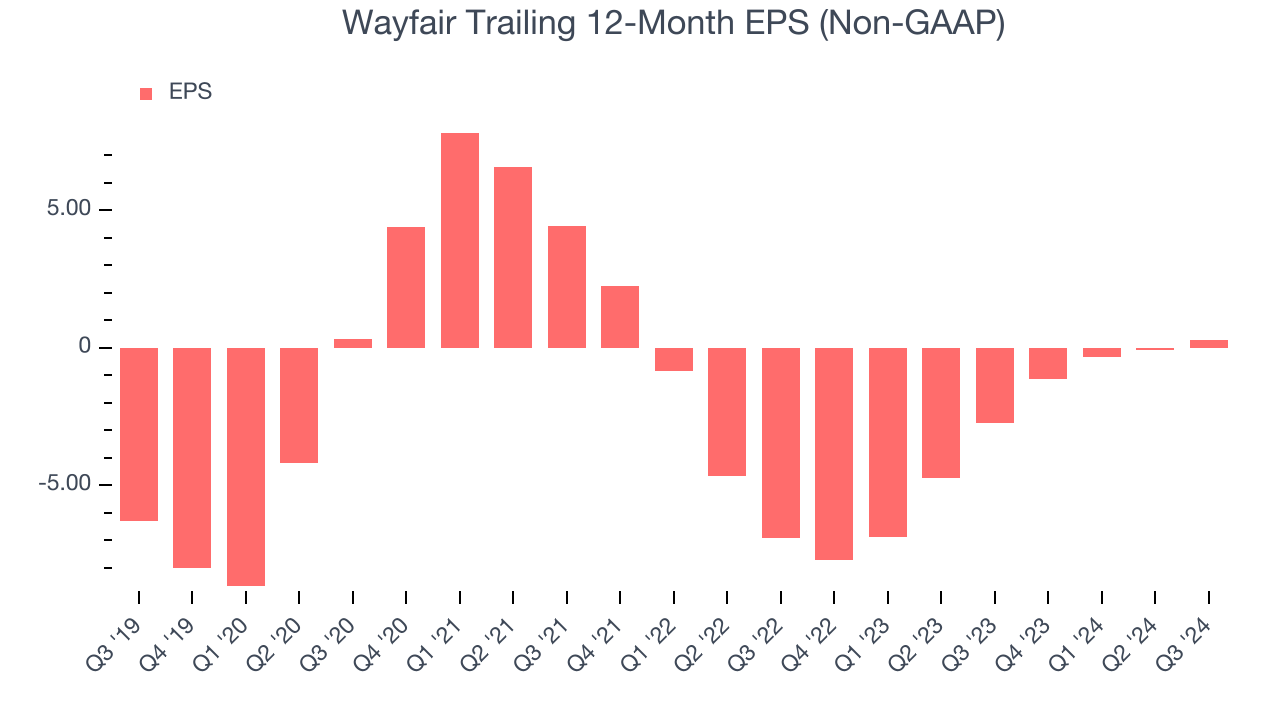

2. Profits Shrinking: Long-Term EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Wayfair, its EPS declined by more than its revenue over the last three years, dropping 60.3% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

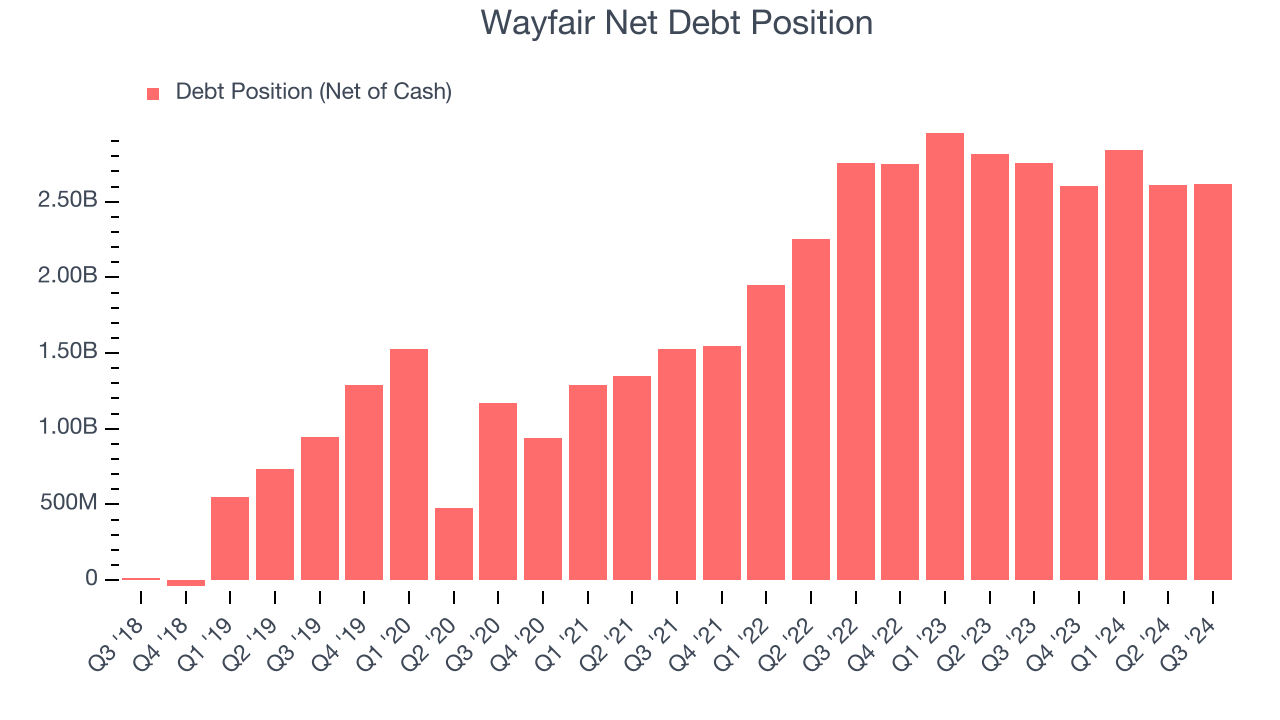

3. High Debt Levels Increase Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Wayfair’s $3.95 billion of debt exceeds the $1.33 billion of cash on its balance sheet. Furthermore, its 6x net-debt-to-EBITDA ratio (based on its EBITDA of $449 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Wayfair could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Wayfair can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Final Judgment

Wayfair falls short of our quality standards. Following the recent decline, the stock trades at 8x forward EV-to-EBITDA, or $39.09 per share. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. We think there are better opportunities elsewhere. For example take a look at Wingstop, one of the fastest growing restaurant franchises.

Stocks We Like More Than Wayfair

With rates dropping, inflation stabilizing and the elections in the rearview mirror, the market is primed for a potential catalyst — and we are picking the stocks that could benefit immensely.

Take advantage of the rebound by checking out our 9 Best Market-Beating Stocks. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.