The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how gig economy stocks fared in Q3, starting with Upwork (NASDAQ: UPWK).

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 6 gig economy stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was 1.6% above.

In light of this news, share prices of the companies have held steady as they are up 4.7% on average since the latest earnings results.

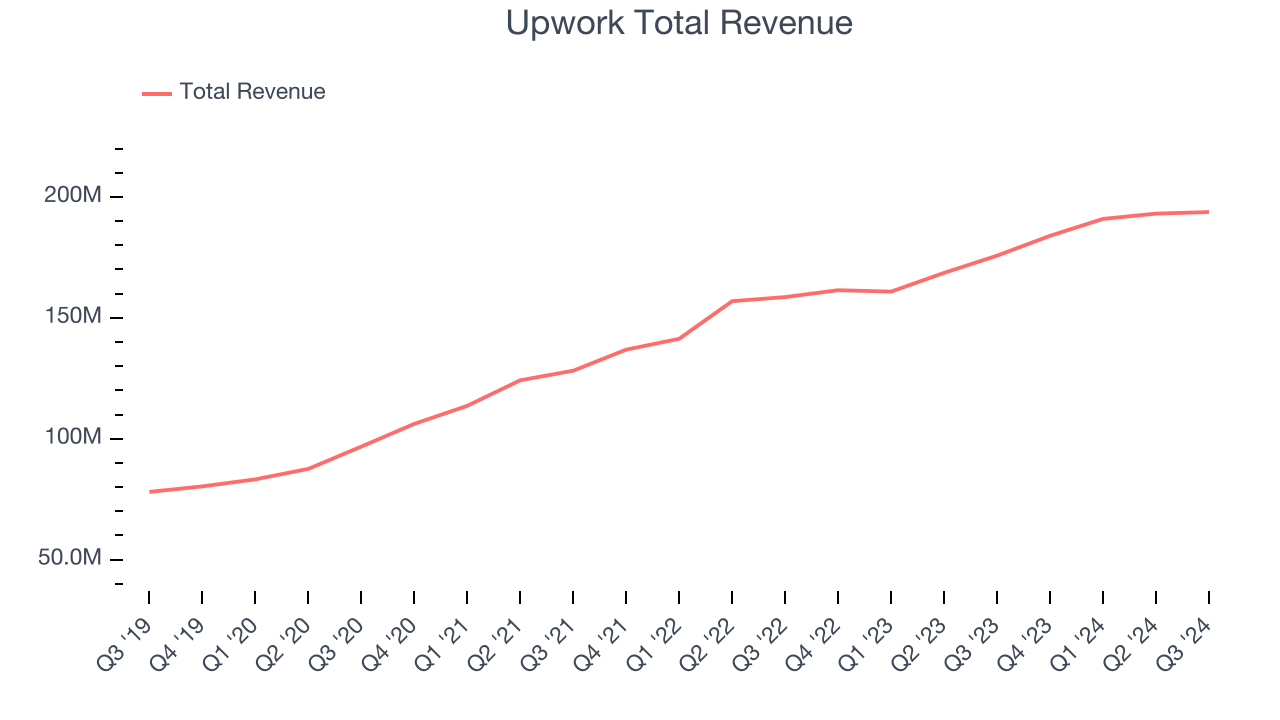

Upwork (NASDAQ: UPWK)

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ: UPWK) is an online platform where businesses and independent professionals connect to get work done.

Upwork reported revenues of $193.8 million, up 10.3% year on year. This print exceeded analysts’ expectations by 5.3%. Overall, it was a strong quarter for the company with optimistic EBITDA guidance for the next quarter and an impressive beat of analysts’ EBITDA estimates.

“Upwork continues to seize the tremendous market opportunity and execute our strategy to deliver durable, profitable growth, with 10% year-over-year revenue growth and our highest-ever net income in the third quarter,” said Hayden Brown, president and CEO, Upwork.

Upwork achieved the highest full-year guidance raise of the whole group. The company reported 855,000 gmv, up 2.3% year on year. Unsurprisingly, the stock is up 7.7% since reporting and currently trades at $15.73.

Is now the time to buy Upwork? Access our full analysis of the earnings results here, it’s free.

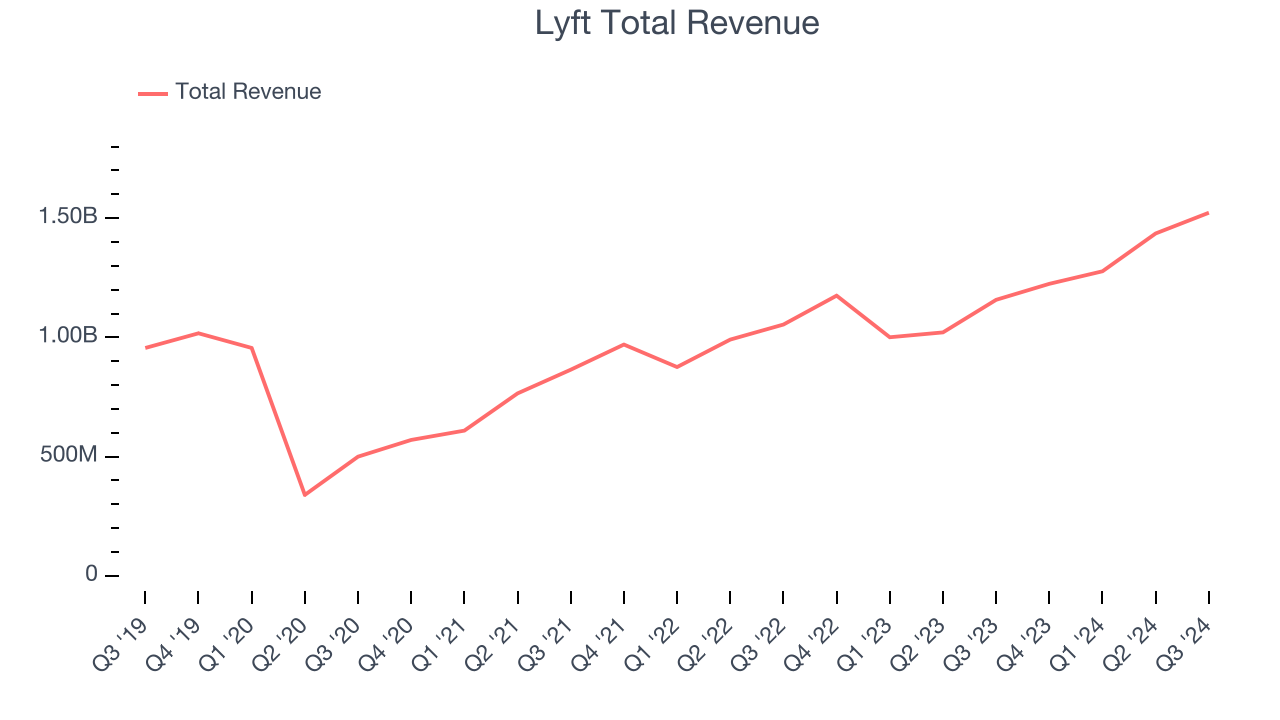

Best Q3: Lyft (NASDAQ: LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $1.52 billion, up 31.5% year on year, outperforming analysts’ expectations by 5.7%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and strong top-line growth.

Lyft scored the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 24.4 million users, up 8.9% year on year. The market seems happy with the results as the stock is up 27.3% since reporting. It currently trades at $18.33.

Is now the time to buy Lyft? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Angi (NASDAQ: ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $296.7 million, down 15.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a decline in its requests.

Angi delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 4.49 million service requests, down 26% year on year. As expected, the stock is down 26.4% since the results and currently trades at $1.94.

Read our full analysis of Angi’s results here.

Uber (NYSE: UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Uber reported revenues of $11.19 billion, up 20.4% year on year. This result surpassed analysts’ expectations by 1.9%. Overall, it was a satisfactory quarter as it also produced a decent beat of analysts’ EBITDA estimates.

The company reported 161 million users, up 13.4% year on year. The stock is down 10% since reporting and currently trades at $71.51.

Read our full, actionable report on Uber here, it’s free.

Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $99.63 million, up 7.7% year on year. This result surpassed analysts’ expectations by 3.4%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and optimistic EBITDA guidance for the full year.

Fiverr had the weakest full-year guidance update among its peers. The company reported 3.77 million active buyers, down 9.4% year on year. The stock is up 16.2% since reporting and currently trades at $29.12.

Read our full, actionable report on Fiverr here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.