Packaging Corporation of America (NYSE: PKG) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 12.7% year on year to $2.18 billion. Its GAAP profit of $2.64 per share was also 5.5% above analysts’ consensus estimates.

Is now the time to buy Packaging Corporation of America? Find out by accessing our full research report, it’s free.

Packaging Corporation of America (PKG) Q3 CY2024 Highlights:

- Revenue: $2.18 billion vs analyst estimates of $2.09 billion (4.4% beat)

- EPS: $2.64 vs analyst estimates of $2.50 (5.5% beat)

- EBITDA: $460.6 million vs analyst estimates of $442.1 million (4.2% beat)

- EPS (GAAP) guidance for Q4 CY2024 is $2.47 at the midpoint, beating analyst estimates by 1.4%

- Gross Margin (GAAP): 23.1%, up from 21.5% in the same quarter last year

- EBITDA Margin: 21.1%, up from 20% in the same quarter last year

- Market Capitalization: $19.54 billion

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “In the Packaging segment, we had great implementation of our previously announced containerboard and corrugated products price increases. Very strong demand throughout the quarter led to all-time quarterly records for containerboard production, total box shipments and shipments per day. We were able to meet this demand, and our customers’ quality and service needs, through the operational benefits of our capital spending program and the continued great focus and execution by our sales, customer service, mill and corrugated products plant employees. Our Paper segment had excellent results with our previously announced price increases implemented as planned, volume above forecasted levels, and well-managed mill operations. Fortunately, none of our facilities were significantly impacted by the two hurricanes during the quarter.”

Company Overview

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

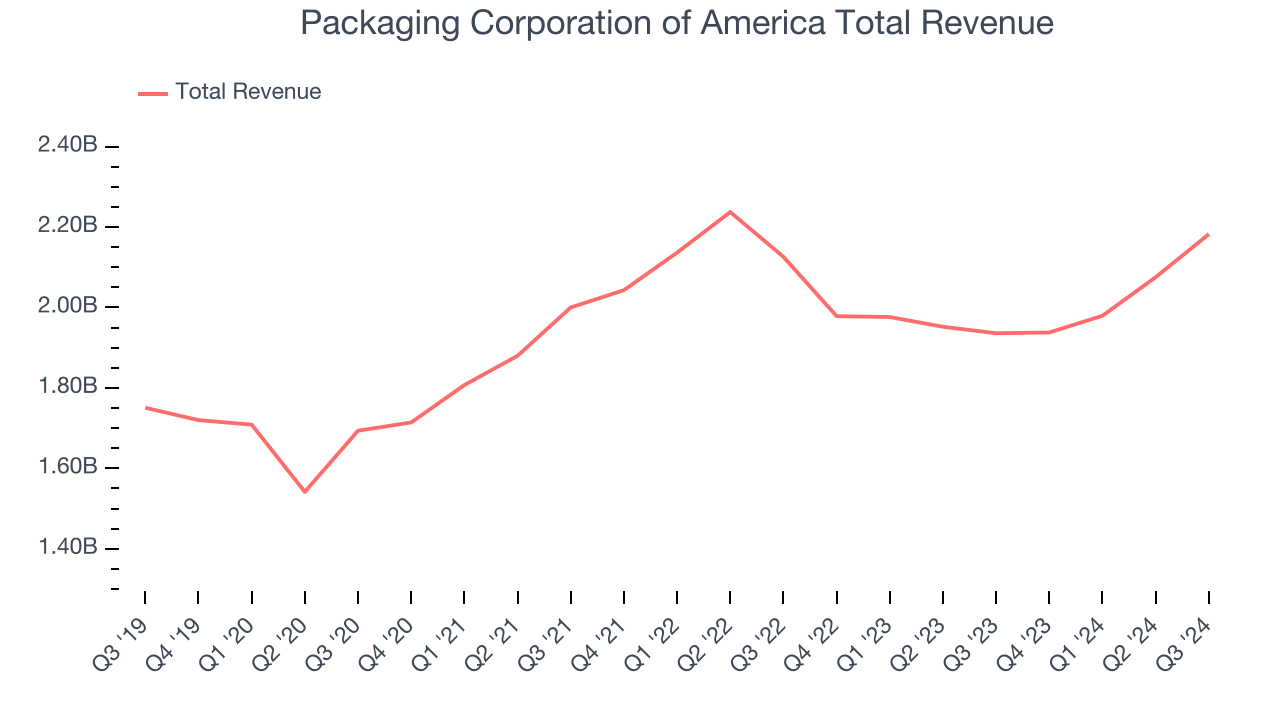

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Packaging Corporation of America’s sales grew at a sluggish 3.2% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Packaging Corporation of America’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.2% annually. Packaging Corporation of America isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Packaging Corporation of America reported year-on-year revenue growth of 12.7%, and its $2.18 billion of revenue exceeded Wall Street’s estimates by 4.4%.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, an acceleration versus the last two years. This projection is admirable and indicates the market thinks its newer products and services will catalyze higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

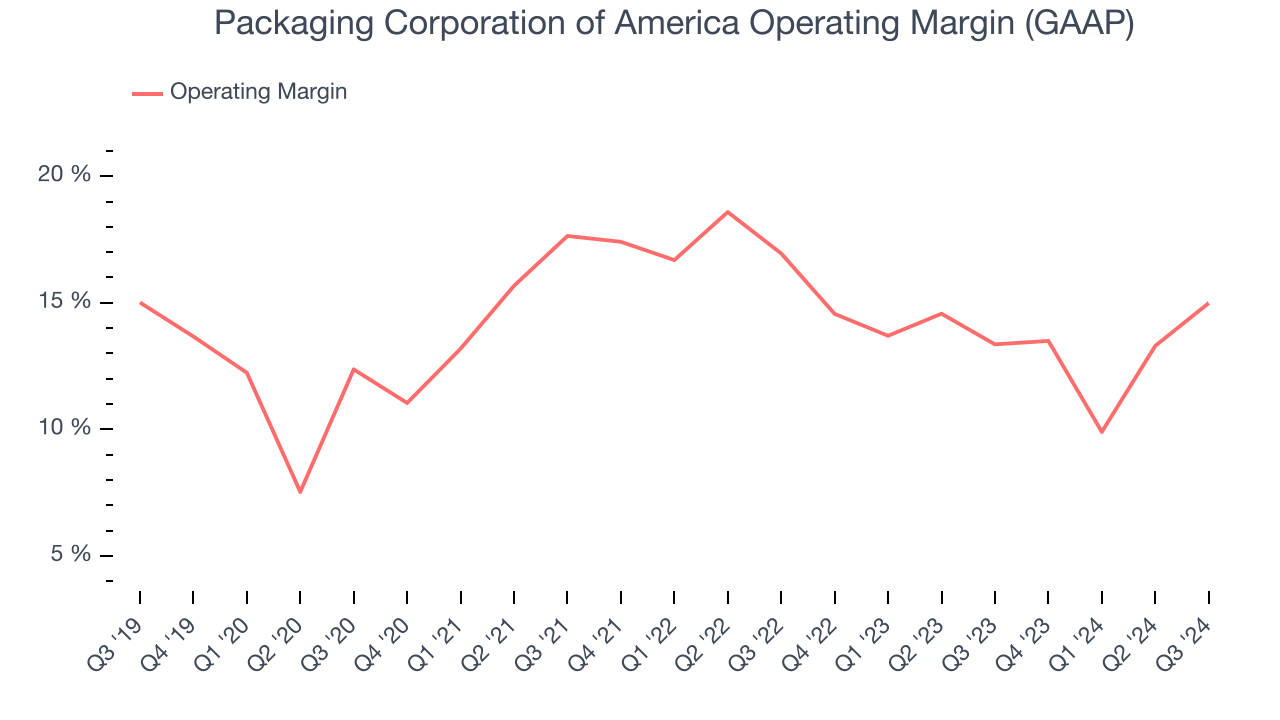

Operating Margin

Analyzing the trend in its profitability, Packaging Corporation of America’s annual operating margin rose by 1.4 percentage points over the last five years, showing its efficiency has improved.

This quarter, Packaging Corporation of America generated an operating profit margin of 15%, up 1.6 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

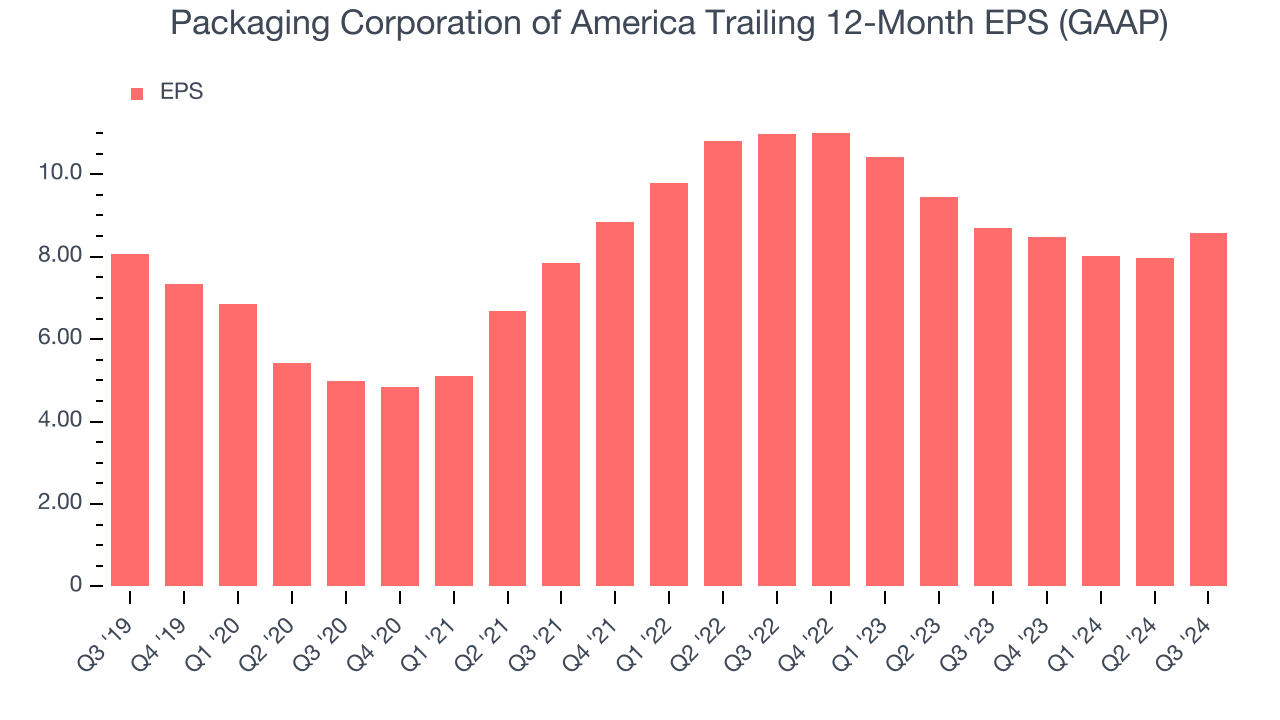

Earnings Per Share

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Packaging Corporation of America’s EPS grew at a weak 1.2% compounded annual growth rate over the last five years, lower than its 3.2% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. Packaging Corporation of America’s two-year annual EPS declines of 11.6% were bad and lower than its two-year revenue performance.

In Q3, Packaging Corporation of America reported EPS at $2.64, up from $2.03 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Packaging Corporation of America’s full-year EPS of $8.58 to grow by 21.4%.

Key Takeaways from Packaging Corporation of America’s Q3 Results

We were impressed by how significantly Packaging Corporation of America blew past analysts’ revenue expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 2.7% to $222.60 immediately after reporting.

Packaging Corporation of America put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.