Homebuilder NVR (NYSE: NVR) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 6.4% year on year to $2.73 billion. Its GAAP profit of $130.49 per share wasin line with analysts’ consensus estimates.

Is now the time to buy NVR? Find out by accessing our full research report, it’s free.

NVR (NVR) Q3 CY2024 Highlights:

- Revenue: $2.73 billion vs analyst estimates of $2.7 billion (1.2% beat)

- EPS (GAAP): $130.49 vs analyst expectations of $131.80 (in line)

- Adjusted Operating Income: $505.8 million vs analyst estimates of $505.1 million (small beat)

- Gross Margin (GAAP): 24.9%, in line with the same quarter last year

- Backlog: $5.32 billion at quarter end, up 10.8% year on year (2.7% beat)

- Market Capitalization: $29.72 billion

Company Overview

Known for its unique land acquisition strategy, NVR (NYSE: NVR) is a respected homebuilder and mortgage company in the United States.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

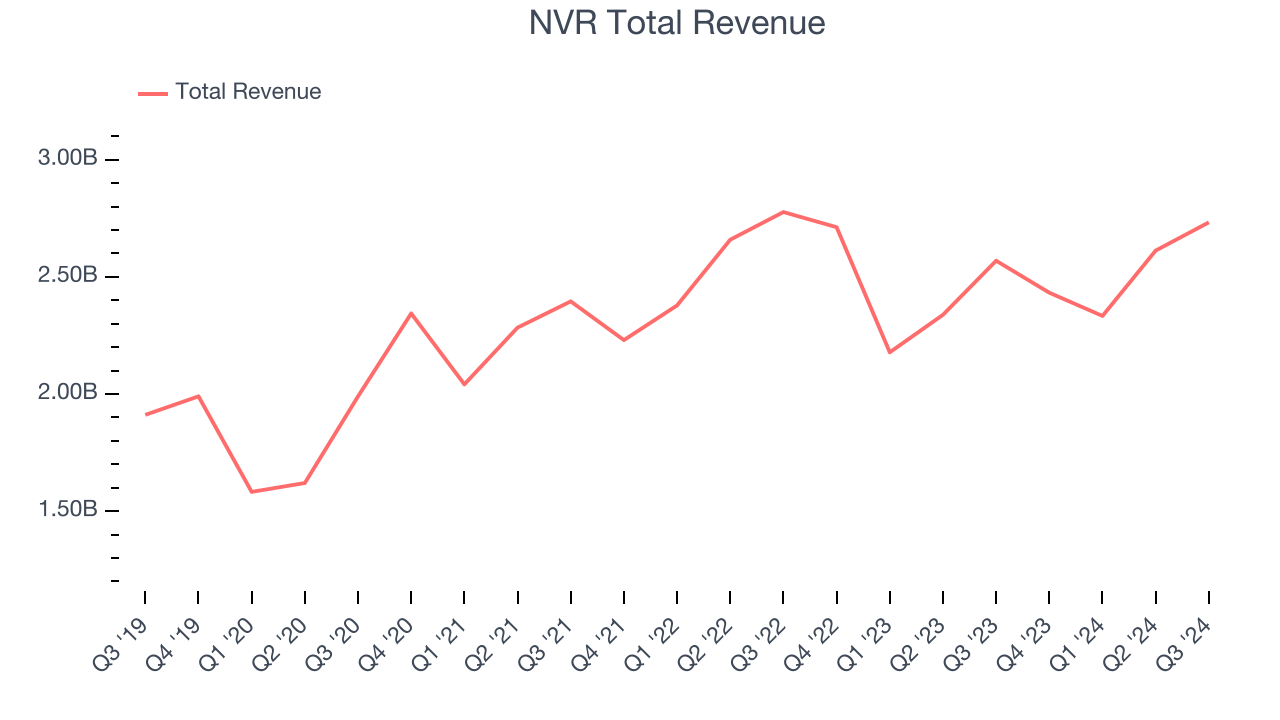

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, NVR grew its sales at a mediocre 6.5% compounded annual growth rate. This shows it couldn’t expand in any major way and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. NVR’s recent history shows its demand slowed as its revenue was flat over the last two years.

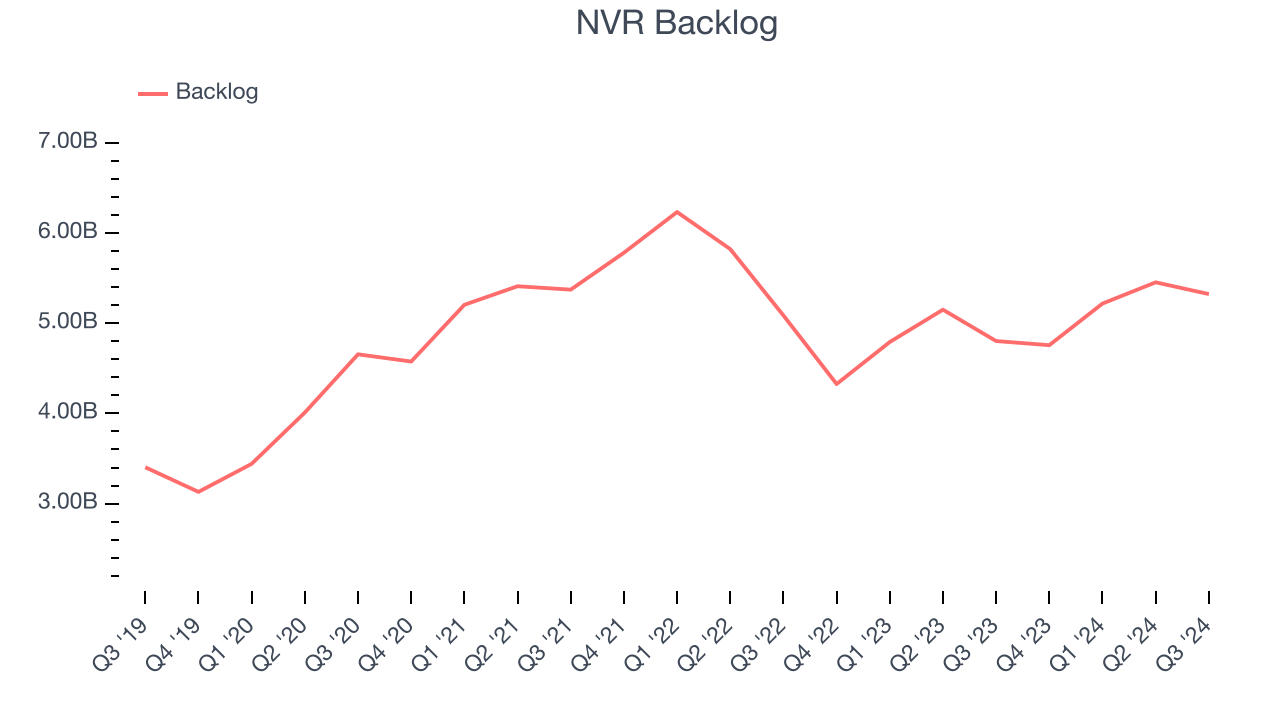

NVR also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. NVR’s backlog reached $5.32 billion in the latest quarter and averaged 3.7% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, NVR reported year-on-year revenue growth of 6.4%, and its $2.73 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, an acceleration versus the last two years. Although this projection indicates the market believes its newer products and services will spur better performance, it is still below average for the sector.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

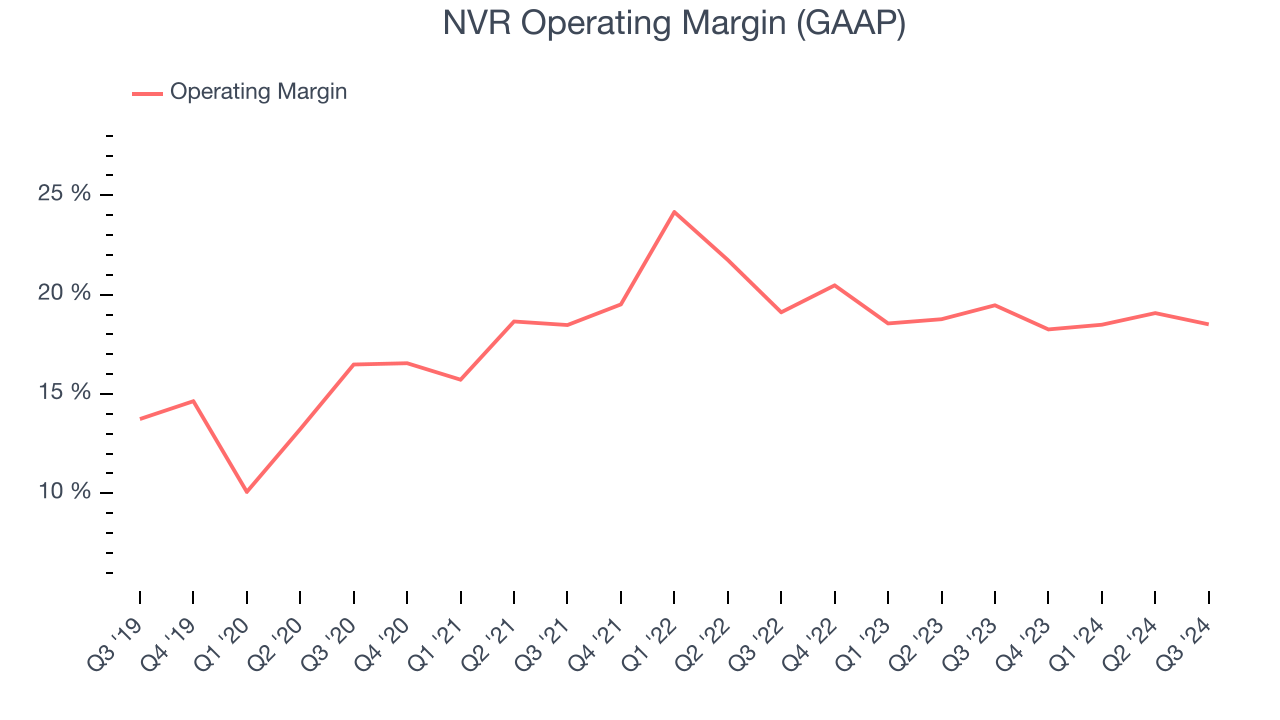

Operating Margin

Looking at the trend in its profitability, NVR’s annual operating margin rose by 4.8 percentage points over the last five years, showing its efficiency has improved.

In Q3, NVR generated an operating profit margin of 18.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

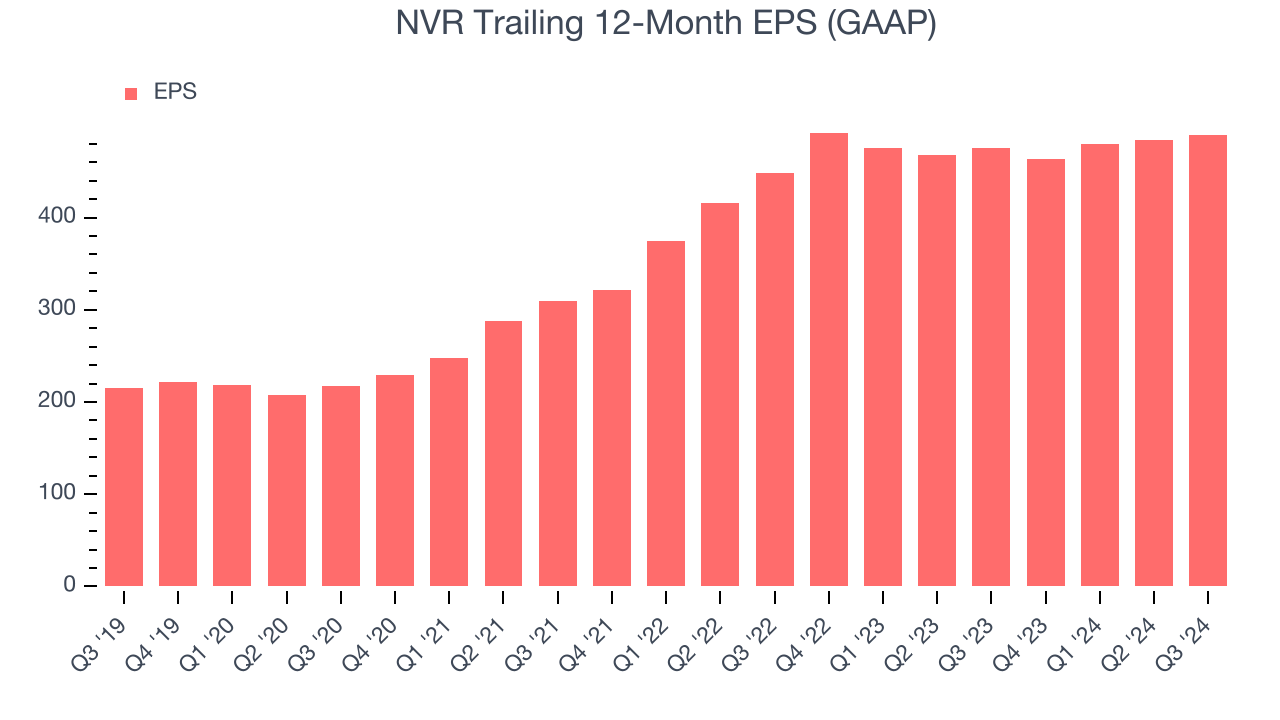

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

NVR’s EPS grew at an astounding 17.8% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue growth. This tells us the company became more profitable as it expanded.

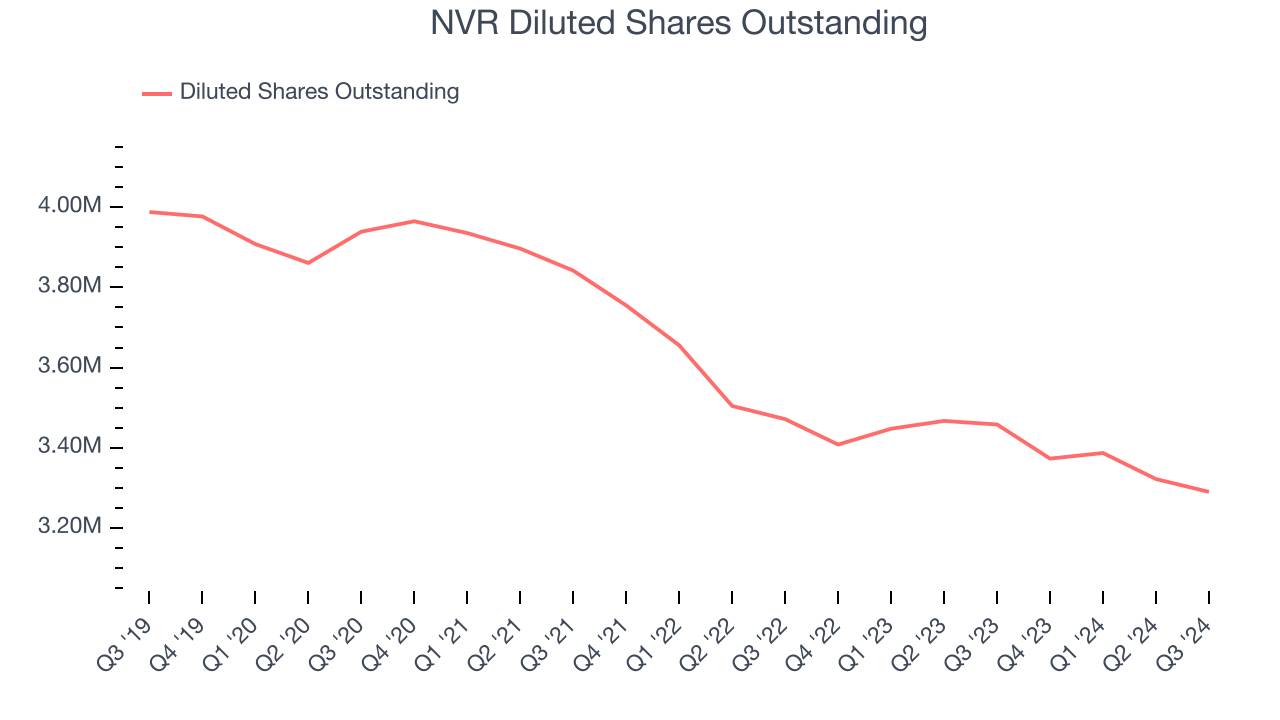

We can take a deeper look into NVR’s earnings to better understand the drivers of its performance. As we mentioned earlier, NVR’s operating margin was flat this quarter but expanded by 4.8 percentage points over the last five years. On top of that, its share count shrank by 17.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For NVR, its two-year annual EPS growth of 4.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, NVR reported EPS at $130.49, up from $125.26 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects NVR’s full-year EPS of $489.16 to grow by 3.6%.

Key Takeaways from NVR’s Q3 Results

We were impressed that NVR beat analysts’ backlog expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $9,440 immediately after reporting.

Is NVR an attractive investment opportunity right now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.