There are many income strategies you can execute with stock options with varying levels of complexity and risk. One of the most popular is the covered call strategy. This requires you to own the underlying stock and write/sell calls against the position to collect premiums. This works best with stocks you plan on holding longer-term so that wiggles and deep pullback won’t shake you as much.

Unfortunately, this strategy is also capital intensive because you need the capital to purchase the actual stock preferably without using margin to avoid interest payments. However, there is a strategy that can be executed to collect the benefits of a covered call without actually owning the underlying stock. This strategy is called a Poor Man's Covered Call.

What is a Poor Man’s Covered Call?

A Poor Man's Covered Call (PMCC) works just like a covered call. However, you don't own the stock. Instead, you buy an in-the-money (ITM) or deep-in-the-money LEAPS call. This back-month call option will represent the stock you would have had to own. From there, you would sell out-of-the-money (OTM) front month/week calls to collect premiums.

Use LEAPS Calls For the Back Month Option

The back month call you purchase should be far enough out and deep enough ITM so that Theta (time decay) isn't an issue. Remember that the Theta value falls faster as the expiration date gets closer. The fastest erosion happens during the last week into expiration. Theta is a factor whenever you have long options. It's a positive factor when you are short options because you're collecting Theta, but with long options you're paying them.

The key is to make sure you're collecting premiums faster on the short call than paying them on the long call. For this reason, long-term equity anticipation securities (LEAPS) are the ideal call options since they are at least nearly a year out. LEAPS are options that are a year to 3 years out.

How to Execute Poor Man’s Covered Call Strategy

A PMCC strategy is similar to a covered call, but instead of buying and holding the stock, you would buy a LEAPS or much further out expiration call option. Let's take an example of a popular and incredibly liquid stock in the computer and technology sector: AI chip leader NVIDIA (NASDAQ: NVDA).

The daily candlestick chart on NVDA has been exhibiting support at the $118 level. It has been making lower highs but maintains support at $118, which sets up for a potential descending triangle breakdown. Since we want to make sure there is sufficient support for our long call, we can choose the $105 strike price to buy a long LEAPS call option and use the $128 strike for the short call position.

Step 1: Buy an In-The-Money (ITM) LEAPS Call Option

The first step is to establish your long position. This would entail buying a deep ITM call with a further-out expiration, preferably a LEAPS call option.

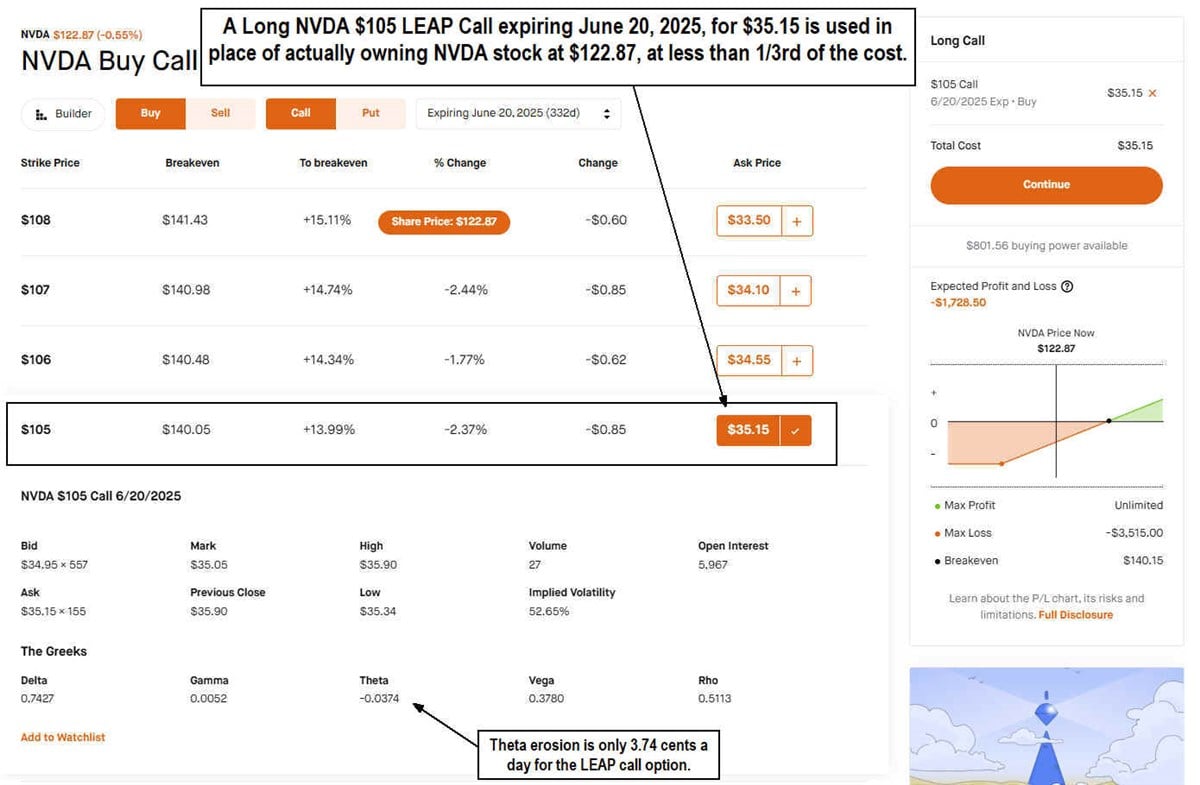

We want to establish our long position first. Since we determined $105 to be a sufficient long-term support level, let's select that strike as our deep ITM back-month call option with an expiration on June 20, 2025, which is 332 days out. The trade would be:

Buy 1 NVDA $105 Call for $35.15

This position would cost us $3,515. This is significantly cheaper than owning the stock, which is trading at $122.87. Owning the stock would cost $12,287. It’s also important to note that the June 20, 2025, expiration is far enough out that the Theta loss is only 3.74 cents a day. While this option is 332 days out, it’s technically not a LEAPS since it’s less than a year out, but you get the point. We want to buy a call option that is deep ITM and expires much further down the road.

Step 2: Sell an Out-of-The-Money (OTM) Front Month/Week Call

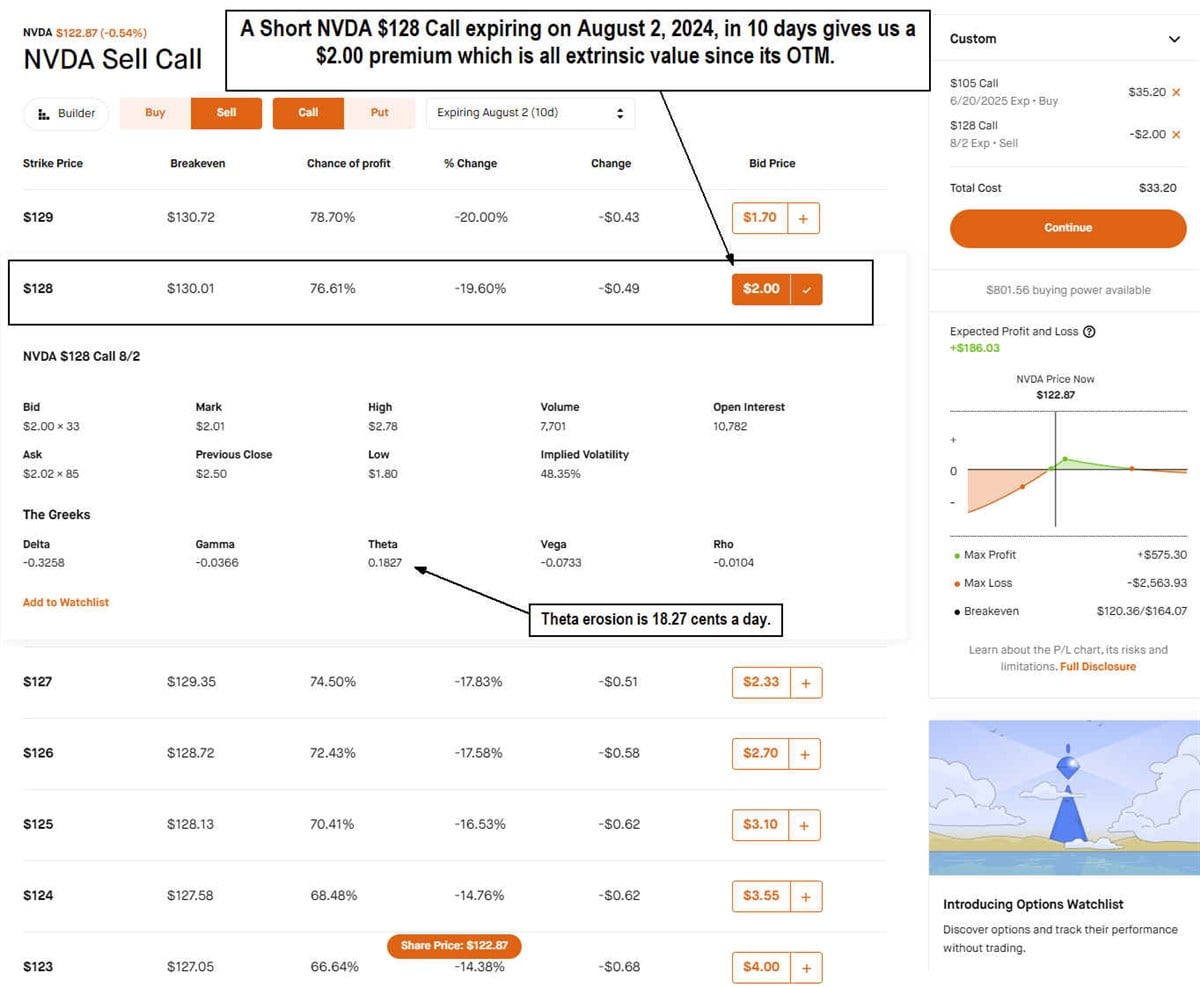

Next, we want to establish a front month or week NVDA call option near a short-term resistance level. Since $128 has been a resistance level and the levels are falling, we can select that as our strike price. The advantage of NVDA stock is that it has weekly options. This enables us to collect premiums more often which having to wait a month in between. We could potentially sell calls every week. We choose the August 2, 2024, expiration which is just 10 days out. The trade would be:

Sell 1 NVDA $128 Call for $2.00

This position pays us a $2.00 credit or $200 for holding the position for 10 days. Since it's out of the money by $5.13, it's all extrinsic premium. Notice the Theta losing 18.27 cents a day, which goes into our pocket. The best case would be if NVDA stock closes just below $128 on expiration. This would result in us keeping the $2.00 premium as well as the appreciation of the $105 call option. With a .74 Delta, the call option would theoretically gain around $3.42 in value (0.74 Delta x 5.13 – 0.374 Theta).

The max profit would be $200 on the short call for 5.16% on the premium.

If we also closed out the NVDA $105 call for a $374 profit, the total gain would be $574 or 16.3% in 10 days.

However, to generate income, we would continue to sell front-month calls against our long back-month call until it was finally closed out. If the short call gets assigned, then we can either buy 100 shares of NVDA to close out the position or exercise the long call.

Weekly Calls Provide More Choice and Potentially More Income

It pays to select a stock with heavy volume to ensure liquidity and tight spreads on the options contracts. It's also beneficial to select a stock with weekly options since it provides more opportunities to sell the calls without having to wait for a monthly expiration. Technically, you could sell calls 4 times a month versus once using weekly versus monthly calls.

The potential to lose money occurs if the stock price collapses beyond your breakeven price level. Breakeven is your cost minus the premium received on the short call. This price level increases each time you sell a call as it adds an additional buffer on the pullbacks. However, weekly calls will also require more active management. Remember, the ideal outcome would be for the underlying stock to close just below the short call strike price at expiration.