The cruise liner industry, represented by major players such as Royal Caribbean Cruises (NYSE: RCL), Carnival Corporation (NYSE: CCL), and Norwegian Cruise Line Holdings (NYSE: NCLH), finds itself at a potential turning point as investors ponder whether it's time to board or disembark these stocks.

Since the onset of the COVID-19 pandemic, the industry has faced turbulent waters, with share prices struggling to regain their pre-pandemic levels. The industry's fate has been closely tied to pandemic-related disruptions, including port closures, travel restrictions, and public health concerns.

However, according to the Cruise Lines International Association (CLIA), global cruise NYSE: NCLH">tourism is set to make a strong comeback in 2023, with passenger volume expected to reach 31.5 million by year-end, representing 106% of 2019 levels.

That increased demand has so far left a mark on the companies mentioned above recent earnings release. And now that all three companies have reported earnings, let’s take a closer look.

Carnival Corporation (NYSE: CCL)

Despite pulling back 35% off its 52-week high set in July, Carnival remains up an impressive 55.71% year-to-date. This impressive return is primarily thanks to the first six months of the year that saw CCL rocket higher as one of the top-performing stocks not associated with artificial intelligence (AI).

For Carnival, the increased demand for global cruise tourism has been apparent in its recent earnings report. The company reported its earnings on September 29, 2023, with an EPS of $0.86, surpassing the consensus estimate of $0.75 by $0.11. The firm generated $6.85 billion in quarterly revenue, exceeding analyst estimates of $6.71 billion, marking a 59.2% year-over-year increase.

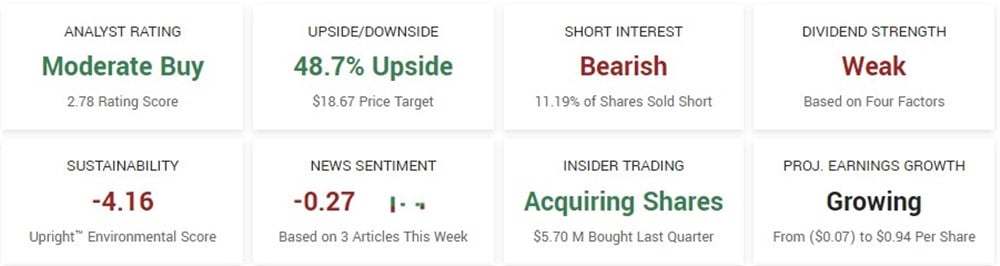

Following their strong earnings report, the consensus price target has risen to $18.67, predicting over 48% upside. Based on eighteen analysts' ratings, CCL has a Moderate Buy rating, with fifteen analysts rating the stock as a Buy.

Royal Caribbean Cruises (NYSE: RCL)

RCL has been the standout performer in the industry, pairing back most of its pandemic losses and now up a staggering 86.85% year-to-date. Unlike CCL, RCL has maintained its uptrend over the year and continues to find support above its 200-day Simple Moving Average (SMA).

Once again, the increased demand for cruising had a significant impact on the company's earnings. The company reported $3.85 EPS for the quarter, beating analysts' consensus estimates of $3.43 by $0.42. The company earned $4.16 billion during the quarter, compared to the consensus estimate of $4.08 billion. Its revenue was up 39.0% on a year-over-year basis.

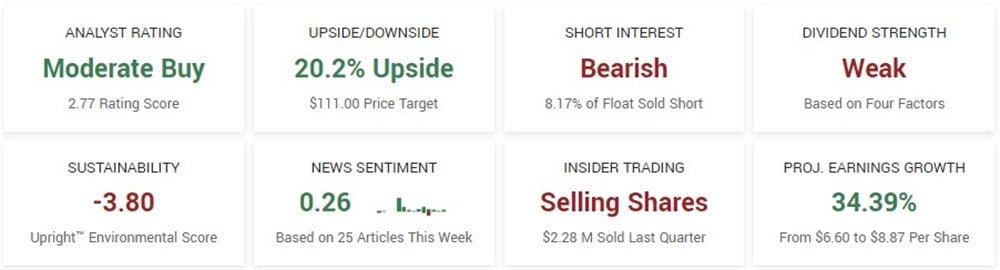

And despite its impressive turnaround and rebound off pandemic lows, analysts are still predicting further upside for the industry leader. The consensus price target of $111 sees over 20% upside for RCL. The stock currently has a Moderate Buy rating based on thirteen analyst ratings.

Norwegian Cruise Line Holdings (NYSE: NCLH)

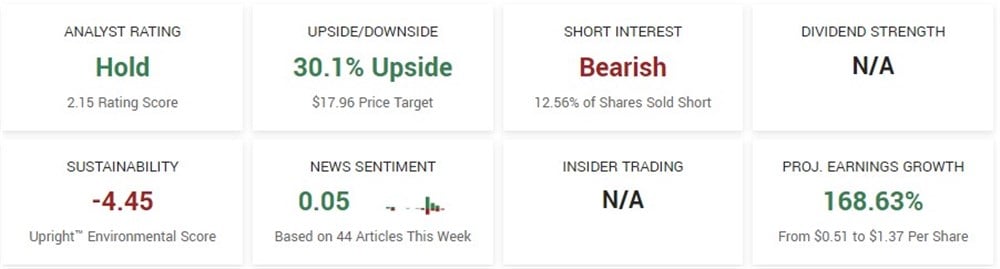

NCLH, unlike the above two, has struggled to rebound from its pandemic lows, and its share performance pales compared to the above. Year-to-date, shares of the cruise liner are up a modest 12.83%.

Despite topping analyst estimates in their recent Q3 earnings report, shares could not rally higher, partly due to the company's guidance. NCLH reported $0.76 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.61 by $0.15. The firm earned $2.54 billion during the quarter, compared to the consensus estimate of $2.53 billion. Full-year 2023 adjusted EPS is expected to be $0.73, versus the consensus of $0.79 and below the prior guidance of $0.80.

Smoother sailing ahead?

The industry is experiencing robust growth, with a growing number of first-time and repeat customers, particularly from the millennial and gen-x demographics. While the sector is thriving, it's worth noting that certain cruise lines are emerging as favorites for investors by enjoying stronger financial results and increased demand.

Concerns about oil price volatility and geopolitical tensions have affected stock performance across the industry in the short term. However, when global tensions ease, the stability and growth potential of the industry as a whole should become more apparent.