Integrated circuits (IC) developer Analog Devices (NYSE: ADI) stock took a rapid rug pull after revealing the softening of demand in its recent earnings report. Shares are trading down (-5.5%) for the year which is still an improvement over the Nasdaq 100 (NASDAQ: QQQ) down (-19%). The maker of integrated circuits (ICs), amplifiers, and data converter products delivered its sixth consecutive quarter of record revenues that grew 77% over the prior year. By all accounts, the Company is firing on all cylinders. However, the real question is whether the good times are coming to an end as demand starts to wane. Investors have reason for concern. Many top semiconductor companies have recently caused concern for investors. NVIDIA (NASDAQ: NVDA) cut it’s guidance due to softness in video games and Applied Micro Devices (NYSE: AMD) commented on the weakness its seeing in their data center business. Semiconductor equipment make Applied Materials (NYSE: AMAT) recently stated that its expects spending in memory to fall in 2022 due to macro uncertainty and weakness in consumer electronics and PCs. Analog Devices saw record revenues again with strength primarily in its Automotive, Industrial, and Communications segments.

Integrated circuits (IC) developer Analog Devices (NYSE: ADI) stock took a rapid rug pull after revealing the softening of demand in its recent earnings report. Shares are trading down (-5.5%) for the year which is still an improvement over the Nasdaq 100 (NASDAQ: QQQ) down (-19%). The maker of integrated circuits (ICs), amplifiers, and data converter products delivered its sixth consecutive quarter of record revenues that grew 77% over the prior year. By all accounts, the Company is firing on all cylinders. However, the real question is whether the good times are coming to an end as demand starts to wane. Investors have reason for concern. Many top semiconductor companies have recently caused concern for investors. NVIDIA (NASDAQ: NVDA) cut it’s guidance due to softness in video games and Applied Micro Devices (NYSE: AMD) commented on the weakness its seeing in their data center business. Semiconductor equipment make Applied Materials (NYSE: AMAT) recently stated that its expects spending in memory to fall in 2022 due to macro uncertainty and weakness in consumer electronics and PCs. Analog Devices saw record revenues again with strength primarily in its Automotive, Industrial, and Communications segments.Slowing Orders and Rising Cancellations

The markets believed that inflation was transitory caused by temporary supply chain disruption from the rebound caused by the pandemic. Companies have been stating all along that demand is strong while supply is tight. The demand strength has kept many company’s stock prices buoyant. However, Analog Devices revealed in their Q3 2022 earnings report that the prolonged economic conditions are starting to impact demand evidenced by slowing orders and rising cancellations.

Demand Shock vs. Supply Shock

Supply shock is treatable, but negative demand shock is another beast altogether. Supply can eventually return to normal, but demand is more subjective and temperamental. It’s not unexpected during a monetary tightening period led by rising interest rates. However, when a best-in-class leader cautions that demand is being adversely affected, the markets will react quickly.

Good Times are Still Here… For Now

Financial markets are less about what’s happening now, but rather what will happen down the road. Analog Devices CEO Vincent Roche did clarify, “While economic uncertainty is beginning to impact bookings, remand continues to outpace supply, resulting in higher backlog, paving the way for a strong finish to a banner year.” Roche tried to soothe investor fears. He still assured analysts that the good times are still here.

Earnings are Still Strong

On Aug. 17 , 2022, Analog Devices reported its fiscal Q3 2022 results for the quarter ending April 2022. The Company reported diluted earnings-per-share (EPS) of $2.52, beating consensus analyst estimates for $2.43 by $0.09. Revenues rose 76.8% year-over-year (YoY) to $3.11 billion beating $3.06 billion consensus analyst estimates. The Company saw record operating cash flow of $4.3 billion and free cash flow of $3.7 billion. They expect Q4 2022 EPS to come in between $2.47 to $2.67 versus $2.50 consensus analyst estimates. Revenues are expected to come in between $3.05 billion to $3.25 billion versus $3.1 consensus analyst estimates. If the good times are coming to an end, then markets will naturally reprice the Company’s valuation. While we’ve seen semiconductor company warnings in relation to gaming and data center, Analog Devices continues to see robust demand in the automotive, communications, electrification and advanced connectivity segments. The question is whether the demand weakness is broad or just segment related.

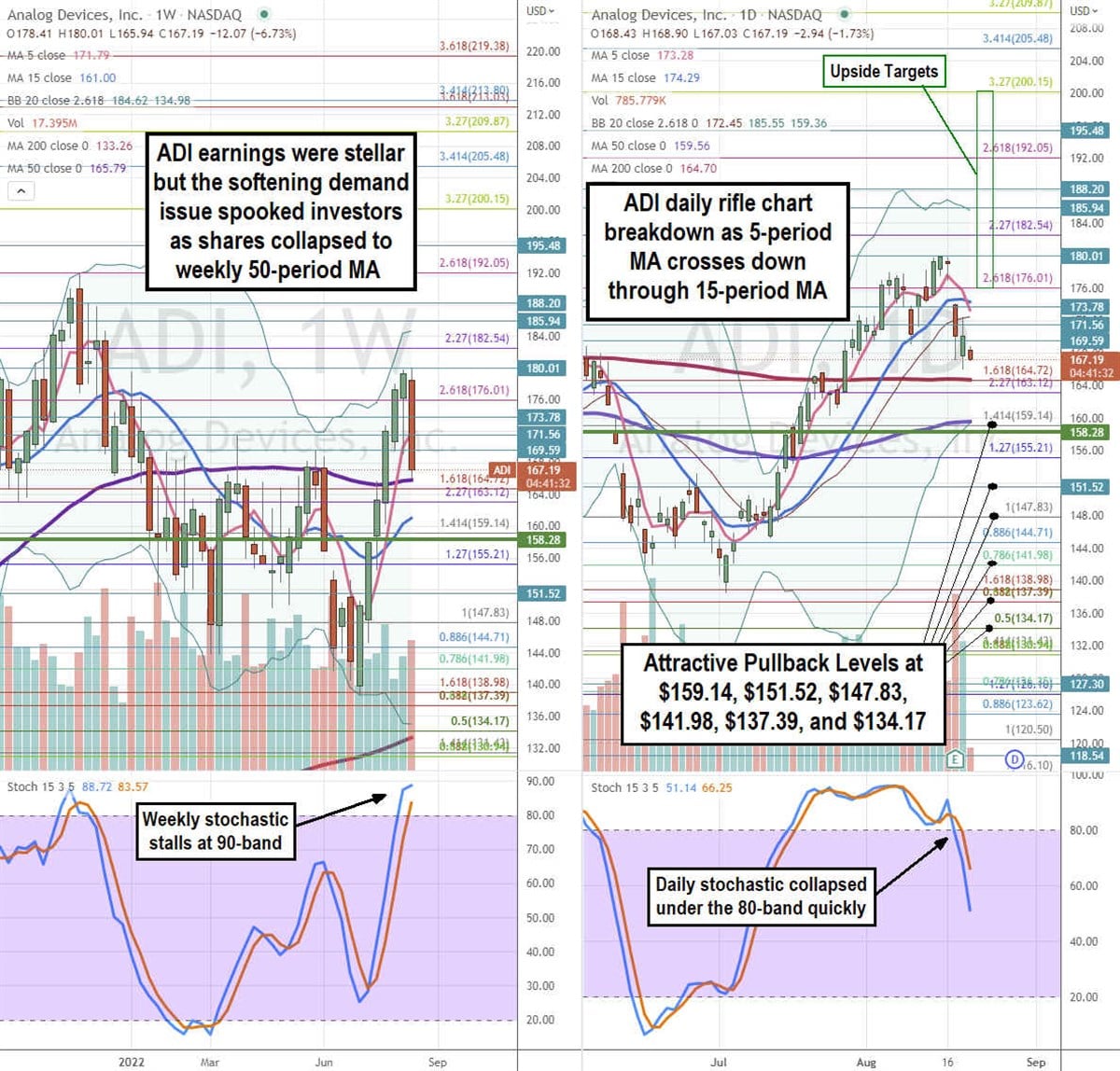

Here’s What the Chart Says

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for ADI shares. The weekly rifle chart was climbing nicely getting close to its 52-week near the $192.05 Fibonacci (fib) level. However, shares peaked at $180.01 before dumping fast on earnings. The weekly uptrend flushed shares down through the weekly 5-period moving average (MA) support at $171.79 to stall at the weekly 50-period MA support at $165.79. The weekly 15-period MA support sits at $161. The weekly stochastic stalled at the 90-band. The weekly market structure low (MSL) buy triggered on the breakout through $158.28. The weekly lower Bollinger Bands (BBs) sit at $134.98. The daily rifle chart breakdown triggered as the daily 5-period MA at $173.28 crossed below the daily 15-period MA at $174.29. The daily 200-period MA support sits near the $164.72 fib level. The daily lower BBs overlap with the daily 50-period MA support at $159.56. The daily stochastic formed a divergence top as it collapse rapidly through the 80-band nearing the 50-band on its oscillation down. Attractive pullback entry levels are at the $159.14 fib/daily 50-period MA/daily lower BBs, $151.52, $147.83 fib, $141.98 fib, $137.39 fib, and the $134.17 fib level. Upside targets range from the $176.01 fib level up towards the $200.15 fib level.