Program successfully doubles the strike length of Southern Silver Zone mineralization

Presence of elevated critical minerals suggest closer proximity to heat source

Regional exploration identifies new high-priority district targets

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided initial results of its 2024 exploration program at its wholly-owned Silvertip polymetallic critical minerals exploration project in northern British Columbia, which included the most extensive surface program completed by Coeur since acquiring the property in 2017.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241218851908/en/

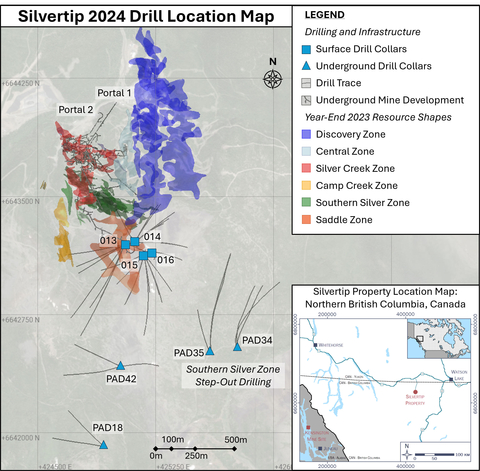

Figure 1: Plan view map showing location of 2024 diamond drillholes. (Graphic: Business Wire)

The 48-hole program, totaling approximately $12 million and over 68,000 feet (nearly 21,000 meters) of drilling, achieved its three priorities of: (i) drilling from underground to grow the known resource along-strike and down-dip; (ii) drilling large step-out holes on major structures to increase the deposit’s footprint for future resource growth; and (iii) conducting district-scale field work to identify other structures similar to Silvertip with potential to host large ore bodies.

“Silvertip’s three-pronged 2024 exploration strategy successfully expanded known areas of mineralization doubled the strike length of the Southern Silver Zone to over 2,000 meters, and identified three new large targets located on our over 50,000 hectare (over 125,000 acre) land package,” said Mitchell J. Krebs, Chairman, President and Chief Executive Officer. “We anticipate continued exploration success in 2025 as we seek to expand the size and enhance our knowledge of this world-class deposit. We remain enthusiastic about Silvertip’s potential to become a future high-quality source of growth for the Company and an important future source of Canadian-based critical minerals.”

Key Highlights1,2

- Continued growth adjacent to the current resource – Drilling from underground extended the Southern Silver Zone by approximately 1,150 feet (350 meters) along strike and the Saddle Zone by roughly 280 feet (85 meters) along strike. Notable assay results include:

Southern Silver Zone

- Hole 65Z23-485-012-029: 22.3 feet at 3.61 ounces per ton (“oz/t”) (5.8 meters at 123.7 grams per tonne (“g/t”)) silver, 2.0% lead, and 1.84% zinc

- Hole 65Z23-485-009-005: 36.9 feet at 1.38 oz/t (11.3 meters at 47.4 g/t) silver, 0.36% lead, and 9.85% zinc

- Hole 65Z23-485-012-031: 14.8 feet at 23.17 oz/t (4.5 meters at 794.2 g/t) silver, 14.62% lead, and 12.32% zinc

Saddle Zone

- Hole SDZ24-485-015-001: 21.7 feet at 2.75 oz/t (6.6 meters at 94.5 g/t) silver, 0.91% lead, and 13.98% zinc

- Hole SDZ23-485-013-017: 25.6 feet at 1.89 oz/t (7.8 meters at 64.9 g/t) silver, 0.31% lead, and 15.07% zinc, and 13.8 feet at 10.53 oz/t (4.2 meters at 361.1 g/t) silver, 6.66% lead, 5.75% zinc

- Hole SDZ23-485-013-021: 11.2 feet 3.25 oz/t (3.4 meters at 133.4 g/t) silver, 1.68% lead, 10.77% zinc

-

Hole SDZ23-PAD-007-003: 22.8 feet at 5.91 oz/t (7.0 meters at 202.5 g/t) silver, 4.58% lead, and 7.0% zinc

-

Large drill step-outs on the Southern Silver Zone confirm mineralization up to 1,000 meters along strike, highlighting considerable growth potential – All five surface step-out holes were drilled up to 1,000 meters from the boundary comprising the 2023 resource and intersected significant visual massive sulfide mineralization. To date, assays have been received for two holes:

- Hole SSZ24-Pad34-001: 17.6 feet at 3.47 oz/t (5.4 meters at 119.1 g/t) silver, 2.79% lead, and 8.89% zinc

- Hole SSZ24-Pad34-002: 26.3 feet at 5.76 oz/t (8.0 meters at 197.5 g/t) silver, 2.94% lead, and 3.93% zinc, and 26.6 feet at 0.33 oz/t (8.12 meters at 11.3 g/t) silver, 0.11% lead, and 13.37% zinc

The assay values for copper, gold, tin, gallium, and indium suggest hotter hydrothermal fluids and proximity to a heat source. High concentrations of silver, zinc, and lead, along with critical metals, indicate multiple stages of mineralization that are typical of Carbonate Replacement Deposit (CRD) systems like Silvertip.

- District exploration identified three high-priority targets showing geological similarities to Silvertip – The district-wide program included geophysical surveys over approximately 37,000 hectares (91,000 acres) to improve understanding of the geology and structure, which are primary factors controlling mineralization at Silvertip. Fieldwork included helicopter-supported reconnaissance geological mapping, as well as rock, soil and stream sediment geochemical surveys. Mapping has confirmed all areas have the same geological setting as the Silvertip deposit. Following on from the results of this work, Coeur secured an option from CMC Metals Ltd (“CMC Metals”) on approximately 10,000 hectares of additional prospective ground adjacent to Silvertip’s current land package.

“The initial results of our 2024 drilling program have already successfully identified three high priority targets that show grades and geology similar to the Silvertip Carbonate Replacement Deposit (CRD) mineralization,” said Aoife McGrath, Senior Vice President of Exploration. “Our district-scale evaluation, including geophysical surveys plus stream and soil geochemical surveys, have set the groundwork for upcoming field programs and are already providing an enhanced understanding of regional geology and structure, in addition to the recognition of new possible mineralization centers. We expect other targets to emerge from this year’s program as results are received, and I am confident that 2025 will be another very exciting year at Silvertip as we continue to explore and develop Silvertip as an emerging Tier 1 CRD District.”

For a complete table of all year-to-date 2024 drill results, including previously unpublished results from late 2023 drilling, please refer to the following link: https://www.coeur.com/files/doc_downloads/2024/12/2024-12-18-Exploration-Update-Appendix-Final.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Detail of Work Undertaken

The key areas of resource expansion and step-out drilling were focused on the Southern Silver Zone and Saddle Zone (see Figure 1), with a total of 68,326 feet (20,827 meters) completed. A total of 34 holes were drilled from underground, of which assay results have been received for five holes, while 14 holes were drilled from surface, of which assay results have been received for two holes. Assay results from these remaining holes will be published when received.

Near-Mine Exploration and Expansion Drilling

Between March and October, one diamond drill was active in the Silvertip underground. This phase of the program aimed to expand the known resource by taking moderate step-outs adjacent to the resource area. This drilling encountered notable mineralization in both the Saddle Zone and the Southern Silver Zone. Assay results for most of this drilling are pending but key highlights from results received so far are outlined above and shown below in Figure 2.

Exploration and Step-out Drilling

Between July and November, surface drilling focused on large step-outs along Southern Silver Zone to rapidly increase the footprint for future resource growth. Five surface diamond drill holes were completed for a total of approximately 18,560 feet (5,658 meters). All five holes cut visually significant massive sulfide mineralization. Assay results have been received for holes SSZ24-PAD34-001 and SSZ24-PAD34-002 and are highlighted in Figure 3. These mineralized intervals are up to 1,000 meters away from the established Southern Silver Zone resource (see Figure 1) and remain open to the southeast. Combined with mineralized intercepts from previous years along this trend, the Southern Silver Zone structure continues to show potential for lateral continuity and resource expansion.

District-Scale Exploration

Surface exploration was conducted between June and September with a focus on evaluating targets over a significantly larger portion of the Silvertip claim blocks. This was the first year of a systematic, multi-year exploration program designed to explore for other CRD style deposits elsewhere on nearly 40,000 hectares of Coeur’s claims, to identify possible intrusive heat sources and to delineate the limits of the system to assist with vectoring.

Early in 2024 the program commenced with remote sensing (ASTER and Sentinel-2) to identify alteration and geological patterns similar to those at the Silvertip deposit. Historic mapping, rock geochemistry and stream sediment geochemistry were combined with this to prioritize areas for more detailed follow-up during the summer months. Field work entailed 1:10,000 scale bedrock mapping, rock sampling, reconnaissance-scale stream sediment sampling and a soil geochemical orientation study (Figures 4 and 5). A total of 157 rock samples, 153 stream sediment samples and 234 soil samples were collected. Due to the short summer season, work was undertaken on only a portion of the claims, with further reconnaissance and follow-up work planned for upcoming summer seasons.

Compilation and field reconnaissance led to the prioritization of three key target areas: Berg, Weiram Mountain-Hamlet Mountain and Brinco Hill. Mapping has confirmed all areas have the same geological setting as the Silvertip deposit, where the McDame Group carbonates are the host lithology, capped by Earn Group sediments. Stratigraphically deeper carbonates of the Atan Group (Rosella Formation) were mapped locally on surface and remain prospective for further exploration both on surface and at depth. Mineralization at the newly optioned Silverknife area is hosted in the Atan Group limestones. Further similarities to Silvertip include the presence of mafic dykes, quartz and calcite breccia zones, and oxide gossans. Assays from rock chip sampling confirmed mineralization similar to that seen at Silvertip mine.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with four wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip polymetallic critical minerals exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures and investments, drill results, resource delineation, expansion, upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade and recovery variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a “qualified person” under S-K 1300, namely our Senior Director, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are available at www.sec.gov.

Notes

The ranges of potential tonnage and grade (or quality) of the exploration results described in this news release are conceptual in nature. There has been insufficient exploration work to estimate a mineral resource. It is uncertain if further exploration will result in the estimation of a mineral resource. The exploration results described in this news release therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

For additional information regarding 2022 mineral reserves and mineral resources, see.

- For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/files/doc_downloads/2024/12/2024-12-18-Exploration-Update-Appendix-Final.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

Conversion Table |

||

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20241218851908/en/

Contacts

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Chicago, Illinois 60606

Attention: Jeff Wilhoit, Senior Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com