Dallas, Texas-based Texas Instruments Incorporated (TXN) designs, manufactures, and sells semiconductors to electronics designers and manufacturers. It is valued at a market cap of $195.9 billion.

This semiconductor company has outperformed the broader market over the past 52 weeks. Shares of TXN have rallied 21.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.5%. Moreover, on a YTD basis, the stock is up 29.7%, compared to SPX’s 1.9% uptick.

However, narrowing the focus, TXN has lagged behind the Invesco Semiconductors ETF’s (PSI) 59.4% rise over the past 52 weeks. Nonetheless, it has outpaced PSI’s 20.9% YTD return.

On Jan. 27, TXN delivered weaker-than-expected Q4 results, yet its shares surged 9.9% in the following trading session. Both its revenue of $4.4 billion and EPS of $1.27 fell short of the consensus estimates. However, its optimistic forecast for the upcoming quarter overshadowed its underwhelming Q4 results. TXN expects Q1 revenue of $4.5 billion and EPS of $1.35 at the midpoint, both above analyst expectations, bolstering investor sentiment.

For fiscal 2026, ending in December, analysts expect TXN’s EPS to grow 17.3% year over year to $6.39. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

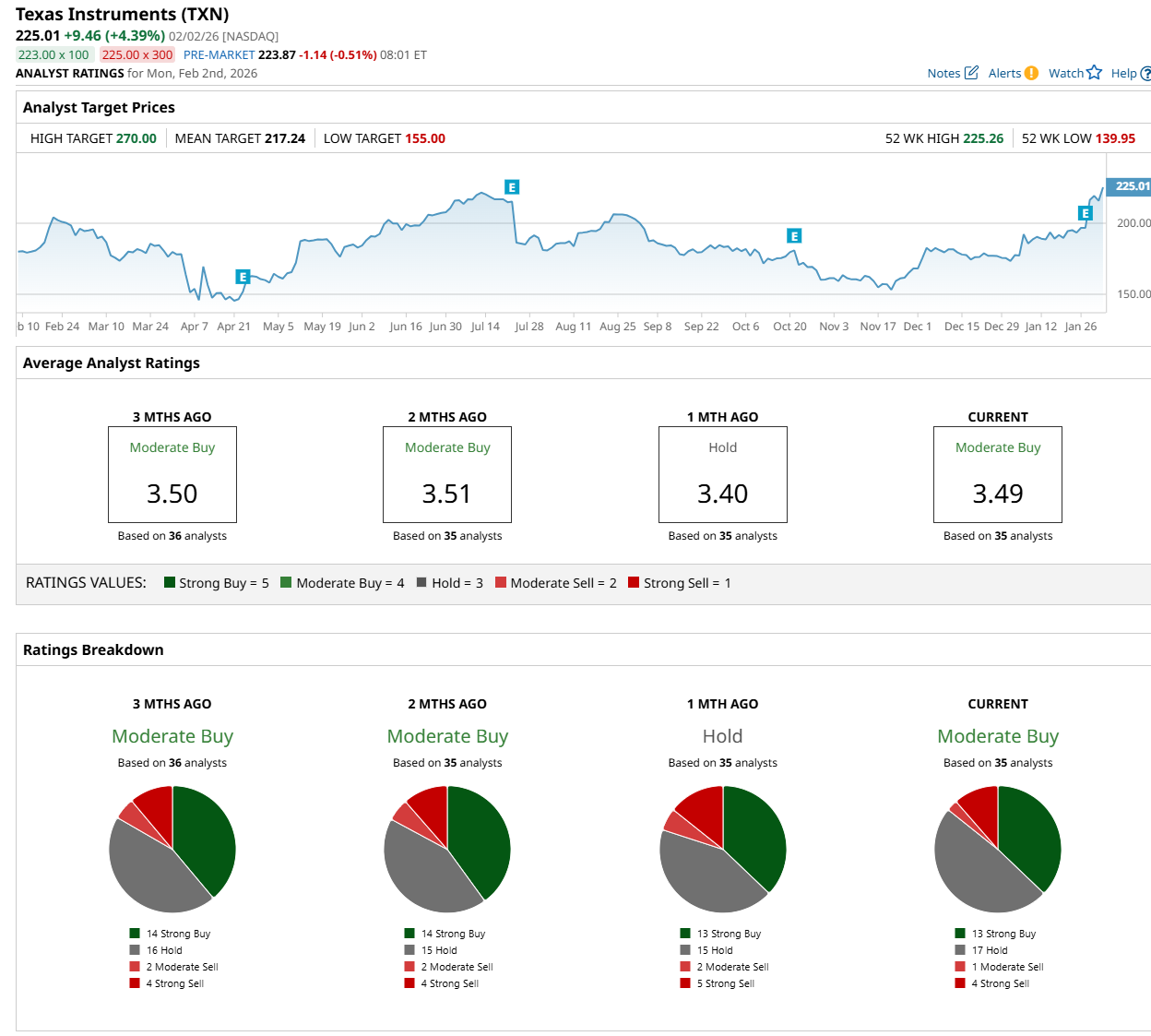

Among the 35 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 13 “Strong Buy,” 17 “Hold,” one "Moderate Sell,” and four “Strong Sell” ratings.

The configuration is more bullish than a month ago, with an overall “Hold” rating, consisting of five “Strong Sell” ratings.

On Jan. 28, Argus Research maintained a “Buy” rating on TXN, with a price target of $250, indicating an 11.1% potential upside from the current levels

While the company is trading above its mean price target of $217.24, its Street-high price target of $270 suggests a 20% premium from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart