Leidos Holdings, Inc. (LDOS) is a technology and defense contractor that delivers scientific, engineering, information technology, and systems integration services to government and commercial customers worldwide, particularly in the defense, intelligence, civil, and health markets. Headquartered in Reston, Virginia, the company supports mission-critical functions such as cybersecurity, enterprise IT modernization, and national security systems integration. Leidos’ market cap is around $25 billion.

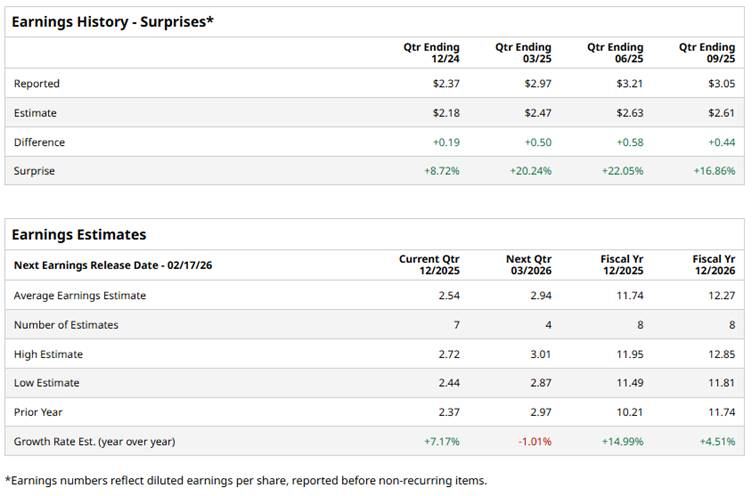

The company is gearing up to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Tuesday, Feb. 17. Ahead of the event, analysts expect LDOS to report a profit of $2.54 per share on a diluted basis, up 7.2% from $2.37 per share in the year-ago quarter. Plus, the company has consistently surpassed Wall Street’s EPS estimates in its last four quarters.

For the full year, analysts expect LDOS to report EPS of $11.74, up 15% from $10.21 in fiscal 2024. Also, its EPS is expected to rise 4.5% year-over-year to $12.27 in fiscal 2026.

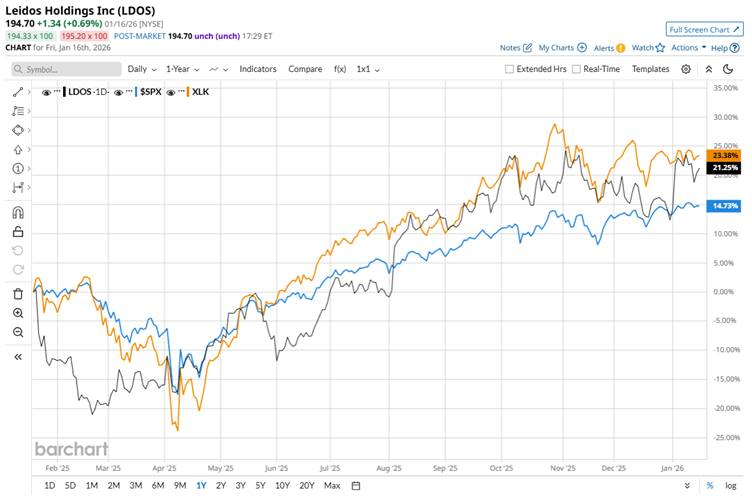

Over the past 52 weeks, LDOS has climbed 25.5%, outperforming the S&P 500 Index’s ($SPX) 16.9% gains but slightly lagging behind the State Street Technology Select Sector SPDR ETF’s (XLK) 26.4% gains over the same time frame.

Leidos Holdings’ stock has been rising as the company has consistently beaten earnings expectations, signaling strong operational performance. Robust revenue growth and growing backlog from federal contracts have boosted investor confidence, as Leidos continues to benefit from elevated U.S. defense and government IT spending and strategic positioning in areas like cybersecurity and digital modernization.

Leidos reported a record $4.5 billion in revenue for the third quarter of fiscal year 2025, representing about a 7% year-over-year increase, while ending the quarter with a total backlog of approximately $47.7 billion.

Analysts’ consensus opinion on LDOS is fairly bullish, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests “Moderate Buy,” and seven give a “Hold.” Its average analyst price target is $218.78, indicating a potential upside of 12.4% from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart