- Support for US Fed Chairman Powell and the independence of the US Federal Reserve has been nearly unanimous.

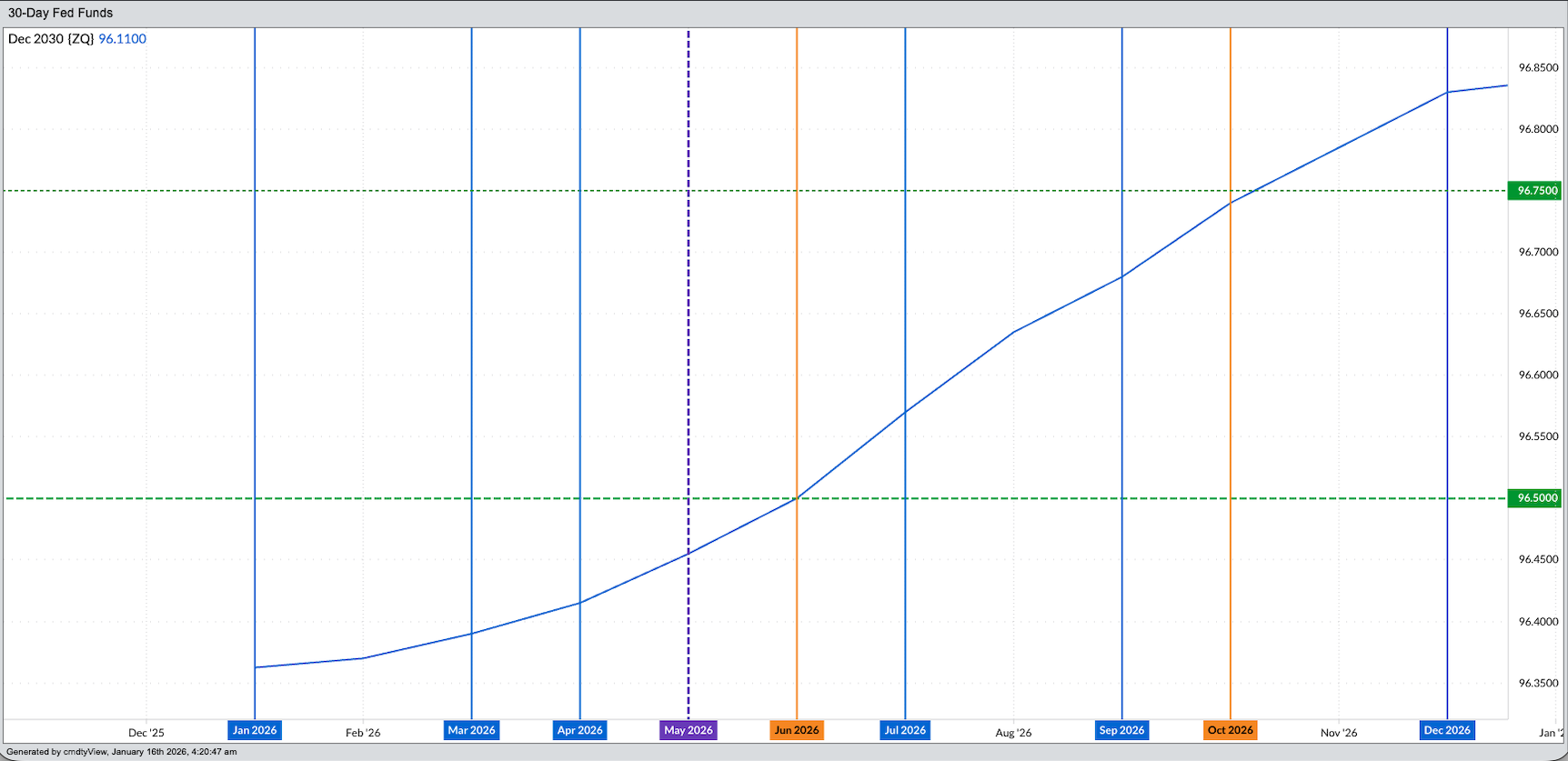

- The Fed fund futures forward curve continues to show the next rate coming at the conclusion of the June FOMC meeting, the first meeting following the end of Powell's term as Chairman.

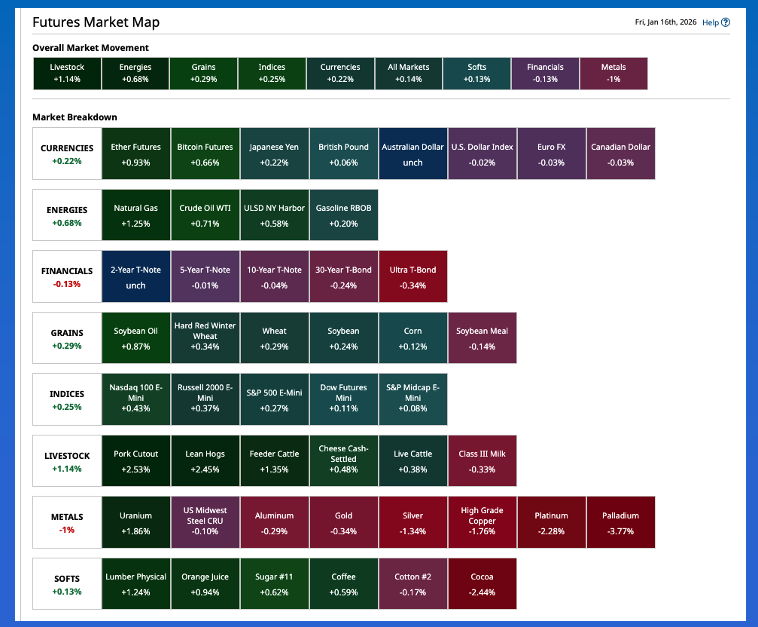

- The commodity complex was mostly in the green to start the day, with the Energies sector awaiting the next social media post by the US president.

Morning Summary: Much of the pre-dawn Friday market discussion had to do with words starting with “In”. Leading off was the nearly unanimous backing of US Fed Chairman Powell by central banks and key figures from around the world in terms of the importance of the US Federal Reserve remaining independent. The potential ripple effects of trumped-up criminal charges with the root cause being displeasure over interest rates is a dangerous precedent (or “president”) to set. Chicago Federal Reserve President Goolsbee was quoted saying, “You’re going to get inflation come roaring back if you try to take away the independence of the central bank”[i]. Speaking of interest rates, the Fed fund futures (ZQF26) forward curve continues to show the next rate cut coming at the conclusion of the June 2026 meeting, interestingly enough the first meeting following Mr. Powell’s term as Fed Chair coming to an end in May. As for markets, US stock index futures were higher to start the day despite Asian markets closing mostly lower and European markets trading lower early in Friday’s session. The US dollar index ($DXY) was quietly weaker, sitting 0.06 lower and on its session low at this writing. Meanwhile, Energies were in the green, waiting for the US president’s next social media post.

Corn: The corn market was quietly higher early Friday morning. The March issue (ZCH26) posted a 1.5-cent trading range overnight on trade volume of 10,000 contracts and was sitting 0.5 cent higher pre-dawn. Technically, March continues to hold above the round number $4.20, as well as its spike low of $4.1725 from this past Tuesday, possibly attracting a light round of new noncommercial buying. It will be interesting to see what the next Commitments of Traders report (legacy, futures only) shows. The previous edition had Watson holding a net-long futures position of 60,110 contracts as of Tuesday, January 6, a decrease of 6,920 contracts. As mentioned, March then lost 24.25 cents from Tuesday to Tuesday (January 13) indicating the net-long futures position might’ve been erased. On the other hand, the commercial hand, the market continues to see support. National average basis was calculated Thursday night at 36.0 cents under March futures as compared to last Friday’s final figure of 37.0 cents under. Additionally, Thursday’s close saw the March-May spread covering 36% calculated full commercial carry while the May-July covered 30%, as compared to last week’s settlements of 38% and 31% respectively. This tells us the corn market’s real supply and demand situation is not as bearish as USDA’s imaginary numbers.

Soybeans: The soybean market was also quietly higher pre-dawn with the March issue (ZSH26) up 2.0 cents on trade volume of about 15,000 contracts. If March is able to stay in the green through today’s close it would be the third consecutive higher daily close, bringing to mind a possible Benjamin Franklin Fish Analogy (Like guests and fish, markets start to stink after three days of moving against the trend). The previous positioning week, from Tuesday, January 6 through Tuesday, January 13, saw March close 17.5 cents lower indicating the noncommercial net-long futures position of 104,770 contracts was likely decreased. Since this past Tuesday, March is up 17.25 cents. Not all of the buying has come from Watson, though, as the March-May futures spread has seen its carry trimmed from 13.25 cents (49% calculated full commercial carry) this past Tuesday to 11.25 cents (41%) at Thursday’s settlement. We’ve also seen export sales announcements totaling 1.328 million metric tons (49 mb) with 706,000 mt (26 mb) to China and 470,000 mt (17 mb) to unknown destinations. Recall March closed 10.5 cents higher yesterday. Last night, the National Soybean Index was priced near $9.8475, up 12.0 cents from Wednesday meaning merchandisers were still pushing the cash market telling us short-term demand is increasing.

Wheat: The wheat sub-sector was in the green to start the day as well, with trade volume in all three markets showing an uptick pre-dawn Friday. The March SRW issue (ZWH26) was up 2.5 cents and on its overnight high at this writing while registering 4,600 contracts changing hands. I don’t see this as a groundswell in commercial support, but rather Watson continuing to cover some of its net-short futures position last reported at 88,090 contracts as of Tuesday, January 6. This past Tuesday saw March SRW close unchanged for the positioning week indicating the noncommercial net-futures position likely didn’t change much. The same could be said about the commercial side as the March-May futures spread closed this past Tuesday at a carry of 11.25 cents (52% calculated full commercial carry) versus the previous Tuesday’s settlement of 10.75 cents carry (49%). This week, we quietly crossed the midpoint of the winter season meaning the spotlight will be turning toward the 2026 crop sitting dormant in the field. Or at least it’s supposed to be dormant. I’ve heard from folks in the US Southern Plains that given the mild winter so far, the HRW crop is still green and trying to grow.

[i] From a piece by Jeff Cox on CNBC.com (LINK)

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart