I’ve seen my fair share of corporate reincarnations. But what Oracle (ORCL) has pulled off over the last 24 months isn’t just a turnaround. It’s a masterclass in how the modern market actually functions.

For years, Oracle was the uncool uncle of the tech world. It was a legacy database company — stable, dividend-paying, and, frankly, boring. Then, the artificial intelligence (AI) revolution hit, and suddenly Larry Ellison’s firm became the infrastructure backbone of the AI trade.

But if you think this is a story about database software, you’re missing the forest for the trees. The real lesson here is about momentum, narrative, and the death of traditional valuation.

The ‘Spike and Fade’ Reality

Look at the price action in late 2025. Following a blockbuster earnings report in September, ORCL shares surged nearly 40% in a single day. For a company with a market capitalization north of $500 billion, that kind of volatility used to be reserved for penny stocks or biotech startups waiting on U.S. Food and Drug Administration (FDA) approval.

In today’s market, price follows narrative, and narrative is a runaway freight train. When Oracle announced its remaining performance obligations (RPO) had ballooned to more than $523 billion — largely thanks to multibillion-dollar AI contracts — the passive-aggressive flow of exchange-traded fund (ETF) buying and algorithmic chasing kicked in.

But then, the inevitable happened. By early 2026, much of that blockbuster gain had evaporated. Why? Because the market finally glanced at the balance sheet.

Risk-First: The Red Flags Nobody Wants to See

While the story was about AI glory, the reality (which I always prioritize) showed a different picture:

- The debt load: Oracle’s notes payable and borrowings have climbed past $100 billion.

- The capex monster: To stay in the AI race, the company is projected to spend roughly $50 billion in capital expenditures for fiscal 2026.

- Negative free cash flow: In Q2 of fiscal 2026, free cash flow was negative, at approximately -$7.3 billion.

In the old market, these numbers would be a screaming siren to get out. In the modern market, they are treated as “necessary investments for future dominance” — at least until the momentum breaks.

Oracle teaches us that value is no longer a static number found in a price-to-earnings (P/E) ratio. It is a moving target. Here is the takeaway:

- Don’t fall in love with the narrative: Larry Ellison is a visionary, but visions don't pay off debt.

- Respect the trend: When a stock goes parabolic, it’s a trade, not an investment. Consider collaring positions like that.

- Watch the RPO vs. cash flow: Contracts are great, but cash is what keeps companies going. If the gap between future promises and actual cash widens too far, the floor eventually drops.

Oracle is currently the poster child for the AI infrastructure trade. It has successfully escaped irrelevance, but it has entered a high-stakes casino. It reminds us that finding strong stocks that can sustain giant moves is very elusive now.

The Issue and 1 Solution for ORCL’s Volatility

Here’s what I mean. Despite stealing headlines for a few months and making investors feel enough FOMO to buy it north of $300, the 20-day exponential moving average (EMA) headfaked lower, then followed through on that. One quarter, $340, and $180 the next. That entire, astonishing one-day move? Gone.

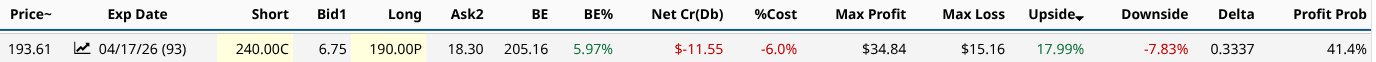

A stock like that could use a collar. So here’s one of many possibilities.

This is three months out, upside to $240, roughly where ORCL traded around Thanksgiving, and a few dollars of downside. Add in the 6% net cost of the options, and you get 18% upside potential and 8% downside. The reason the ratio is not much higher than 2:1 is the time factor. Only going out for three months is not conducive to great pricing.

However, the idea is that I will know if I’m right quickly. So if the stock dares to move up that much in a few months, the gift is appreciated (literally). And if it falls back below what could be a support area here, my losses are capped.

When a stock can be moved around like this one, we need to tread lightly. This is not the era of finding value. It's a time when navigating the casino is the first order of business.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Barclays Calls This 1 AI Server Stock ‘Best in Class’ Amid Upgrade to ‘Overweight’ Rating

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings

- Why Rosenblatt Thinks Rigetti Computing Stock Can Soar 60% from Here

- Micron Stock’s Stunning Run Isn’t Over Yet — Could $500 Be Next?