NAND memory has flipped from afterthought to headline story in a matter of months, even as global chip sales start to cool at the edges. Recent Morgan Stanley data on November activity highlight memory — and NAND in particular — as a clear standout.

A fresh report flags that NAND contract prices are now projected to jump in early 2026 as AI data loads and hyperscaler pre‑buying run into constrained supply. That setup fits alongside forecasts that see the NAND flash market climbing toward roughly $72.6 billion by 2030, powered by SSD adoption and storage needs that keep rising faster than general chip demand.

Right in the middle of this storm sit two familiar names: Sandisk (SNDK) and Western Digital (WDC). Sandisk now lives and dies by NAND pricing and AI storage demand, whereas Western Digital is tethered to the same data boom from the HDD side.

With NAND prices spiking, there's now an obvious question for early 2026 investors. In the coming memory supercycle, will Sandisk or Western Digital turn out to be the smarter stock to own? Let’s take a closer look.

Sandisk (SNDK)

Headquartered in California, Sandisk designs NAND flash memory and solid‑state storage for enterprise, cloud, mobile, and consumer devices. SNDK stock trades at $409 as of Jan. 15. Shares are up 72% year-to-date (YTD), and have gained 858% over the past six months.

This pricing now reflects an equity value of around $57 billion, with a forward price-to-earnings (P/E) of 33.5 times and price‑to‑sales (P/S) of 7.7 times versus sector medians of 26.1 and 3.6x. That indicates investors are assigning a clear premium to SanDisk’s direct exposure to the strengthening NAND cycle.

Sandisk’s premium is anchored in concrete catalysts tied to the current memory upturn. SNDK stock recently drew attention after reports suggested the company could potentially double pricing on certain 3D NAND used in enterprise SSDs, while Nomura argued that memory suppliers are likely to keep enterprise 3D NAND pricing higher in both the short and medium term.

Execution has started to reflect that backdrop. In the last reported quarter, the company delivered EPS of $0.90 versus a $0.58 consensus estimate, creating a $0.32 beat and a 55% positive surprise underscoring how quickly profitability is recovering as pricing and mix improve.

SanDisk’s rating profile lines up with that growth story. This earnings beat flows into aggressive forward expectations. The Street is now looking for EPS of $2.94 for the December quarter, $3.34 for the March 2026 quarter, and $11.60 for fiscal 2026. That translates into a 99% year-over-year (YOY) decline for the December quarter but growth of roughly 657% for March 2026 and a 552% climb for 2026, underscoring how deep the prior downturn was relative to the projected recovery.

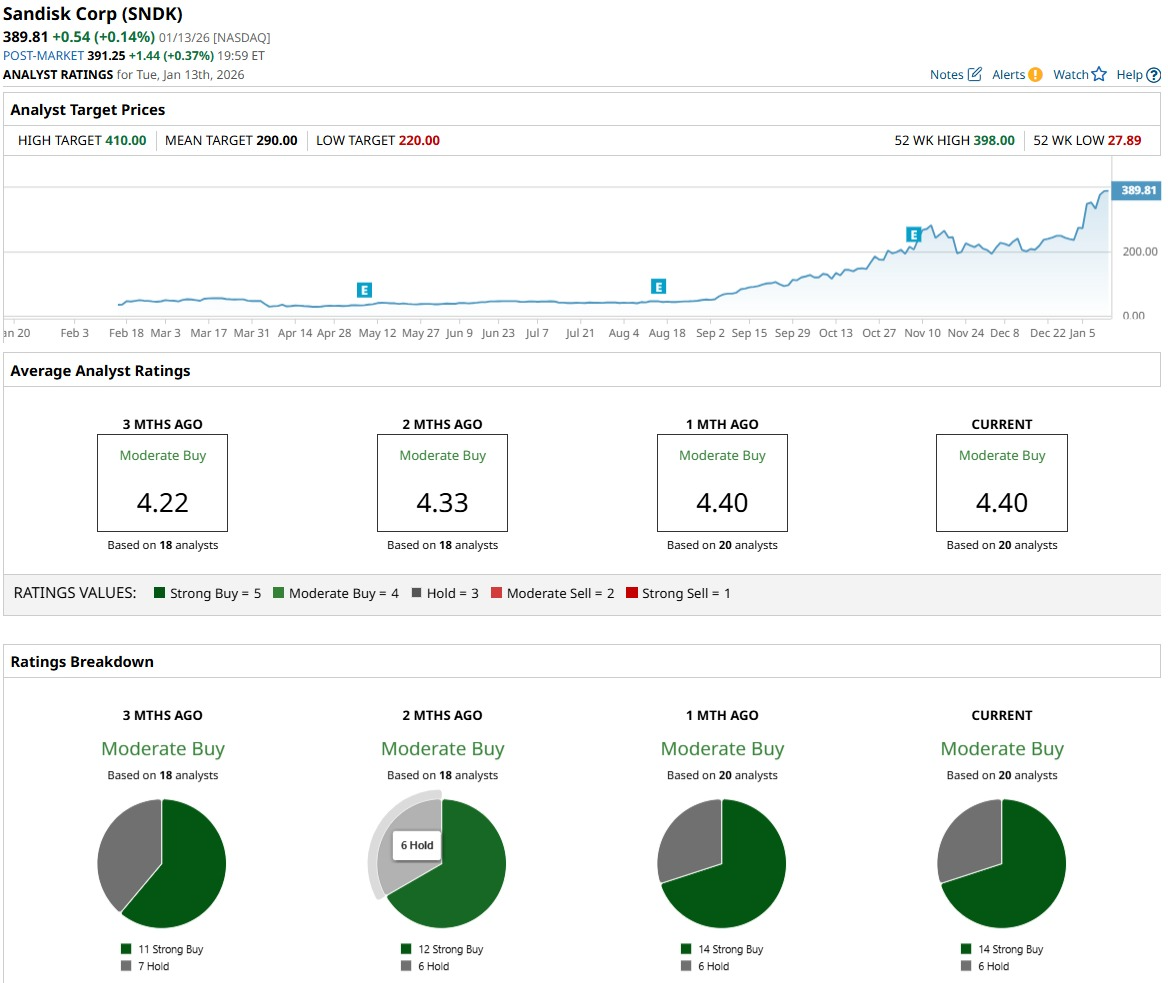

SNDK stock carries a consensus “Moderate Buy” view from 20 analysts. The average target sits at $290, which implies roughly 29% potential downside from the current price.

Western Digital Corporation (WDC)

Headquartered in San Jose, California, Western Digital (WDC) develops high‑capacity hard disk drives and storage systems for cloud, enterprise, and client markets. WDC stock represents roughly $73 billion in equity value and returns a forward annual dividend of $0.50 per share, which equates to a yield near 0.23%.

WDC stock is trading at $222 as of Jan. 15, up 29% YTD and 358% over the past 52 weeks.

Western Digital's valuation sits on a P/S multiple of 7.7 times and price‑to‑book of 12.4 times versus sector medians of 3.6 and 4.8, suggesting that the market is willing to pay substantially more than peers for the firm's cash generation.

This premium is directly tied to how central Western Digital’s high‑capacity HDDs have become in the current AI buildout. The company benefits from AI models that require petabytes of training and inference data to sit behind GPU clusters, where HDDs still offer the lowest cost per bit at hyperscale.

This operating backdrop is already flowing through to the financials. The Q1 fiscal 2026 report showed non‑GAAP revenue of $2.82 billion, up 8% sequentially and 27% YOY, with gross margin at 43.9% — an improvement of 260 basis points quarter-over-quarter and 660 basis points YOY — and operating income of $856 million as the business scaled into stronger demand. The report also showed EPS of $1.64 versus a $1.47 consensus estimate, a $0.17 beat that translated into a nearly 12% positive surprise and emphasizes the leverage to AI‑driven storage spending.

The outlook for the next prints remains constructive. This current consensus points to EPS of $1.80 for the December 2025 quarter and $7.13 for fiscal 2026, versus prior‑year marks of $1.55 and $4.53, respectively. That implies expected growth of roughly 16% YOY and 57% YOY, and reinforces the idea that Western Digital is entering a higher‑earnings run‑rate even as broader chip sales cool.

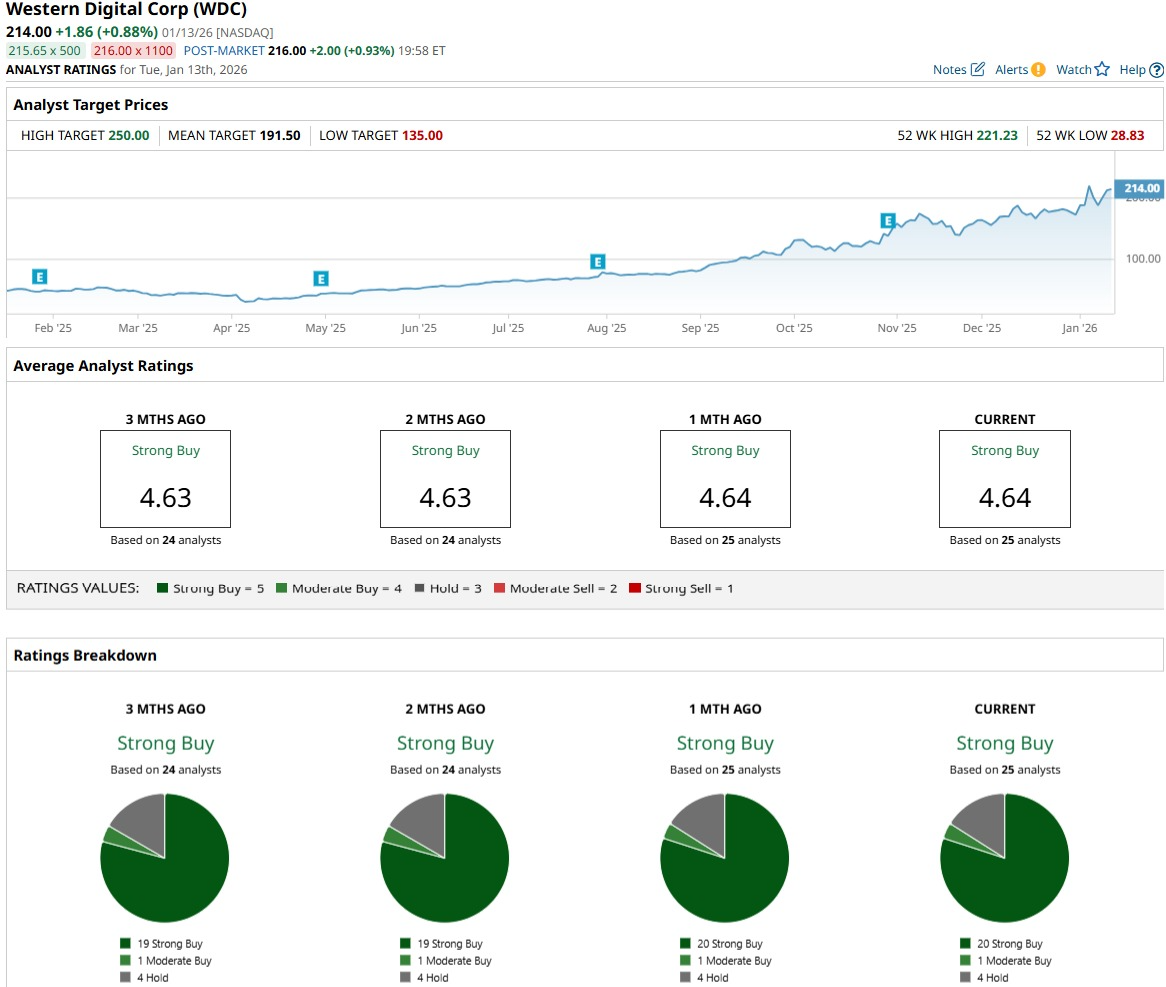

Western Digital’s analyst rating profile reflects that confidence. WDC stock carries a consensus “Strong Buy” recommendation from 25 analysts with coverage. The average target sits at $191.50, implying about 14% potential downside from the current price.

The Bottom Line

For a pure NAND upcycle bet, Sandisk still looks like the higher‑octane choice, even if a lot of good news is already priced in. Western Digital, by contrast, offers steadier earnings, a small dividend, and more balanced AI‑storage exposure for investors who want growth without Sandisk’s sharper swings. Over the next year, SNDK shares are more likely to stay sensitive to every NAND pricing headline, while WDC stock has a better shot at grinding higher with AI‑driven data‑center demand and execution on earnings.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart