Micron Technology (MU) has extended its rally into 2026. The stock is already up 25% year-to-date (YTD) and has gained over 247% over the past 12 months. Despite its monster rally, MU stock could still have meaningful upside ahead.

The primary catalyst behind Micron’s surge is accelerating demand for its memory and storage products, particularly from data center operators building out artificial intelligence (AI) infrastructure. As hyperscalers and enterprises invest heavily in AI workloads, the need for high-performance DRAM and NAND solutions will remain high, strengthening Micron’s earnings growth outlook.

What makes the current environment particularly favorable for Micron is the supply situation. Memory markets remain supply-constrained while demand is strengthening. This dynamic supports higher pricing across memory products, which will likely drive higher margins and stronger profitability for Micron.

This combination of strong AI-driven demand, tight supply conditions, and rising margins helps explain why Micron’s valuation remains compelling despite its sharp run-up. Analysts’ earnings forecasts for fiscal 2026 and 2027 suggest the stock is still undervalued relative to its EPS growth forecast, suggesting further upside potential.

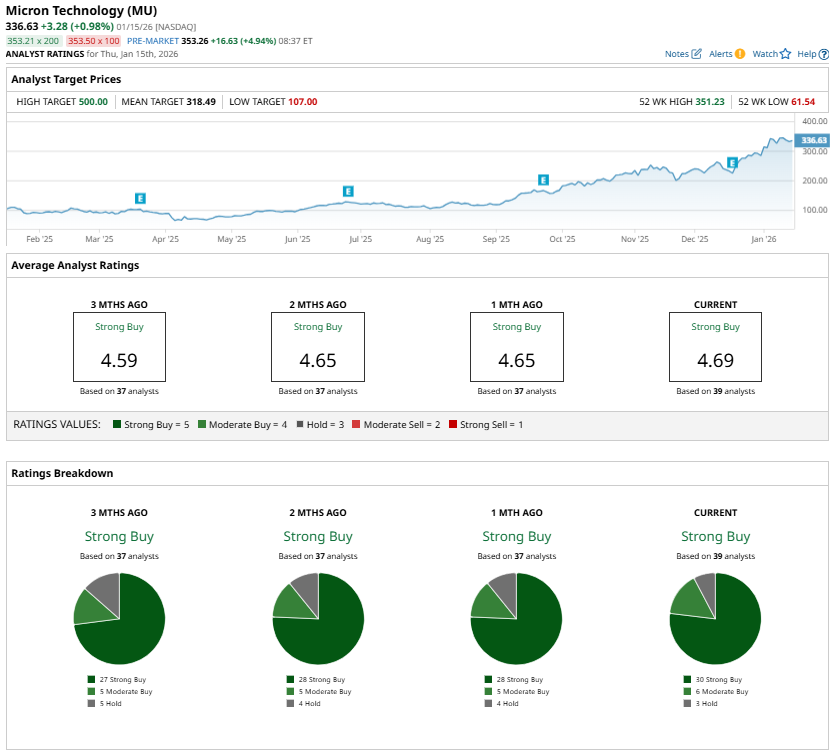

At least one analyst now projects Micron's shares could reach $500 within the next 12 months, representing the Street's highest price target. Based on the stock’s Jan. 15 closing price of $336.63, that forecast implies upside of more than 48%.

Micron Could Deliver Massive Earnings Growth

Micron has entered one of the strongest growth phases in its history. The company has started fiscal 2026 on a solid footing, and management remains optimistic, forecasting record top- and bottom-line performance in the second quarter and across the full fiscal year. Management projects momentum to strengthen as the year progresses, supported by a combination of strong end-market demand and tight industry supply conditions that are expected to persist well beyond calendar 2026.

Industry fundamentals are working in Micron’s favor. Demand remains robust across key markets, while capacity constraints are keeping supply constrained. Against this backdrop, the company is advancing discussions with customers on multiyear agreements that include specific volume commitments, a development that could provide greater earnings visibility and stability. At the same time, Micron is focused on maximizing output from its existing manufacturing footprint, ramping its most advanced technology nodes, and investing to expand future supply.

The data center market is a key driver of this growth story. Management expects server demand to remain strong throughout 2026, reflecting the rapid increase in memory and storage requirements with each new server generation. Micron’s product portfolio is well positioned to capitalize on this trend, particularly through its high-value offerings, such as High Bandwidth Memory (HBM), high-capacity server DRAM, and data center solid-state drives (SSDs).

Importantly, Micron has finalized price and volume agreements covering its entire calendar 2026 HBM supply, including its next-generation HBM4 products. Management sees the HBM market expanding rapidly, supporting its growth.

NAND flash memory is also expected to contribute meaningfully to earnings growth. Improved pricing, higher shipments, and a favorable product mix are likely to drive revenue gains, while manufacturing cost reductions should support expanding gross margins.

Analysts currently expect Micron to generate earnings of $32.19 per share in fiscal 2026, representing year-over-year (YoY) growth of over 319%. Even after this surge, growth is projected to continue, with fiscal 2027 earnings expected to rise by nearly 32% off a much higher base. If industry conditions remain tight and demand continues to exceed supply, these estimates may prove conservative.

The Bottom Line

Micron has entered a multi-year earnings expansion cycle driven by AI-related demand, tight industry supply, and a strong product portfolio. While the stock has already delivered significant gains, its forward price-to-earnings multiple of 11.1 suggests further upside.

With profit growth accelerating and valuation still relatively modest, the prospect of Micron shares advancing toward the $500 level by 2026 appears increasingly attainable.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Selling Costco and 3 Other Unusually Active Puts Could Save You From Overpaying

- Barclays Calls This 1 AI Server Stock ‘Best in Class’ Amid Upgrade to ‘Overweight’ Rating

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings

- Why Rosenblatt Thinks Rigetti Computing Stock Can Soar 60% from Here