One of the fastest ways new options traders lose money has nothing to do with the market. It’s strategy confusion.

Most beginners learn about long calls and puts, and then immediately jump into complex trades — spreads, condors, diagonals — without understanding when and why each strategy should be used. As options strategist Rick Orford explains in his latest video, the problem isn’t that options are too complicated. It’s that traders fail to adequately define their trading goals first, resulting in strategy mismatch.

Start with the most important question: Why are you trading options?

Before choosing a strategy, Rick encourages traders to slow down and ask one simple question: Are you trading options for high returns, or for consistent income?

That answer instantly narrows your strategy universe.

If your goal is aggressive growth, you may lean toward long calls or puts. But if your goal is steady income on a weekly or monthly basis, your focus shifts toward strategies that get paid up front and define risk.

That’s where strategies like covered calls, credit spreads, and cash-secured puts come into play.

Why Cash-Secured Puts Make Sense for New Traders

Rick highlights cash-secured puts as one of the most beginner-friendly income strategies, especially for traders who want to own quality stocks at lower prices.

A cash-secured put works like this:

You sell a put option and set aside enough cash to buy the stock if assigned. You collect a premium immediately. If the stock stays above your strike, the option expires worthless and you keep the income. If it drops below, you buy the stock at a discount you already chose.

No guessing. No leverage surprises. No margin panic.

That structure alone eliminates many of the emotional mistakes that wipe out new accounts.

Using Data Instead Of Emotion: Expected Move & Probability

What makes Rick’s walkthrough especially valuable is how he pairs the strategy with Barchart’s tools, so traders aren’t relying on gut feel.

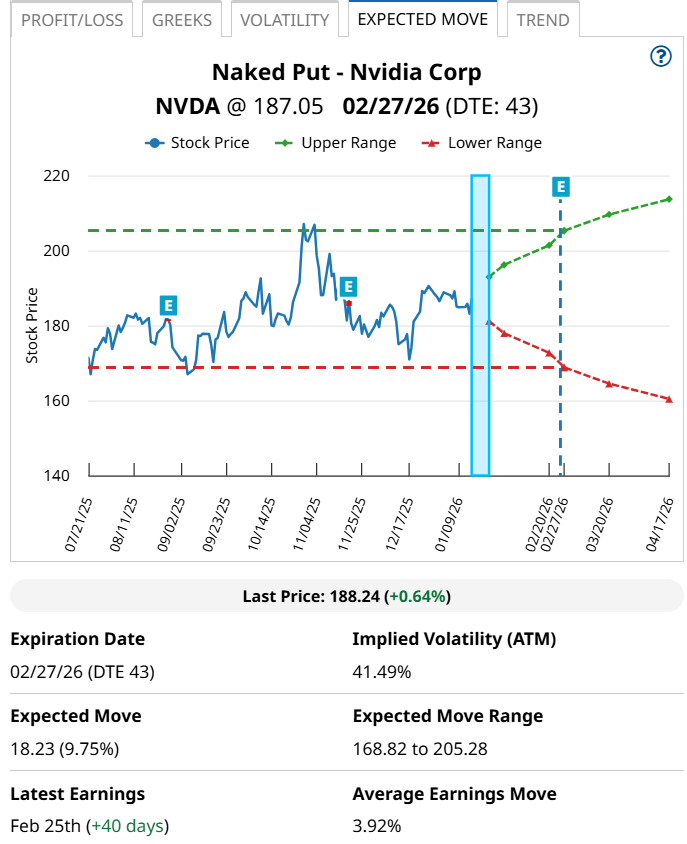

He starts with Expected Move, found inside Barchart’s P&L charts. Expected Move projects a likely trading range by expiration, based on 85% of the value of an at-the-money straddle.

For put sellers, the lower end of that range becomes a decision guide:

- Sell below it to reduce assignment risk

- Sell above it to increase premium and probability

This is where strategy turns into process.

A Real Example: Selling Income on Nvidia

In this clip from the video, Rick walks through a real cash-secured put example using Nvidia (NVDA).

By selecting a 30–45 day expiration and choosing a strike informed by Expected Move, the trade offers:

- Immediate premium income

- A high probability of profit

- The opportunity to buy Nvidia at a meaningful discount if assigned

Instead of chasing upside or guessing direction, the trader defines every outcome before entering the trade. That’s the difference between trading and guessing.

Why This Matters For Long-Term Success

Most blown-up options accounts fail for predictable reasons:

- No clear objective

- Mismatched strategies

- Emotional decision-making

- No plan for assignment or risk

Rick’s approach flips that script:

- Define the goal first, and then choose the strategy second.

- Use data to select strikes and expirations; then manage the trade – not your emotions.

That’s how traders survive long enough to get good at the process.

The Takeaway

Options don’t wipe out accounts, but misused strategies do.

Cash-secured puts aren’t flashy, but they’re structured, disciplined, and repeatable. For new traders, that combination matters far more than chasing the perfect trade.

If you want to stop guessing and start trading with intent, this quick clip — and the full video — are worth your time:

For more education, check out our options tutorials and resources.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart