Charlotte, North Carolina-based Duke Energy Corporation (DUK) is an energy company that generates, transmits and distributes electricity and natural gas to millions of customers across multiple states. Valued at a market cap of $92.5 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 before the market opens on Tuesday, Feb. 10.

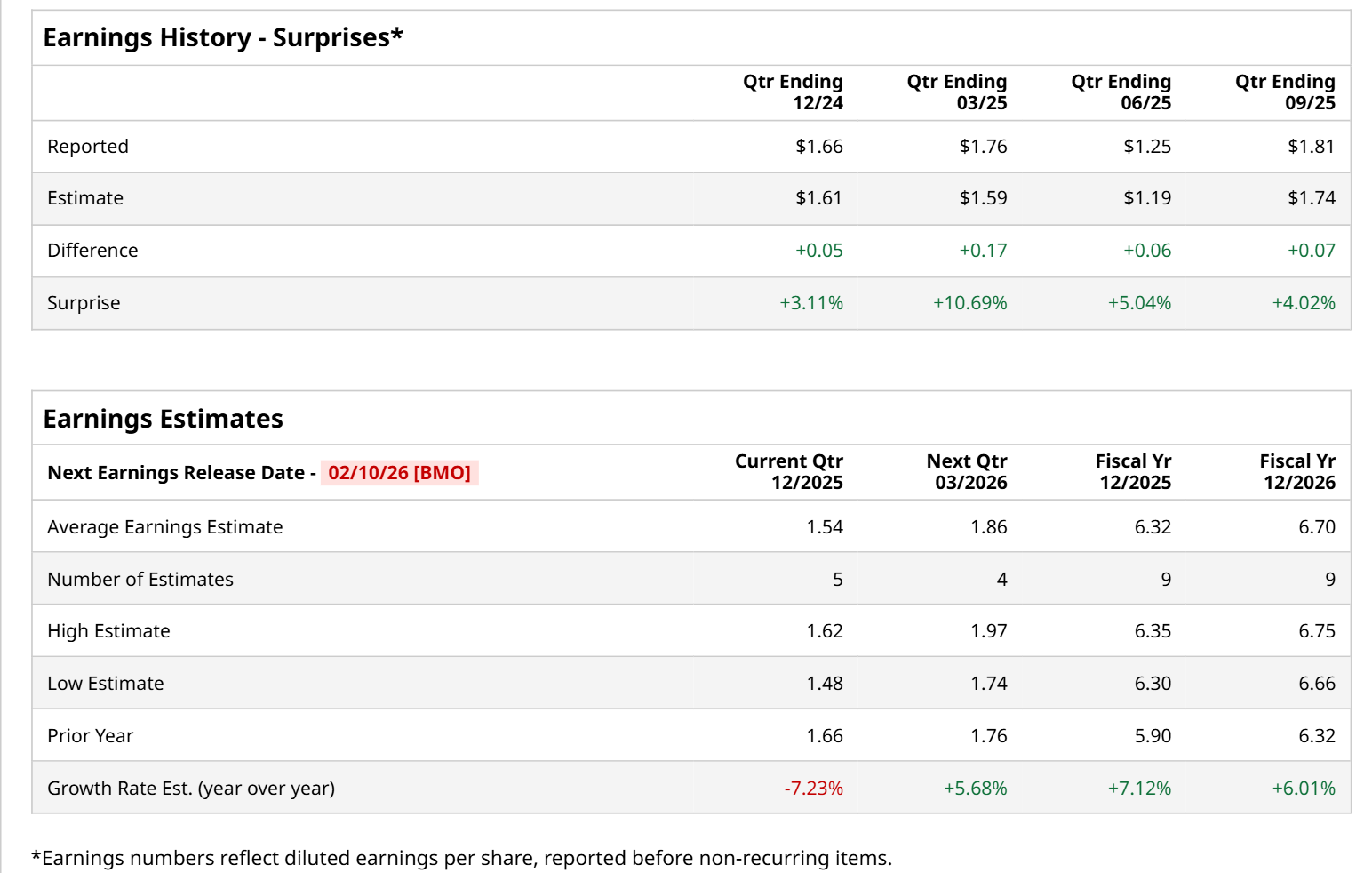

Ahead of this event, analysts expect this utility company to report a profit of $1.54 per share, down 7.2% from $1.66 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.81 per share in the previous quarter exceeded the consensus estimates by 4%.

For the current fiscal year, ending in December, analysts expect DUK to report a profit of $6.32 per share, up 7.1% from $5.90 per share in fiscal 2024. Its EPS is expected to further grow 6% year-over-year to $6.70 in fiscal 2026.

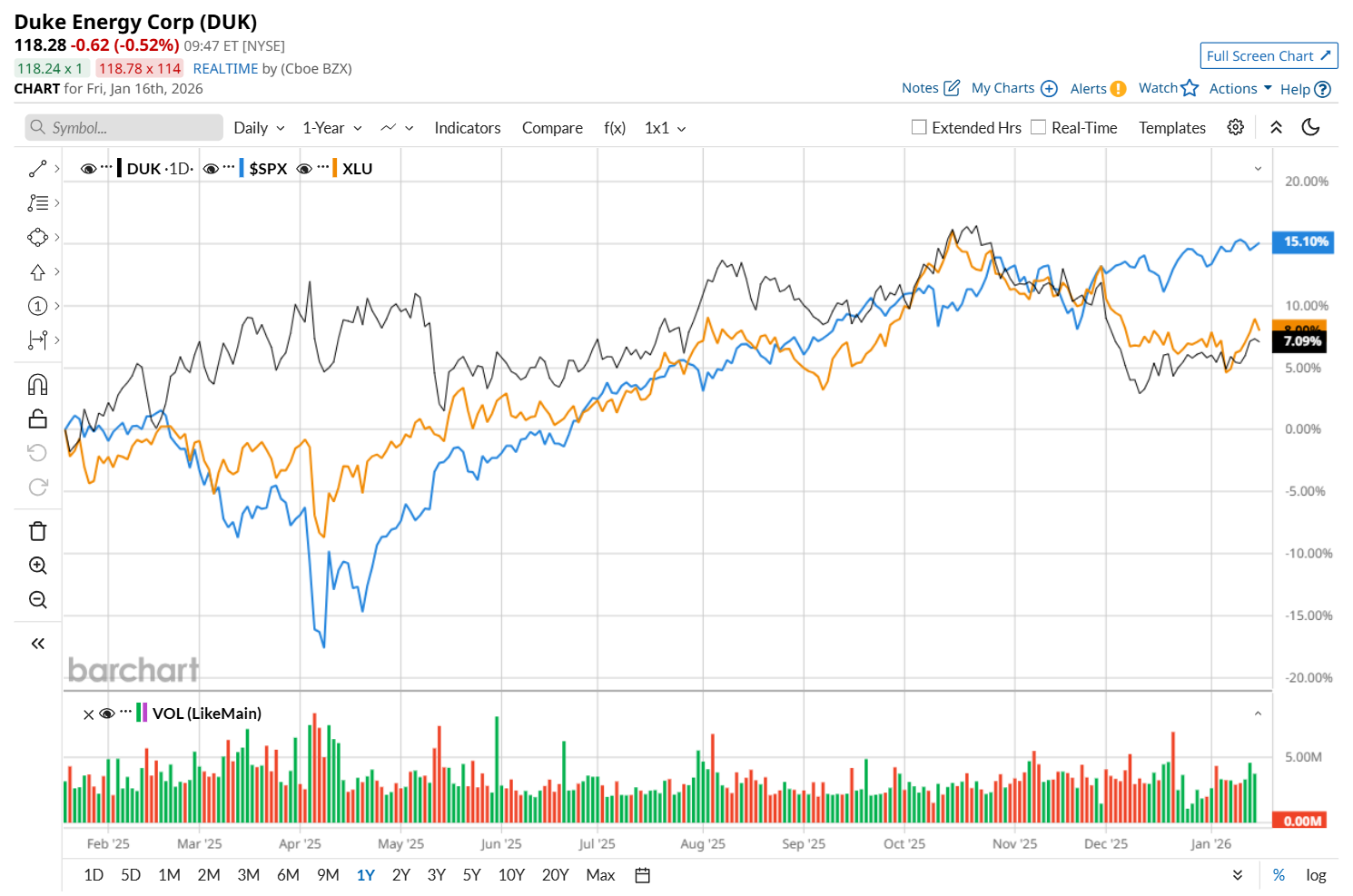

DUK has gained 8.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.7% return and the State Street Utilities Select Sector SPDR ETF’s (XLU) 9.9% uptick over the same time period.

On Nov. 7, shares of DUK closed down marginally after its Q3 earnings release, despite delivering better-than-expected results. The company's total operating revenue rose 4.8% year-over-year to $8.5 billion, surpassing consensus estimates by 1.4%. Meanwhile, its EPS climbed 15.3% from the year-ago quarter to $1.81, topping Wall Street’s expectations of $1.74.

Wall Street analysts are moderately optimistic about DUK’s stock, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 11 recommend "Strong Buy," one indicates a "Moderate Buy,” and 12 suggest "Hold.” The mean price target for DUK is $135.21, indicating a 14.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Oracle's Modern Market Masterclass: What ORCL Can Teach Us All About Today's Market

- Does a Major Disruption Like Wednesday’s Verizon Outage Even Move the Needle for VZ Stock? What You Need to Know.

- Is Intel Stock a Buy at New 52-Week Highs?

- How to Dial In on the Best Option Strategy and Strike for Your Trading Goals