A grain and oilseed composite, including CBOT soybean, corn, wheat, oats, and rough rice futures, fell 1.41% in Q4 and was 9.78% lower in 2025. In my Q3 Barchart report on the sector, I concluded with the following:

Each year is a new adventure in the agricultural sectors, and commodity cyclicality suggests that prices are at or near levels that will discourage production, reduce inventories, and increase demand, leading to higher prices over the coming months and years. Moreover, the weather in the critical growing regions and developments in worldwide trade could cause sudden price volatility. At the current levels, prices have limited downside potential, while the upside could be substantial. I favor long positions in the sector, leaving plenty of room to add on further declines over the coming months. The 2026 crop year and supply uncertainty are just around the corner in early 2026, which could ignite price recoveries.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Grains and oilseed futures could be poised for a recovery in 2026.

Soybean futures rise in Q4 and 2025- Mixed results in soybean products

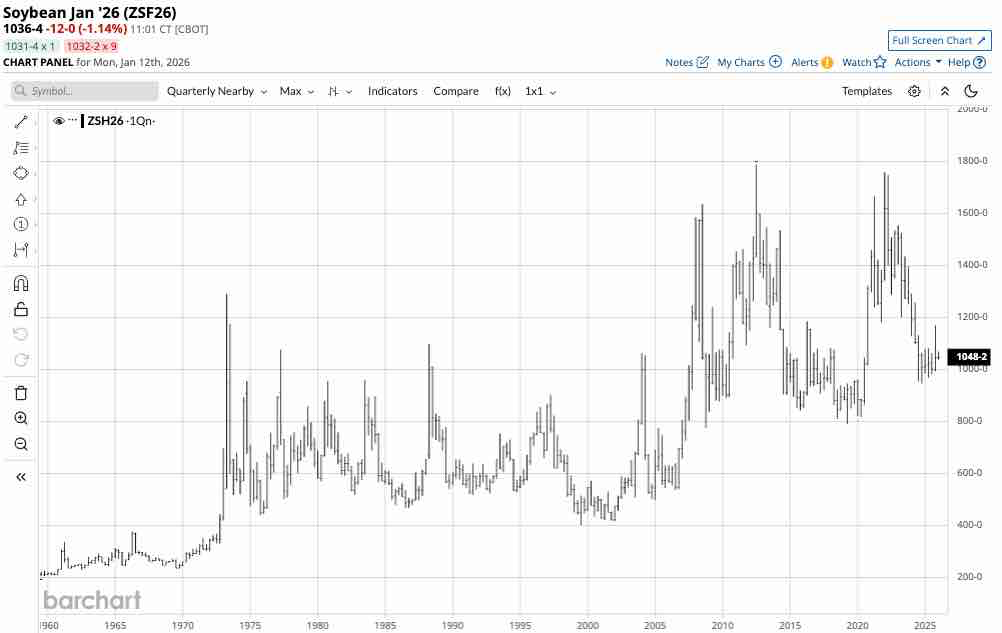

Nearby CBOT soybean futures moved 2.87% higher in Q4.

The quarterly chart shows that soybean futures rose 3.23% in 2025, with the nearby price settling at $10.3050 per bushel on December 31, 2025. Soybean futures have remained in a bearish trend since the 2022 high, when the price rose to 29.75 cents per bushel, below the all-time 2012 peak of $17.89 per bushel. Nearby bean futures were slightly higher on January 12, 2026.

Nearby soybean meal futures rallied 10.84% in Q4 and were 4.31% lower in 2025, settling at $294.50 per ton on December 31, 2025. Nearby soybean oil futures fell 1.64% in Q4 and were 20.84% higher in 2025, settling at 48.07 cents per pound on December 31, 2025.

Soybean, soybean meal, and soybean oil futures were slightly higher on January 12, 2026.

Corn futures rise in Q4, but fall in 2025

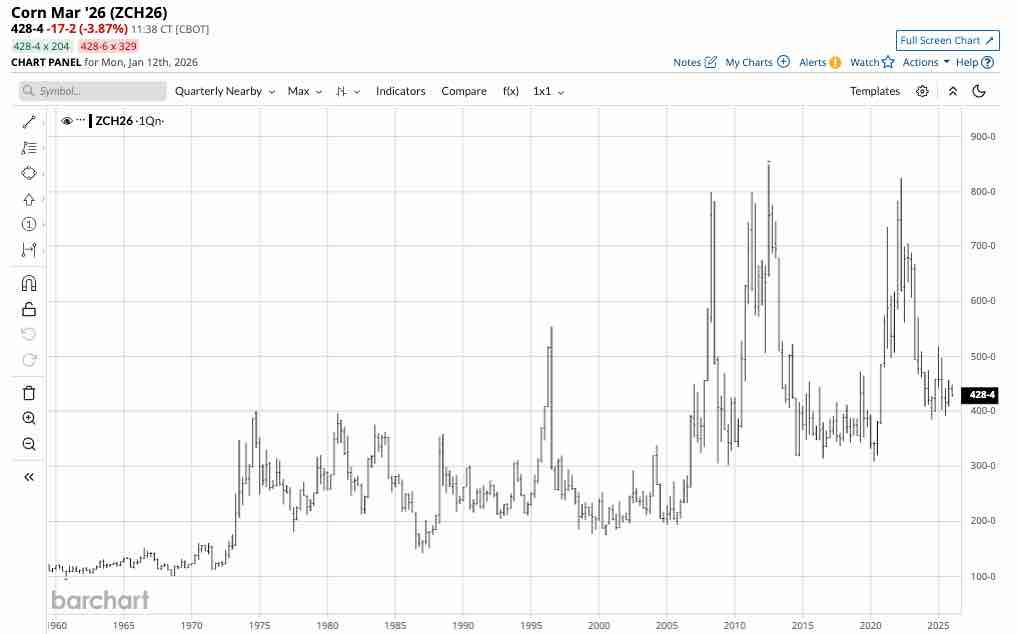

Nearby CBOT corn futures rose 5.96% in Q4.

The quarterly chart shows that corn futures fell 3.98% in 2025, with the nearby price settling at $4.4025 per bushel on December 31, 2025. Corn futures have remained in a bearish trend since the 2022 high, when the price rose to 24.50 cents, below the all-time 2012 peak of $8.49 per bushel. Corn futures were lower on January 12, 2026.

Wheat futures are steady but moved lower in 2025

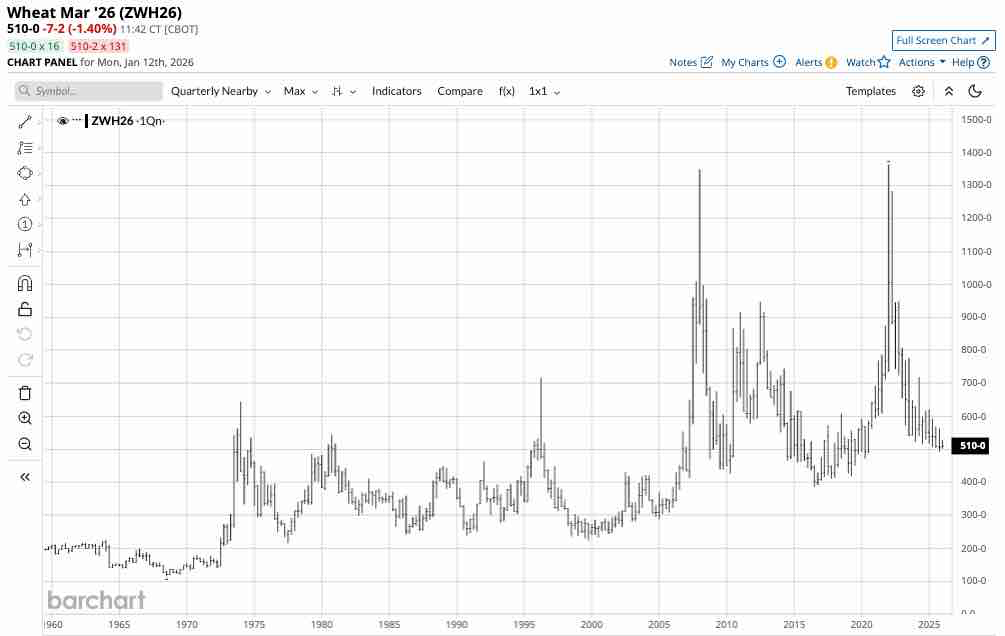

Nearby CBOT soft red winter wheat futures edged 0.20% lower in Q4.

The quarterly chart shows that CBOT wheat futures fell 8.07% in 2025, with the nearby price settling at $5.07 per bushel on December 31, 2025. CBOT wheat futures remained in a bearish trend since the record high of $13.6350 in 2022.

Nearby KCBT hard red winter wheat futures rallied 3.42% in Q4 and were 7.96% lower in 2025, settling at $5.1475 per bushel on December 31, 2025. Nearby MGE spring wheat futures were 2.00% higher in Q4 and were 3.65% lower in 2025, settling at $5.74 per pound on December 31, 2025.

CBOT soft red and KCBT hard red winter wheat futures were marginally higher, while the MGE spring wheat futures were slightly lower in January 2026.

Weakness in oats and rice futures markets

CBOT oat futures fell 1.63% in Q4 and were 8.47% lower in 2025, settling at $3.0250 per bushel on December 31, 2025.

CBOT rough rice futures moved 14.06% lower in Q4 and were 31.59% lower in 2025, settling at 9.595 per hundredweight on December 31, 2025.

The oats were marginally lower, and rough rice futures were slightly higher than the 2025 closing prices on January 12, 2026.

The outlook for 2026- Commodity cyclicality

The most compelling case for commodity cyclicality in 2026 could be in the grain and oilseed sector, as prices have been in bearish trends since the 2022 highs. Prices rose to multi-year and, in some cases, all-time highs in 2022 when Russia invaded Ukraine. Russia and Ukraine are Europe’s breadbasket, with significant grain production. The war ignited supply fears, which did not materialize, given bumper crops that satisfied global demand over the past years. However, the war continues, and each year is a new adventure as the weather and crop conditions determine the path of least resistance of prices. In 2026, the weather, crop diseases, tariffs, sanctions, and other issues will determine if the price direction for grain and oilseed commodities.

In 2022, prices rose to highs, leading to increased production, growing inventories, and a decline in demand, which drove bearish price trends in 2023, 2024, and 2025. Prices have reached levels where inflationary pressures that increased production costs could cause significant price bottoms, as commodity prices tend to fall to levels where production becomes uneconomic and decreases, inventories decline, and consumption increases. The grain sector could be a textbook case for commodity cyclicality in 2026.

Global population growth increases the demand side of grain and oilseed fundamental equations, and each year, supplies must keep pace with the growing demand. The current price levels could limit downside risks, while the upside could be explosive if weather conditions create shortages.

I am cautiously bullish on grain and oilseed prices in 2026, as the risk-reward favors the upside.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart