Amidst the quest by market participants for AI stocks, AppLovin (APP), a marketing platform, has been quietly creating value. APP stock has surged by 83% in the last 52 weeks, and, despite a couple of bumpy trading days this week, the rally seems to be far from over.

Recently, Evercore ISI initiated coverage on the mobile software company with an “Outperform” rating and a price target of $835. This would imply a 39% upside from current levels.

Evercore believes that as a “dominant ad tech platform,” AppLovin is positioned for sustained growth. Further, Evercore opines that between FY25 and FY28, the company is positioned for revenue and EBITDA CAGR exceeding 30%.

Evercore isn’t the only one bullish on AppLovin. Last month, Benchmark reiterated its “Buy” rating and upped the price target for APP stock to $775. The rationale is an expanding total addressable market, robust top-line growth, and industry-leading profitability.

About AppLovin Stock

Headquartered in Palo Alto, AppLovin is a provider of technological solutions that supports businesses connecting with their “ideal customers.” This is achieved through end-to-end software along with AI solutions.

AppLovin has a presence in the United States and internationally. Currently, the company has two business segments—advertising and apps. The company is on a high-growth trajectory, and for Q3 2025, revenue increased by 68% on a year-on-year (YoY) basis to $1.4 billion. For the same period, the adjusted EBITDA was $1.15 billion, which was higher by 79% on a YoY basis.

Backed by the fundamental factor of robust growth coupled with a positive outlook, APP stock has trended higher by almost 74% in the last six months.

Strong Fundamentals and Headroom for Growth

On looking beyond the headline growth numbers, there are several other positives about AppLovin. The first point to note is the company’s high-margin business. For Q3 2025, the adjusted EBITDA margin was 82%. With AI-driven solutions that provide an edge over peers, it’s likely that robust margins will be sustained.

Further, the company reported free cash flow of $1 billion for Q3. This implies an annualized FCF potential of $4 billion. Strong financial flexibility allows AppLovin to invest in platform innovation. At the same time, aggressive share repurchase is creating value.

It’s also worth mentioning that AppLovin ended Q3 with a cash buffer of $1.7 billion. Further, the company has an undrawn credit facility of $1 billion. This implies a strong liquidity buffer of $2.7 billion.

A key point from the growth perspective is strong global presence. For Q3 2025, AppLovin reported revenue of 49% from the United States. The international market contribution is therefore significant and magnifies the total addressable market and provides headroom for sustained growth.

Another growth catalyst is the company’s impending opportunity to acquire clients outside mobile gaming. With aggressive investments, the company’s advertising solutions are relevant to the broader advertising ecosystem. As an example, there is a big opportunity for growth in the e-commerce business globally.

What Analysts Say About APP Stock

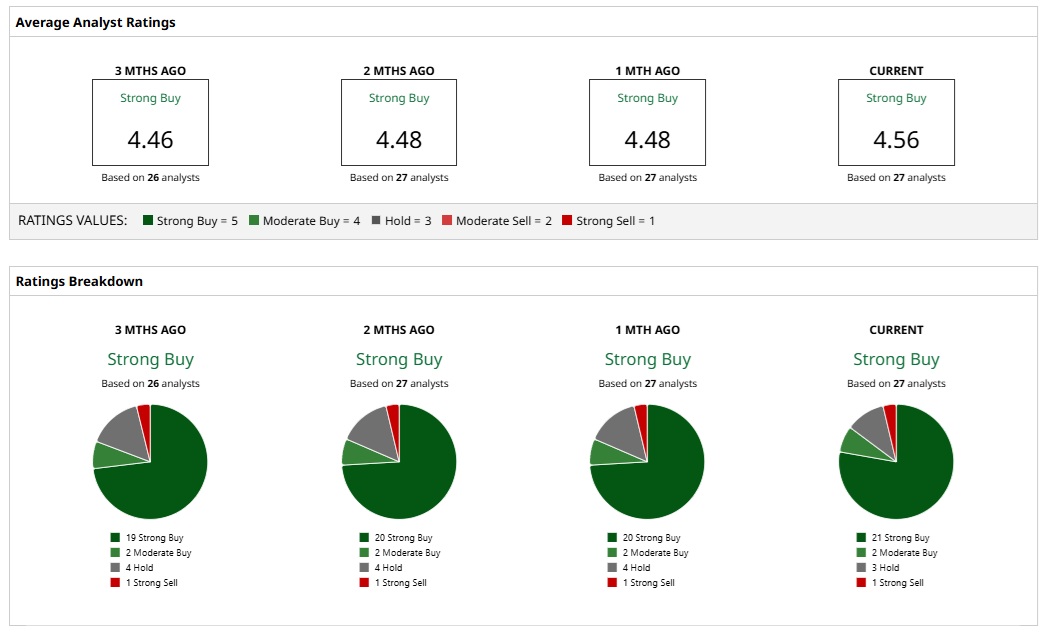

Based on the ratings of 27 analysts, APP stock is a consensus “Strong Buy.” An overwhelming majority of 21 analysts assign a “Strong Buy” rating to APP. Further, two and three analysts have assigned a “Moderate Buy” and “Hold” rating, respectively. One analyst, however, believes that APP stock is a “Strong Sell.”

Based on these ratings, analysts have a mean price target of $726.48 currently, which would imply an upside potential of 21%. Further, with the most bullish price target of $860, the upside potential for APP stock is 43%.

The positive outlook is underscored by the point that analysts expect earnings growth for FY25 and FY26 at 105.7% and 62.5%, respectively. This is likely to ensure that APP stock remains in an uptrend.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Selling Meta Platforms Stock. Should You?

- NAND Demand Stays Strong as Chip Sales Slump. Is Sandisk or Western Digital Stock a Better Buy in January 2026?

- 3 Dividend Aristocrats Built to Perform During Uncertainty With Plenty of Upside

- The AI Pick-and-Shovel Trade Hiding in Plain Sight: Stocks & ETFs to Invest in Water