I’m often asked, “what does a good chart look like?” Now, that’s a very subjective question, and a good chart by itself doesn’t guarantee us anything. But a good chart helps put the balance of return and risk in our favor.

So, to help readers understand what I see, this is a good chart:

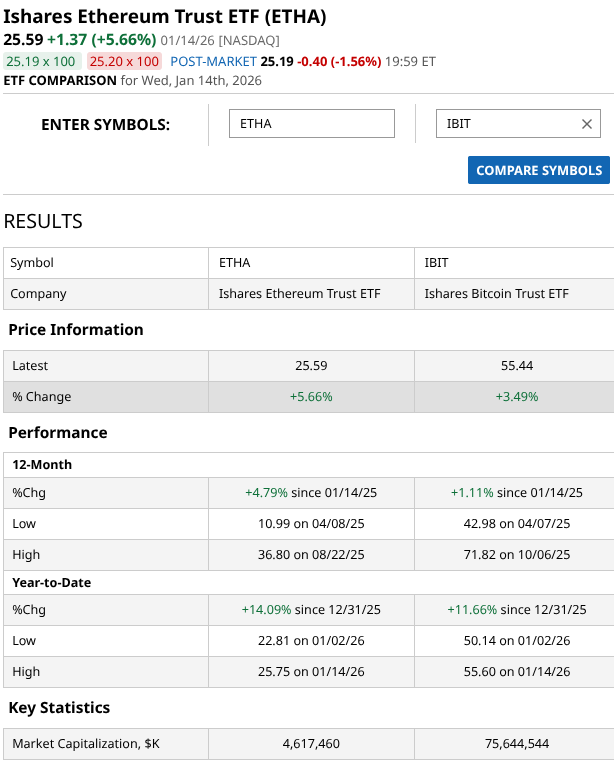

The 20-day EMA is hinting at breaking out along with the current price. The 50-day EMA has flattened out, inspiring hope it will turn up next. And the Percentage Price Oscillator (PPO) below just crossed into positive territory, for the third time in its brief history. Although cryptocurrencies are never-endingly volatile, as a trading vehicle, this ETF is pretty attractive.

The iShares Ethereum Trust (ETHA) has been overshadowed by its sister ETF that tracks the best-known cryptocurrency, the iShares Bitcoin Trust (IBIT).

In the investment world, being first usually means getting the lion’s share of the headlines and the capital. That’s exactly what happened with Bitcoin (BTCUSD). When spot ETFs launched, IBIT became the fastest-growing ETF in history, attracting more than $70 billion in assets.

Now, the dust is settling. And that produces a potentially powerful trading move for ETHA. It’s up 14% year to date, and looking for more. While outperforming IBIT.

These days, the market loves a laggard with a story. I suspect some traders are shifting their mindsets from “why do I need this?” to “why don’t I own more of this?”

The ‘Digital Gold’ vs. ‘Digital Infrastructure’ Gap

The reason ETHA has been ignored is simple: Bitcoin is an easy “sell.” It’s “digital gold.” You buy it, you tuck it away, and you hope the world’s fiat currencies keep devaluing. It’s a macro trade.

Ethereum (ETHUSD) is different. It’s a programmable network. It’s the “pipes” for the future of finance. For the average “passive-aggressive” ETF investor, that’s a harder concept to grasp. Consequently, ETHA’s AUM has hovered around $11 billion — a respectable number for any other fund, but a rounding error compared to the Bitcoin behemoths.

Why the Math Is Changing in 2026

In the modern market, price action is the only truth, and the truth is that Ethereum’s supply is being vacuumed up.In late 2025, when Ethereum pulled back from its highs, we saw stakers dumping their coins en masse. That created a price ceiling. Now that selling pressure has essentially dried up. And really, other than supply-demand imbalances, what is more important to crypto trading? Not much.

The comeback isn't just about supply; it’s about Wall Street utility. BlackRock (BLK) isn’t just running an ETF; they are leading the charge into real-world asset (RWA) tokenization.

They aren’t doing that on the Bitcoin network. They are doing it on Ethereum. When major banks start settling bonds and money market funds on-chain, they need Ethereum to do it.

ETHA Is Having Its Moment

Ethereum has spent the last 18 months in Bitcoin’s shadow, but the “infrastructure trade” is finally catching up to the “store of value” trade. ETHA is no longer just the other crypto; it is a tactical play on the very plumbing of a progressing modern financial system.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ETHA: The ‘Other’ Crypto ETF Is About to Step Out of Bitcoin’s Shadow

- This Trump-Linked Penny Stock Just Regained Nasdaq Compliance. Should You Buy It for 2026?

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?

- The Market Is Stress Testing Crypto. This 1 ETF Is a Tactical, High-Risk Way to Bet on Its Comeback.