Arista Networks, Inc. (ANET), headquartered in Santa Clara, California, develops, markets, and sells data-driven, client-to-cloud networking solutions for data center, campus, and routing environments. Valued at $183.4 billion by market cap, the leading tech company offers Ethernet switches, pass-through cards, transceivers, and enhanced operating systems. It also provides host adapter solutions and networking services. The cloud networking giant is expected to announce its fiscal fourth-quarter earnings on Thursday, Feb. 12, after the market closes.

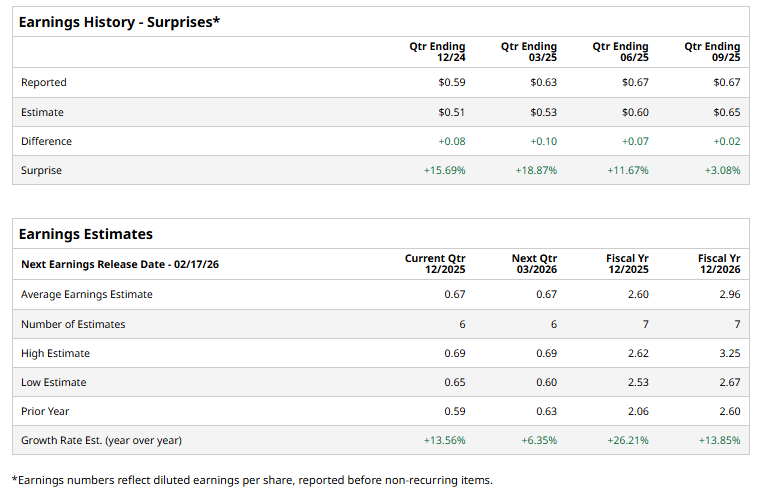

Ahead of the event, analysts expect ANET to report a profit of $0.67 per share on a diluted basis, up 13.6% from $0.59 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect ANET to report EPS of $2.60, up 26.2% from $2.06 in fiscal 2024. Its EPS is expected to rise 13.9% year over year to $2.96 in fiscal 2026.

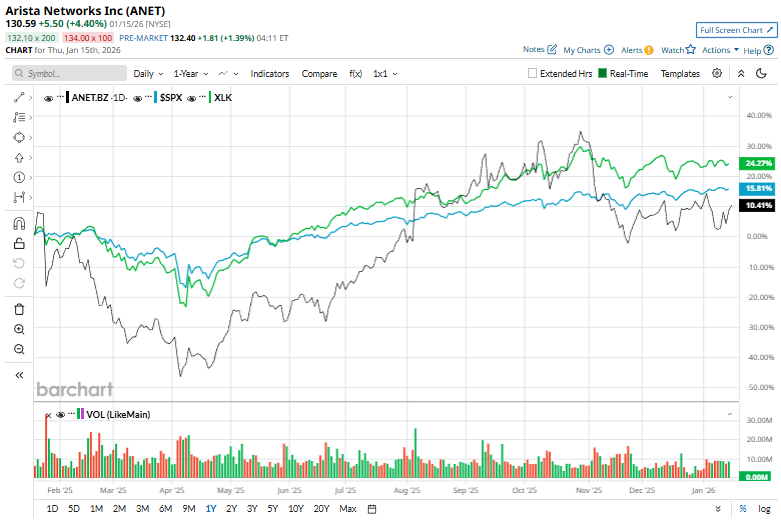

ANET stock has gained 12.5% over the past year, outpacing the S&P 500 Index’s ($SPX) 16.7% gains and the Technology Select Sector SPDR Fund’s (XLK) 23.2% rise over the same time frame.

Arista’s stock gained 1.8% on Dec. 10 after the company unveiled new campus networking capabilities, including its VESPA technology for scalable Wi-Fi mobility, enhancements to its AI-powered AVA platform, and expanded outdoor switching solutions running on its EOS software. Arista leadership noted that demand for its integrated, software-driven networking approach continues to strengthen as customers seek simpler operations, greater automation, and consistent performance across data center, cloud, and enterprise environments.

Analysts’ consensus opinion on ANET stock is bullish, with a “Strong Buy” rating overall. Out of 24 analysts covering the stock, 17 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and five give a “Hold.” ANET’s average analyst price target is $167.22, indicating a potential upside of 28% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart