It certainly doesn't bode well for the global order when two of the world's largest economies are displaying such blatant disregard for consistency in their respective policies. Whether it is on the geopolitical front or in the tech sector, it appears that the USA and China are competing to outperform each other in terms of policy shifts. And when it comes to tech, Nvidia (NVDA) is the centerpiece now. The Santa Clara, CA-based company is not merely a chipmaker now, as it has emerged as a key component of diplomacy for the two economic powerhouses.

Why? Well, its chips are the most powerful in the world, and they remain the most vital aspect of the AI buildout throughout the world. China knows this, and thus, they are looking to build their own chip industry to reduce dependence on a U.S. company like Nvidia. Although they have met with some success, overall, the chips made in the world's second-largest economy are still substantially behind the ones developed by Nvidia, even the earlier generations.

To Restrict or Not to Restrict

The United States, under the AI Diffusion Rule established earlier last year, had imposed export restrictions on Nvidia's H200 chips to stifle Chinese access to advanced American technology. Then, in mid-2025, Nvidia reported no sales of AI chips to China, a country that once accounted for almost $20 billion in annual revenues for the company.

In fact, in October 2025, CEO Jensen Huang revealed, “At the moment, we are 100% out of China,” adding, “We went from 95% market share to 0%.”

Then, in another policy shift in December 2025, President Donald Trump announced that it would allow Nvidia to sell H200 chips to China, subject to conditions, including security requirements and a 25% “fee” or surcharge on the revenue from such sales. Nvidia’s stock reacted positively, but skepticism remained. And rightly so, as within a month, there were even more rules that Nvidia had to follow to sell its H200 chips to China.

Just a few days ago, the U.S. Bureau of Industry and Security formally published licensing rules for exporting H200 (and similar advanced chips) to China. Key elements included that exports be only allowed on a case-by-case basis, under strict licensing rules, the hardware supplied should not be inimical to U.S. interests, and the China shipments could not exceed 50% of U.S. domestic sales of the same parts. Meanwhile, the 25% surcharge rule was to remain.

Beijing, not willing to bow down and perhaps reposing confidence in its domestic chip capabilities, has reportedly turned hesitant about importing the H200 chips. What does this mean? Yes, more restrictions! The Chinese authorities are seemingly developing rules on how many of Nvidia's H200 chips to permit into the country, with provisions also allegedly afoot on which companies can import them as well. Amid all this uncertainty, Jensen Huang has made perhaps the most definitive statement about a metric that will truly define if China will allow the import of H200 chips: purchase orders.

And that should be that, I think. Only after the company gets concrete purchase orders should it really consider the Chinese market active and start reporting sales from there, again.

Financials and Fundamentals Keep Chugging Along, Dismissing China Uncertainties

All this has not put a slight dent in Nvidia's growth story as its financials continued on their path of surpassing Street expectations, despite not reporting any AI chip revenue from China since the middle of last year.

While over the past 10 years, the company has seen its revenue and earnings explode at CAGRs of 44.06% and 66.66%, respectively, the latest quarterly results of Q3 2025 drive home the fact that the momentum is well and truly intact for the Jensen Huang-led company.

Nvidia delivered another strong quarter in Q3 2025, beating both revenue and earnings estimates while posting year-over-year (YoY) growth rates above 50% for each.

Revenue for the period came in at $57.1 billion, up 62% from the same quarter last year. Earnings per share rose 60% to $1.30, topping the consensus call of $1.26. The data center business, which remains the main growth engine, increased 66% to $51.2 billion.

Cash flow performance stayed robust too. Operating cash flow rose to $23.8 billion from $17.6 billion a year earlier, and free cash flow jumped 65% to $22.1 billion. The company ended the quarter with $60.6 billion in cash, short-term debt under $1 billion, and long-term debt at $7.5 billion, leaving cash more than eight times the long-term debt figure.

Guidance for the December quarter calls for revenue around $65 billion, implying 65.4% YoY growth.

Overall, the fundamental thesis for investing in Nvidia remains as the $4.45 trillion market cap company's stock is up 40% over the past year, reflecting limited impact from the China headwinds.

With more than a 90% market share in the GPU market, Nvidia's supremacy lies not only in its Blackwell or the soon-to-be-commercially-deployed Rubin chips, but rather in the whole ecosystem comprised of CUDA software and NVLink, its interconnecting architecture for GPUs. This broad capability positions them as the preferred partner for a wide range of clients, from large-scale data center operators to leading automotive manufacturers.

Lastly, Nvidia's exposure to China-related risks is further mitigated by the rapid rise of sovereign AI initiatives. Countries such as Saudi Arabia and the UAE have emerged as some of the company's most significant customers, committing capital well exceeding $100 billion over multi-year horizons. These are not short-term tactical investments; they represent long-term strategic programs tied to national digital infrastructure and economic diversification goals.

When sovereign entities across the globe begin to rely on Nvidia's technology as a foundational element of their AI ambitions, the demand profile gains a degree of stability that is rare in the sector. This durable, government-backed backlog provides a meaningful buffer against the cyclical volatility that often affects technology companies, particularly those with concentrated geographic or customer exposure.

Analyst Opinion on NVDA Stock

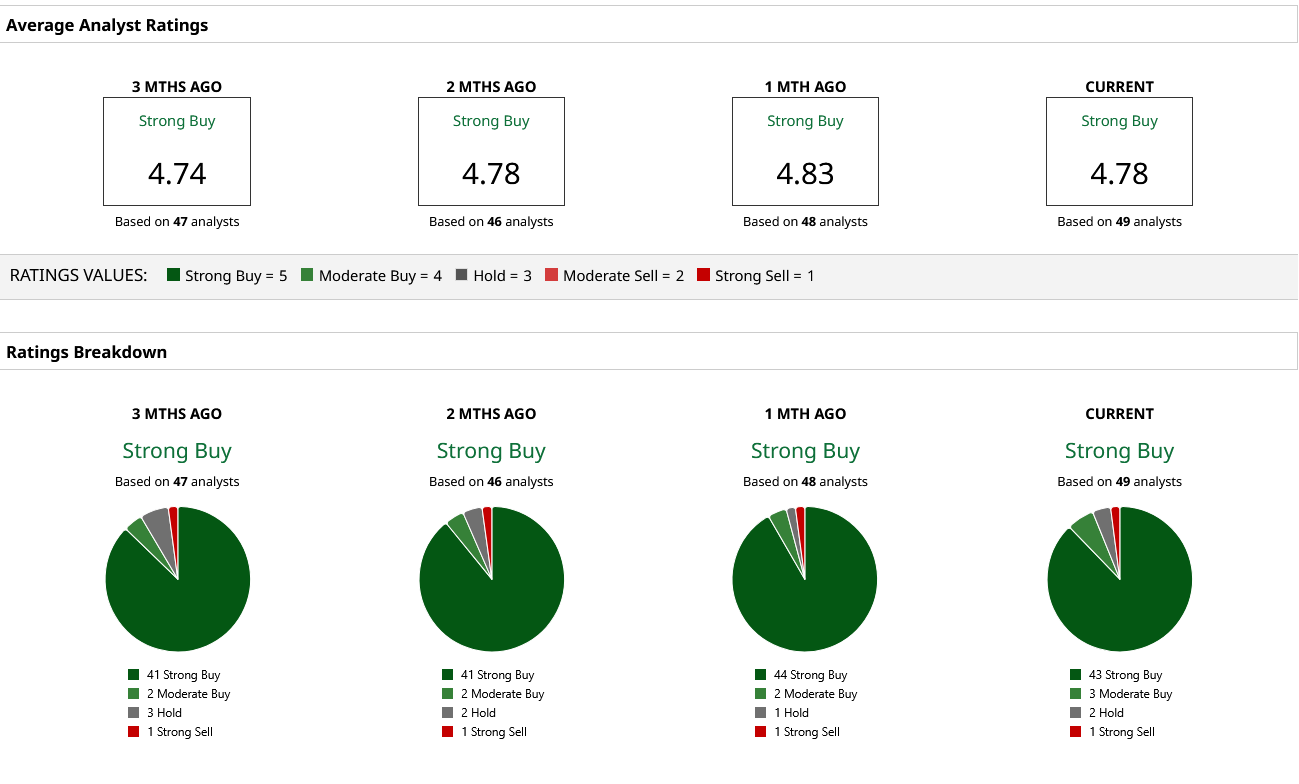

Thus, analysts have attributed a rating of “Strong Buy” for the NVDA stock, with a mean target price of $255.07. This denotes an upside potential of about 36% from current levels. Out of 49 analysts covering the stock, 43 have a “Strong Buy” rating, three have a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Barclays Calls This 1 AI Server Stock ‘Best in Class’ Amid Upgrade to ‘Overweight’ Rating

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings

- Why Rosenblatt Thinks Rigetti Computing Stock Can Soar 60% from Here

- Micron Stock’s Stunning Run Isn’t Over Yet — Could $500 Be Next?