Big gains and growing dividends don't usually happen overnight. They are built quietly over years of rising payouts, expanding earnings, and investor patience.

While the trend shifts toward strategies easily distracted by headlines, hot trades, and short-term moves, it helps to step back and focus on what has actually worked over time. Businesses that keep growing profits and raising dividends are more likely to outperform their peers, at least eventually, even if they're not always the most talked-about names.

That is exactly why I keep track of my Dividend Aristocrats list: these are S&P 500 companies that have increased their dividends for at least 25 consecutive years. They've rewarded shareholders through good times and bad, making them a natural starting point for investors who value consistency. But when that consistency is paired with strong earnings growth and solid price performance, the long-term results can be compelling - which is what I did for this article.

How I came up with the following stocks

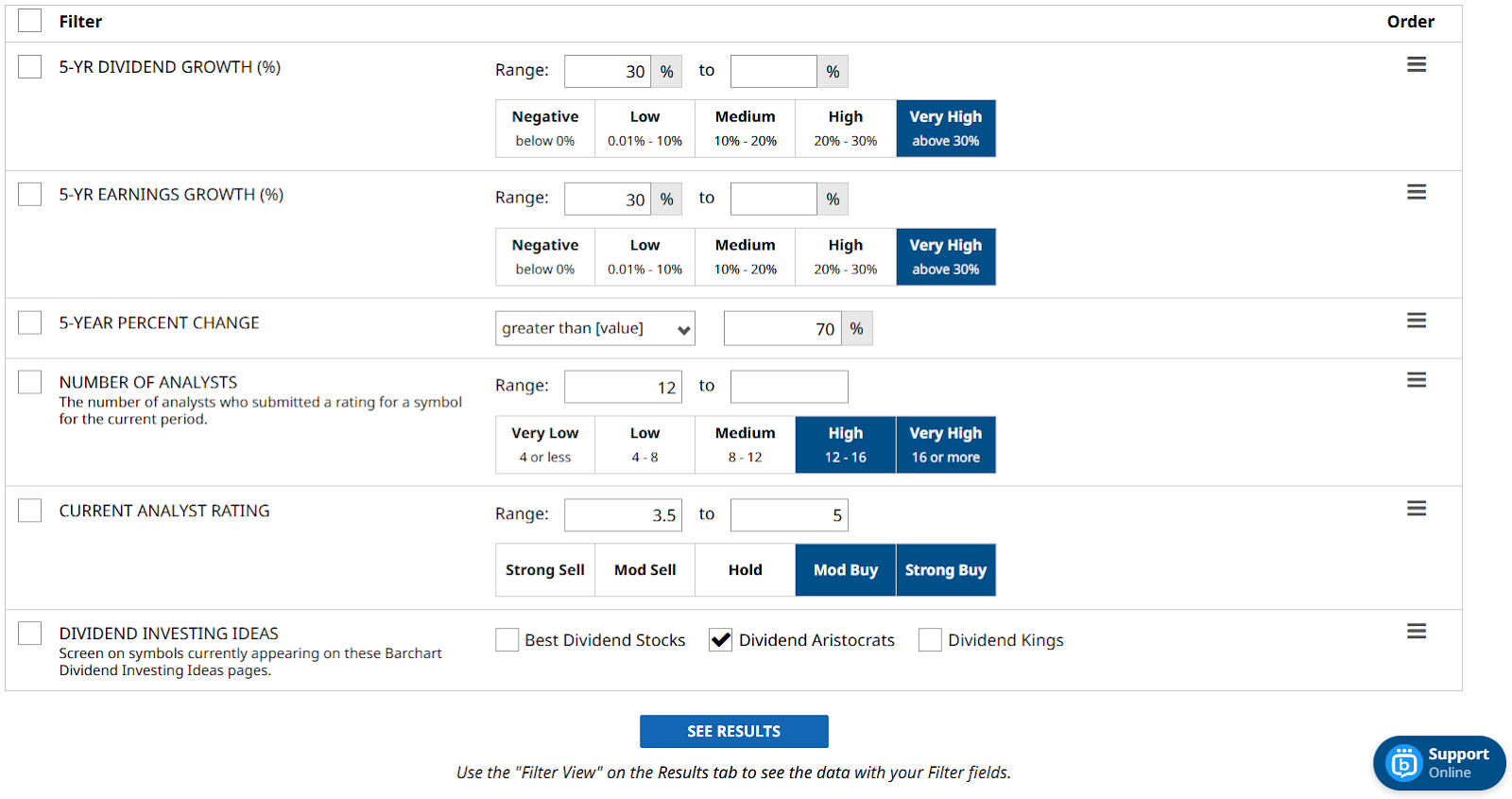

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- 5-YR Dividend Growth (%): Above 30%. I'm looking for companies that have increased their dividends at least 30% in the past 5 years.

- 5-YR Earnings Growth (%): Above 30%. These companies have “Very High” and sustainable earnings in the past 5 years.

- 5-Year Percent Change: Greater than 70%. I am looking for stocks with an upside of more than 70% over the past 5 years.

- Number of Analysts: 12 or higher. The more the analysts, the better the consensus.

- Current Analyst Rating: 3.5-5. Buy ratings only.

- Dividend Investing Ideas: Dividend Aristocrats.

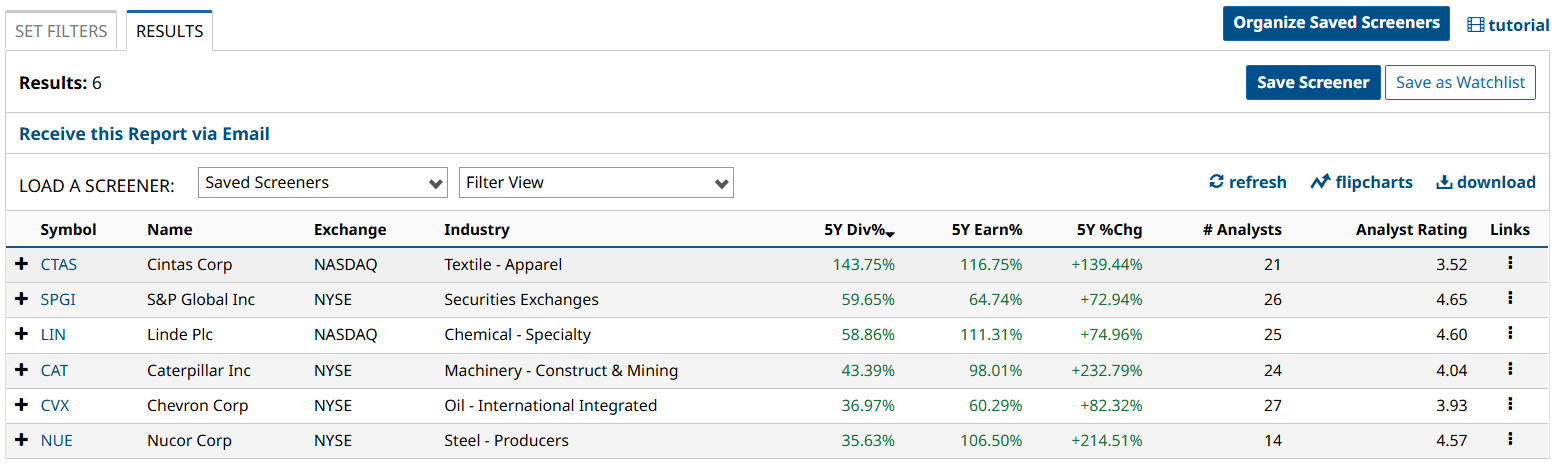

I hit the screen and got 6 results. I will cover three with the highest 5-YR Dividend Growth.

Let’s start with the first Dividend Aristocrat:

Cintas Corp (CTAS)

Cintas Corp is a leading provider of corporate identity, uniform, and facility services. It offers sanitary and safety products across different industries. For example, its Garment Dispensing Solution gives customers a more efficient, technology-driven way to manage apparel and reduce losses, which is a quiet growth driver for the business.

In its recent quarterly financials, the company reported that sales increased 9% YOY to $2.8 billion. Meanwhile, its net income grew 10% to $495 million. Cintas also pays a forward annual dividend of $1.80, translating to a yield of a little less than 1%. While that looks small compared to the others on the list, what keeps investors hooked is growth: earnings were up 117%, its dividend grew 144%, and its stock price is up 141% over the last five years.

Even better, a consensus among 21 analysts rates the stock a “Moderate Buy”. The stock has a high target of $255, suggesting a potential upside of over 30%.

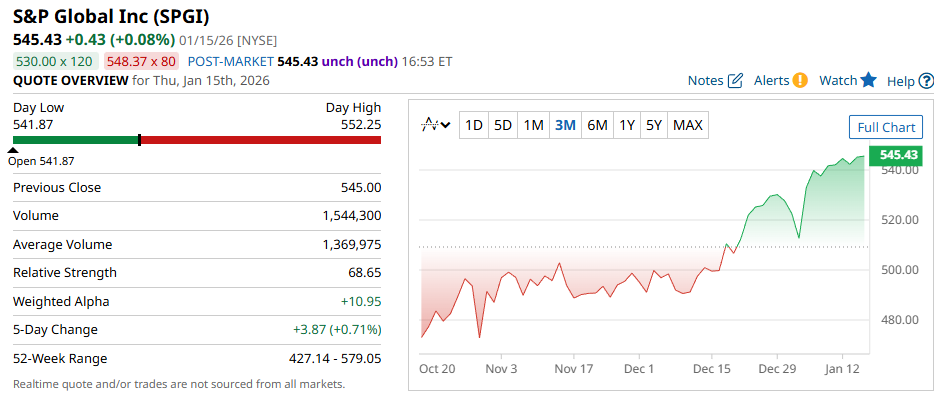

S&P Global Inc (SPGI)

The next on my Dividend Aristocrat list is S&P Global Inc, a globally recognized company that provides critical financial intelligence, credit ratings, and benchmark indices used by retail and institutional clients. Its recent With Intelligence acquisition deepens its reach into private markets data, reinforcing its long-term growth and cash flow potential.

In its latest quarterly financials, the company’s sales rose 9% to $3.9 billion, while net income increased 21% to $1.2 billion. S&P Global pays a forward annual dividend of $3.84, translating to a yield of approximately 0.7%. Similar to Cintas, its dividend may not be the flashiest, but its five-year earnings and dividends grew 65% and 60%, respectively. The result? SPGI stock is up 73% over the last five years.

While 26 analysts rate the stock a “Strong Buy”, there's as much as 26% upside should it reach its high target price of $689.

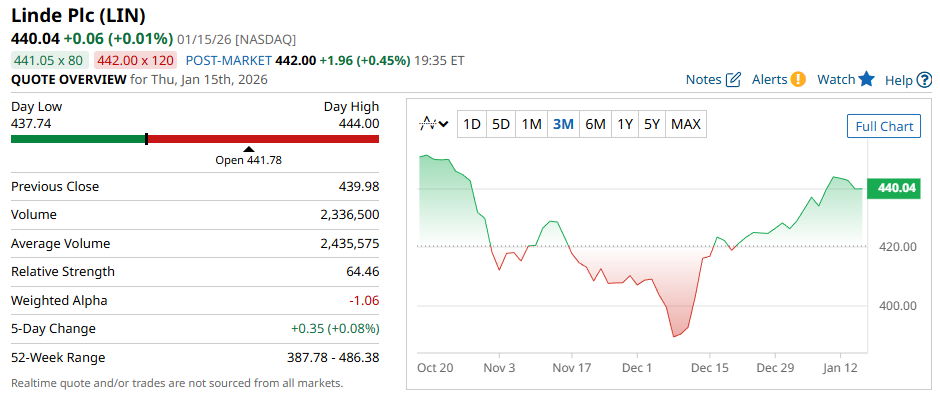

Linde Plc (LIN)

The third and last Dividend Aristocrat on my list is Linde Plc, a global leader specializing in chemicals and engineering. Its U.S. space sector investments highlight how Linde supplies critical industrial gases for specific industries, while also focusing on sustainability.

The company’s recent quarterly financials reported sales rose 3% to $8.6 billion. Meanwhile, its net income increased 25% to $1.9 billion. Linde also pays a forward annual dividend of $6.00 a share, translating to a yield of approximately 1.3%.

In terms of growth, the company’s five-year earnings rose 111%, its dividend increased 58.86%, resulting in its stock price growing almost 75%- all while providing long-term investors with sustainable income and decent capital appreciation.

A consensus among 25 analysts also rates the stock a “Strong Buy”. Its high target is $565, which suggests as much as 28% upside if it hits the target over the next year.

Final Thoughts

These three Dividend Aristocrats offer the potential for higher dividends and growth over time. Now, if you are looking for the highest returns in the market within a short period of time, then this list is probably not for you. But for investors looking to hold quality companies, forever, these could be great additions to any income portfolio

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Dividend Aristocrats Built to Perform During Uncertainty With Plenty of Upside

- As Citigroup Slashes Jobs, Should You Buy, Sell, or Hold the Dividend Stock Yielding 2%?

- 2 Rock-Solid Dividend Stocks to Buy for Steady Passive Income

- UnitedHealth Just Got a Checkup, and UNH Stock Has Some Big Problems to Treat in 2026. The Bull and Bear Cases Now.