Exton, Pennsylvania-based West Pharmaceutical Services, Inc. (WST) designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products. Valued at $19.8 billion by market cap, the company’s technologies include the design and manufacture of packaging components, research and development of drug delivery systems, and contract laboratory services and other services. The leading manufacturer of containment and delivery systems is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

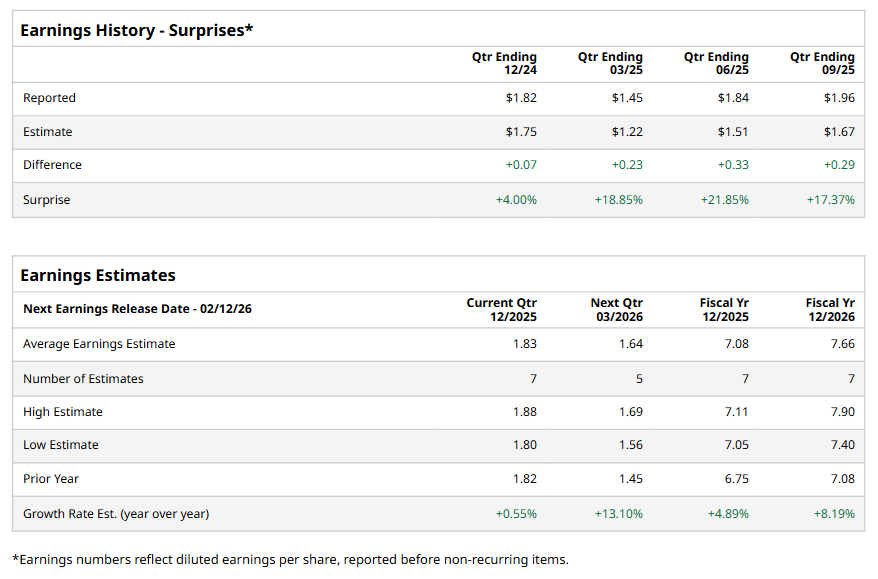

Ahead of the event, analysts expect WST to report a profit of $1.83 per share on a diluted basis, up marginally from $1.82 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect WST to report EPS of $7.08, up 4.9% from $6.75 in fiscal 2024. Its EPS is expected to rise 8.2% year-over-year to $7.66 in fiscal 2026.

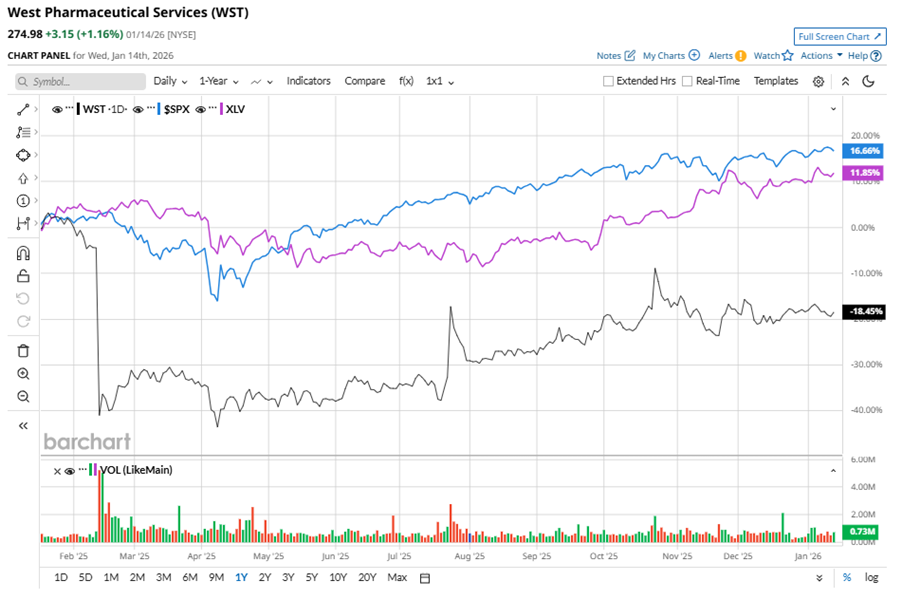

WST stock has underperformed the S&P 500 Index’s ($SPX) 18.6% gains over the past 52 weeks, with shares down 16.4% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 12.8% returns over the same time frame.

WST's underperformance is due to investor concerns about its outlook and operational headwinds, including tariff-related cost pressures and inventory destocking by customers, despite being a leader in injectable drug delivery systems.

On Oct. 23, 2025, WST shares closed up by 10.9% after reporting its Q3 results. Its adjusted EPS of $1.96 surpassed Wall Street expectations of $1.67. The company’s revenue was $804.6 million, topping Wall Street forecasts of $785.5 million. WST expects full-year adjusted EPS in the range of $7.06 to $7.11, and revenue in the range of $3.06 billion to $3.07 billion.

Analysts’ consensus opinion on WST stock is bullish, with a “Strong Buy” rating overall. Out of 17 analysts covering the stock, 12 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” WST’s average analyst price target is $345, indicating a potential upside of 25.5% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart