With a market cap of $18.4 billion, Indiana-based Zimmer Biomet Holdings, Inc. (ZBH) is a global medical technology leader specializing in musculoskeletal healthcare. The company designs, manufactures, and markets a broad portfolio of orthopedic reconstructive implants, sports medicine and trauma products, dental solutions, and surgical technologies, including robotic-assisted systems.

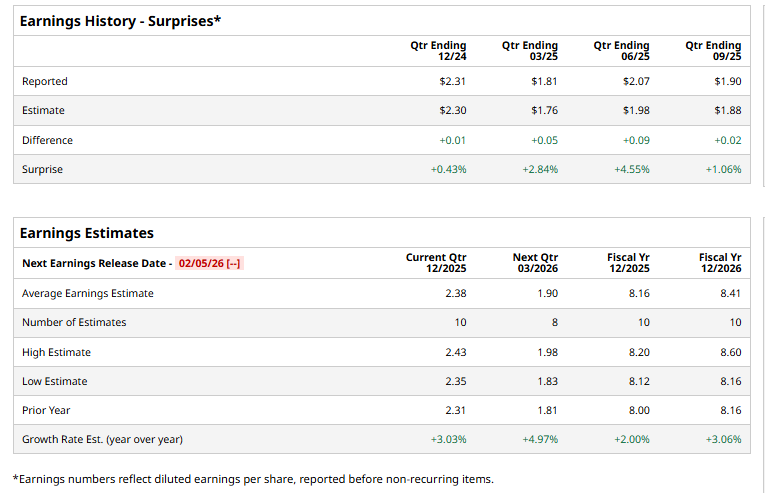

The company is slated to announce its fiscal Q4 2025 results soon. Ahead of the event, analysts expect Zimmer Biomet to report an adjusted EPS of $2.38, up 3% from $2.31 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in each of the past four quarterly reports while missing on another occasion.

For fiscal 2025, analysts predict the medical device maker to report adjusted EPS of $8.16, a 2% rise from $8 in fiscal 2024. Looking forward, adjusted EPS is projected to improve 3.1% year over year to $8.41 in fiscal 2026.

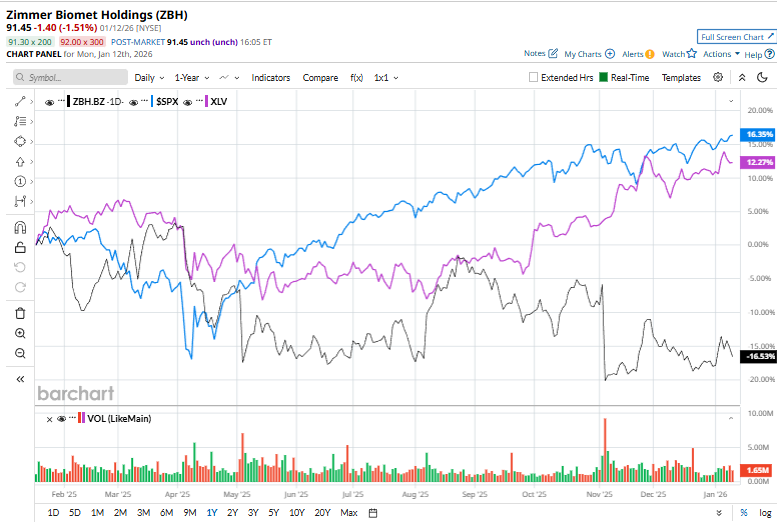

Shares of Zimmer Biomet have declined 12.5% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 19.7% increase and the Health Care Select Sector SPDR Fund's (XLV) 12.7% rise over the same period.

Over the past year, ZBH shares have underperformed the broader market, primarily due to disappointing sales growth, lowered guidance, competitive pressures, and operational challenges. The company trimmed the upper end of its organic revenue growth forecast for 2025 after weaker performance in Latin America and emerging Europe, which disappointed investors and weighed on the stock. Additionally, elevated operational expenses and integration costs related to acquisitions and new technology investments have pressured profit margins, fueling further caution among analysts and contributing to downgrades and modest investor sentiment.

Analysts' consensus rating on ZBH stock is skeptical, with an overall "Hold" rating. Among 26 analysts covering the stock, six recommend a "Strong Buy,” one has a "Moderate Buy" rating, 16 give a "Hold" rating, and three have a "Strong Sell.” The average analyst price target for Zimmer Biomet is $102.73, indicating a potential upside of 12.3% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart