With a market cap of $22.4 billion, Ralph Lauren Corporation (RL) is a prominent American designer, marketer, and distributor of premium lifestyle products anchored in fashion and classic American style. Founded in 1967 and headquartered in New York City, the company’s portfolio spans apparel, footwear, accessories, home furnishings, fragrances, and hospitality offerings, marketed under iconic brand names such as Polo Ralph Lauren, Ralph Lauren Purple Label, Double RL, and Lauren Ralph Lauren.

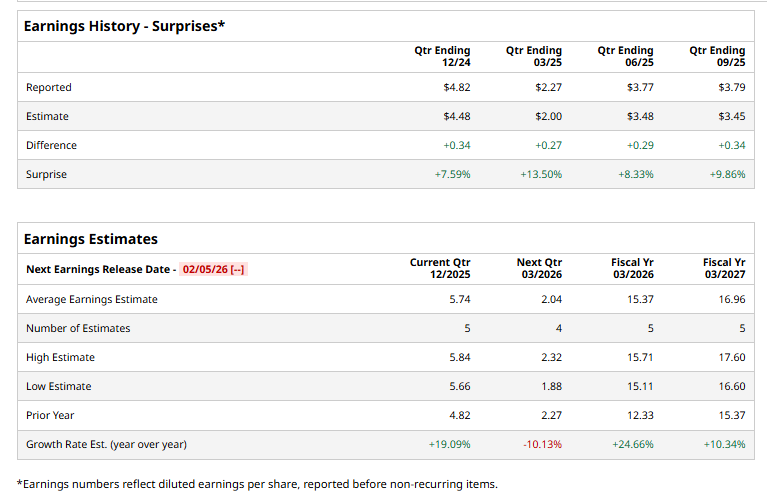

The luxury fashion giant is expected to release its Q3 fiscal 2026 earnings soon. Ahead of this event, analysts expect RL to post earnings of $5.74 per share, up 19.1% from $4.82 per share reported in the same quarter last year. The company has surpassed the Street’s bottom-line estimates in the past four quarters.

For the current year, analysts forecast Ralph Lauren to report an EPS of $15.37, indicating a 24.7% increase from $12.33 reported in fiscal 2025. Also, its EPS is expected to grow 10.3% year over year to $16.96 in fiscal 2027.

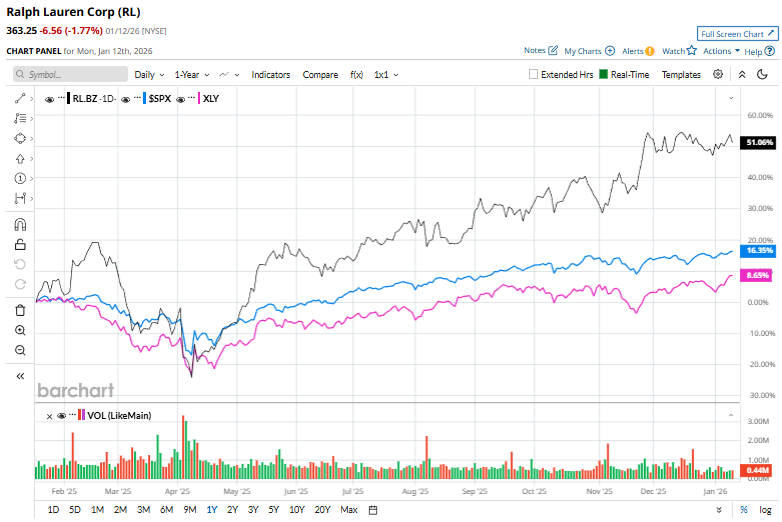

Over the past year, shares of RL have gained 53.1%, significantly outperforming the S&P 500 Index’s ($SPX) 19.7% rise and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 12.8% return during the same time frame.

Shares of Ralph Lauren climbed 3% in the afternoon trading session on Dec. 11 after Guggenheim initiated coverage with a “Neutral” rating, amid broader upbeat sentiment from Wall Street. Several analysts issued upward price target revisions, citing strong brand momentum, while the company’s consistent track record of beating revenue and earnings estimates, and raising full-year guidance, along with solid growth in China and Europe, reinforced investor confidence.

Analysts’ consensus view on RL is largely bullish, with a “Strong Buy” rating overall. Among 19 analysts covering the stock, 13 suggest a “Strong Buy,” one gives a “Moderate Buy,” and five recommend a “Hold.” Its mean price target of $393.06 represents an 8.2% premium to current price

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart