C3.ai (AI), the enterprise AI outfit known for powering big, industrial-grade artificial intelligence (AI) applications, has had a rough run this year. Revenue slowed, margins thinned, costly pilots piled up, and a few sales slip-ups did not help either. Adding in the geopolitical jitters and a government shutdown hitting a key customer base, we understand the reason behind the stock sinking and confidence wobbling.

But every story has a turn. C3.ai’s latest milestone – earning FedRAMP (Federal Risk and Authorization Management Program) authorization – marks a meaningful shift in momentum. With its platform now cleared for sensitive federal workloads, the company gains a powerful gateway into government contracts, a space it has been strategically courting despite market turbulence. The certification builds on existing federal clearances and signals greater credibility in a sector that prizes security above all.

With FedRAMP backing now secured and federal paths opening up, the momentum feels different. So, after slipping by more than half from the YTD peaks, is this where C3.ai’s real recovery begins, and should investors snag its shares now?

About C3.ai Stock

C3.ai, founded in 2009 and based in Redwood City, California, builds enterprise AI software that helps businesses work smarter. Serving sectors like manufacturing, finance, government, energy, and defense, C3.ai provides over 130 ready-to-use AI applications. By combining advanced AI with practical solutions, the company helps organizations worldwide improve efficiency, innovate faster, and tackle complex challenges, making AI a real, usable tool for their everyday operations.

Valued at roughly $2.2 billion, C3.ai’s shares have trudged through a bruising year, shedding 55.52% in 2025, as guidance cuts, leadership turbulence, and missed targets shook confidence. The August 28.2% nosedive – hit because C3.ai’s management warned it would miss its guidance by a wide margin – only deepened doubts. Yet its latest quarterly results sparked a slight but telling bounce, hinting that this long-battered AI name might not be done fighting just yet.

Over the past month, C3.ai has finally shown a flicker of momentum. The 14-day RSI has climbed steadily to 50.29 from November’s oversold depths, signaling renewed buying interest, although the stock is still down 65.46% from last year’s $44.34 peak. The MACD oscillator is echoing that shift in tone. The yellow line has crossed above the blue signal line, and the histogram has turned positive, hinting that bearish pressure is easing and short-term momentum is swinging back in the bulls’ favor.

A Closer Look at C3.ai’s Mixed Q2 Results

C3.ai’s Q2 of fiscal 2026 report landed on Dec. 3, like one of those updates where the numbers look “fine” on paper but tell a more harrowing story underneath. The company beat bottom line expectations and matched the top line, yet both metrics declined sharply year-over-year (YOY). The stock slipped after hours but rose 4.45% in the next trading session, hinting that the quarterly results instilled some confidence in the stock.

The company’s adjusted loss came in at -$0.25 per share, wider than last year’s -$0.06 per-share loss, but narrower than what analysts expected. Meanwhile, revenue came in at $75.15 million, matching estimates but dropping 20.3% YOY. Subscription revenue slid to $70.2 million, while professional services revenue cratered 62.8% as customers moved away from one-off engineering projects. That shift also crushed margins as adjusted gross profit fell to $40.9 million from $66.3 million, with margins shrinking from 70% to 54% thanks to cost-heavy initial deployments.

The 43-day government shutdown certainly did not make matters any easier. It froze workflows across civilian and defense agencies, dragged decision cycles, and elongated sales timelines in manufacturing, healthcare, shipbuilding, and industrial markets. Combining that with weaker subscription contributions and rising operating expenses, the YOY deterioration becomes clearer, even though some sequential improvement showed up.

Yet, buried in the turbulence, the Federal segment was the bright flame. Federal, defense, and aerospace bookings surged 89% annually, making up 45% of total bookings. C3.ai expanded ties with the U.S. Department of Health and Human Services (HHS), the Department of Defense (DOD), the U.S. Army, BAE Systems (BAESY), Naval Air Warfare, the Marine Corps, Los Alamos National Lab, and others. Booz Allen Hamilton (BAH) even joined the Strategic Integrator Program to build commercial-off-the-shelf solutions, perfectly aligned with the government’s new Commercial Off-the-Shelf (COTS) mandate.

Cash levels did slide, from $164.4 million at FY25-end to $103.2 million. Plus, operating cash burn rose to $80 million in the first half, with free cash flow still negative at $46.9 million.

Still, Q2 was not short on action. The company closed 46 agreements, while total bookings jumped 49% quarter-over-quarter (QOQ). High-value deals grew, partner-driven business hit 89%, and Verdantix named the company a Leader in industrial AI.

C3.ai’s Q3 outlook is not exactly bright. Management is guiding for revenues to be between $72 million and $80 million, a steep 19% to 27% drop from last year’s $98.8 million, due to a murky macro backdrop, longer sales cycles, and a heavier tilt toward early-stage deployments. Losses are set to deepen, too. Adjusted operating loss is pegged at $44 million to $52 million, wider than last year’s $23.1 million hit.

For fiscal 2026, the tone stays muted. Management anticipates revenues coming in between $289.5 million and $309.5 million, well below fiscal 2025’s $389.1 million, marking a 20% to 26% decline. And the company expects the red ink to flow further, with adjusted operating loss projected between $180.5 million and $210.5 million, compared to $88.1 million last year.

Analysts are not exactly cheering for C3.ai right now. They anticipate losses deepening 39.1% YOY to about -$3.06 a share in fiscal 2026, before easing slightly next year with a modest 12.1% annual improvement to roughly -$2.69 per-share loss.

C3.ai Secures Federal Trust with FedRAMP Authorization

C3.ai is stepping up its government game. With FedRAMP Moderate authorization, building on its existing IL5 and IL6 security clearances, the Agentic AI Platform now meets the U.S. government’s strict standards for handling sensitive cloud data.

This stamp of trust not only validates C3.ai’s security credentials but opens a pipeline to government contracts, a market with scale and stability. Positioned on the FedRAMP Marketplace, the company can accelerate adoption across federal programs, giving its AI solutions newfound visibility. Plus, recent wins, including contracts with the U.S. Army, Defense Logistics Agency, and the Air Force, highlight a strategic push into defense applications.

For a stock battered by broader market woes and execution hiccups, this move could be a catalyst, signaling credibility, growth potential, and a strategic pivot into high-value, secure government workloads.

What Do Analysts Expect for C3.ai Stock?

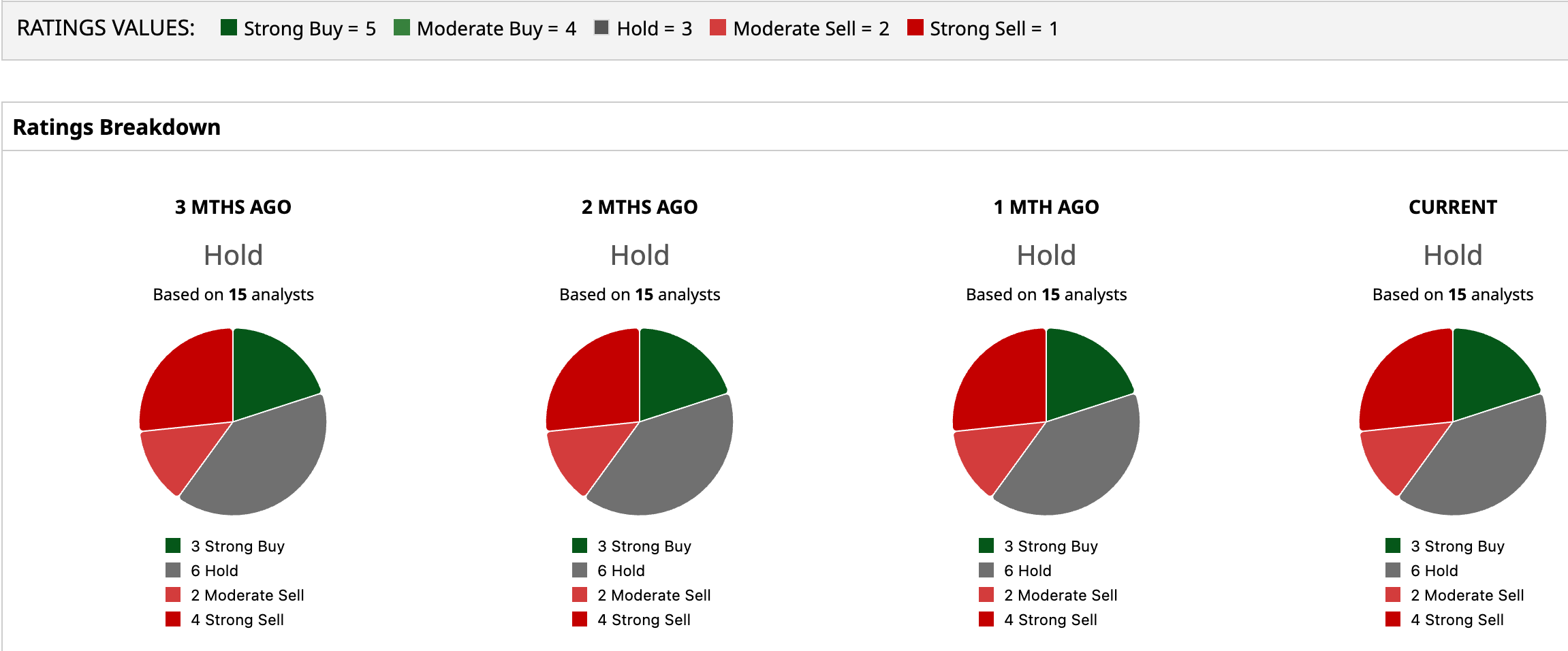

Analysts are playing it safe with C3.ai, giving a consensus rating of “Hold.” Out of 15 analysts covering the stock, just three suggest a “Strong Buy,” six recommend a “Hold,” two advise a “Moderate Sell,” and the remaining four analysts are outright skeptical, giving a “Strong Sell” rating.

The mean price target of $16.67 suggests the stock could surge by 8.6% from the current price levels. The Street-high target of $40 represents potential upside of 160.6%.

Final Thoughts on C3.ai

C3.ai’s FedRAMP authorization is a hard-earned credibility boost, cracking open the government door and spotlighting its platform. Still, the road ahead is not smooth, as losses are anticipated to widen and the top line is projected to decline. From a valuation standpoint, AI stock is priced at 6.1x price-to-sales trailing, pricier than some sector peers but still under its historical median. Momentum is tentative, analysts are cautious, yet federal expansion could be the spark.

The question is not just upside, but whether C3.ai can turn credibility into consistent cash flow without tripping over execution hurdles.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Says This 1 Chip Stock Is a Strong Buy Now... And It’s Not What You Think It Is

- After a Record-Setting Run, This Signal Says Silver Prices Might Be Peaking. Here’s How to Play It.

- C3.ai Just Scored a Government Win. Should You Buy the Beaten-Down AI Stock Now?

- The Saturday Spread: Here’s How to Properly Trade the Nvidia (NVDA) Stock Discount