Everyone loves a good deal, but in the markets, the best deals rarely announce themselves. And I say we're fortunate, because sometimes, even the strongest companies get pushed into oversold territory, not because the business is broken, but because sentiment is.

While others get fearful, that's exactly where I find opportunity. And that’s why I often turn to Dividend Aristocrats, the elite group of S&P 500-listed companies that have consistently increased their dividends for over 25 years. And when these stocks trade near their recent lows- while still earning solid analyst support and paying a reliable (and increasing) stream of income, to me, this creates a window of opportunity.

With that, today, I’m focused on finding Dividend Aristocrats that are sitting at that sweet spot where value meets momentum.

How I came up with the following stocks

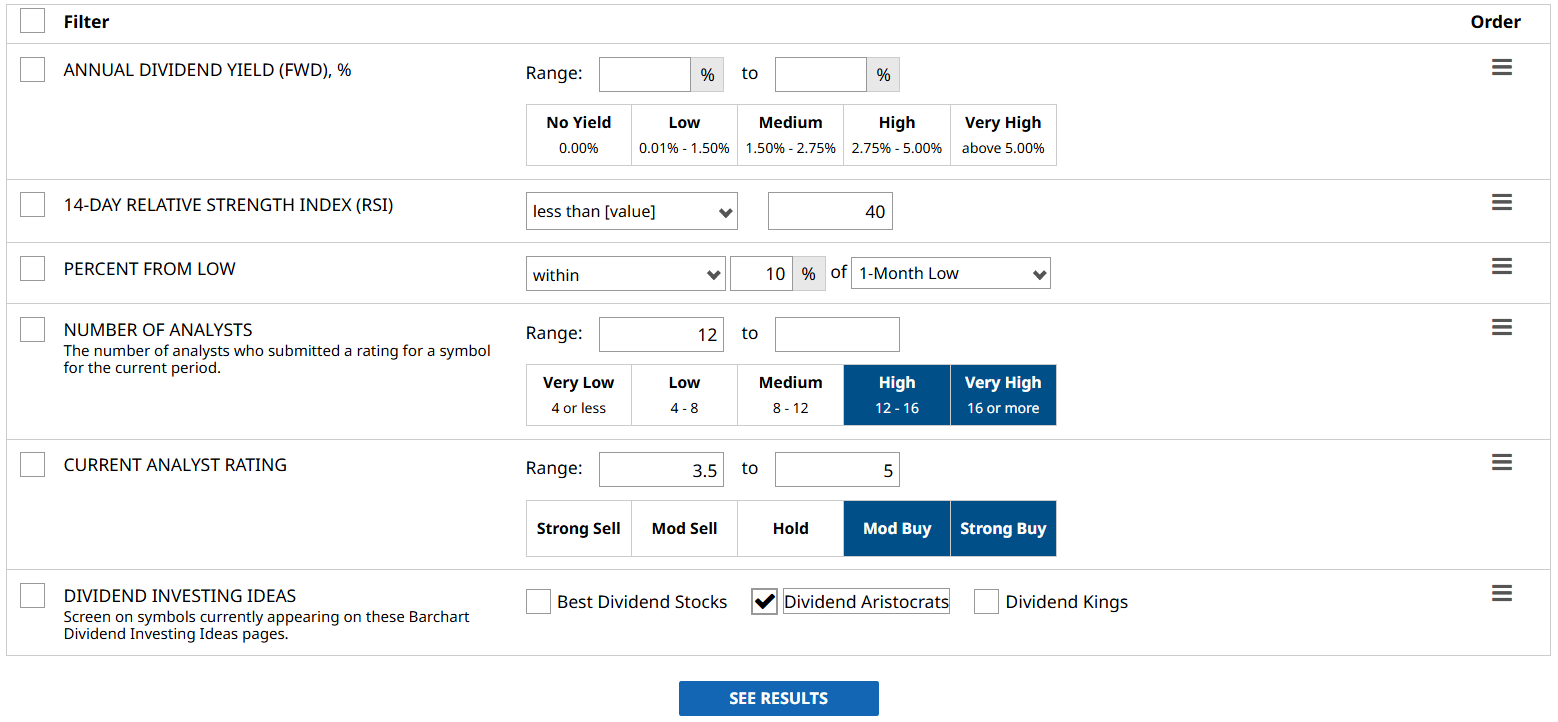

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield (FWD), %: Left blank to sort the results from highest to lowest yield.

- 14-Day Relative Strength Index (RSI): Less than 40%. RSI below 30% suggests that the stock is “oversold” and above 80% is considered “overbought”. I set the maximum to 40% as the “practically oversold zone”.

- Percent From Low: Within 10% of the 1-month low. It confirms that the stock is still near a bullish reversal zone, which may give me a chance to get in before the rebound begins.

- Number of Analysts: 12 or higher. A higher consensus, the better.

- Current Analyst Rating: 3.5–5. Stocks that are “Moderate” to “Strong Buy”.

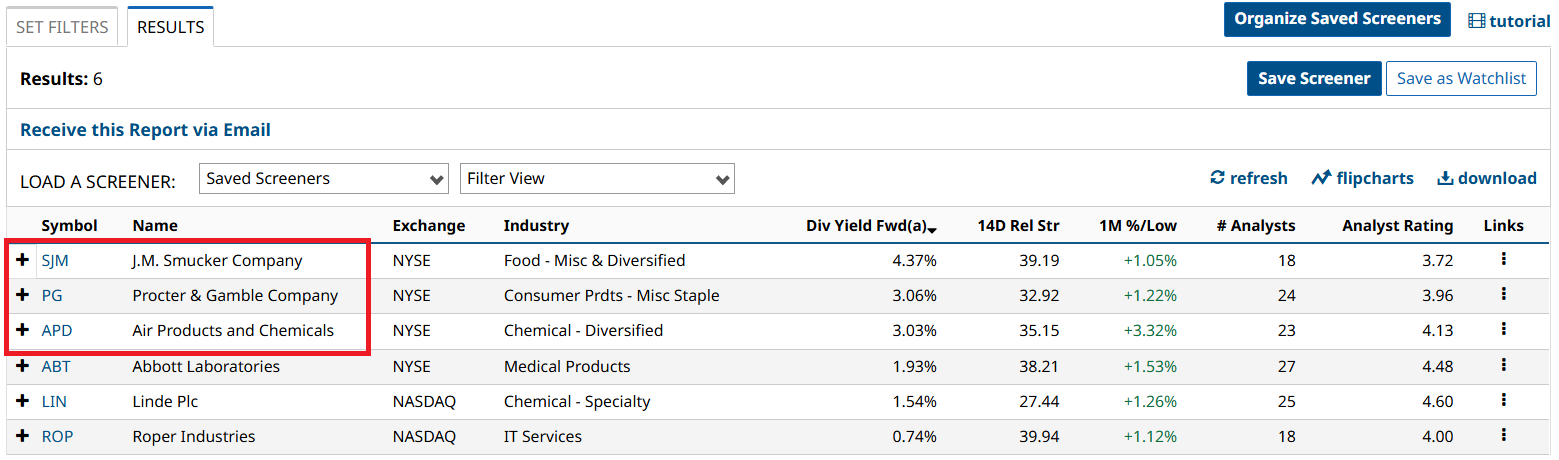

The screen returned six results, and I’ll cover three, sorted by yield from highest to lowest, to compile my list of the best Dividend Aristocrats to buy now.

Let’s start with the first Dividend Aristocrat:

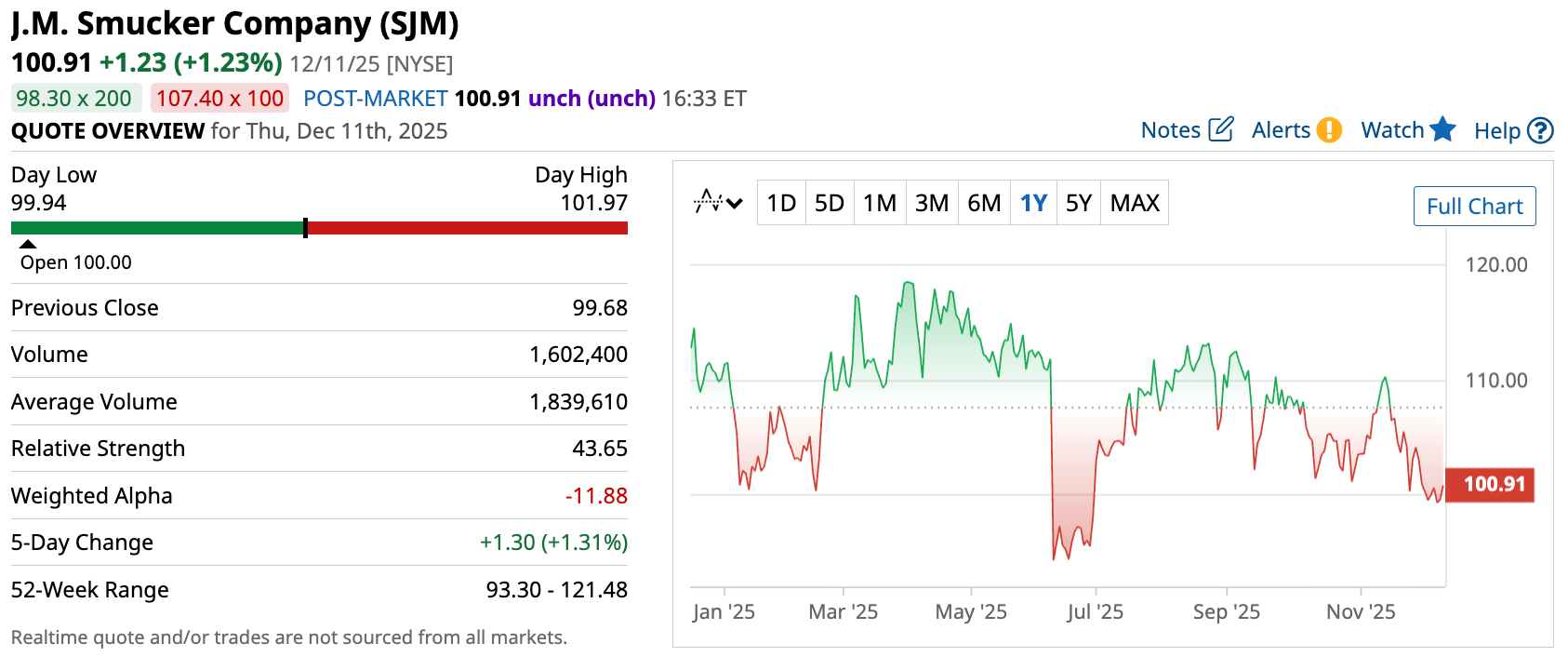

J.M. Smucker Company (SJM)

J.M. Smucker is a company that started selling apple butter and has grown to manufacture some of the world’s biggest brands, including Smucker’s jams, Folgers coffee, and Milk-Bone. Aside from that, it also dominates the premium pet foods market with a 47% share.

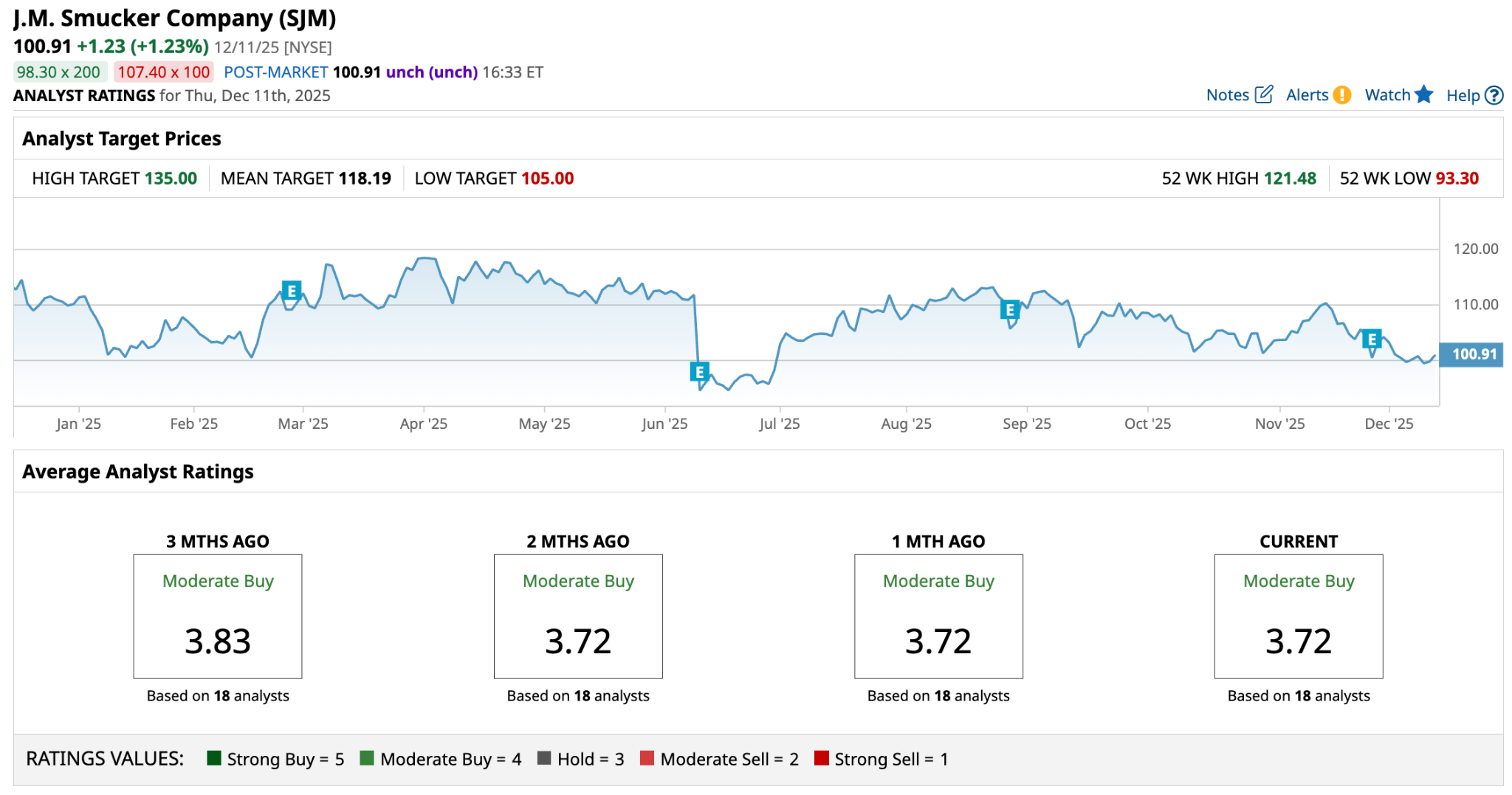

In its recent quarterly report, sales rose 2.6% YOY to $2.3 billion, while its net income rose 1085% to $241 million. While the stock is up marginally from its 1-month low, it does currently have an RSI of 39.19, possibly making the current level a particularly attractive entry point.

The company pays a forward annual dividend of $4.40, translating to a yield of around 4.4%, the highest yield on this list. At the same time, a consensus among 18 analysts rates the stock a “Moderate Buy”, a rating that has been consistent over the past three months. Aside from that, with a high target of $135, there could be as much as 35% upside in the stock over the next 12 months.

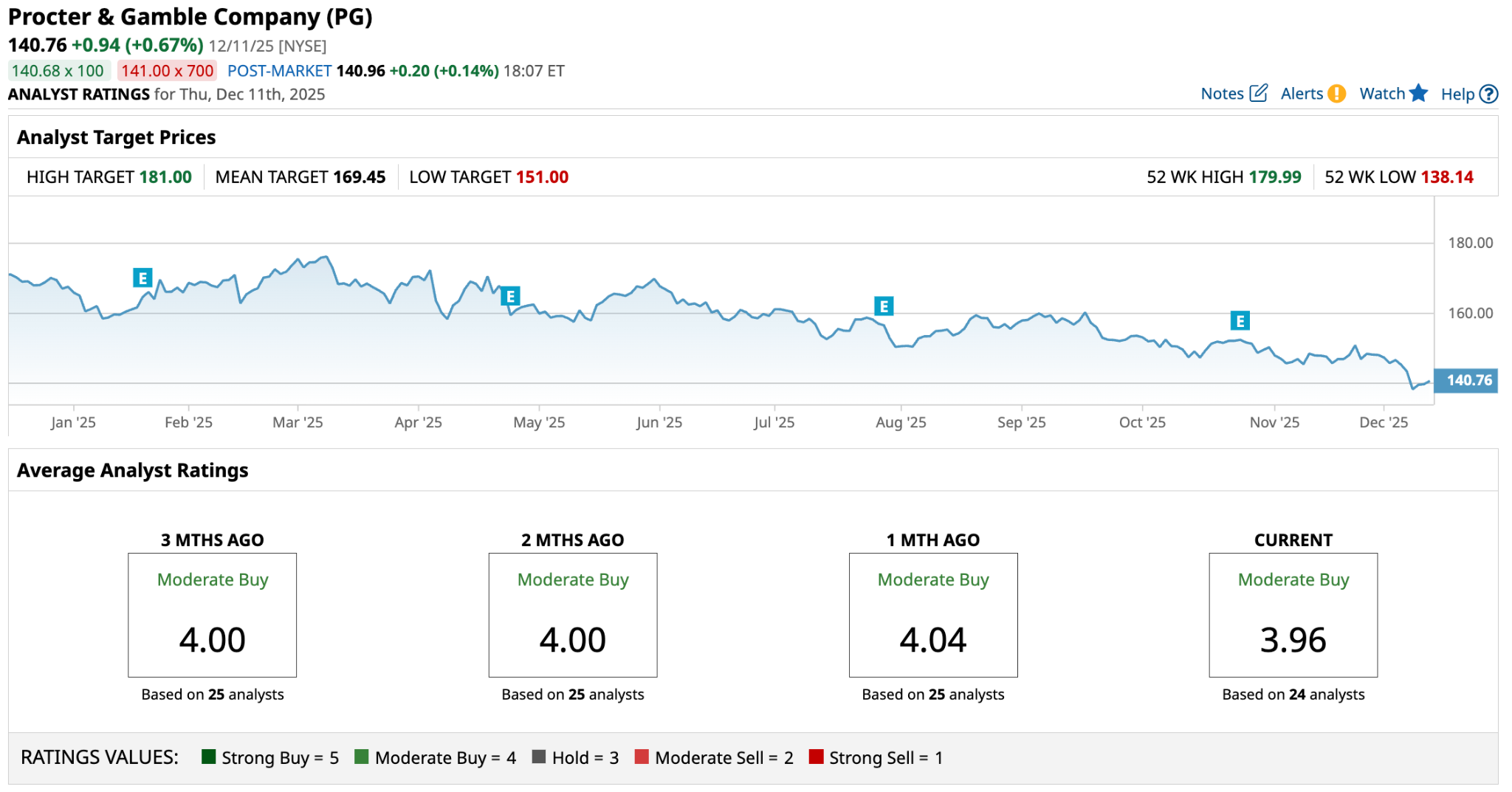

Procter & Gamble Company (PG)

The second Dividend Aristocrat on my list is Procter & Gamble, a company that probably doesn’t need much introduction. P&G is a consumer goods corporation that produces household and personal care products. Its extensive portfolio includes Tide, Pampers, Gillette, and more. However, you may not know that P&G's latest breakthrough is the world's smallest Pampers, designed for micro preemies, demonstrating P&G's commitment to meeting real needs with precision and care.

P&G’s first-quarter 2026 financials reported sales were up 3% YOY to $22 billion, and its net income grew 20% to $4.8 billion. Procter & Gamble stock trades with an RSI of 32.92; it is inching toward “oversold” territory but still holding steady in a potentially attractive buying zone.

The company pays a forward annual dividend of $4.23, yielding approximately 3%. Further, a consensus among 24 analysts rates the stock a “Moderate Buy”. Aside from that, there’s also some upside at today’s prices- as much as 29% should the stock hit its high price of $181 over the next 12 months.

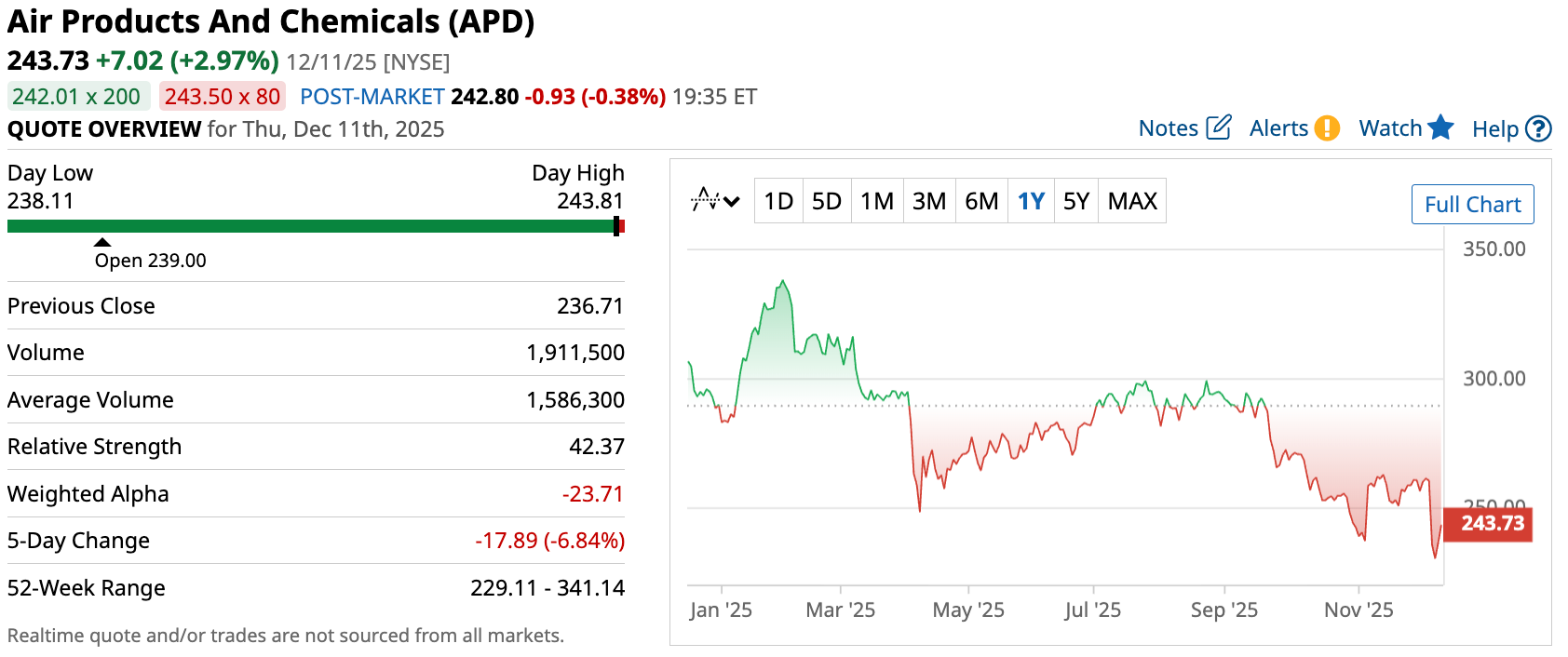

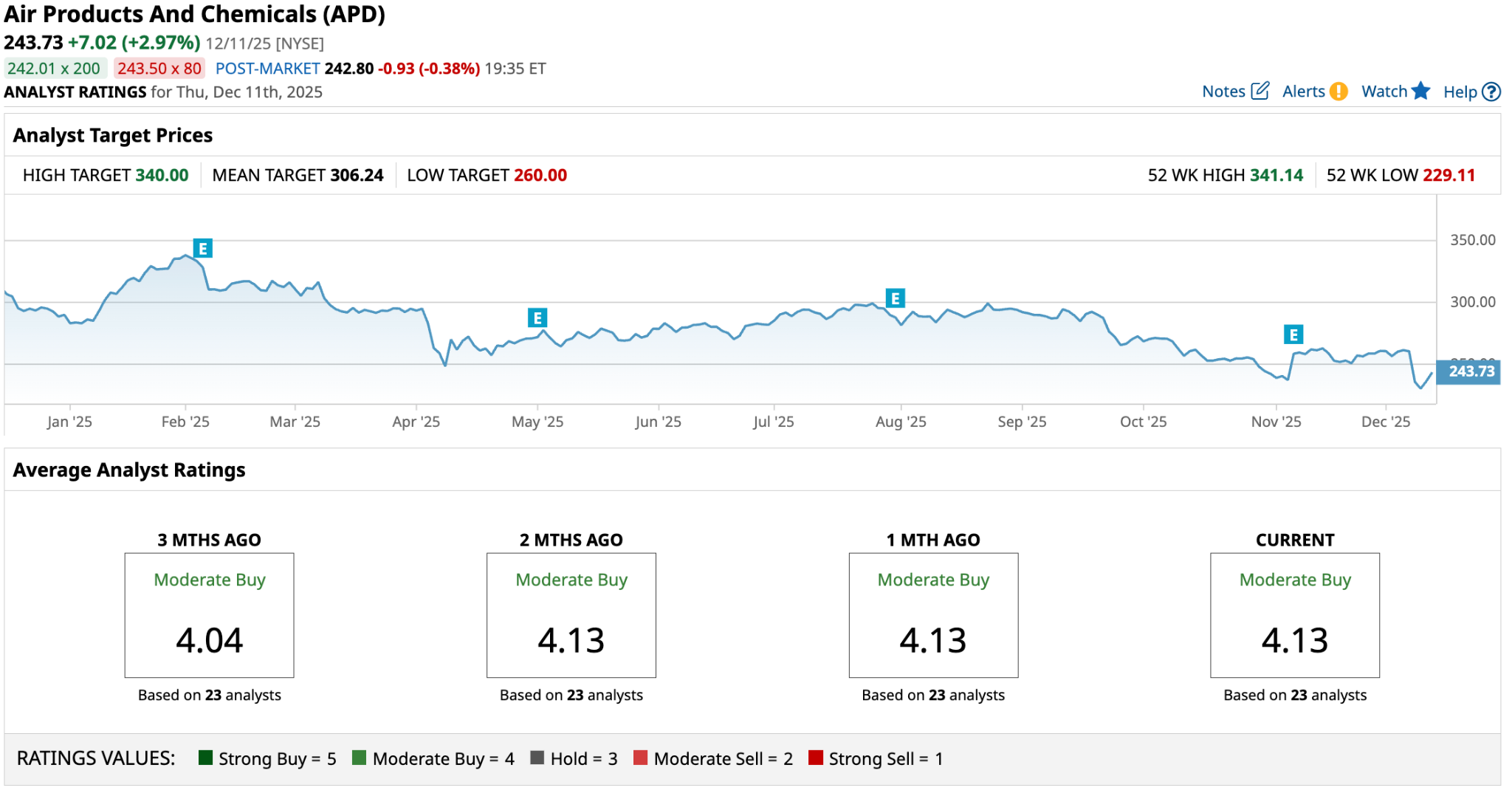

Air Products and Chemicals (APD)

The last Dividend Aristocrat on my list is Air Products and Chemicals, one of the leading global industrial gases companies that supplies critical elements such as oxygen, hydrogen, helium, and related equipment to various industries. The company is also leaning into sustainability with large-scale low-emission hydrogen and ammonia projects, including advanced discussions with Yara, to strengthen long-term demand visibility.

In its most recent quarterly report, the company reported sales were down almost 1% YOY to $3.17 billion, while net income transitioned to a $4.9 million net loss this quarter as a result of one-off charges and strategic business and asset actions.

Still, Air Products and Chemicals stock gained more than 6% from its 1-month low, and currently has a 14-day RSI of 35.15, hinting at a potentially decent entry point.

The company pays a forward annual dividend of $7.16, translating to a yield of around 3%. With that, a consensus among 23 analysts rates the stock a “Moderate Buy”. The stock has a high target of $350, suggesting as much as 48% upside over the next year.

Final thoughts

So, there you have it, the three Dividend Aristocrats worth buying, and within 10% of their 1-month low. While they don’t offer the highest yields, each of these companies offers a mix of improving fundamentals, catalysts that could drive a rebound, and, of course, a lifetime of income. For investors looking to lock in high-quality dividends at discounted prices, these companies could be a great addition to a portfolio seeking long-term stability and upside.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart