Wall Street has been eyeing up rare earth stocks due to the government taking large stakes in many of them. One stock in particular has vaulted into the market's spotlight, as it is arguably the most major rare earth company in the U.S. and received the first government rare earth investment.

The company in question is MP Materials (MP), and it operates the Mountain Pass mine in California, near Nevada's border. It received a $9.6 million tech investment in November 2020, followed by a jumbo $400 million equity stake in July 2025 to build magnet manufacturing facilities. Soon after, it signed a $500 million deal with Apple (AAPL).

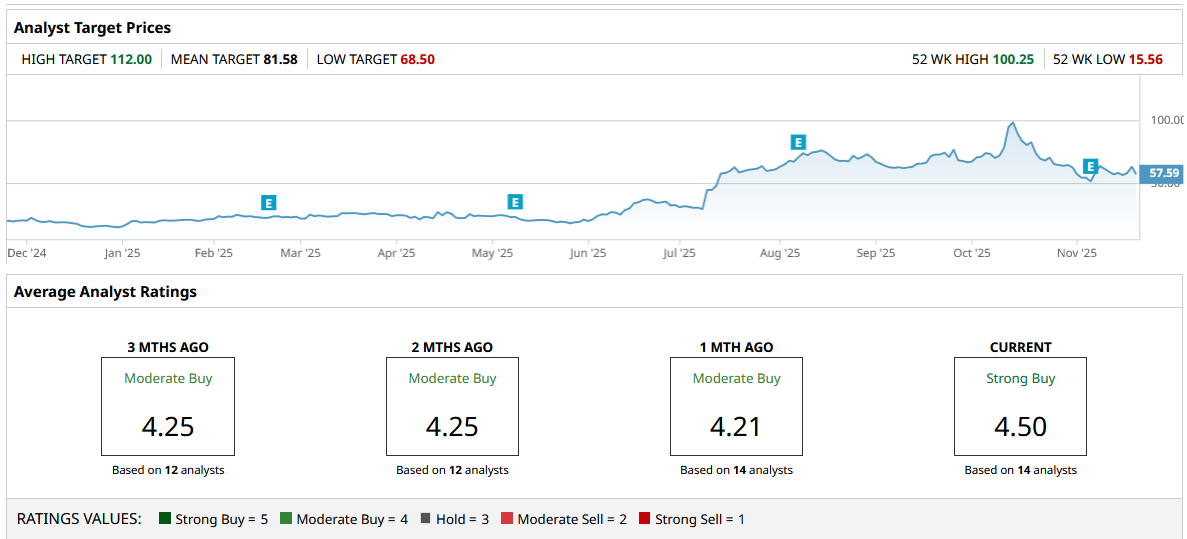

Both of these deals grabbed headlines, and the market didn't stay dormant on MP stock. From its trough in May 2025 to its peak in October 2025, MP stock rose by over 310%. It has corrected by almost 30% since then and sits at $57.

However, certain analysts see the stock going a lot higher.

Analysts Are Increasing Their Price Targets on MP Materials

The most recent price target increase came from Deutsche Bank analyst Corinne Blanchard. She increased her price target from $68 to $71. That's a dinky increase, but the more important detail is that it was upgraded from a "Hold" to a "Buy" rating.

On CNBC, she justified the increase, saying that the MP stock was finally "trading on the fundamental value," and that now it “represents a good entry point for investors looking to gain exposure to a great company, in a great thematic, in a great sector here in the U.S.” She added, "I think MP Materials checks all the boxes here, and that's the rationale of our upgrade here."

The gist of the upgrade is that Deutsche Bank believes the price has come down far enough that the risk is now worth the upside potential. MP Materials is the “only player in the West as a fully integrated Rare Earth company.”

Fundamentals Remain Bullish for MP Materials

The company's CEO said that the current quarter will be an inflection point regarding cash flow, production, and more. The Deutsche Bank analyst agreed, saying that the company is set to benefit from the government's $110 per kilogram floor price for its neodymium-praseodymium (NdPr) oxide. This is almost double the current market price.

Q3 2025 results showed a 51% increase in NdPr production. The company expects a return to profitability in Q4 2025 and beyond, targeting mid-2026 for heavy rare earth commissioning.

Should You Buy MP Stock Now?

Looking at analyst estimates, they see Q3 2025 to be a transition quarter, with Q4 2025 starting to bear the fruits of the government deal signed this summer. Q4 2025 earnings are expected to increase 164.29% year-over-year (YoY), with Q1 2026 growth expected to be 193.75%. EPS is expected to increase from $0.09 to $0.82 from year-end 2025 to year-end 2026. The higher end of the estimates puts EPS at $0.96 in Q4 2026.

You're paying ~45 times forward 2026 earnings on the highest end. If the company can expand production more rapidly than previously thought, earnings would also perform better due to the government's set floor price. Plus, the agreement is likely to stay in effect for the long term. So analysts believe MP stock deserves a much higher premium due to the lengthy earnings visibility.

I'd buy the stock below $60 due to the rigid long-term narrative here.

Analysts are not universally bullish, but even the lowest price targets are higher than its current trading price.

The highest price target is $112 and implies over 92% upside potential from here. The average price target of $81.58 implies 41% upside potential.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Silver Stalled- Was the Recent Record High the Top?

- The Bull and Bear Cases for Gold, Silver Prices in November 2025