Tesla (TSLA) shares remain subdued as investors continue to reassess their exposure to artificial intelligence (AI) stocks, especially amid renewed macroeconomic uncertainty.

According to White House officials, investors may never receive October inflation data even though President Donald Trump has already signed a funding bill to put an end to the government shutdown.

This could make the Federal Reserve hold rates steady in December, keeping borrowing costs high, which often hurts high-growth names like TSLA that depend on cheap capital for innovation and expansion.

At the time of writing, Tesla stock is up only 1.63% versus the start of this year.

Ron Baron Remains Uber Bullish on Tesla Stock

According to billionaire investor Ron Baron, the recent pullback in TSLA shares is an opportunity to initiate or expand positions in the electric vehicle (EV) manufacturer.

Baron currently has some 40% of his personal net worth invested in the automotive giant, reflecting deep conviction in its long-term growth potential.

He expects the company’s AI bets to prove transformative for its stock price over the next 10 years.

In a CNBC interview today, Baron confirmed he’s already made about $8 billion from the EV stock since 2014, but said the returns over the next decade could still be five times higher.

“I don’t expect to sell Tesla stock in my lifetime,” he concluded.

Wells Fargo Disagrees With Baron on TSLA Shares

Wells Fargo’s senior analyst Colin Langan does not share Baron’s optimism on Tesla shares. He maintains the electric vehicles firm at “Underweight” due to weakness in its core business.

“Available TSLA delivery data for October shows steep weakness,” Langan told clients in his latest research note, adding the company’s artificial intelligence ambitions will take time to realize.

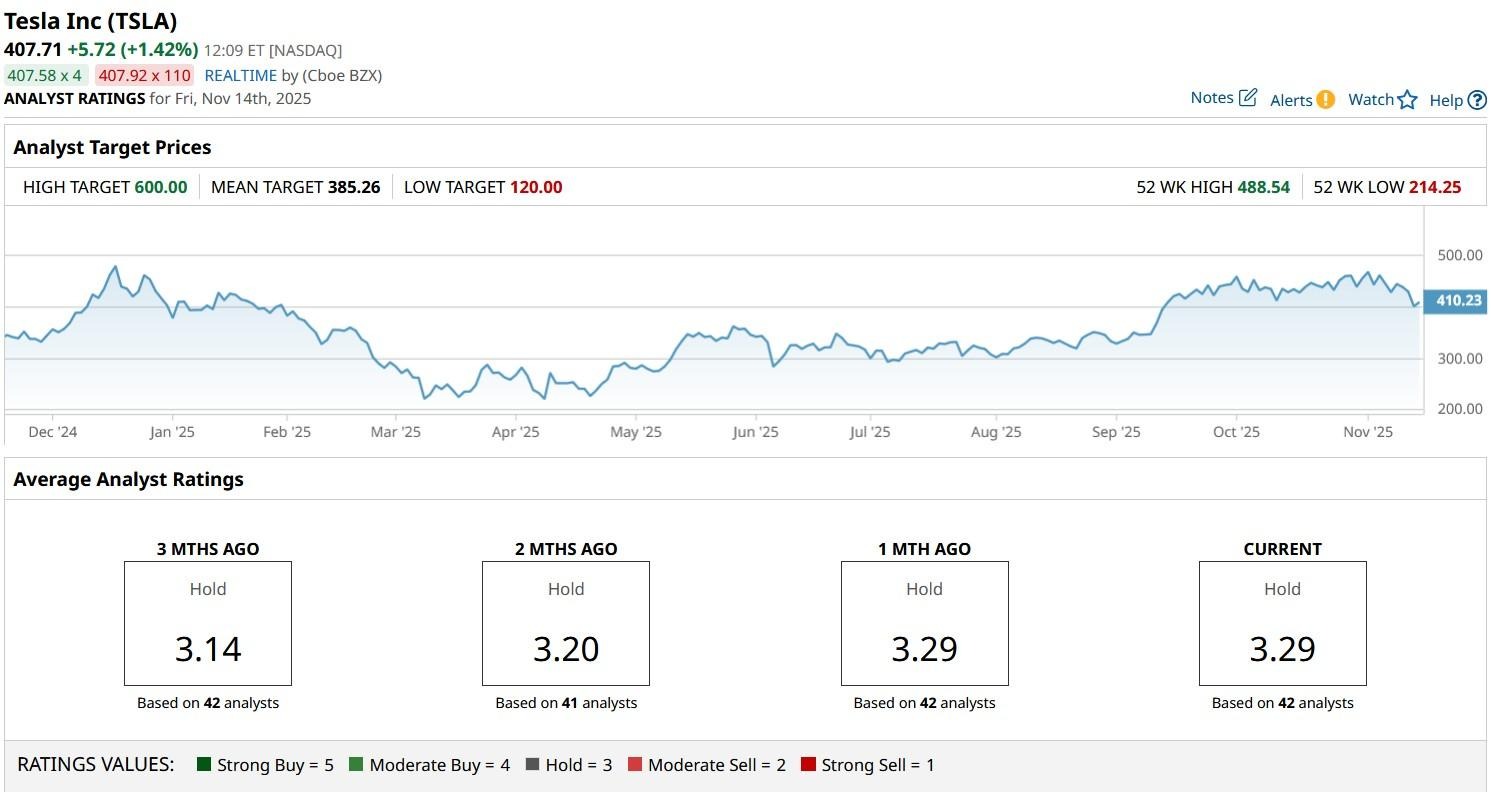

Langan currently has $120 price target on TSLA stock, indicating potential downside of a massive 70% from here.

Note that the EV stock is currently trading below its 20-day and 50-day moving averages (MA), which also suggests bears remain in control, at least for the near term.

What’s the Consensus Rating on Tesla?

Other Wall Street firms aren’t particularly bullish on Tesla stock either.

The consensus rating on TSLA shares currently sits at “Hold” only, with the mean target of roughly $385 indicating potential downside of more than 3% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Warned That the AI Bubble Is About to Burst. If You Agree, Use Options to Bet Against These 2 Stocks.

- Cathie Wood Is Buying the Dip in Circle Stock. Should You?

- These 3 Unusually Active Puts Deep ITM Offer Strategic Plays for Both Bulls and Bears

- META Stock Has Fallen 15% This Month, but Wedbush Says It Can Soar 50% from Here