With a market cap of $15.8 billion, Dow Inc. (DOW) is a leading materials science company with a global footprint, offering innovative and sustainable solutions across packaging, infrastructure, mobility, and consumer markets. The company operates through three main segments: Packaging & Specialty Plastics, Industrial Intermediates & Infrastructure, and Performance Materials & Coatings.

Shares of the Midland, Michigan-based company have underperformed the broader market over the past 52 weeks. DOW stock has decreased 52.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.3%. Moreover, shares of the company have dropped 44.7% on a YTD basis, compared to SPX's 15.5% return.

Looking closer, shares of the materials science company have also lagged behind the Materials Select Sector SPDR Fund's (XLB) 8.7% dip over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 revenue of $9.97 billion, Dow’s shares jumped nearly 13% on Oct. 23 as its adjusted loss of $0.19 per share was significantly smaller than the expected loss. Investors cheered the company’s strong cost discipline, having achieved over half of its planned $6.5 billion in near-term cash support, including $1 billion in capital spending cuts and accelerated cost reductions. Additionally, higher volumes from new U.S. Gulf Coast polyethylene and alkoxylation assets lifted margins.

For the fiscal year ending in December 2025, analysts expect DOW to report an adjusted loss of $1 per share, reflecting a 158.5% year-over-year decline. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

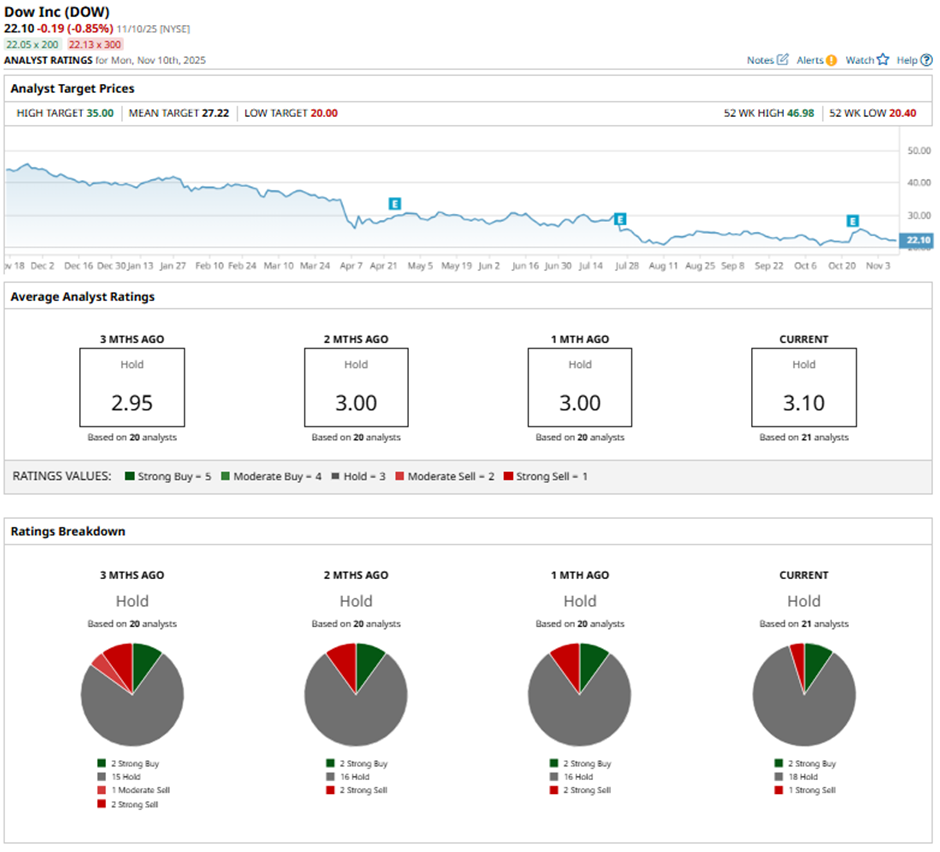

Among the 21 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 18 “Holds,” and one “Strong Sell.”

On Oct. 24, BofA analyst Matthew DeYoe raised Dow Inc.’s price target to $26 while maintaining a “Neutral” rating.

The mean price target of $27.22 represents a 23.2% premium to DOW’s current price levels. The Street-high price target of $35 suggests a 58.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend Stock Yields More Than 8% and Analysts Say You Can ‘Count on It’ Here

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?