VANCOUVER, BC / ACCESSWIRE / August 23, 2021 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN) is pleased to announce the results from the next five drill holes which have been received for the Powerline Deposit, AurMac Property, Yukon. Step-out grid-based drilling continues to identify significant intervals of consistent gold mineralization further expanding the mineralization footprint of this impressive and growing on and near-surface gold deposit. Gold mineralization remains open in all directions and current drilling activities are now focused on resource expansion to the east and west of Powerline Phase 1 drilling completed in July.

Assay highlights from this series of drill results include:

- 45.7 metres of 0.69 g/t Au from surface in DDH AX-21-93

- 52.3 metres of 0.70 g/t Au from 119.9m in DDH AX-21-95

- 110.7 metres of 0.62 g/t Au from 96.6m in DDH AX-21-99

- 195.9 metres of 0.54 g/t Au from surface in DDH AX-21-100

- Including 24.8m of 1.51 g/t Au

"The ongoing results are steadily and strongly demonstrating the size potential of the Powerline Deposit," states Tara Christie, President and CEO. "It's extremely rare to outline a near-surface deposit of this size and tenor immediately adjacent to an existing highway, communications and power infrastructure. The Company is fully funded through 2022 and plans an aggressive drill campaign designed to continue to expand and define resources towards an updated AurMac Mineral Resource in 2022."

Video to accompany this news release is located on our website.

Image 1: Photograph of visible gold from 140.8 metres ("m") to 142.0 m in AX-21-99, which assayed 4.65 g/t over 1.2 m.

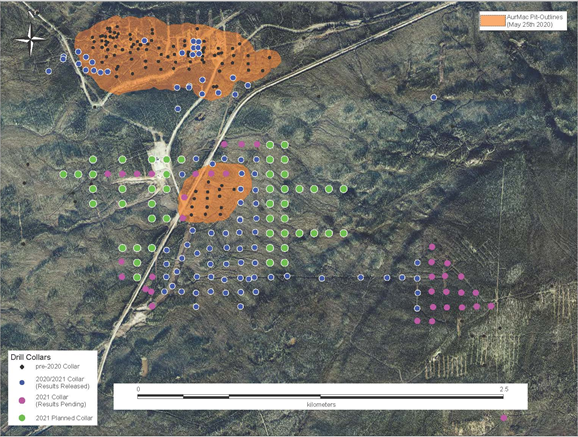

Figure 1: 2021 Drill program at Powerline and Aurex Hill, showing historic, completed and planned diamond drill holes.

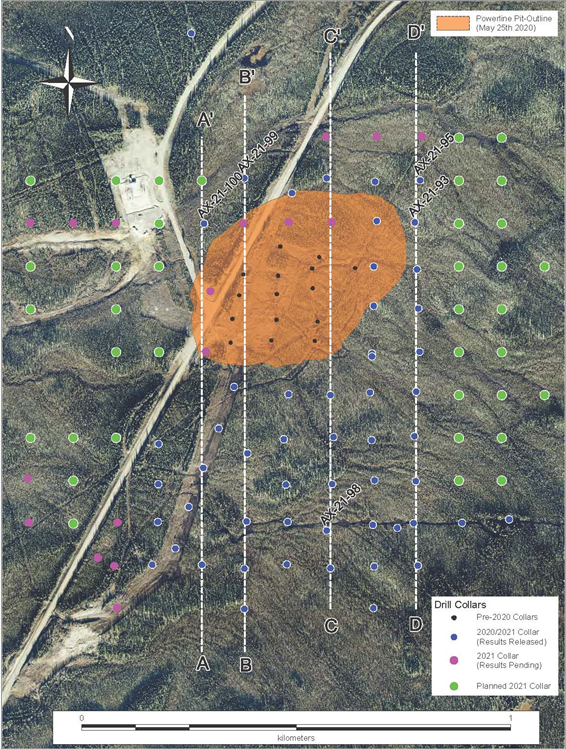

Figure 2: Plan map of Powerline Zone 2021 drill holes reported, planned and completed.

Figure 3: Sections for Figure 2 (looking west).

Table 1: 2021 Highlighted Powerline Diamond Drill Analytical Results

| Hole ID | From (m) | To (m) | Interval* (m) | Au (g/t) |

|---|---|---|---|---|

| AX-21-93 | 7.6 | 53.3 | 45.7 | 0.69 |

| including | 9.1 | 14.6 | 5.5 | 1.03 |

| Including | 23.5 | 24.7 | 1.2 | 1.59 |

| Including | 35.1 | 36.6 | 1.5 | 5.48 |

| Including | 38.1 | 39.2 | 1.1 | 1.14 |

| including | 40.4 | 41.5 | 1.1 | 1.03 |

| and | 71.3 | 75.6 | 4.3 | 0.5 |

| and | 119.4 | 123.0 | 3.6 | 1.24 |

| including | 121.9 | 123.0 | 1.1 | 3.24 |

| and | 144.3 | 148.7 | 4.4 | 0.35 |

| AX-21-95 | 34.3 | 35.6 | 1.3 | 0.95 |

| and | 62.2 | 65.2 | 3.0 | 0.93 |

| including | 62.2 | 63.7 | 1.5 | 1.19 |

| and | 119.9 | 172.2 | 52.3 | 0.70 |

| including | 119.9 | 121.4 | 1.5 | 1.84 |

| including | 122.6 | 125.0 | 2.4 | 1.98 |

| including | 146.3 | 148.3 | 2.0 | 1.56 |

| including | 148.3 | 149.4 | 1.1 | 6.32 |

| Including | 150.9 | 151.8 | 0.9 | 3.34 |

| Including | 159.4 | 160.9 | 1.5 | 2.77 |

| including | 168.6 | 169.2 | 0.6 | 4.36 |

| AX-21-98 | 80.8 | 161.9 | 81.1 | 0.22 |

| including | 80.8 | 82.3 | 1.5 | 1 |

| and | 150.9 | 164.8 | 13.9 | 0.49 |

| including | 160.0 | 161.9 | 1.9 | 1.79 |

| AX-21-99 | 28.4 | 29.2 | 0.8 | 1.1 |

| and | 96.6 | 207.3 | 110.7 | 0.62 |

| including | 96.6 | 97.5 | 0.9 | 4.11 |

| including | 111.4 | 112.4 | 1.0 | 8.88 |

| including | 113.4 | 114.5 | 1.1 | 1.31 |

| including | 115.8 | 117.1 | 1.3 | 4.11 |

| including | 118.4 | 119.6 | 1.2 | 2.18 |

| including | 130.0 | 131.5 | 1.5 | 4.43 |

| including | 132.8 | 134.0 | 1.2 | 1.96 |

| including | 140.8 | 142.0 | 1.2 | 4.65 |

| including | 155.5 | 156.9 | 1.4 | 2.33 |

| including | 174.9 | 175.8 | 0.9 | 12.9 |

| AX-21-100 | 6.1 | 202.0 | 195.9 | 0.54 |

| including | 10.7 | 12.2 | 1.5 | 5.91 |

| including | 22.9 | 47.7 | 24.8 | 1.51 |

| including | 101.2 | 102.7 | 1.5 | 1.73 |

| including | 133.1 | 134.8 | 1.7 | 10.5 |

| including | 168.0 | 173.7 | 5.7 | 1.3 |

| including | 183.4 | 184.4 | 1.0 | 1.53 |

| including | 190.1 | 191.6 | 1.5 | 5.45 |

* True widths are estimated to be greater than 90% of the reported intervals.

2021 Drilling Program Update

Phase 1 Drilling at AurMac included drilling at both the Powerline and Aurex Hill targets.

At Powerline, 10,476 m (50 holes) was drilled in a systematic, 100 m centered, drill grid designed to test the expansion potential of the Powerline Deposit. Drilling at Aurex Hill included 18 diamond drill holes totalling 4,386 m. Assay results from 35 of the 50 Powerline holes have been received and reported, with 12 holes from Powerline and the entirety of the18 holes from Aurex Hill pending.

Phase 2 Drilling began in late July and is designed to expand the limits of the Powerline Deposit and is planned to continue until December 2021 and then planned to resume in February 2022.

Qualified Person

Paul D. Gray, P.Geo., Vice President of Exploration for the Company, is a "qualified person" as defined under NI 43-101 and has reviewed and approved the content of this news release.

Upcoming Catalysts

- Webinar "Ramping Up to Rapidly Advance AurMac, Mayo Mining District, Yukon", Moderated by Robert Sinn (Goldfinger), August 30, 2021, 1:00 pm Pacific Time

- Invest Yukon Exploration Investment Summit, September 2, 2021, 10:00 am Pacific Time

- Precious Metals Beaver Creek, September 8-11, 2021

- Presentation September 10th at 4:40 pm Mountain Time

COVID-19 Update

Banyan Gold continues to take proactive measures to protect the health and safety of our Yukon communities, our contractors and our employees from COVID 19 and exploration activities in 2021 will have additional safety measures in place, following and exceeding all the recommendations of Yukon's Chief Medical Officer. Over 90% of Banyan Gold employees and contractors on site are fully vaccinated.

About Banyan

Banyan's primary asset AurMac is adjacent to Victoria Gold's Eagle Gold Mine, in Canada's Yukon Territory, which announced commercial production on July 1, 2020. The AurMac initial resource of 903,945 oz Au (see Table 2 below) was announced in May 2020. Our major strategic shareholders include Alexco Resource Corp, Franklin Gold and Precious Metals Fund, Osisko Development, and Victoria Gold Corporation. Banyan is focused on gold exploration projects that have the geological potential, size of land package and proximity to infrastructure that is advantageous for a mineral project to have potential to become a mine. Our Yukon based projects both fit this model and our objective is to gain shareholder value by advancing projects in our pipeline.

The 173 sq km AurMac Property lies 30 km from Victoria Gold's Eagle Project and adjacent to Alexco's Keno Hill Silver District and is highly prospective for structurally controlled, intrusion related gold-silver mineralization. The property is located adjacent to the main Yukon highway and just off the main access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Property benefits from a 3-phase powerline, existing Yukon Energy Corp. switching power station and cell phone coverage. Banyan has optioned the properties from Victoria Gold and Alexco respectively with a right to earn up to a 100% subject to royalties.

The 2020 Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 ("NI 43-101") guidelines for the AurMac Property is 903,945 ounces of gold. It is a near surface, road accessible pit constrained Mineral Resource contained in two near/on-surface deposits: The Airstrip and Powerline deposits. The Mineral Resource is summarized in Table 2 below.

Table 2: Pit-Constrained Inferred Mineral Resources at a 0.2 g/t Au Cut-Off - AurMac Property

Deposit | Classification | Tonnage | Average Au Grade | Au Content |

Airstrip | Inferred | 45,997,911 | 0.524 | 774,926 |

Powerline | Inferred | 6,578,609 | 0.610 | 129,019 |

Total Combined | Inferred | 52,576,520 | 0.535 | 903,945 |

Notes:

- The effective date for the Mineral Resource is May 25, 2020.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,500/ounce, US$1.50/t mining cost, US$2.00/t processing cost, US$2.50/t G+A, 80% heap leach recoveries, and 45° pit slop.

- Mineral Resource Estimate prepared in accordance with 43-101 guidelines by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc, with technical report filed July 7,2020.

The Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt is a sediment hosted, structurally controlled, intrusion related gold deposit, with a large land package (over 125 sq km), with the resource contained in the Main Zone area (900 m x 600 m) daylighting at surface and numerous other known surface gold targets. The Main Zone oxide zone is amenable to heap leach open pit mining, with column leach recoveries of 86%. The project has an existing gravel access road.

Table 3 shows the Hyland Main Zone Indicated Gold Resource Estimate, prepared in accordance with NI 43-101, at a 0.3 g/t gold equivalent cutoff, contains 8.6 million tonnes grading 0.85 g/t AuEq for 236,000 AuEq ounces with an Inferred Mineral Resource of 10.8 million tonnes grading 0.83 g/t AuEq for 288,000 AuEq ounces. NI 43-101 prepared by Robert Carne, Allan Armitage and Paul Gray on May 1, 2018.

Table 3: Hyland Main Zone Indicated Gold Resource Estimate

Cut-off Grade (AuEq g/t) | In situ Tonnes | Au | Ag | AuEq | |||

Grade (g/t) | Ozs | Grade (g/t) | Ozs | Grade (g/t) | Ozs | ||

Indicated | |||||||

0.3 | 8,637,000 | 0.78 | 216,000 | 7.04 | 1,954,000 | 0.85 | 236,000 |

Inferred | |||||||

0.3 | 10,784,000 | 0.77 | 266,000 | 5.32 | 1,845,000 | 0.83 | 288,000 |

Notes:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimate.

- Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq. AuEq grade is based on $1,350.00/oz Au, $17.00/oz Ag and assumes a 100% recovery. The AuEq calculation does not apply any adjustment factors for difference in metallurgical recoveries of gold and silver. This information can only be derived from definitive metallurgical testing which has yet to be completed.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN". For more information, please visit the corporate website at www.BanyanGold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie

Tel: (888) 629-0444

Email: tchristie@banyangold.com

David Rutt

Tel: (888) 629-0444

Email: drutt@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release contains forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, Banyan's objectives, goals or future plans, statements regarding exploration expectations, exploration or development plans and mineral resource estimates. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, uncertainties inherent in resource estimates , capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Statements in this news release regarding Banyan which are not historical facts are "forward-looking statements" that involve risks and uncertainties. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations.

SOURCE: Banyan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/660840/Banyan-Gold-Reports-1107-M-of-062-gt-AU-and-Continued-Growth-at-the-Powerline-Deposit-Aurmac-Property-Yukon