StockNews.com has created the proprietary POWR Ratings model to put the odds of investing success in your favor. That’s because our “A” rated Strong Buy stocks would have generated a compounded annual return of +28.90%.

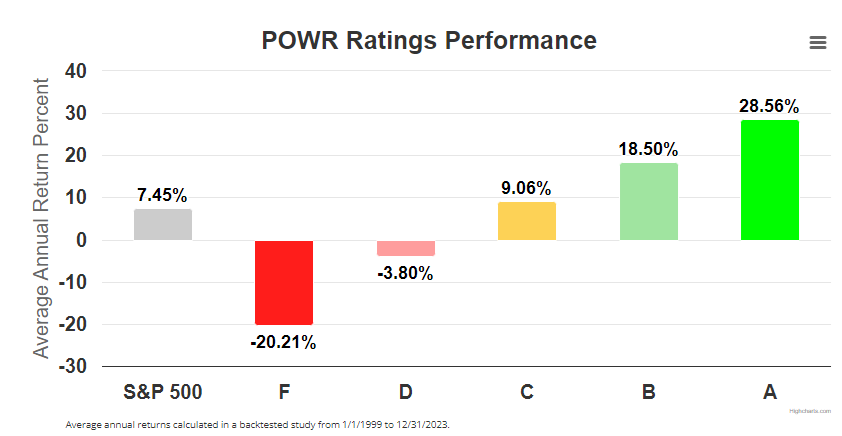

POWR Ratings Performance

Yes, the +28.56% compounded annual gain of the "A" rated Strong Buy stocks did outperform the S&P 500 by more than 4X since 1999.

Just as impressive is how we help investors avoid the worst stocks. That’s because the “F” rated Strong Sells would have tumbled an average of -20.21% a year over the same time frame.

One of the cornerstone trading strategies used in the POWR Options program is called the POWR Pairs Trade. It involves the simultaneous purchase of a bullish call on Buy (A& B Rated) but underperforming stocks and a bearish put on Sell Rated (D&F Rated) but outperforming names. The expectation is for the higher rated Buy stocks to begin to close the relative underperformance gap with the lower rated Sell stocks.

Then bring in fundamental, technical and implied volatility analysis to further provide a probabilistic edge.

A quick example of a trade just enacted in the POWR Options Portfolio will help shed some light.

Monday, February 12, POWR Options recommended buying bullish calls on Qualcomm (QCOM) and buying bearish puts on Advanced Micro Devices (AMD).

Qualcomm was a Strong Buy (A Rated) stock in the POWR Ratings. Advanced Micro was a Sell (D rated) stock in the POWR Ratings. Both stocks are in the Semiconductor & Wireless Chip industry.

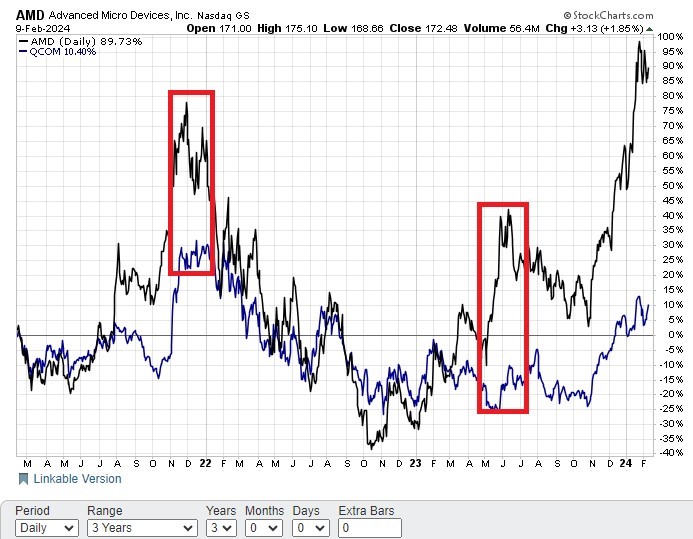

Yet AMD had greatly outperformed QCOM over the past several months. The chart below shows just how much. AMD stock had rallied over 90% since the recent lows in October. QCOM stock was up nicely in that same time frame, but only by about 30%.

The previous two times the comparative performance had reached similar extremes saw that performance gap narrow dramatically. We expect a similar convergence once again with QCOM outperforming AMD over the coming weeks.

Valuation

AMD was back at the highest Price/Sales (P/S) ratio level in the past 3 years with a 12x multiple. The previous time it got over 12x in late 2021 marked a signficant top in the stock. Even more extreme given that interest rates were near zero back then in late 2021 and are now well over 4%.

Unlike AMD, P/S ratio for QCOM was well below the 3-year highs at under 5x. Much more reasonably valued.

Implied Volatility

Current IV for AMD options stood at 51%, or about average. Decidedly cheap when compared to the actual, or historic, IV of 63%. Qualcomm options are even cheaper with current IV at just the 40% level and actual IV at 67%.

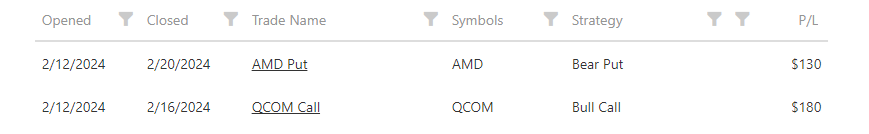

POWR Options went long the QCOM April $160 calls for $4.20 and the AMD April $150 puts for $3.70 on Monday February 12.

Exited the QCOM calls at $6.00 on Friday February 16 for a $1.80 gain or a 42.85% gain in less than a week.

Sold the AMD April $150 puts on February 20 at $5.00 for a gain of $1.30. Gain here as well of 35% in just over a week.

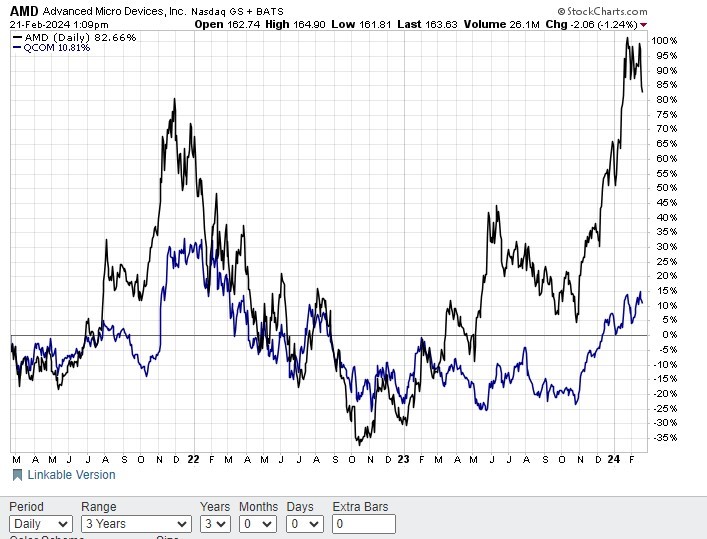

The comparative performance chart below shows how the gap narrowed since trade inception. QCOM rallied .4% while AMD dropped 7%.

Certainly, the POWR Pairs trade process isn’t a guarantee of profits. Trading is all about probabilities and not certainty. But it has proven profitable since the POWR Options program was created some three years ago.

Those looking to add another strategy to their trading toolbox may want to take a closer look and consider the POWR Options methodology.

What To Do Next?

While the concepts behind options trading are simpler than most people realize, applying those concepts to consistently make winning options trades is no easy task.

The solution is to let me do the hard work for you, by starting a 30 day to my POWR Options newsletter.

I’ve been uncovering the best options trades for over 30 years and with the quantitative muscle of the POWR Ratings as my starting point I’ve achieved an 82% win rate over my last 17 closed trades!

During your trial you’ll get full access to the current portfolio, weekly market commentary and every trade alert by text & email.

I’ll be adding the next 2 exciting options trades (1 call and 1 put) when the market opens this Monday morning, so start your trial today so you don’t miss out.

There’s no obligation beyond the 30 day trial, so there is absolutely no risk in getting started today.

About POWR Options & 30 Day Trial >>

Here’s to good trading!

Tim Biggam

Editor, POWR Options Newsletter

AMD shares fell $181.86 (-100.00%) in premarket trading Friday. Year-to-date, AMD has gained 23.84%, versus a 6.97% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

The post How To Profit Using The POWR Options Pairs Trade appeared first on StockNews.com