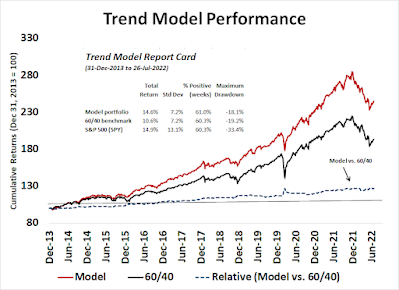

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

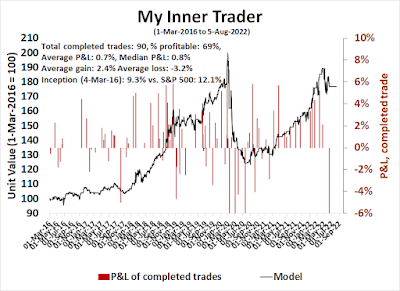

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Defying gravityWhy is the stock market holding up so well? What happened to all the warnings from the Fed? One speaker after another warned that the Fed is nowhere near a dovish pivot. CNN reported that former New York Fed President Bill Dudley issued a similar warning that rising stock prices translate into even more rate hikes:Dudley added that another rate hike of three-quarters of a percentage point is still "potentially in play," depending on how the economy evolves. He expects the Fed will need to raise interest rates to 4% or higher — up from 2.5% today...

Dudley warned that the uptick in the stock market may be counterproductive because it translates to easier financial conditions. And that's exactly the opposite of what the Fed wants as it tries to tame inflation.

"Ironically," Dudley said, "the big rally in financial markets increases pressure on the Fed to do more."Wall Street shrugged off the Fed's warnings and Friday's hot jobs report. The S&P 500 is testing a key resistance level, and the NASDAQ 100 blew past resistance and it is now approaching a key falling trend line.

Why is the market defying gravity?

The full post can be found here.