Regardless of what the loudmouthed know-it-all in the locker room thinks, retail investors (that's code for you and me) don't have much of an impact on stock prices.

It might be fun to think that buying 100 shares of Apple Inc. (Nasdaq: AAPL) is somehow part of some larger force of collective wisdom pushing stock prices higher - but with average liquidity of nearly $5 billion (in AAPL shares) the only players with enough might to make the stock move are the big boys - institutional buyers.

When I say institutional buyers, I'm referring to mutual funds, hedge funds, pension funds, and insurance companies.

It's nearly impossible for a stock to deliver a huge upside run without the deep-pocketed firepower of institutional buying - and that's why it's so important to look for clues indicating they're building positions and scooping shares.

After all, wouldn't you rather go sailing with the wind doing the work rather than paddling back to shore?

I know I sure would. And here's how we can...

Read the Signals Wall Street Is Trying to HideTo really illustrate what I'm referring to let's go back to AAPL for just a moment.

Pardon me, in advance, I'm about to trot out a few numbers- but I swear it will be brief.

Over the last 50 days, AAPL's average daily volume has been 53.4 million shares. The stock's average share price over the same time period was $96.75, which means over the last 50 days AAPL stock experienced roughly $5.2 billion worth of trading volume each day - or roughly $258 billion trading volume over the entire 50-day period.

That's what I'm talking about when I talk about institutional buying power.

Because institutions are working with such large amounts of capital, they need to spread their purchases out over much longer time frames than you and me. It's not uncommon for it to take an institutional buyer several weeks or even months to actually build the desired position.

Here's why...

If I'm an institutional buyer looking to establish a $100 million (or more) position in a stock I'm not going to just queue up a single order and hit the "send" button. No way - that single order would not only tip my hat to day traders, but an order of that size would disrupt pricing and I'd likely end up grossly overpaying.

Instead, institutional buyers will typically spread out their purchases over several weeks or even months in order to keep their cards close to their vest and avoid pricing anomalies.

And here's the exciting part...

Institutional investors are basically looking at all the same data when hunting for new investment ideas. Therefore, it's not uncommon for multiple traders to see the same thing, at the same time, which means you can get multiple institutional firms all establishing positions in the same stock at the same time.

When that happens you generally see above-average spikes in volume as the stock price moves up.

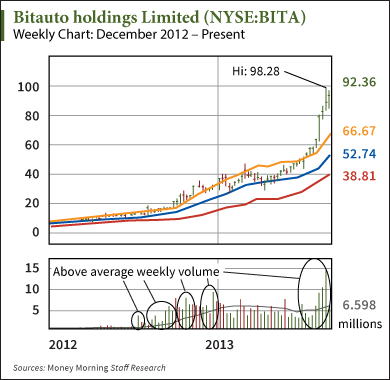

The chart below demonstrates a 660% gain in Bitauto Holdings Limited (NYSE: BITA) over the last 13 months. As you can see for the circled areas, the majority of the upside moves corresponded to above-average volume, typically associated with institutional buying.

Of course, I chose BITA as an example because of its 660% gain in just over a year - but it's also a great example of how huge increases in weekly volume can be an indicator that the stock is getting ready to make a huge move to the upside.

Of course, I chose BITA as an example because of its 660% gain in just over a year - but it's also a great example of how huge increases in weekly volume can be an indicator that the stock is getting ready to make a huge move to the upside.

It's kind of like looking behind the curtain at what the big boys are doing - and it's really easy for anyone to do.

Here's a way you can use high-volume institutional buying as a new tool in your own investment strategy...

If you're considering buying a stock, take a look at weekly volume. I suggest weekly volume rather than daily volume because it absorbs a lot of the day-to-day variances. And that makes it a much better indicator of buying and selling over longer periods

Make sure the stock you're targeting has above-average volume during "up" periods. That's a clear indicator that the bulls are winning the fight and it's also very likely that institutional buyers are behind the move. While above-average volume isn't a sure thing, it sure is a strong vote of confidence.

On the other hand, if the stock you're targeting is experiencing the opposite, above average volume during "down" periods, then you might want to think twice before establishing a position...

Tags: how to be a retail investor, how to invest, how to invest in stocks, how to invest like Warren Buffett, institutional investors, investing tipsThe post Let the "Big Boys" Do the Legwork and Take Bigger Gains for Yourself appeared first on Money Morning - Only the News You Can Profit From.