( click to enlarge )

( click to enlarge )The short trend continues to favor Facebook Inc (NASDAQ:FB) bears. The stock price is shown in a range and the downtrend may continue on breaking range support area. However, the daily MACD histogram has started to diverge positively. At this point, let price break the resistance line ($29) shown in the daily chart for a safe bullish trade to happen. If price break the support line ($27.1) on a close basis, then the fall might continue.

You should really consider spending few bucks in this fabulous source of information. Sign up now to receive a risk-free trial with Benzinga Professional

( click to enlarge )

( click to enlarge )Opko Health Inc. (NYSE:OPK) broke out from its sideways consolidation on Friday with a 5% rally and a close over resistance at $7. Keep this one on your radar over the next week.

( click to enlarge )

( click to enlarge )3D Systems Corporation (NYSE:DDD) Broken 50-day SMA may act as resistance. For bigger correction price has to fall below the support line. Some of the short-term technicals are still bearish.

( click to enlarge )

( click to enlarge )I have Mercury Systems Inc (NASDAQ:MRCY) on my watchlist. It may be ready to break out of this flag consolidation. Bullish MACD cross on daily. Potential swing long above 7.58

( click to enlarge )

( click to enlarge )Gevo, Inc. (NASDAQ:GEVO) closed the day with a "doji" candlestick reflecting clear indecision. These candlesticks usually signal a reversal in trend. Additionally, the stock continues to hold above its rising 50dma support. I think in the short term GEVO will bounce nicely off this bottom.

( click to enlarge )

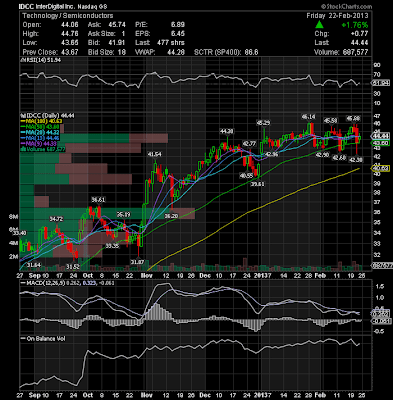

( click to enlarge )InterDigital, Inc. (NASDAQ:IDCC) continues to consolidate between the 43 and 45 price level. Breakout on either side on closing basis may give good direction. 50-day SMA continue to act as support for the stock during this consolidaiton.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC