( click to enlarge )

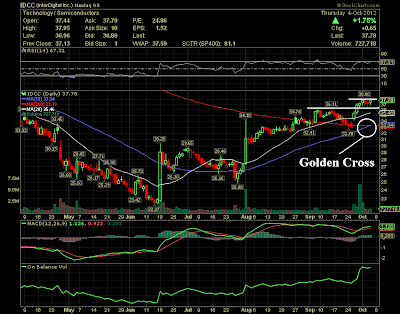

( click to enlarge ) InterDigital, Inc.(NASDAQ:IDCC) looks to be a possible breakout play tomorrow. A break above 38 on heavy volume makes this one look good for a possible strong move NORTH. The medium term trend still looks bullish as the stock is still above 50-day and 200-day moving average with 50-day moving average crossed on top over 200-day moving average recently to form Golden Cross, a strong bullish sign. Additionally, the MACD also shows buy as MACD is on top of signal line. Stay tuned !!

( click to enlarge )

( click to enlarge ) Amazon.com, Inc. (NASDAQ:AMZN) is back above the 20-day SMA and is headed for a test of the $264 resistance.

( click to enlarge )

( click to enlarge ) Neostem Inc. (NYSEAMEX:NBS) over 75c next stop 84 then the run to $1+. Short-term indicators have switched to the upside. Only a close below 58c would have negative implications. Hold on with a stop loss at this level.

( click to enlarge )

( click to enlarge ) Jamba, Inc.(NASDAQ:JMBA) showing signs of a potential reversal trend. I'd like to see a close over 2.42 before getting involved. Just to note, the technical daily chart above shows bullish MACD crossover.

( click to enlarge ) James River Coal Company (NASDAQ:JRCC) put a nice reversal candle today. The stock is now trading close to the resistance level at the 3-3.08 range. A close above this range would impart strength and the stock could move easily to 3.25-3.5 subsequently. The near-term outlook for the stock does not appear negative. If you are long, initial stop loss should be placed at 2.6

( click to enlarge ) James River Coal Company (NASDAQ:JRCC) put a nice reversal candle today. The stock is now trading close to the resistance level at the 3-3.08 range. A close above this range would impart strength and the stock could move easily to 3.25-3.5 subsequently. The near-term outlook for the stock does not appear negative. If you are long, initial stop loss should be placed at 2.6During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC