12 August 2021 – TheNewswire - Altus Strategies Plc (AIM:ALS), (TSXV:ALTS), (OTC:ALTUF) announces encouraging, high-grade results from Reverse Circulation (“RC”) drilling at its 100% owned Diba gold project (“Diba” or the “Project”) located in western Mali. Diba hosts a shallow-dipping, near-surface gold deposit (the “Diba Deposit”) and a number of other prospective targets.

Highlights:

-

- High-grade gold intersections from RC drilling at the Diba gold project in western Mali

- Intersections from the Diba Deposit include (down-the-hole and not true widths):

-

- 8.50 g/t Au over 24m from 20m (including 26.45 g/t Au over 7m)

- 2.54 g/t Au over 30m from 36m

- 1.30 g/t Au over 30m from 12m

- 2.45 g/t Au over 15m from 26m

- Infill drilling targeting 550m long, high-grade zone within the core of the Diba Deposit

- Drilling programme now on hold pending the end of the rainy season in September

- Resource potential of the Diba Deposit and Diba NW prospect to be tested

- Diba is strategically located in a world famous gold belt that hosts numerous open pit mines

-

Steven Poulton, Chief Executive of Altus, commented:

“We are delighted to report on these excellent initial results from the current RC drilling programme at the Diba gold project in Western Mali. An intersection of 8.50 g/t Au over 24m from 20m downhole is exceptional. The RC programme is designed to expand and infill the existing Diba resource, as well as define a maiden resource at the Diba NW prospect. Infill drilling within the current deposit has improved our understanding of the high-grade mineralisation that strikes northeast for approximately 550m through the Diba Deposit.

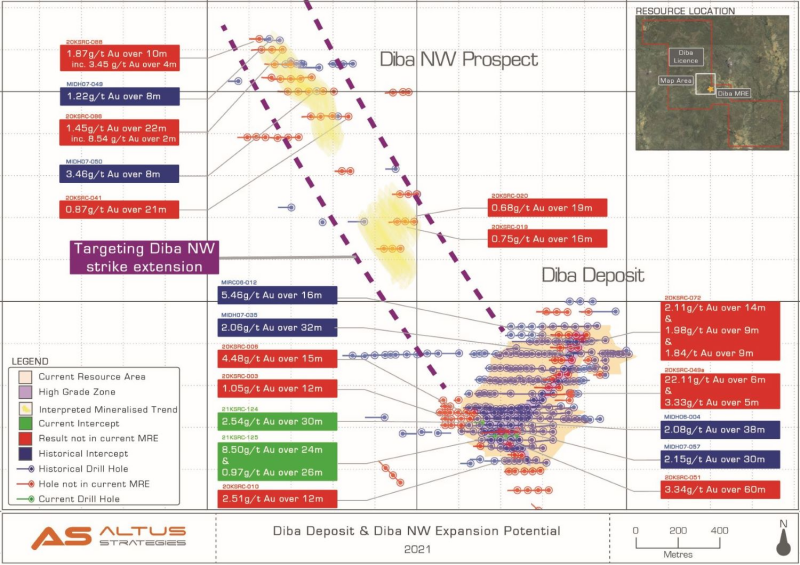

“Previous results received from the Diba NW prospect indicate the discovery of two northwest trending, shallow-dipping and consistent zones of mineralisation totalling approximately 900m in strike length, with intersections including 1.45 g/t Au over 22m from 55m. Drilling at Diba NW will resume following the end of the rainy season in September. The programme is testing on-strike and down-dip extensions to the mineralisation, prior to the completion of a maiden resource estimate for Diba NW. We look forward to updating shareholders on further assay results from the current programme as they are received.”

Diba Project: Drilling Programme

The planned drilling programme at Diba includes up to 7,500m of Air Core (“AC”) and 12,500m of RC drilling. To date, 2,989m of AC and 1,803m of RC drilling have been completed. The programme is due to recommence after the current rainy season, which ends in September. Capital Drilling Limited has been contracted to undertake the balance of the drilling programme. The programme comprises 7,000m (46 RC holes) in and around the Diba Deposit, testing potential down-dip and on-strike extensions, as well as infilling areas to increase the resource confidence. Approximately 5,500m (36 RC holes) is planned, to define and extend mineralisation at the Diba NW prospect. The drilling programme will also test the potential to link the mineralised zone at Diba NW to the current Diba Deposit. In addition, a number of priority prospects, located within 3km of the Diba Deposit, will be tested by AC drilling.

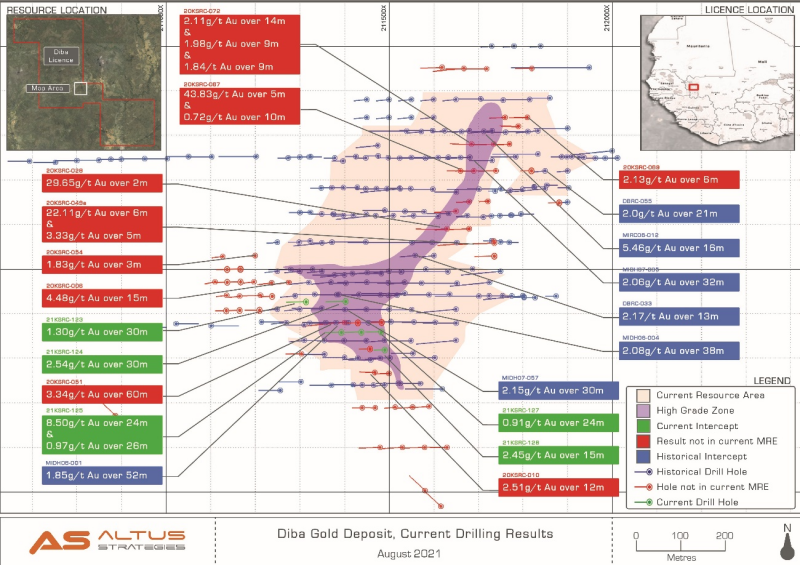

Assay results for the first six RC holes received from the Diba Deposit and two RC holes from Diba NW, totalling 626m, are summarised in Table 1 below. The holes were drilled at -60 degrees inclination and ranged between 80m to 102m in length. Drilling has been orientated perpendicular to the strike of the Diba Deposit and the interpreted structural orientation of the Diba NW target.

Table 1: Diba drill intersections from current programme

|

Hole ID |

Prospect |

From (m) |

To (m) |

Intersection (m) |

Grade (g/t Au) |

|

21KSRC-123 |

Diba Deposit |

12 |

42 |

30 |

1.30 |

|

46 |

50 |

4 |

1.16 |

||

|

60 |

68 |

8 |

0.96 |

||

|

84 |

85 |

1 |

0.88 |

||

|

21KSRC-124 |

Diba Deposit |

13 |

16 |

3 |

0.87 |

|

26 |

29 |

3 |

0.50 |

||

|

36 |

66 |

30 |

2.54 |

||

|

70 |

80 |

10 |

0.98 |

||

|

85 |

88 |

3 |

0.76 |

||

|

21KSRC-125 Including |

Diba Deposit |

20 |

44 |

24 |

8.50 |

|

24 |

31 |

7 |

26.45 |

||

|

49 |

75 |

26 |

0.97 |

||

|

21KSRC-126 |

Diba Deposit |

14 |

19 |

5 |

2.70 |

|

28 |

31 |

3 |

1.20 |

||

|

35 |

39 |

4 |

0.90 |

||

|

44 |

48 |

4 |

1.34 |

||

|

58 |

59 |

1 |

0.76 |

||

|

68 |

69 |

1 |

0.61 |

||

|

77 |

80 |

3 |

0.82 |

||

|

21KSRC-127 |

Diba Deposit |

21 |

45 |

24 |

0.91 |

|

50 |

54 |

4 |

0.73 |

||

|

58 |

59 |

1 |

0.58 |

||

|

63 |

66 |

3 |

0.98 |

||

|

21KSRC-128 |

Diba Deposit |

26 |

41 |

15 |

2.45 |

|

45 |

49 |

4 |

0.93 |

||

|

54 |

56 |

2 |

1.00 |

||

|

21KSRC-129 |

Diba NW |

No significant results |

|||

|

21KSRC-130 |

Diba NW |

No significant results |

|||

Notes:

-

1.Intersections based on 0.5 g/t Au cut off and ≤ 3m consecutive internal waste

-

2.Intersections are down-the-hole and do not represent true widths of mineralisation

-

3.No grade capping has been applied

-

4.Estimated true widths for the holes is from 75% to 100% of the intercept width

Illustrations

The following figures relate to the disclosures in this announcement and are visible in the version of this announcement on the Company's website (www.altus-strategies.com) or in PDF format by following this link: https://altus-strategies.com/site/assets/files/5330/altus_nr_-_diba-_12_august_2021.pdf

-

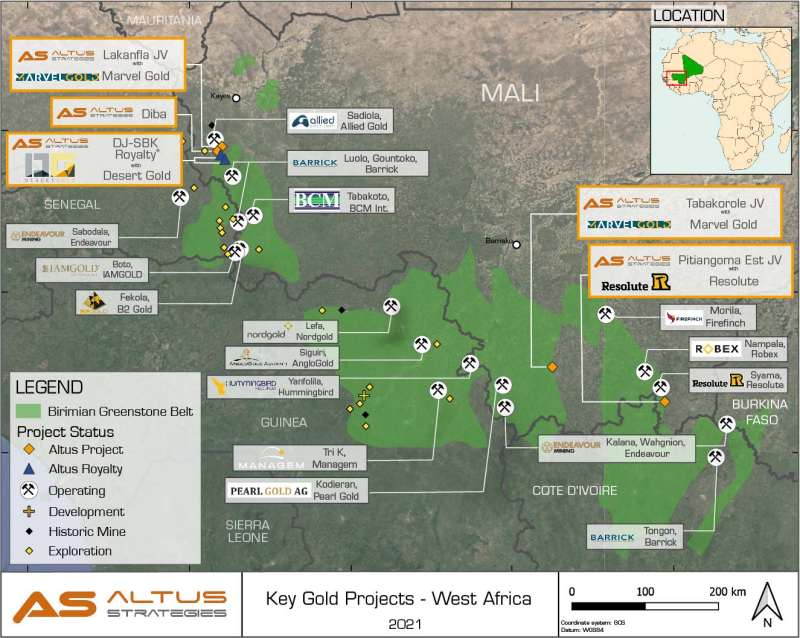

- Location of the Diba gold project in western Mali is shown in Figure 1.

- Plan of drill holes with assay results returned from Diba Deposit is shown in Figure 2.

- Plan of Diba Deposit and Diba NW Prospect is shown in Figure 3.

- Selection of photos from the latest drilling programme is shown in Figure 4.

Figure 1: Location of the Diba gold project in western Mali

Figure 2: Plan of drill holes with assay results returned from Diba Deposit

Figure 3: Plan of Diba Deposit and Diba NW Prospect

Figure 4: Selection of photos from the latest drilling programme

Diba Project: Location

The 81km2 Diba project (Korali Sud licence) is located in the Kayes region of western Mali, approximately 450km northwest of the capital city of Bamako. The Project sits 5km west of the Company’s Lakanfla gold project, which is under joint venture with ASX-listed Marvel Gold Limited, and approximately 13km south of the multi-million ounce Sadiola gold mine and 35km south of the multi-million ounce Yatela former gold mine, both owned by Allied Gold Corp. Diba is contiguous with the Sadiola permit on its northern and eastern boundaries. Mineralisation hosted on these properties is not necessarily indicative of mineralisation hosted at Diba.

Diba Mineral Resource Estimate

Diba hosts a deposit for which a mineral resource estimate (“MRE”) of 217,000 ounces at 1.39 g/t gold (Indicated) and 187,000 ounces at 1.06 g/t gold (Inferred) in both oxide and fresh domains has been made, as set out in Table 1. The MRE was previously reported by the Company on 6 July 2020 (see Altus’ news release titled “Significant Gold Resource at Diba Project, Western Mali”). The Diba deposit remains open down dip and along strike.

Table 1: Diba Mineral Resource Estimate

|

Domain |

Indicated |

Inferred |

||||

|

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

Tonnes (t) |

Grade (g/t) |

Contained gold (oz) |

|

|

Oxide |

3,900,000 |

1.46 |

183,100 |

939,000 |

1.10 |

33,200 |

|

Fresh |

934,000 |

1.12 |

33,600 |

4,540,000 |

1.05 |

153,300 |

|

Total |

4,834,000 |

1.39 |

217,000 |

5,479,000 |

1.06 |

187,000 |

Notes:

-

- The MRE has an effective date of 6 July 2020.

- The Mineral Resources in the MRE are classified according to the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) "Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines", dated 29 November 2019, and CIM "Definition Standards for Mineral Resources and Mineral Reserves", dated 10 May 2014.

- Mineral Resources are reported within a pit shell and are reported to a base-case cut-off grade of 0.5 g/t gold.

- The quantity and grade of Inferred Resources in the MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Resource category.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The MRE may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- All tonnages reported are dry metric tonnes. Minor discrepancies may occur due to rounding to appropriate significant figures.

- Tonnages are rounded to 1,000t and gold to 1,000oz as this is an estimate.

- Altus is the operator and 100% owner of Diba.

Diba Deposit: Geology and Mineralisation

Mineralisation at Diba is sediment-hosted within a series of stacked lenses, typically between 20m and 40m thick. The lenses are shallow-dipping at approximately 30 degrees angled to the east/east-southeast. The Diba deposit is considered to be controlled by a number of northwest and northeast orientated structures, with gold occurring as fine-grained disseminations in localised high-grade, calcite-quartz veinlets. Alteration at Diba is typically albite-hematite+/-pyrite, although pyrite content is generally very low (<1 %). The weathering profile at the Project is estimated to be up to 70m vertical depth, resulting in extensive oxidation from surface. The oxide gold mineralisation at the Diba deposit is predominantly found in saprolite within 50m of surface and across a compact 700m x 700m area.

QAQC

All RC samples were collected following industry best practices with an appropriate number and type of certified reference materials (standards), blanks and duplicates inserted to ensure an effective QAQC regime. The samples announced in this release were drilled by International Drilling Company (‘IDC’). Samples were collected at 1m sample intervals and a representative sample was split at the site and sent for analysis at SGS SARL (Bamako, Mali) by fire assay technique FAE505. All standard, blanks and duplicates have been reviewed and no significant issues with the data have been identified.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master's degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

|

Altus Strategies Plc Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767 E-mail: info@altus-strategies.com |

|

SP Angel (Nominated Adviser) Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

SP Angel (Broker) Grant Barker / Richard Parlons |

Tel: +44 (0) 20 3470 0471 |

|

Shard Capital (Broker) Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

|

Yellow Jersey PR (Financial PR & IR) Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512 E-mail: altus@yellowjerseypr.com |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s focus on Africa and differentiated approach, of generating royalties on its own discoveries as well as through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law or regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organisation of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

Glossary of Terms

The following is a glossary of technical terms:

“AC” means Aircore drilling

“Au” means gold

“g” means grams

“g/t” means grams per tonne

“grade(s)” means the quantity of ore or metal in a specified quantity of rock

“km” means kilometres

“m” means metres

“MRE” means mineral resource estimate

“NI 43-101” means National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators

“Qualified Person” means a person that has the education, skills and professional credentials to qualify as a qualified person under NI 43-101

“RC” means reverse circulation drilling

“t” means a metric tonne

**END**

Copyright (c) 2021 TheNewswire - All rights reserved.