Photo from Intuit Solutions

Photo from Intuit Solutions

Originally Posted On: https://www.intuitsolutions.net/case-study-custom-bigcommerce-checkout-financing-options/

- Buy now, pay later options continue to surge in online shopping, offering flexible installments and low interest rates for larger purchases and buyers short on cash.

-

- Since approval odds will vary depending on creditworthiness, ecommerce merchants often choose to integrate multiple financing options in their website’s checkout.

-

- Merchants seek checkout solutions that facilitate an immediate, nondisruptive application process.

-

- A custom-developed solution for one of our clients lets applicants denied by their primary financing option automatically receive a secondary offer.

How Buy Now Pay Later Options Help Ecommerce Businesses

Buy Now Pay Later (BNPL) options, also referred to as “Point of Sale (POS) financing,” are becoming increasingly popular in ecommerce. More than half of Americans report using a BNPL service, allowing them to defer payment on purchases until later – a trend that was further exacerbated by the pandemic, with many shoppers short on cash.

Even shoppers that don’t experience financial difficulties appreciate the additional options in financing their online purchases. Unlike credit cards, BNPL options typically have flexible installments, limited fees, and little to no interest rates.

For ecommerce merchants, integrating BNPL apps into their online checkout can prove to be profitable by:

-

- Encouraging browsers to become buyers

-

- Making high-ticket items more budget-friendly

-

- Reducing cart abandonment

-

- Increasing Average Order Value (AOV)

-

- Cultivating repeat buyers

-

- Providing a competitive edge against sites that don’t offer BNPL options

Client Case Study: Integrating Multiple Financing Options for All Credit Types

A solid foundation cannot be overstated in any context. This is especially true when it comes to the bedrock of all vehicles on the road – tires and rims.

A family-owned business that stays connected to its roots, BB Wheels understands what it’s like living and shopping on a budget. So they’ve made it their mission to provide customers with the safest and highest-quality tires, wheels, rims, and accessories without breaking the bank.

BBWheels wanted to enable a real-time financing approval process within the checkout page to serve shoppers of all budgets and credit backgrounds. This called for a custom-developed solution that communicates the denial of one financing option to trigger a prompt for an alternative.

The solution would include:

-

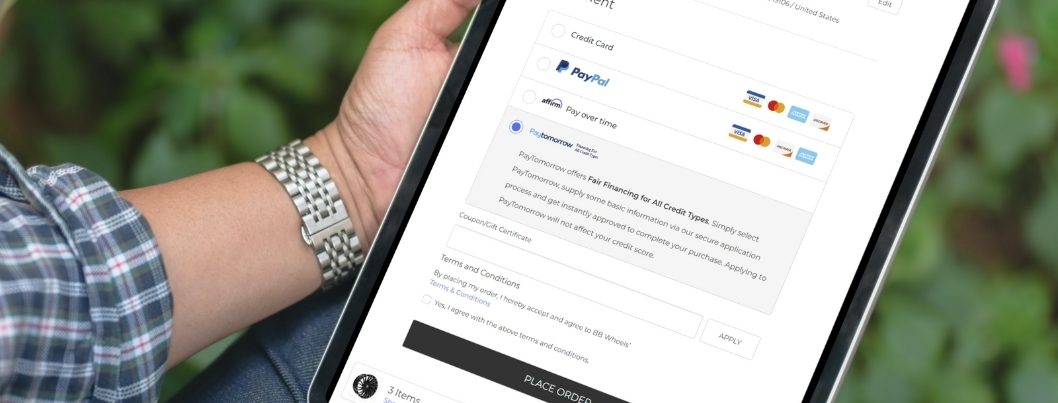

- Two different BNPL financing options, Affirm and Paytomorrow, integrated with their BigCommerce checkout.

-

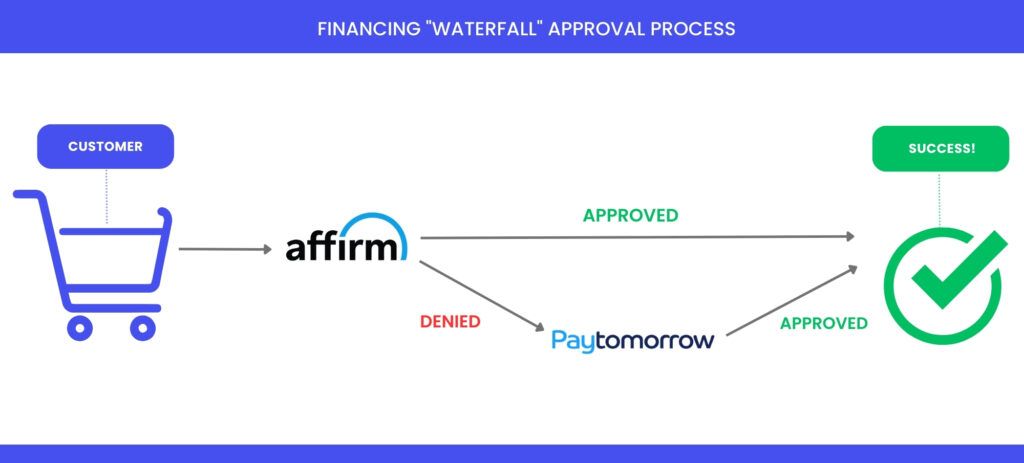

- A custom “waterfall” process that gives customers not approved by their initial choice another path to purchase through a second option with more lenient approval odds.

The Solution: A Custom BigCommerce Checkout Flow with Primary and Secondary Buy Now, Pay Later Options

Our team developed a BigCommerce checkout customization that funnels customers who do not qualify for Affirm to a second financing option, PayTomorrow, at checkout.

The process includes the following steps:

-

- Customers who select Affirm as their payment method complete the standard application process through a modal popup at checkout.

-

- If Affirm declines the application, the user will close the popup.

-

- The Affirm modal closure in conjunction with the Affirm application decline triggers a prompt for the PayTomorrow popup.

-

- If the user confirms the prompt, the payment method is set to PayTomorrow.

-

- The PayTomorrow modal will appear when the user clicks “Place Order.”

The Results: A Custom BigCommerce Checkout Improving Conversions through Flexible Financing

Offering BNPL options in ecommerce checkouts can be a powerful tool for boosting checkout conversions and driving repeat customers. To accommodate the full spectrum of buyers, merchants must integrate financing providers accommodating customers of varying credit backgrounds.

With a custom-developed checkout flow that enables primary and secondary financing options, BBWheels can help more customers secure the tires, rims and wheels of their dreams for a safe, reliable driving experience.

Do you have a request for a custom checkout feature? We take on development-intensive customizations for the BigCommerce Checkout and would be happy to discuss your project! Call us at 866-901-4650 or contact us here to discuss your needs today.