Animal health products manufacturer Phibro Animal Health (NASDAQ: PAHC) missed Wall Street’s revenue expectations in Q2 CY2026, with sales flat year on year at $378.7 million. Its non-GAAP profit of $0.57 per share was 13.2% below analysts’ consensus estimates.

Is now the time to buy Phibro Animal Health? Find out by accessing our full research report, it’s free.

Phibro Animal Health (PAHC) Q2 CY2026 Highlights:

- Revenue: $378.7 million vs analyst estimates of $386.6 million (flat year on year, 2% miss)

- Adjusted EPS: $0.57 vs analyst expectations of $0.66 (13.2% miss)

- Operating Margin: 10.1%, up from 8.9% in the same quarter last year

- Free Cash Flow Margin: 2.1%, similar to the same quarter last year

- Market Capitalization: $1.67 billion

“This was a strong quarter for us, and I’m really proud of how our teams are executing around the world,” stated Jack Bendheim, President and Chief Executive Officer.

Company Overview

With a portfolio of approximately 800 product lines serving farmers and veterinarians in 90 countries, Phibro Animal Health (NASDAQ: PAHC) develops, manufactures, and markets health products for livestock and companion animals, including antibacterials, vaccines, nutritional supplements, and mineral additives.

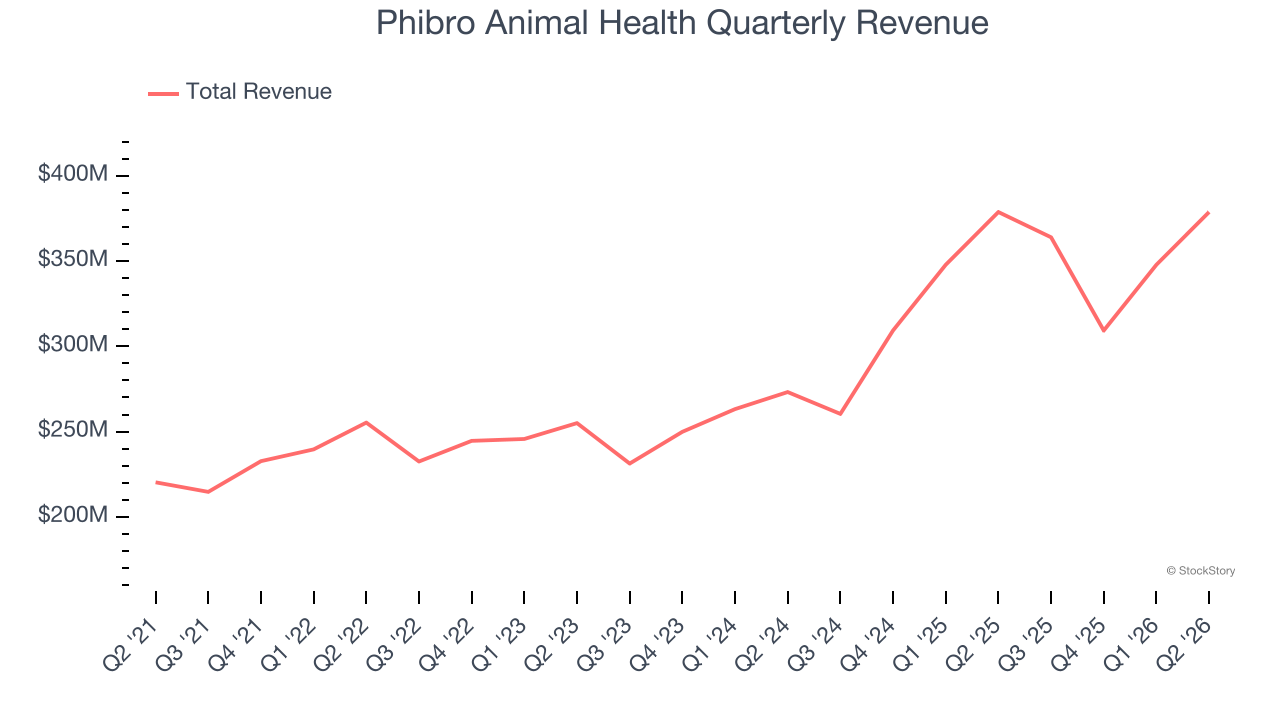

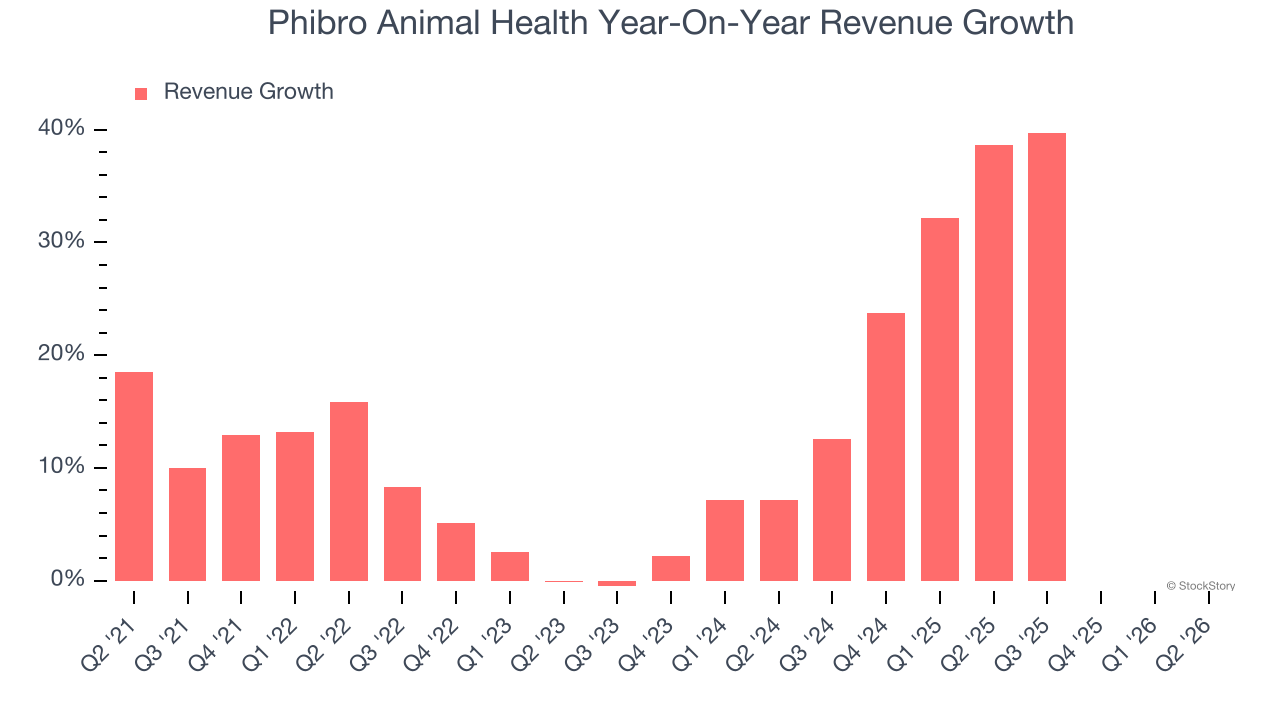

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Phibro Animal Health’s 10.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Phibro Animal Health’s annualized revenue growth of 17.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Phibro Animal Health missed Wall Street’s estimates and reported a rather uninspiring 0% year-on-year revenue decline, generating $378.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and indicates the market sees some success for its newer products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

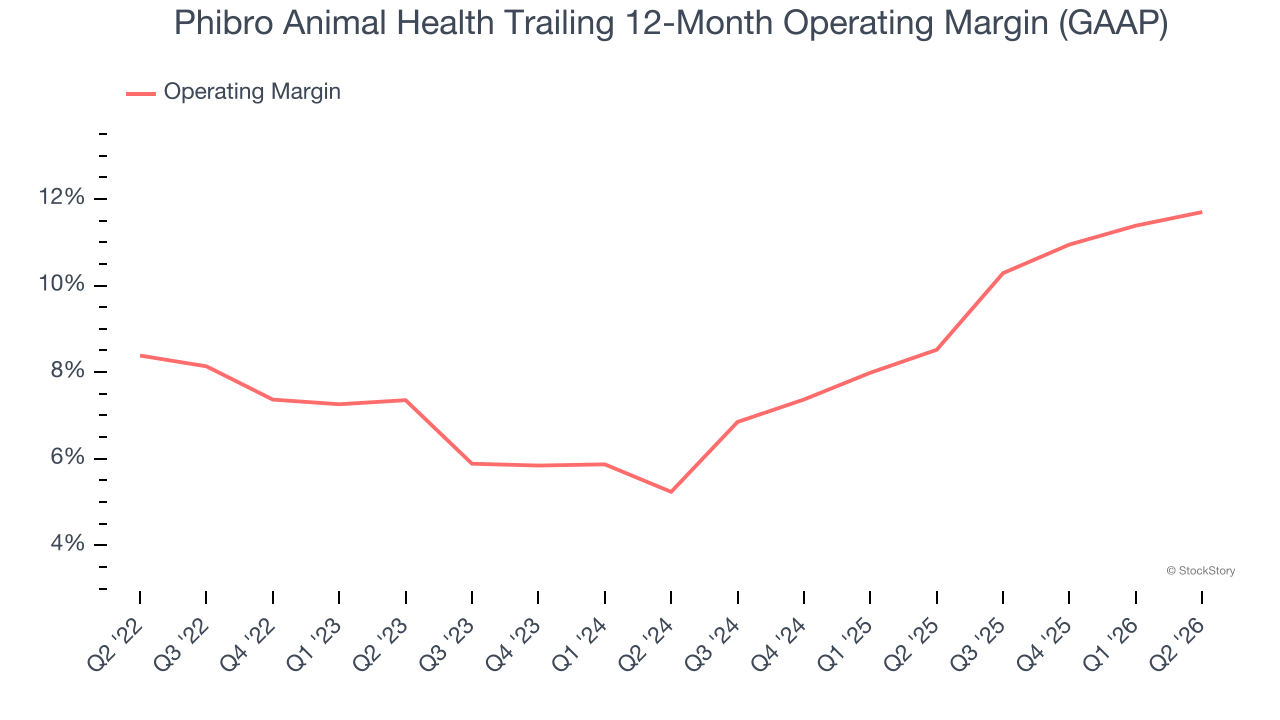

Operating Margin

Phibro Animal Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.5% was weak for a healthcare business.

On the plus side, Phibro Animal Health’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6.5 percentage points on a two-year basis.

In Q2, Phibro Animal Health generated an operating margin profit margin of 10.1%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

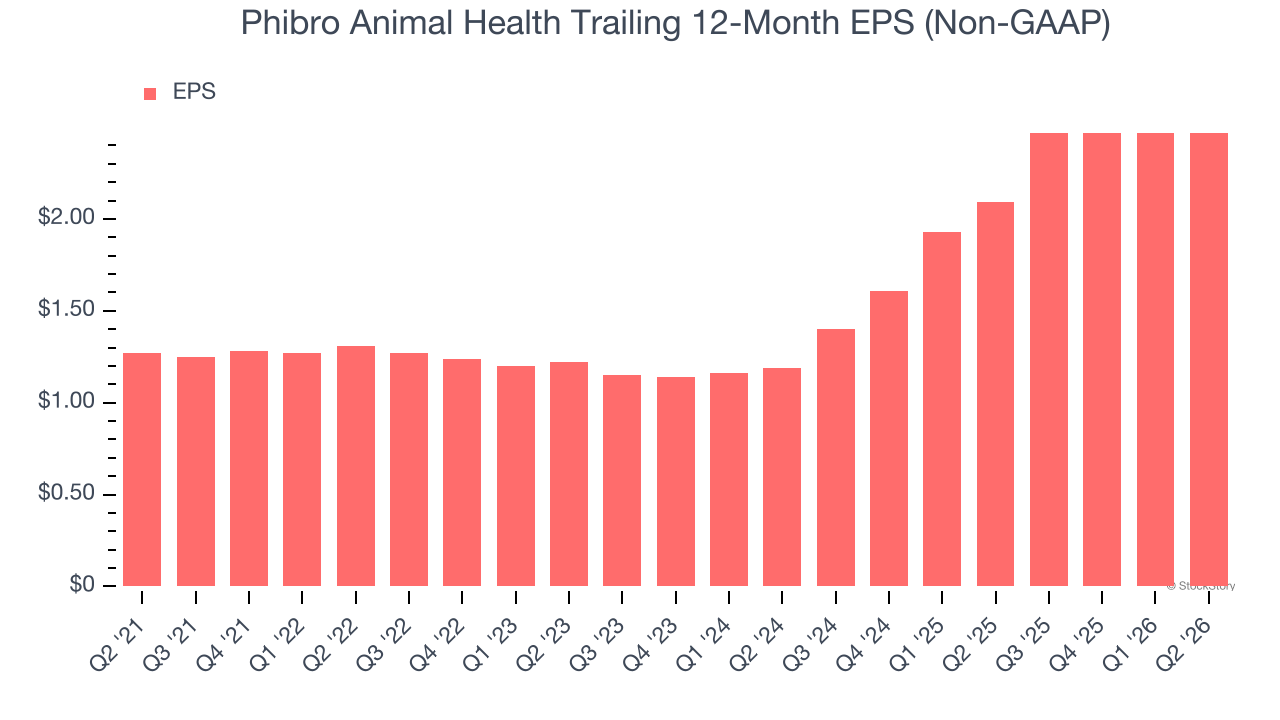

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Phibro Animal Health’s EPS grew at a spectacular 14.2% compounded annual growth rate over the last five years, higher than its 10.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Phibro Animal Health’s earnings to better understand the drivers of its performance. As we mentioned earlier, Phibro Animal Health’s operating margin expanded by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Phibro Animal Health reported adjusted EPS of $0.57, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Phibro Animal Health’s full-year EPS of $2.47 to grow 17.4%.

Key Takeaways from Phibro Animal Health’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. Still, the stock traded up 5.5% to $43.24 immediately after reporting.

Is Phibro Animal Health an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).