Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at AdaptHealth (NASDAQ: AHCO) and its peers.

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

The 7 senior health, home health & hospice stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.7%.

Luckily, senior health, home health & hospice stocks have performed well with share prices up 12% on average since the latest earnings results.

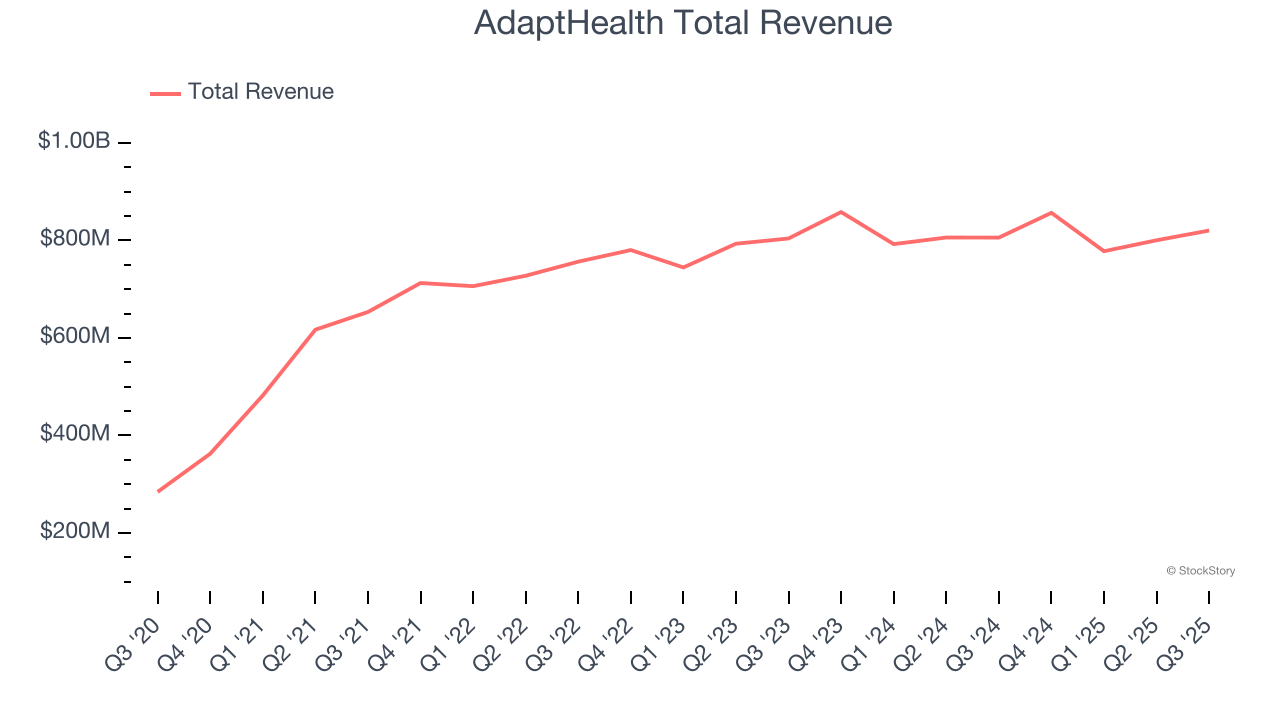

AdaptHealth (NASDAQ: AHCO)

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ: AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

AdaptHealth reported revenues of $820.3 million, up 1.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ revenue estimates but full-year revenue guidance meeting analysts’ expectations.

AdaptHealth delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 10.7% since reporting and currently trades at $10.07.

Is now the time to buy AdaptHealth? Access our full analysis of the earnings results here, it’s free for active Edge members.

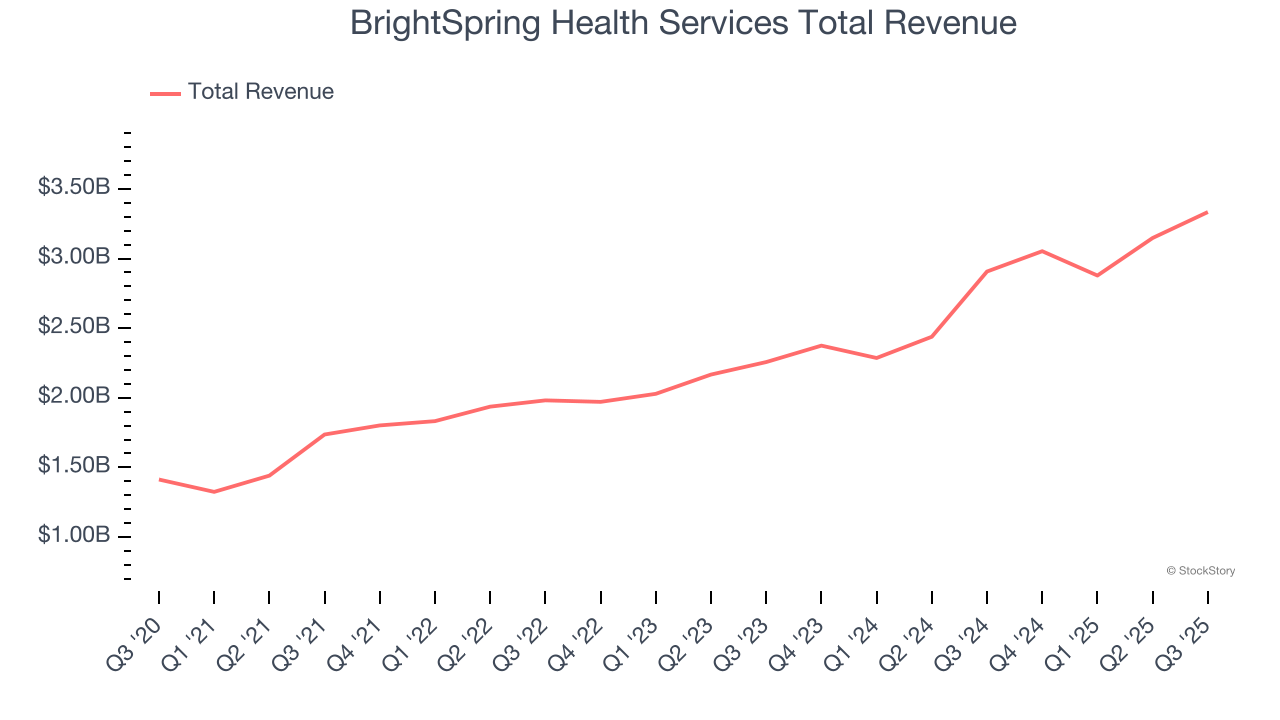

Best Q3: BrightSpring Health Services (NASDAQ: BTSG)

Founded in 1974, BrightSpring Health Services (NASDAQ: BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

BrightSpring Health Services reported revenues of $3.33 billion, up 14.7% year on year, outperforming analysts’ expectations by 5.3%. The business had a very strong quarter with an impressive beat of analysts’ revenue and EPS estimates.

BrightSpring Health Services delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 21.8% since reporting. It currently trades at $41.41.

Is now the time to buy BrightSpring Health Services? Access our full analysis of the earnings results here, it’s free for active Edge members.

Brookdale (NYSE: BKD)

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE: BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale reported revenues of $813.2 million, up 3.7% year on year, falling short of analysts’ expectations by 1.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS and revenue estimates.

Brookdale delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 28.1% since the results and currently trades at $11.67.

Read our full analysis of Brookdale’s results here.

The Pennant Group (NASDAQ: PNTG)

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ: PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

The Pennant Group reported revenues of $227.4 million, up 25.9% year on year. This result topped analysts’ expectations by 2.5%. It was a very strong quarter as it also produced full-year revenue guidance exceeding analysts’ expectations and an impressive beat of analysts’ revenue estimates.

The Pennant Group scored the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 13.5% since reporting and currently trades at $28.58.

Read our full, actionable report on The Pennant Group here, it’s free for active Edge members.

Chemed (NYSE: CHE)

With a unique business model combining end-of-life care and household services, Chemed (NYSE: CHE) operates two distinct businesses: VITAS, which provides hospice care for terminally ill patients, and Roto-Rooter, which offers plumbing and water restoration services.

Chemed reported revenues of $624.9 million, up 3.1% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and revenue in line with analysts’ estimates.

The stock is up 2.6% since reporting and currently trades at $450.62.

Read our full, actionable report on Chemed here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.