Texas Roadhouse currently trades at $188.92 per share and has shown little upside over the past six months, posting a middling return of 2.3%. The stock also fell short of the S&P 500’s 11.5% gain during that period.

Is now the time to buy TXRH? Find out in our full research report, it’s free.

Why Does Texas Roadhouse Spark Debate?

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ: TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

Two Things to Like:

1. Restaurant Growth Signals an Offensive Strategy

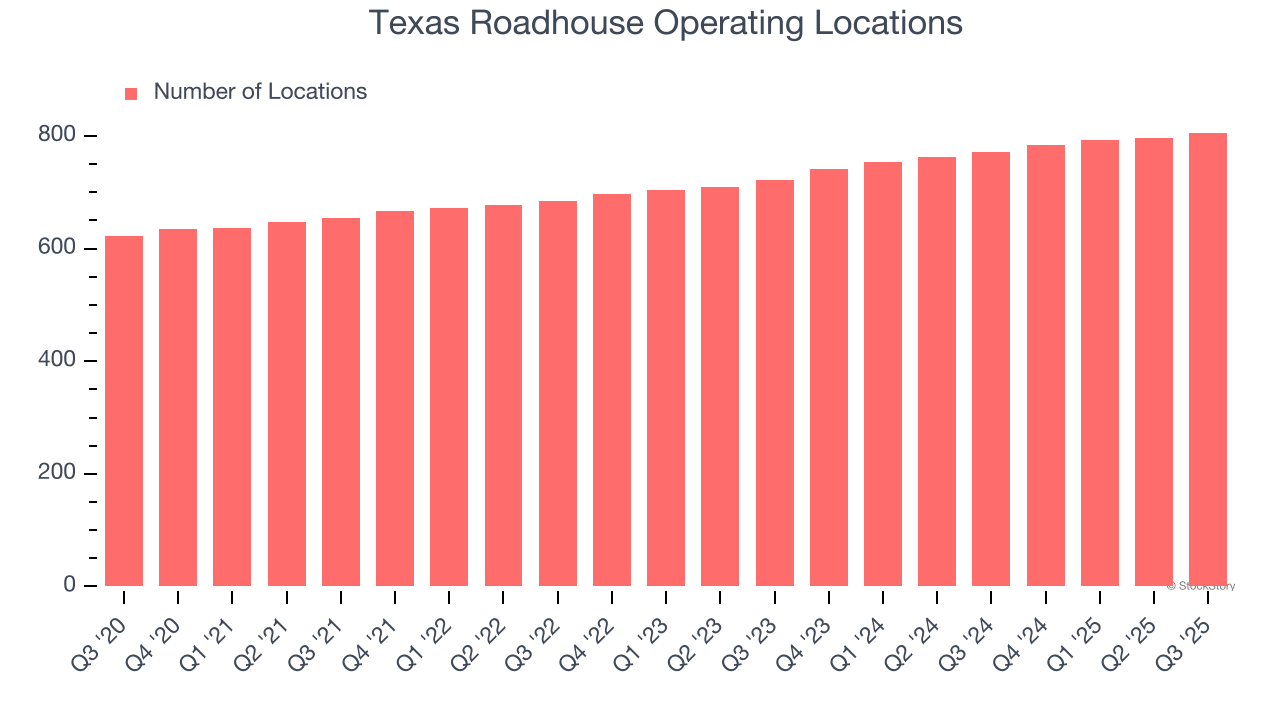

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Texas Roadhouse operated 806 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 6% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Surging Same-Store Sales Show Increasing Demand

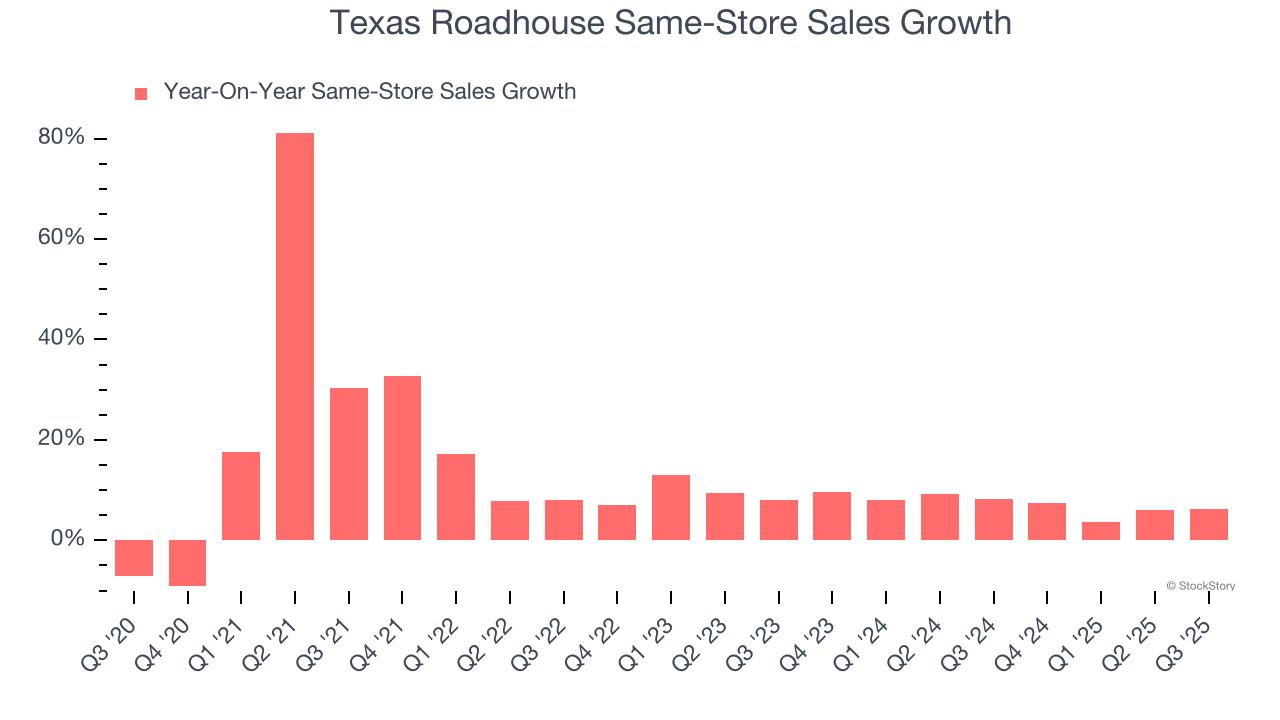

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Texas Roadhouse has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 7.3%.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

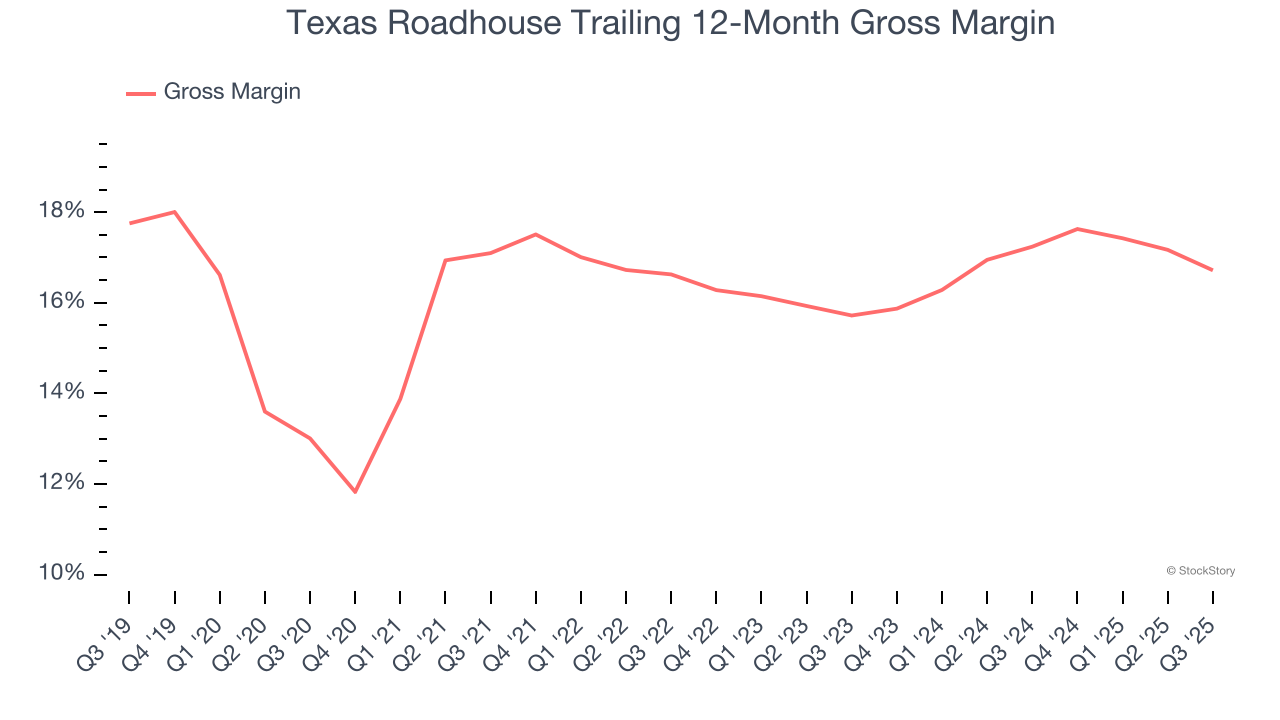

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells, like ingredients, and indicate its level of pricing power.

Texas Roadhouse has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 17% gross margin over the last two years. That means Texas Roadhouse paid its suppliers a lot of money ($83.04 for every $100 in revenue) to run its business.

Final Judgment

Texas Roadhouse has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 29.5× forward P/E (or $188.92 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.