Workforce housing company Target Hospitality (NASDAQ: TH) announced better-than-expected revenue in Q2 CY2025, but sales fell by 38.8% year on year to $61.61 million. The company’s full-year revenue guidance of $315 million at the midpoint came in 15.5% above analysts’ estimates. Its GAAP loss of $0.15 per share was 40.6% below analysts’ consensus estimates.

Is now the time to buy Target Hospitality? Find out by accessing our full research report, it’s free.

Target Hospitality (TH) Q2 CY2025 Highlights:

- Revenue: $61.61 million vs analyst estimates of $56.42 million (38.8% year-on-year decline, 9.2% beat)

- EPS (GAAP): -$0.15 vs analyst expectations of -$0.11 (40.6% miss)

- Adjusted EBITDA: $3.5 million vs analyst estimates of $6.2 million (5.7% margin, 43.5% miss)

- The company lifted its revenue guidance for the full year to $315 million at the midpoint from $275 million, a 14.5% increase

- EBITDA guidance for the full year is $55 million at the midpoint, above analyst estimates of $52.93 million

- Operating Margin: -27.5%, down from 29.3% in the same quarter last year

- Free Cash Flow Margin: 5.5%, down from 31.8% in the same quarter last year

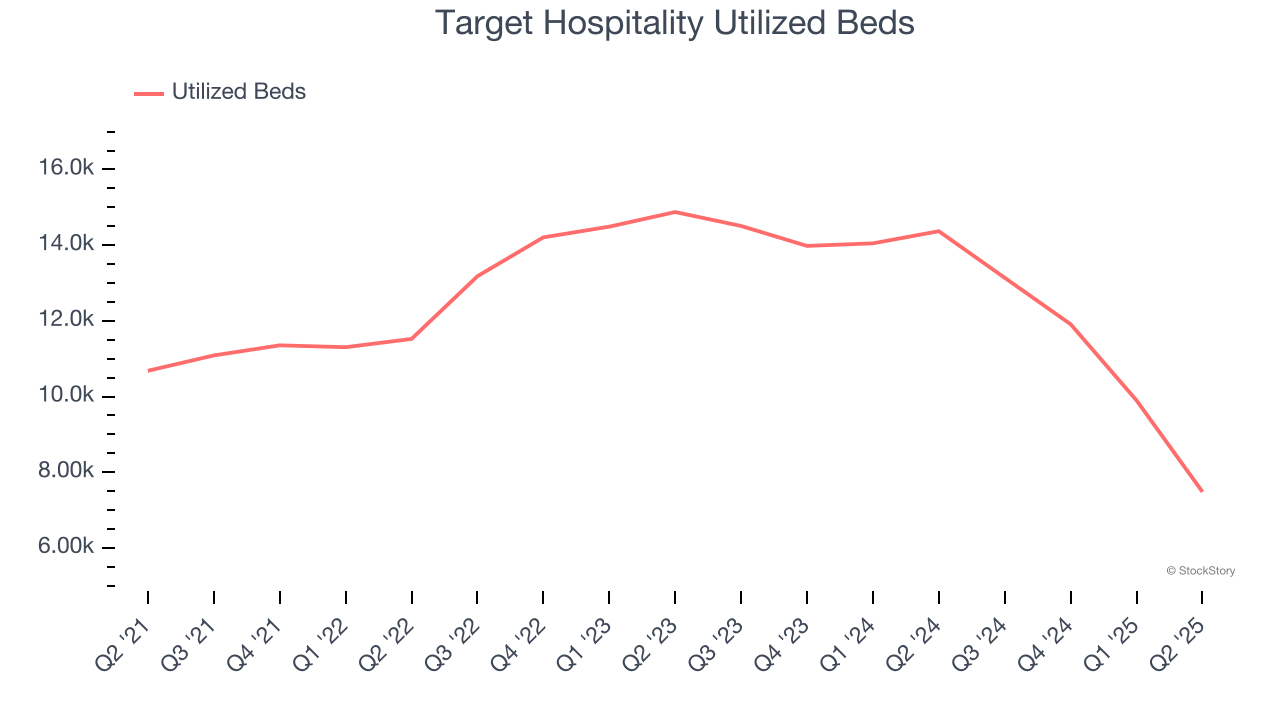

- Utilized Beds: 7,482, down 6,888 year on year

- Market Capitalization: $725.4 million

"We have made remarkable progress in our strategic initiatives to expand and diversify Target's business portfolio. In the first half of 2025, we announced two new contracts valued at over $400 million across various industries, all benefiting from strong long-term growth trends," stated Brad Archer, President and Chief Executive Officer.

Company Overview

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Revenue Growth

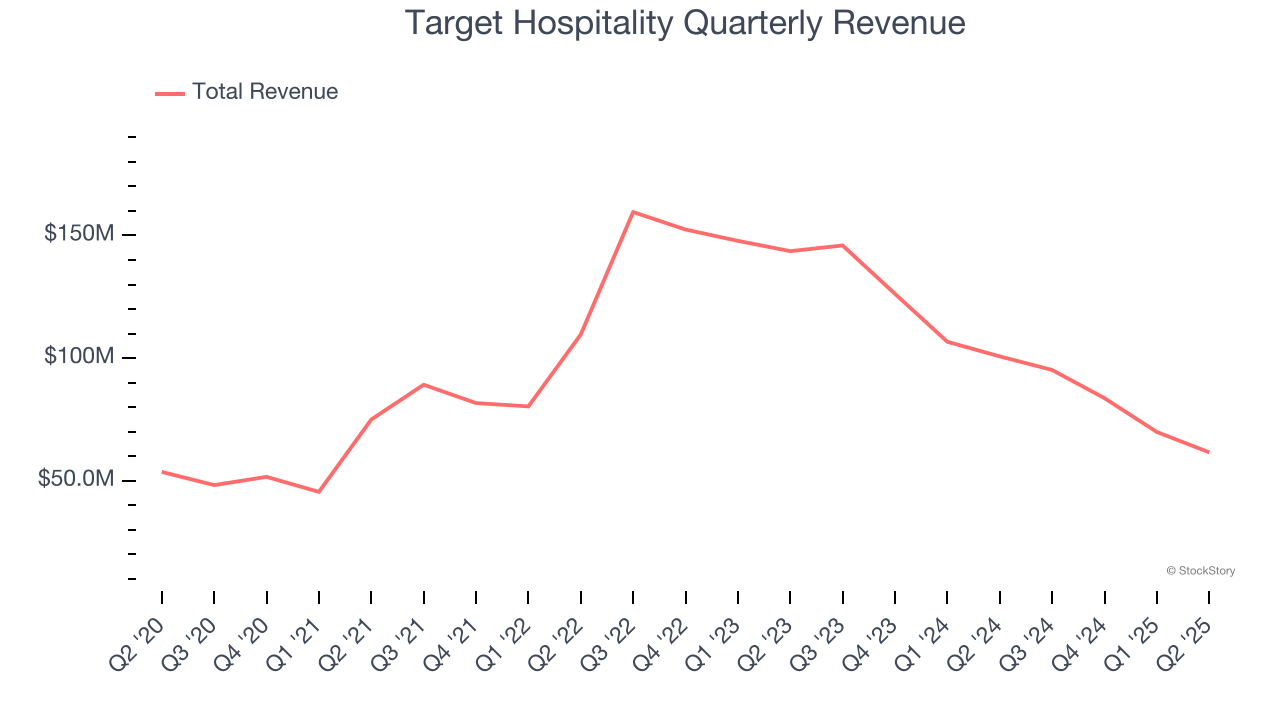

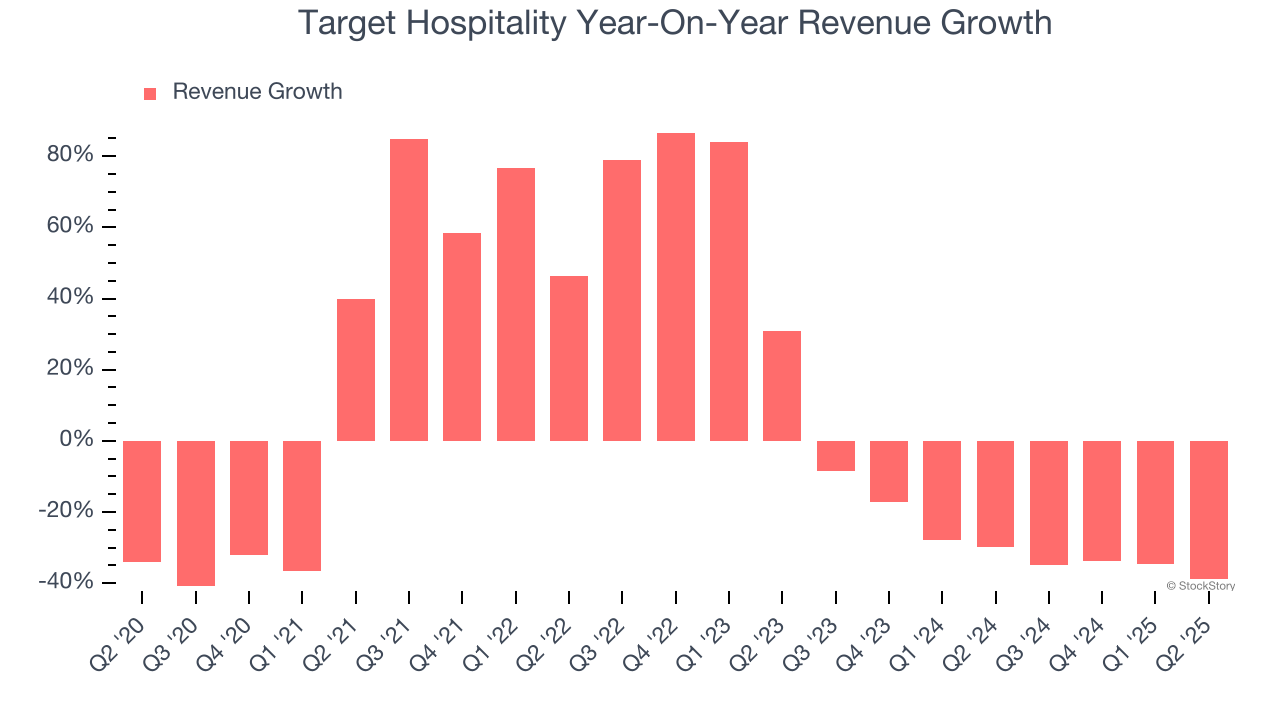

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Target Hospitality grew its sales at a weak 1.9% compounded annual growth rate. This wasn’t a great result, but there are still things to like about Target Hospitality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Target Hospitality’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 28.3% annually.

We can better understand the company’s revenue dynamics by analyzing its number of utilized beds, which reached 7,482 in the latest quarter. Over the last two years, Target Hospitality’s utilized beds averaged 12.5% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Target Hospitality’s revenue fell by 38.8% year on year to $61.61 million but beat Wall Street’s estimates by 9.2%.

Looking ahead, sell-side analysts expect revenue to decline by 18.1% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties. At least Target Hospitality is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

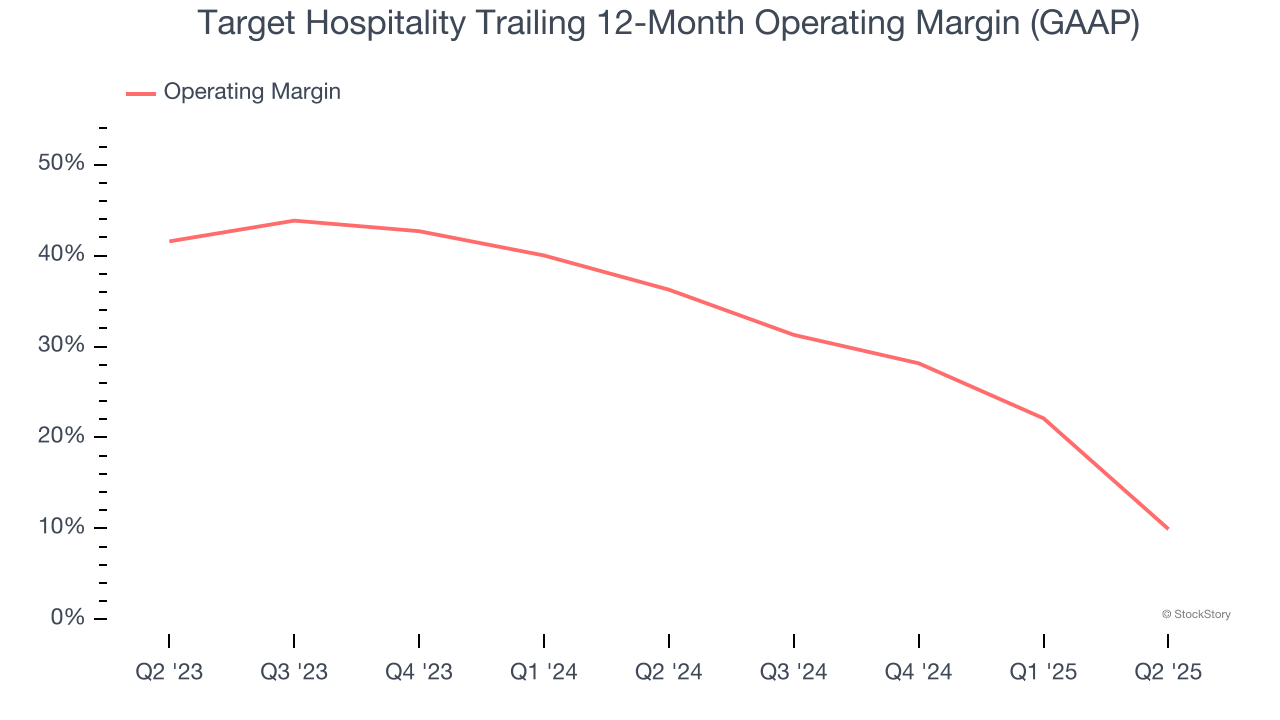

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Target Hospitality’s operating margin has shrunk over the last 12 months, but it still averaged 25.9% over the last two years, elite for a consumer discretionary business. This shows it’s an well-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

In Q2, Target Hospitality generated an operating margin profit margin of negative 27.5%, down 56.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

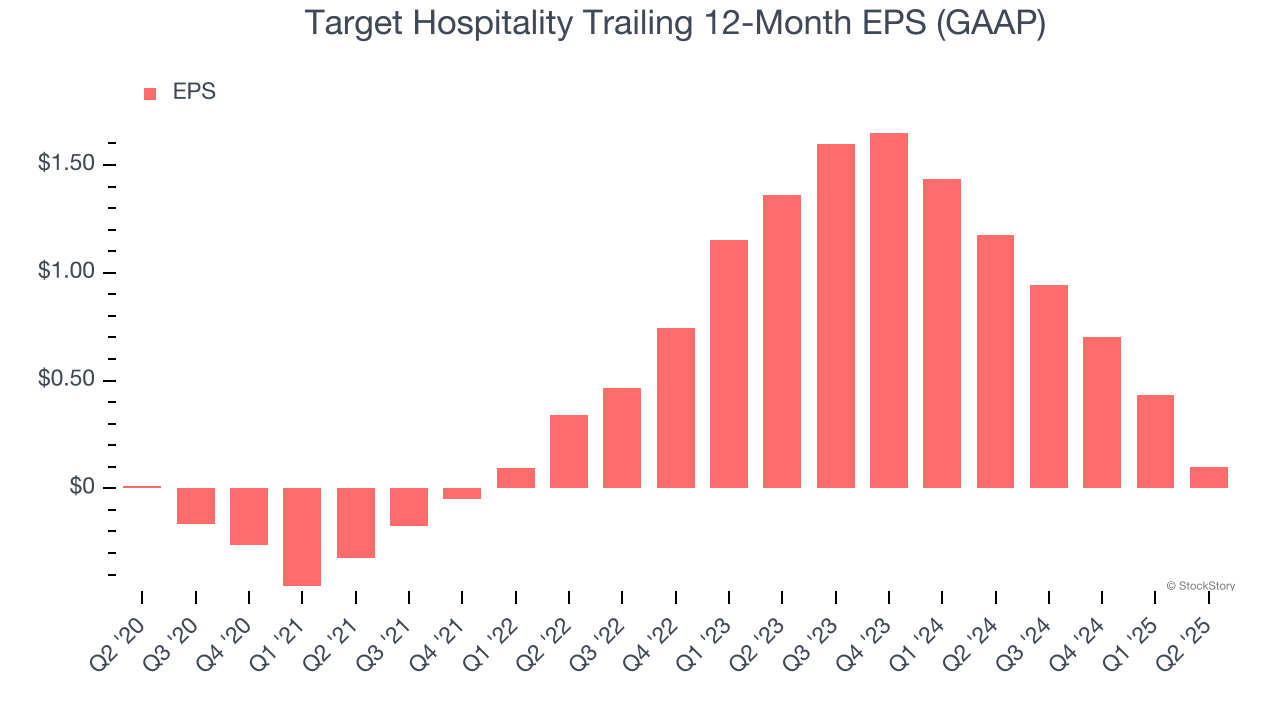

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Target Hospitality’s EPS grew at an astounding 56.1% compounded annual growth rate over the last five years, higher than its 1.9% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q2, Target Hospitality reported EPS at negative $0.15, down from $0.18 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Target Hospitality’s Q2 Results

We were impressed by how significantly Target Hospitality blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 10.5% to $8.07 immediately following the results.

Sure, Target Hospitality had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.