Civil infrastructure company Construction Partners (NASDAQ: ROAD) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 50.5% year on year to $779.3 million. On the other hand, the company’s full-year revenue guidance of $2.8 billion at the midpoint came in 0.6% above analysts’ estimates. Its GAAP profit of $0.79 per share was 9.7% below analysts’ consensus estimates.

Is now the time to buy Construction Partners? Find out by accessing our full research report, it’s free.

Construction Partners (ROAD) Q2 CY2025 Highlights:

- Revenue: $779.3 million vs analyst estimates of $789.2 million (50.5% year-on-year growth, 1.3% miss)

- EPS (GAAP): $0.79 vs analyst expectations of $0.88 (9.7% miss)

- Adjusted EBITDA: $131.7 million vs analyst estimates of $127.9 million (16.9% margin, 3% beat)

- The company reconfirmed its revenue guidance for the full year of $2.8 billion at the midpoint

- EBITDA guidance for the full year is $420 million at the midpoint, above analyst estimates of $413.7 million

- Operating Margin: 10.6%, up from 8.8% in the same quarter last year

- Backlog: $2.94 billion at quarter end

- Market Capitalization: $5.23 billion

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "We are pleased to report strong performance and excellent year-over-year growth across our key financial metrics this quarter. Despite persistent weather-related delays, including record or near-record rainfall across many of our Sunbelt markets, our teams executed with discipline and delivered robust operational results, generating significant cash flow from operations and driving a record high Adjusted EBITDA margin(1) of 16.9%. In the Southeast alone, May marked the second-wettest month on record, leading to project delays and impacting fixed asset cost recoveries. Our family of companies, now more than 6,200 employees in eight states, worked through these challenges with resilience and operational excellence, while also building a record project backlog of $2.94 billion. CPI remains well-positioned for continued success as we move through the busy construction season to close out our fiscal year and build out this record backlog."

Company Overview

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Revenue Growth

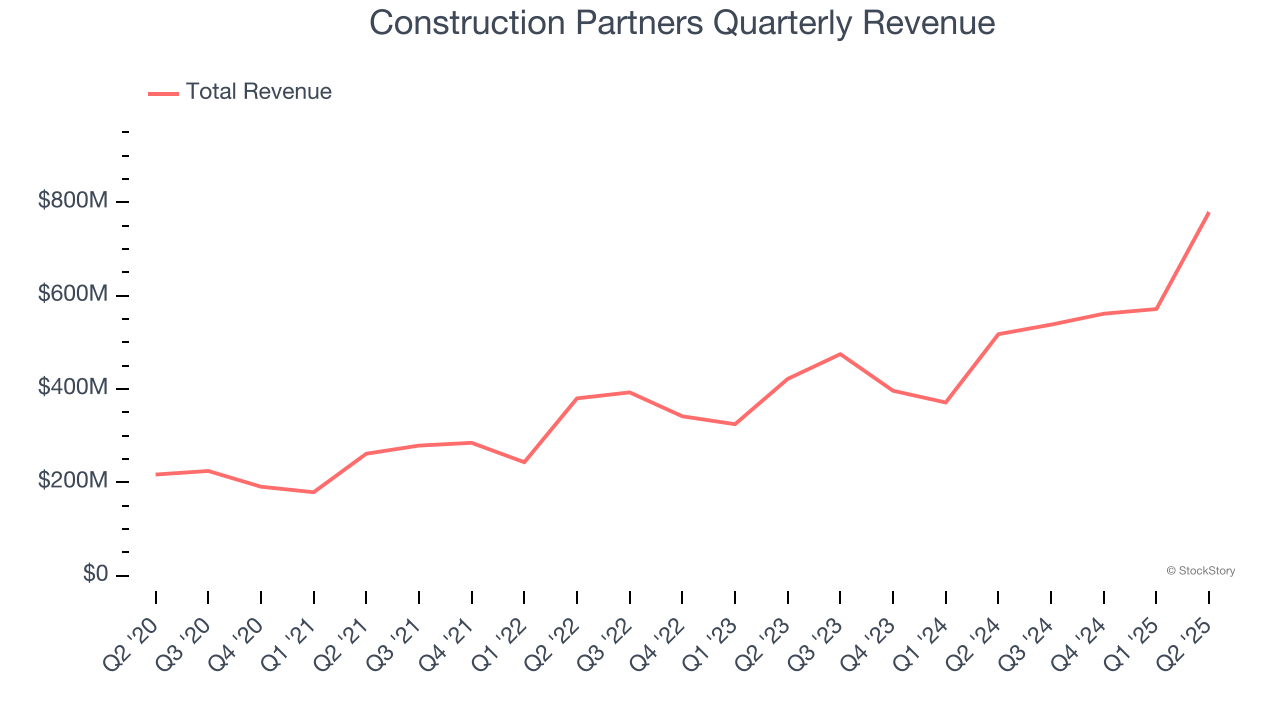

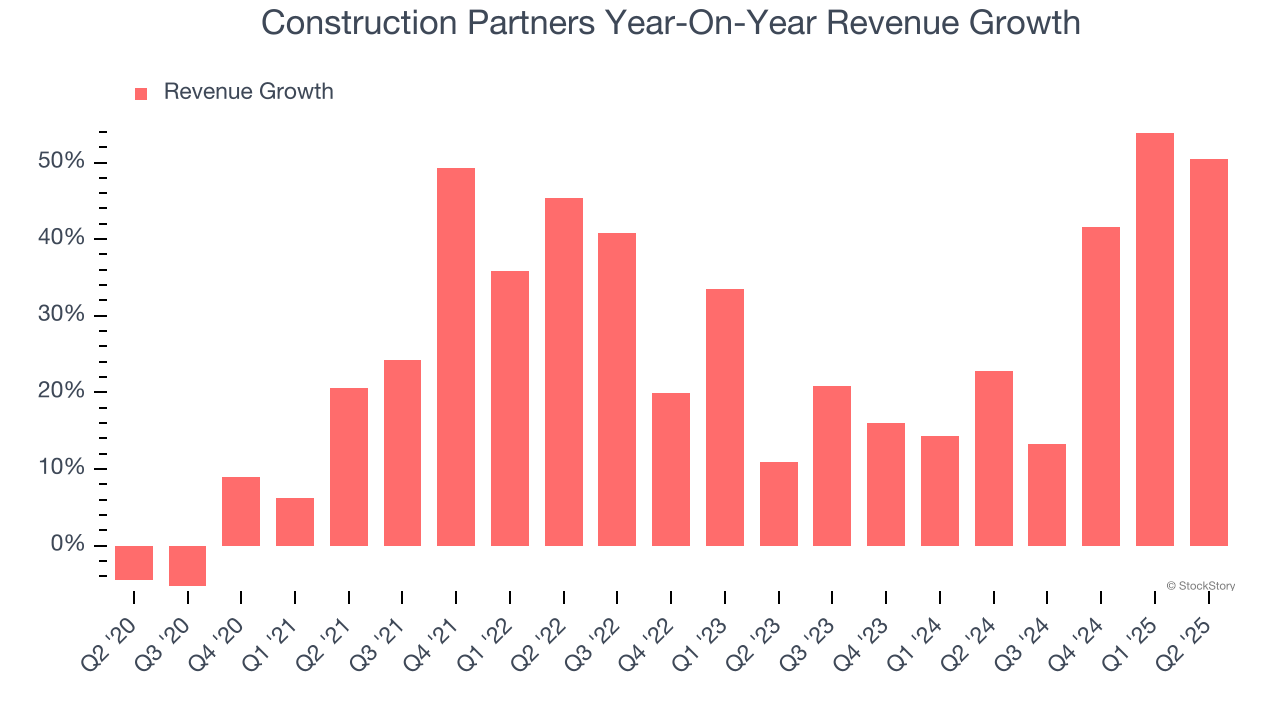

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Construction Partners’s 25.1% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Construction Partners’s annualized revenue growth of 28.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Construction Partners achieved a magnificent 50.5% year-on-year revenue growth rate, but its $779.3 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 28.3% over the next 12 months, similar to its two-year rate. This projection is eye-popping and suggests the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

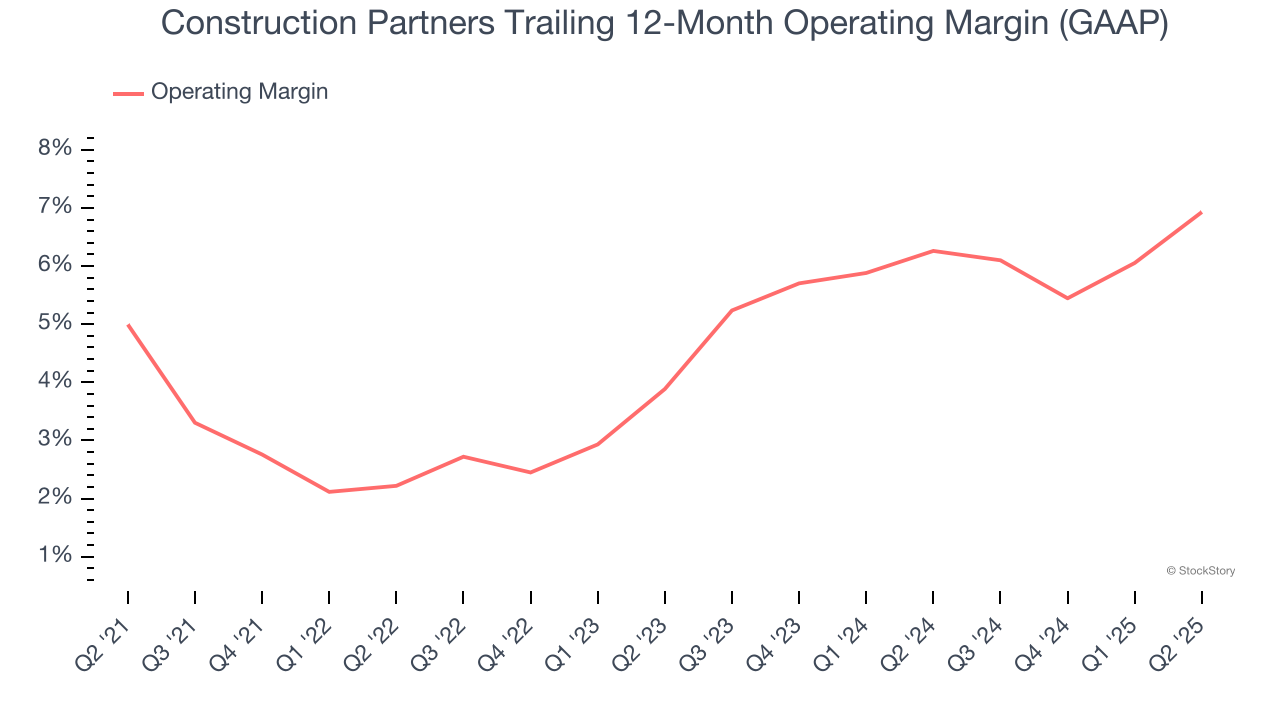

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Construction Partners’s operating margin rose by 1.9 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, Construction Partners generated an operating margin profit margin of 10.6%, up 1.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

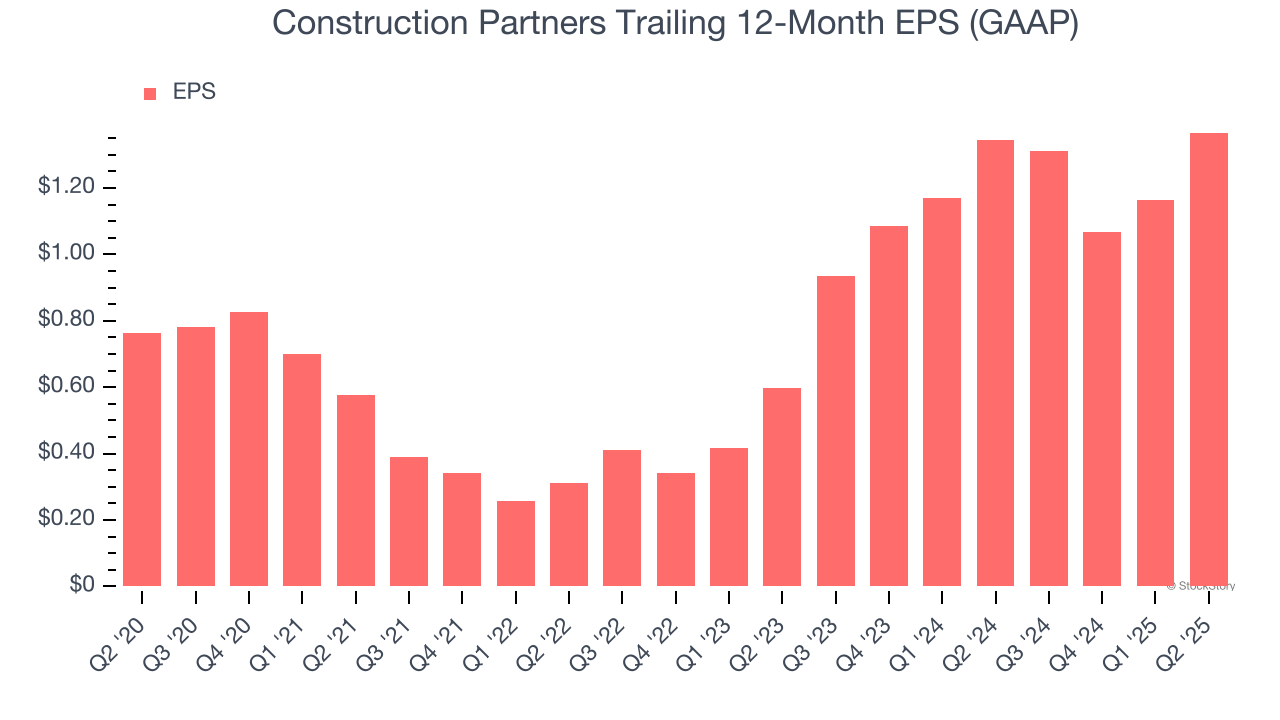

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Construction Partners’s EPS grew at a remarkable 12.4% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 25.1% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

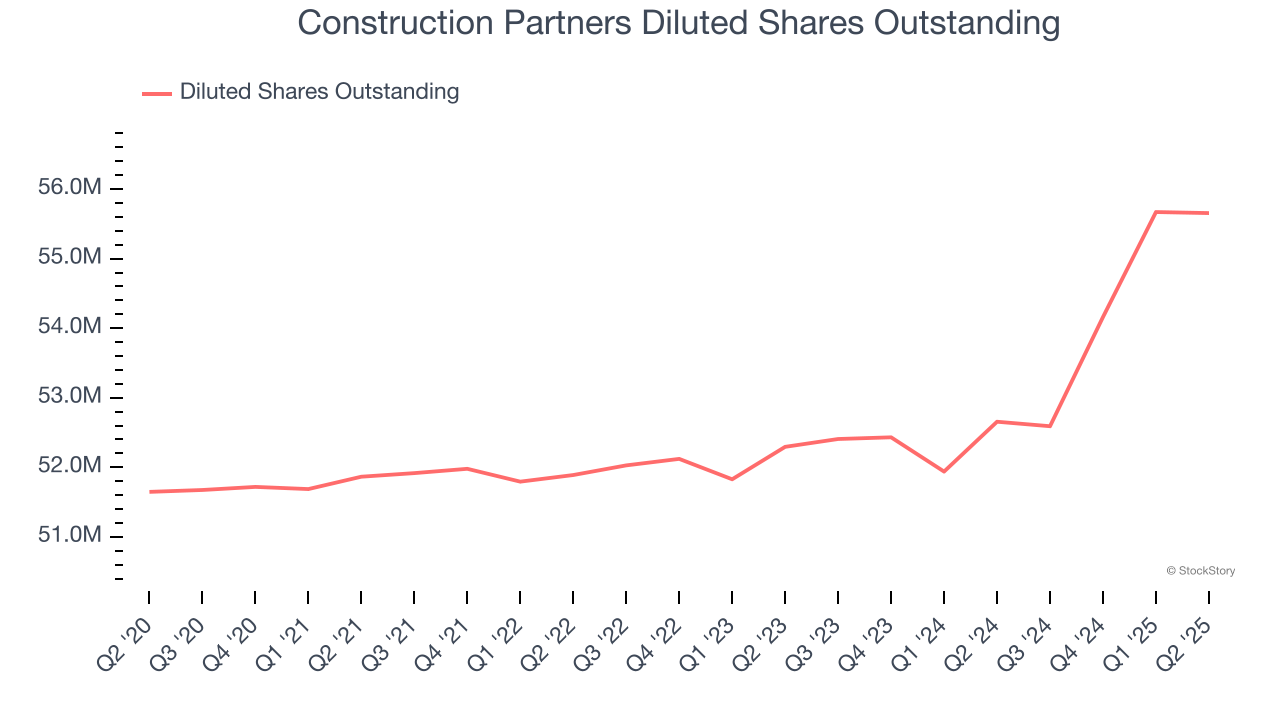

We can take a deeper look into Construction Partners’s earnings to better understand the drivers of its performance. A five-year view shows Construction Partners has diluted its shareholders, growing its share count by 7.8%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Construction Partners, its two-year annual EPS growth of 51.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Construction Partners reported EPS at $0.79, up from $0.59 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $1.37 to grow 95.5%.

Key Takeaways from Construction Partners’s Q2 Results

It was great to see Construction Partners’s full-year EBITDA guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a mixed quarter. Still, the stock traded up 10.4% to $103.32 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.