Skincare company BeautyHealth (NASDAQ: SKIN) announced better-than-expected revenue in Q1 CY2025, but sales fell by 14.5% year on year to $69.6 million. On the other hand, next quarter’s revenue guidance of $73.5 million was less impressive, coming in 2.9% below analysts’ estimates. Its GAAP loss of $0.08 per share was 37.6% above analysts’ consensus estimates.

Is now the time to buy BeautyHealth? Find out by accessing our full research report, it’s free.

BeautyHealth (SKIN) Q1 CY2025 Highlights:

- Revenue: $69.6 million vs analyst estimates of $63.34 million (14.5% year-on-year decline, 9.9% beat)

- EPS (GAAP): -$0.08 vs analyst estimates of -$0.13 (37.6% beat)

- Adjusted EBITDA: $7.3 million vs analyst estimates of -$5.54 million (10.5% margin, significant beat)

- The company reconfirmed its revenue guidance for the full year of $285 million at the midpoint

- EBITDA guidance for the full year is $20 million at the midpoint, above analyst estimates of $11.98 million

- Operating Margin: -17.2%, up from -20.9% in the same quarter last year

- Free Cash Flow was $3 million, up from -$18.66 million in the same quarter last year

- Market Capitalization: $178.9 million

“Our first quarter results reflect strong execution and continued momentum in our transformation strategy,” said CEO Marla Beck.

Company Overview

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ: SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $322.5 million in revenue over the past 12 months, BeautyHealth is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

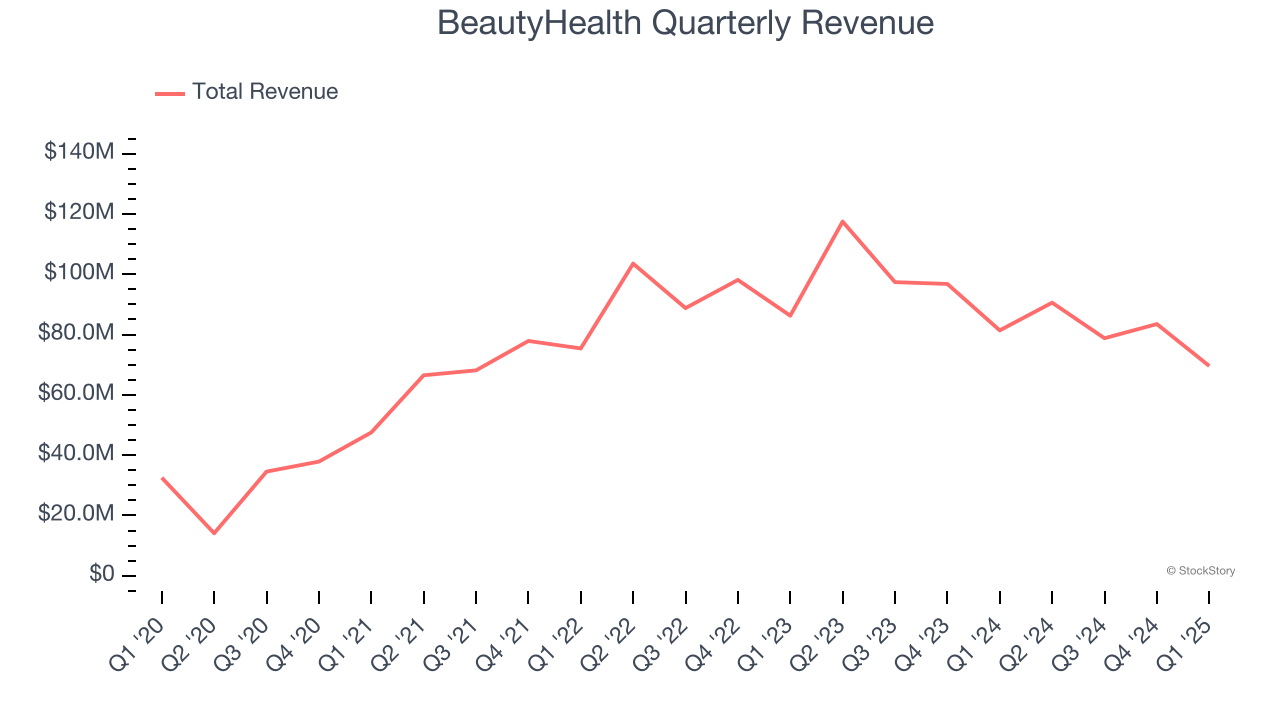

As you can see below, BeautyHealth’s 3.8% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, BeautyHealth’s revenue fell by 14.5% year on year to $69.6 million but beat Wall Street’s estimates by 9.9%. Company management is currently guiding for a 18.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 9.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

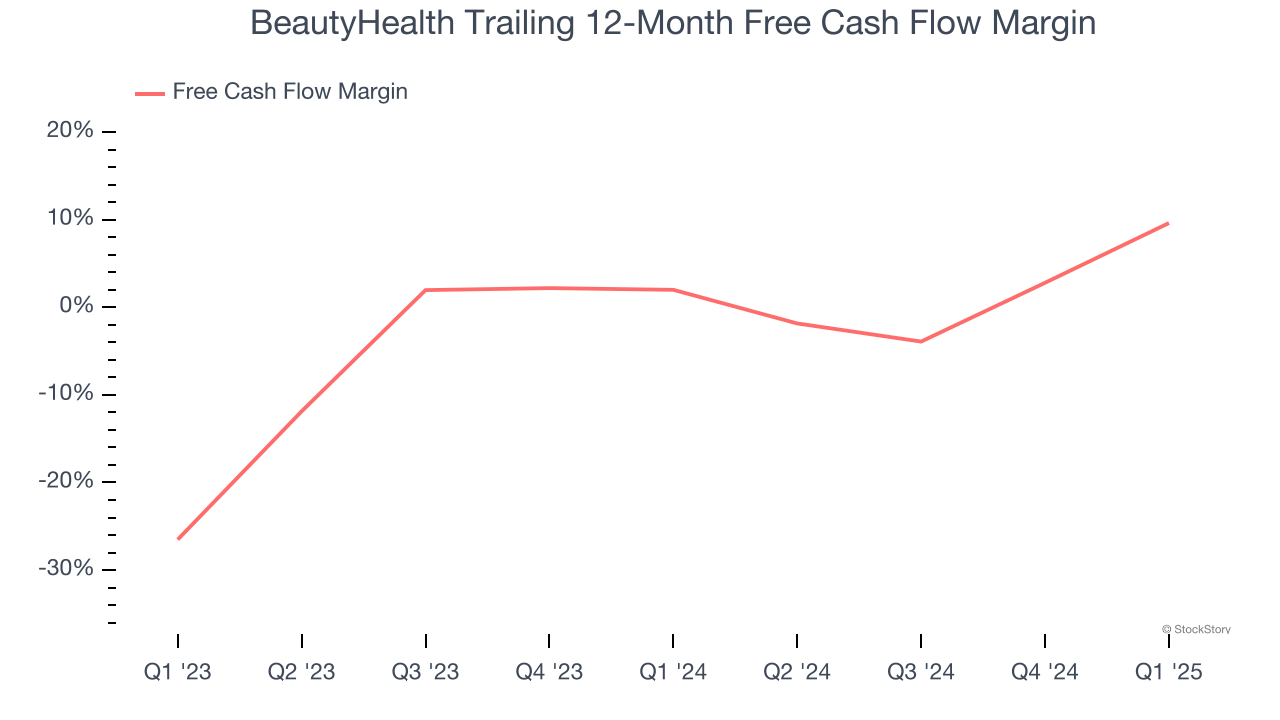

BeautyHealth has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.4% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that BeautyHealth’s margin expanded by 7.6 percentage points over the last year. This is encouraging because it gives the company more optionality.

BeautyHealth’s free cash flow clocked in at $3 million in Q1, equivalent to a 4.3% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from BeautyHealth’s Q1 Results

We were impressed by how significantly BeautyHealth blew past analysts’ gross margin expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 2.4% to $1.26 immediately after reporting.

Sure, BeautyHealth had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.