Senior living provider The Pennant Group (NASDAQ: PNTG) announced better-than-expected revenue in Q1 CY2025, with sales up 33.7% year on year to $209.8 million. Its non-GAAP profit of $0.27 per share was 13.7% above analysts’ consensus estimates.

Is now the time to buy The Pennant Group? Find out by accessing our full research report, it’s free.

The Pennant Group (PNTG) Q1 CY2025 Highlights:

- Revenue: $209.8 million vs analyst estimates of $201.5 million (33.7% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.27 vs analyst estimates of $0.24 (13.7% beat)

- Adjusted EBITDA: $16.37 million vs analyst estimates of $14.22 million (7.8% margin, 15.2% beat)

- Operating Margin: 6%, up from 5% in the same quarter last year

- Sales Volumes rose 28.9% year on year (34.3% in the same quarter last year)

- Market Capitalization: $928.4 million

“We are off to a strong start in 2025,” said Brent Guerisoli, the Company’s Chief Executive Officer.

Company Overview

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ: PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

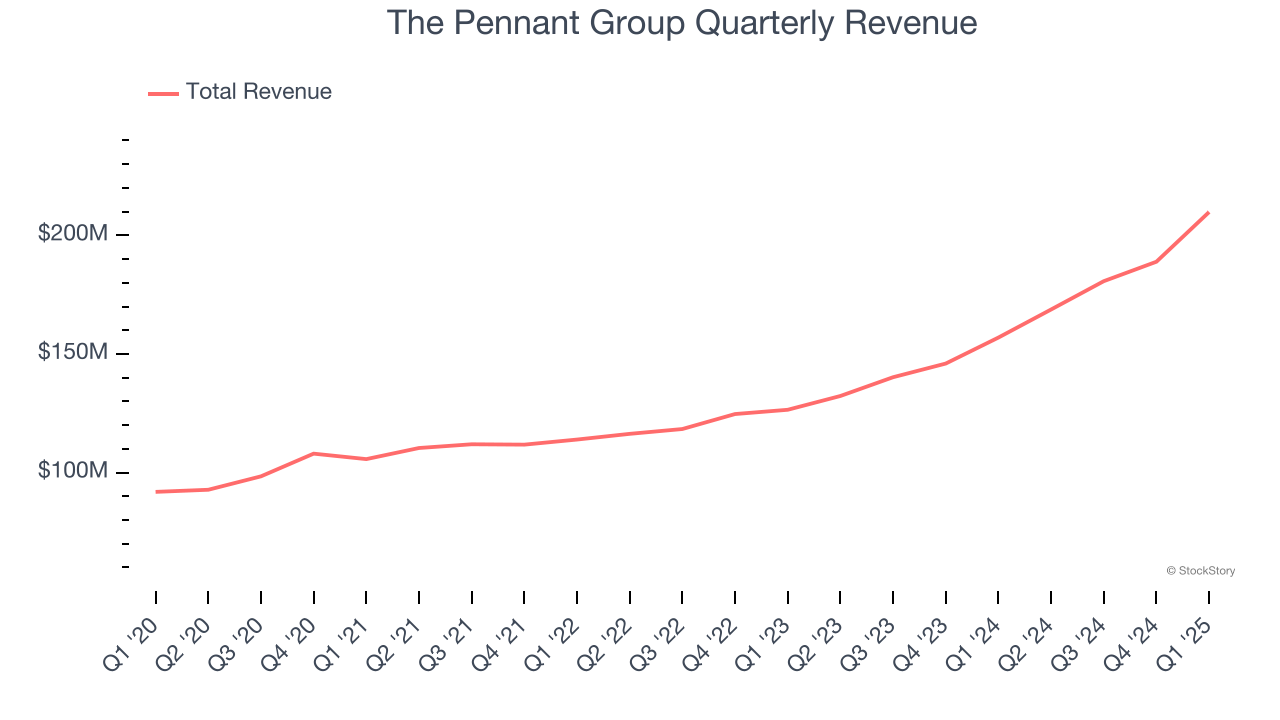

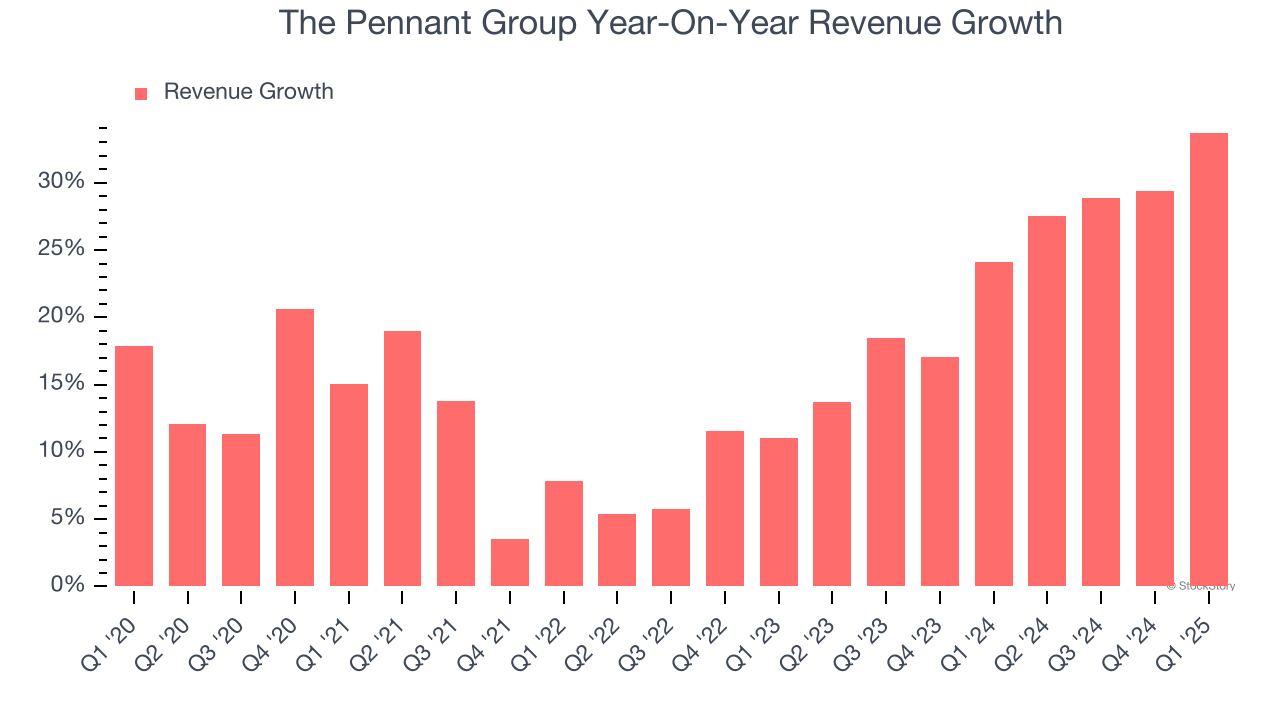

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, The Pennant Group’s 16.2% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. The Pennant Group’s annualized revenue growth of 24.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

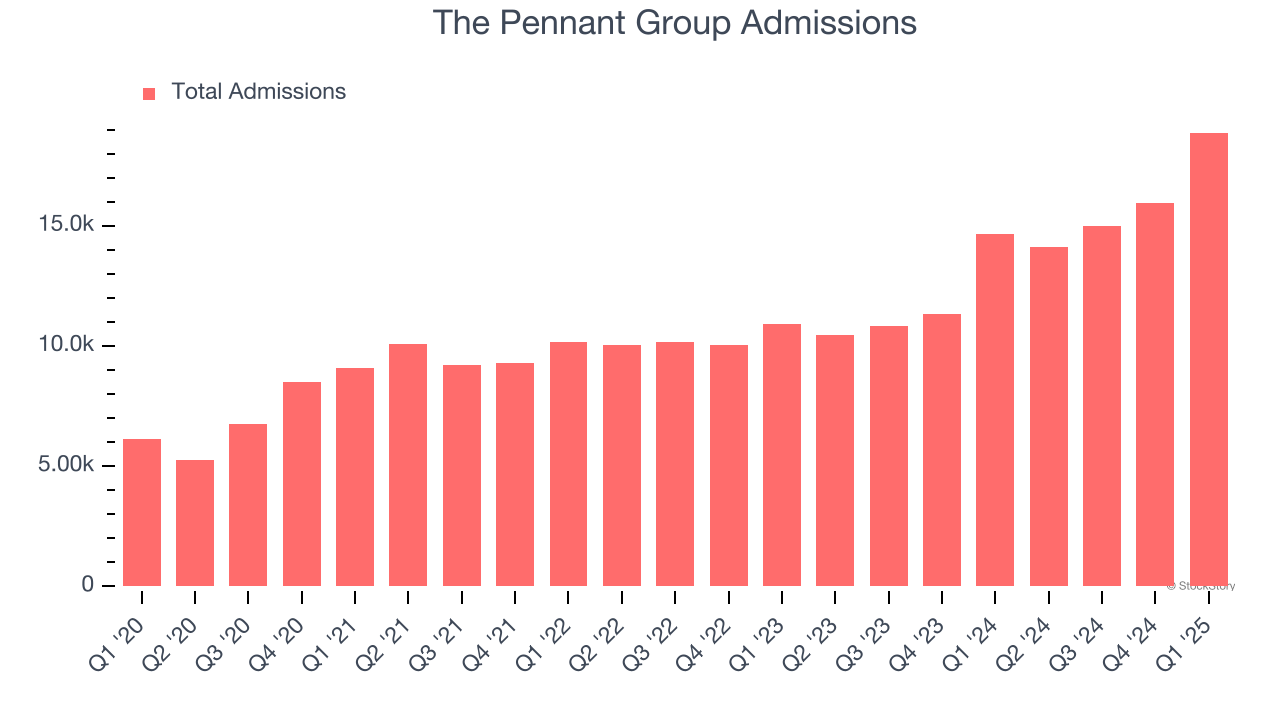

We can better understand the company’s revenue dynamics by analyzing its number of admissions, which reached 18,878 in the latest quarter. Over the last two years, The Pennant Group’s admissions averaged 25.1% year-on-year growth. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, The Pennant Group reported wonderful year-on-year revenue growth of 33.7%, and its $209.8 million of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

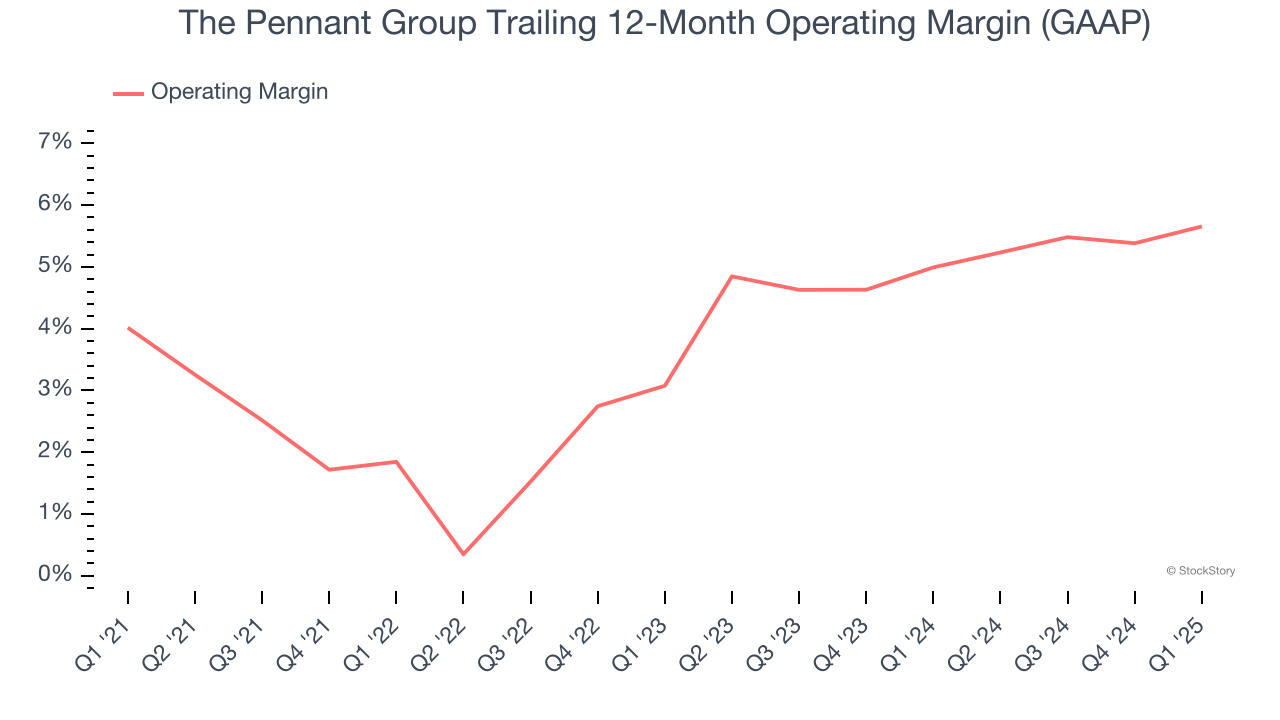

The Pennant Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for a healthcare business.

On the plus side, The Pennant Group’s operating margin rose by 1.6 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, The Pennant Group generated an operating profit margin of 6%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

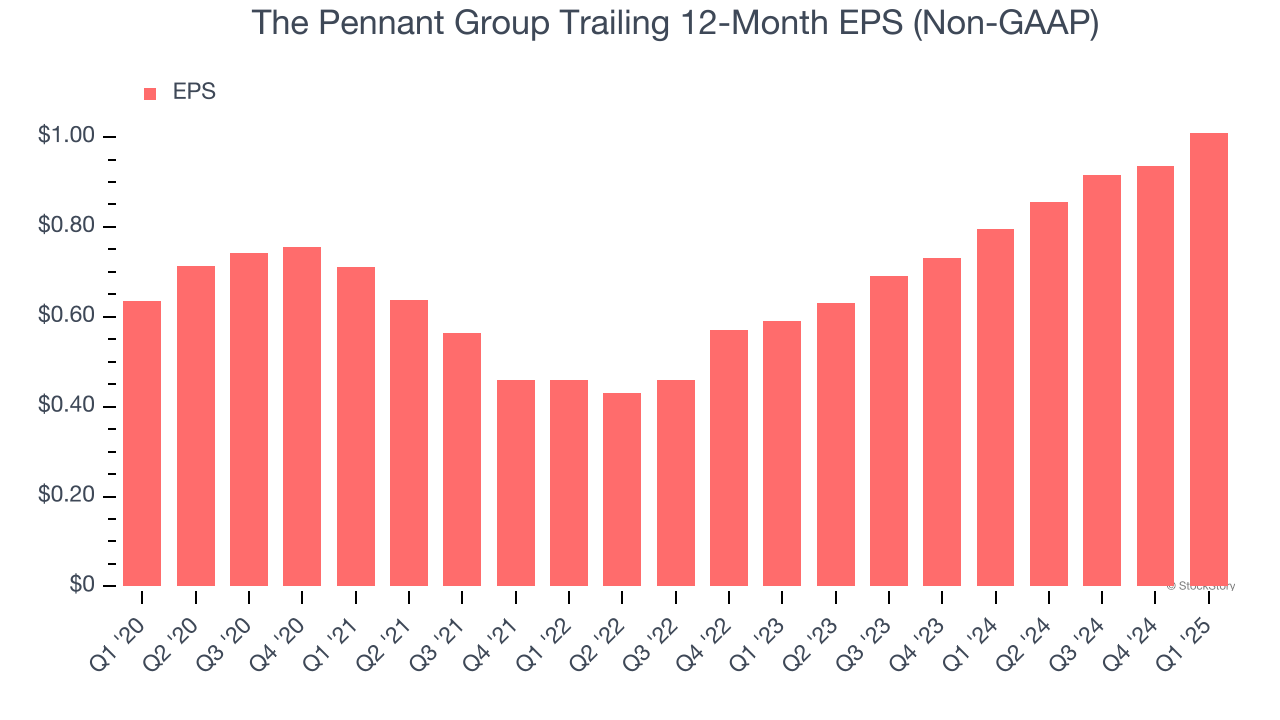

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The Pennant Group’s EPS grew at a remarkable 9.7% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 16.2% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

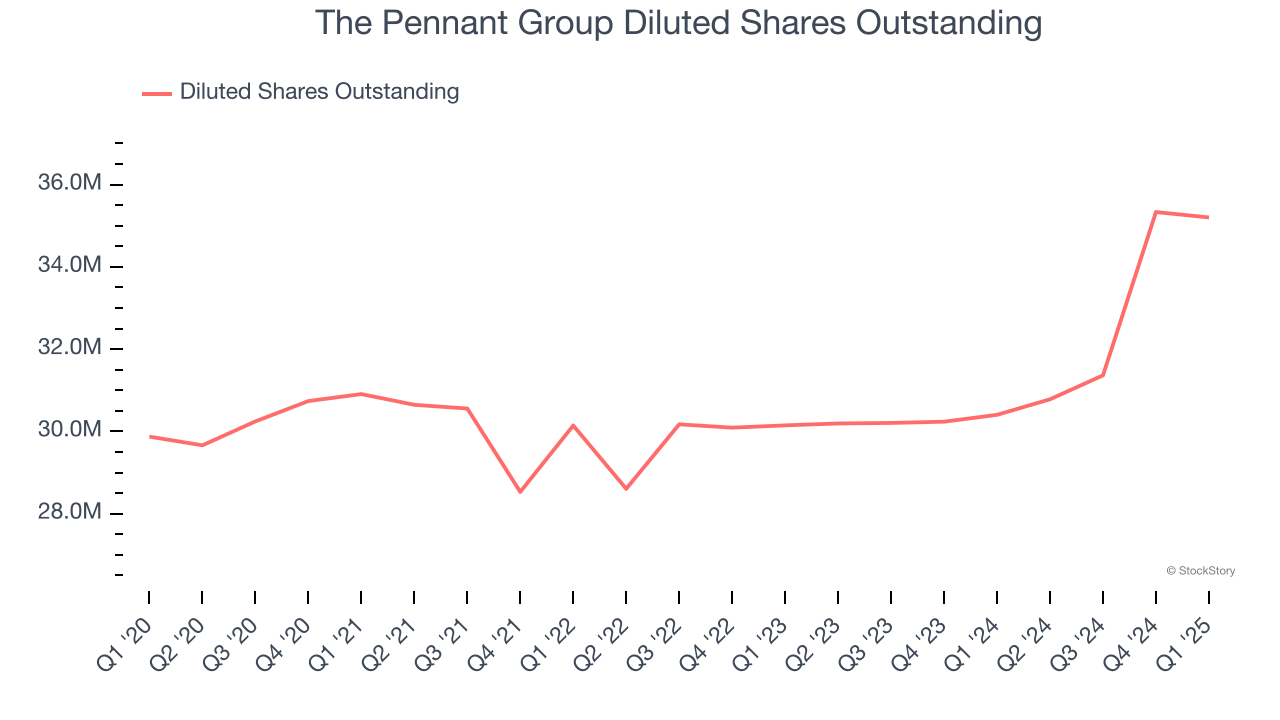

We can take a deeper look into The Pennant Group’s earnings to better understand the drivers of its performance. A five-year view shows The Pennant Group has diluted its shareholders, growing its share count by 17.8%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, The Pennant Group reported EPS at $0.27, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects The Pennant Group’s full-year EPS of $1.01 to grow 12.4%.

Key Takeaways from The Pennant Group’s Q1 Results

We enjoyed seeing The Pennant Group beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $26.84 immediately following the results.

Is The Pennant Group an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.