Biotech company Vertex Pharmaceuticals (NASDAQ: VRTX) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 15.7% year on year to $2.91 billion. The company expects the full year’s revenue to be around $11.88 billion, close to analysts’ estimates. Its non-GAAP profit of $3.98 per share was 1% below analysts’ consensus estimates.

Is now the time to buy Vertex Pharmaceuticals? Find out by accessing our full research report, it’s free.

Vertex Pharmaceuticals (VRTX) Q4 CY2024 Highlights:

- Revenue: $2.91 billion vs analyst estimates of $2.78 billion (15.7% year-on-year growth, 4.9% beat)

- Adjusted EPS: $3.98 vs analyst expectations of $4.02 (1% miss)

- Adjusted Operating Income: $1.20 billion vs analyst estimates of $1.19 billion (41.2% margin, 0.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $11.88 billion at the midpoint, in line with analyst expectations and implying 7.8% growth (vs 11.7% in FY2024)

- Operating Margin: 35.2%, down from 39.3% in the same quarter last year

- Market Capitalization: $120.9 billion

“2024 marked a year of tremendous growth for Vertex and we anticipate 2025 will be another important year with the landmark JOURNAVX approval and launch for moderate-to-severe acute pain; the launch of our fifth CF medicine, ALYFTREK; the continuing global launch of CASGEVY; and multiple ongoing pivotal trials. We are excited to drive diversification of the revenue base, disease areas of focus, R&D pipeline, and geographies to continue to deliver long-term value to both patients and shareholders,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex.

Company Overview

Founded in 1989 to focus on a broad range of diseases, Vertex Pharmaceuticals (NASDAQ: VRTX) has since narrowed its focus and is now a biotechnology company known for its groundbreaking treatments for cystic fibrosis (CF), a genetic lung disease.

Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

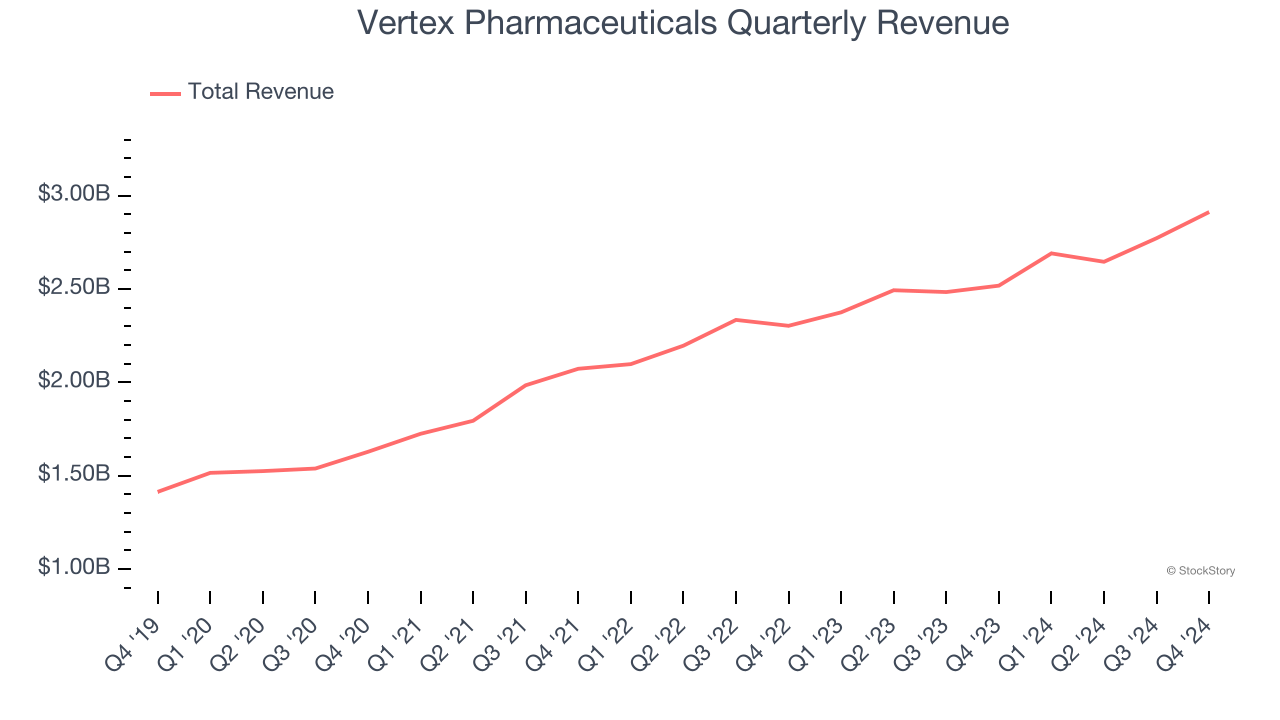

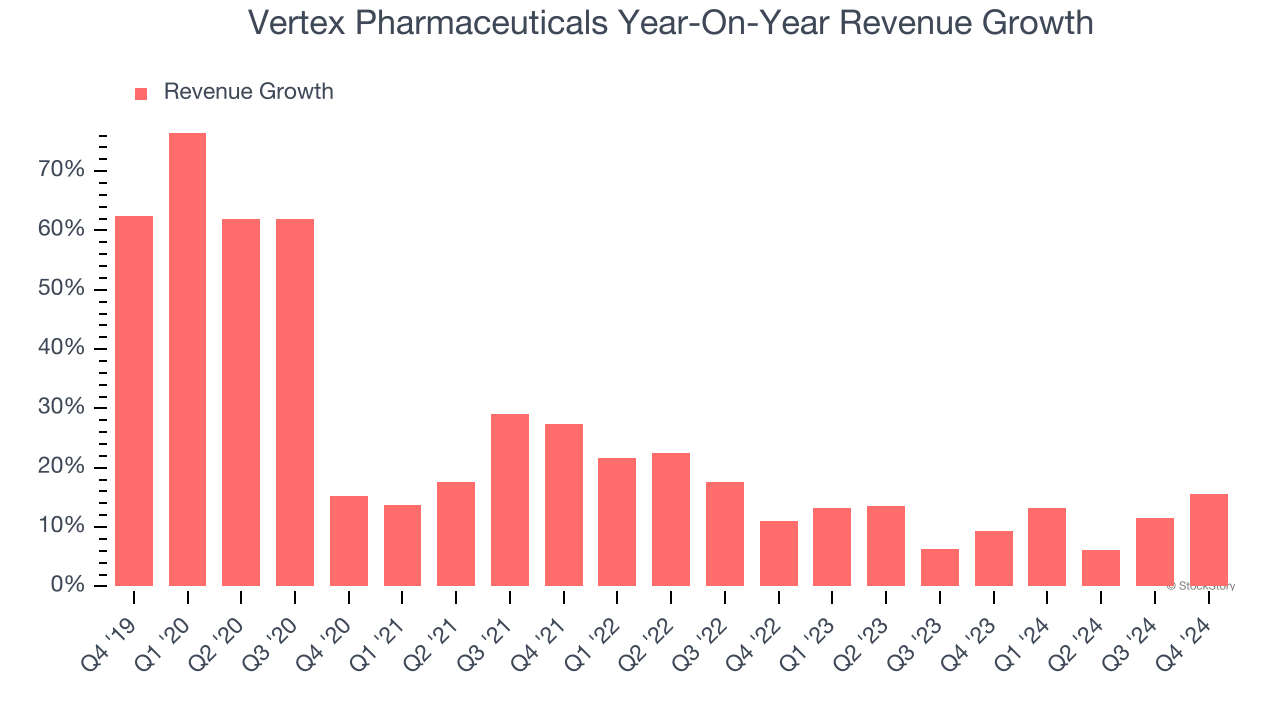

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Vertex Pharmaceuticals’s sales grew at an excellent 21.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Vertex Pharmaceuticals’s annualized revenue growth of 11.1% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Vertex Pharmaceuticals reported year-on-year revenue growth of 15.7%, and its $2.91 billion of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and implies the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

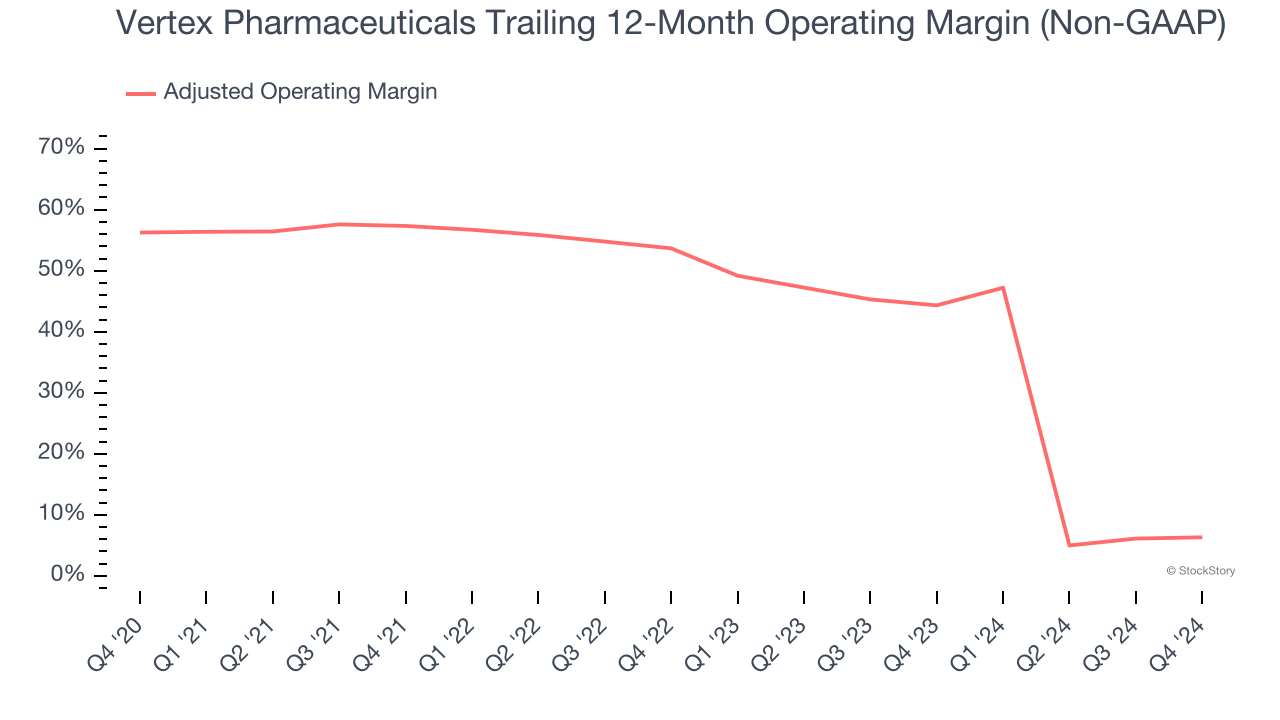

Adjusted Operating Margin

Vertex Pharmaceuticals has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 40.6%.

Analyzing the trend in its profitability, Vertex Pharmaceuticals’s adjusted operating margin decreased by 49.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 47.4 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Vertex Pharmaceuticals generated an adjusted operating profit margin of 41.2%, down 4.6 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

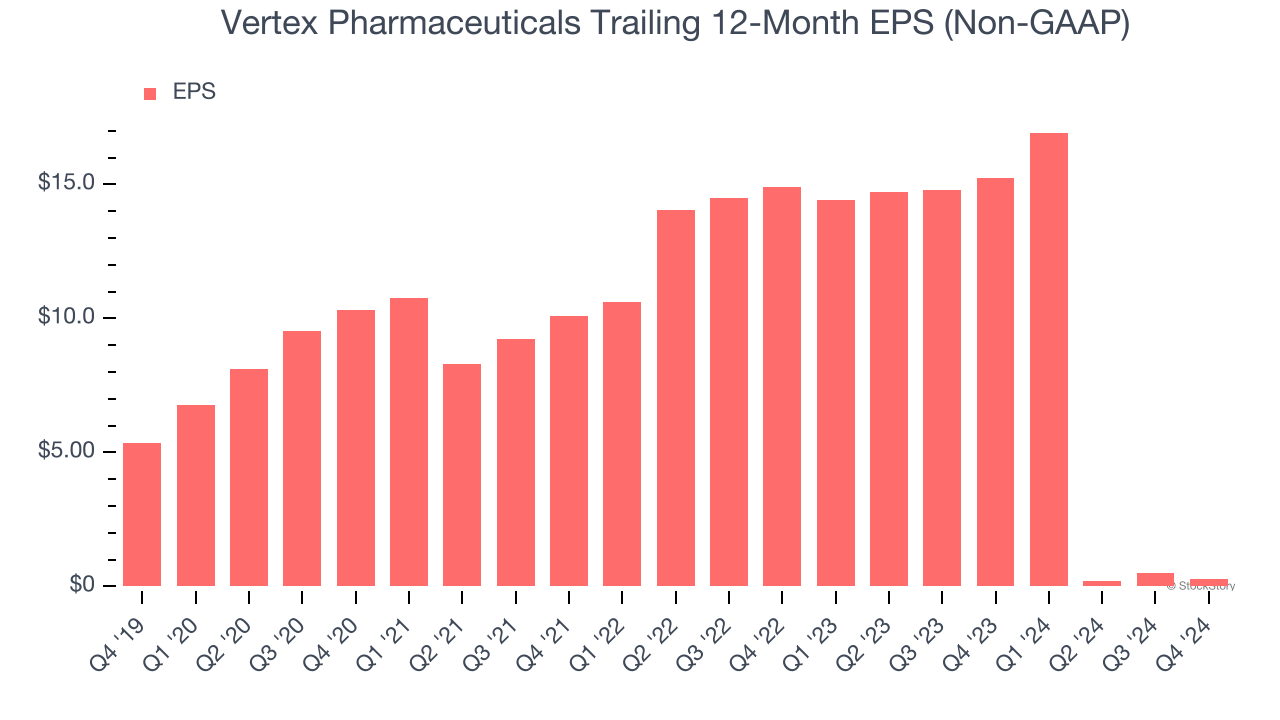

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Vertex Pharmaceuticals, its EPS declined by 44% annually over the last five years while its revenue grew by 21.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Vertex Pharmaceuticals’s earnings can give us a better understanding of its performance. As we mentioned earlier, Vertex Pharmaceuticals’s adjusted operating margin declined by 49.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Vertex Pharmaceuticals reported EPS at $3.98, down from $4.20 in the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Vertex Pharmaceuticals’s full-year EPS of $0.29 to grow 6,298%.

Key Takeaways from Vertex Pharmaceuticals’s Q4 Results

We enjoyed seeing Vertex Pharmaceuticals exceed analysts’ revenue and adjusted operating income expectations this quarter. On the other hand, its EPS slightly missed and its full-year revenue guidance was in line. Overall, this quarter was decent. The stock remained flat at $472.04 immediately following the results.

So should you invest in Vertex Pharmaceuticals right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.