Since December 2020, the S&P 500 has delivered a total return of 84.2%. But one standout stock has more than doubled the market - over the past five years, BNY has surged 189% to $117.00 per share. Its momentum hasn’t stopped as it’s also gained 29.3% in the last six months thanks to its solid quarterly results, beating the S&P by 16.2%.

Is now the time to buy BNY, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is BNY Not Exciting?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons you should be careful with BK and a stock we'd rather own.

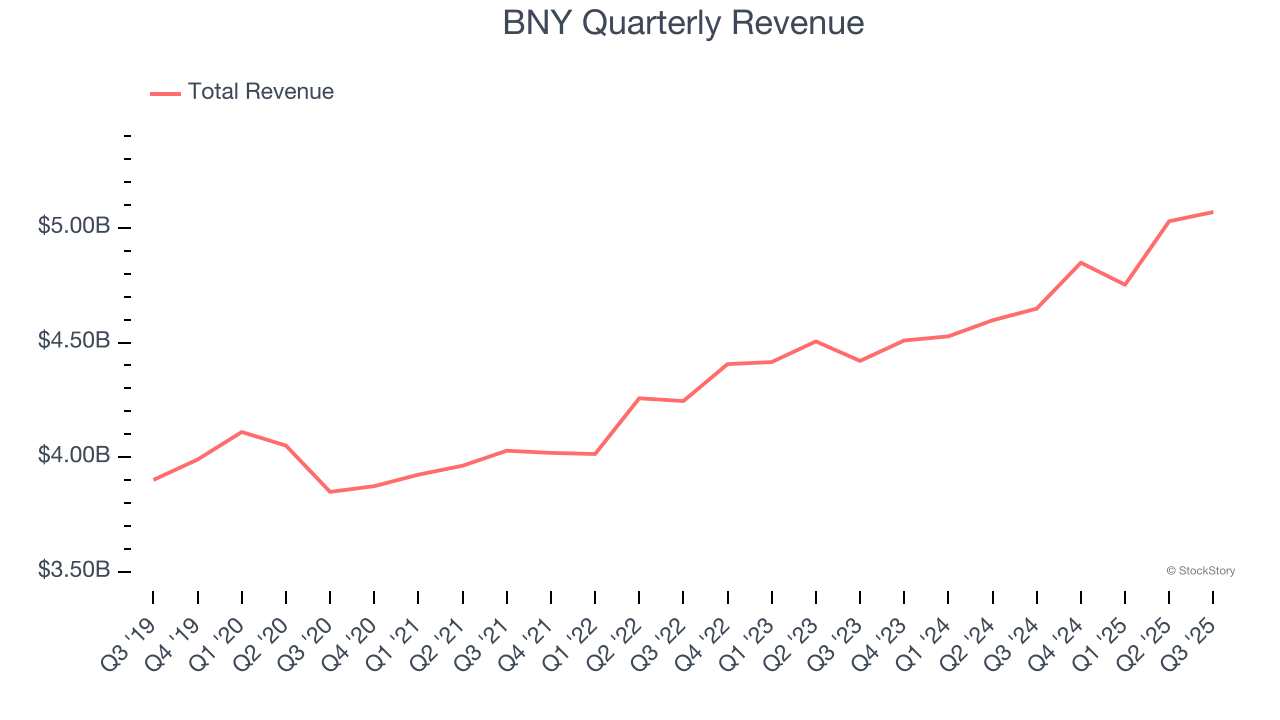

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Unfortunately, BNY’s 4.2% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the financials sector.

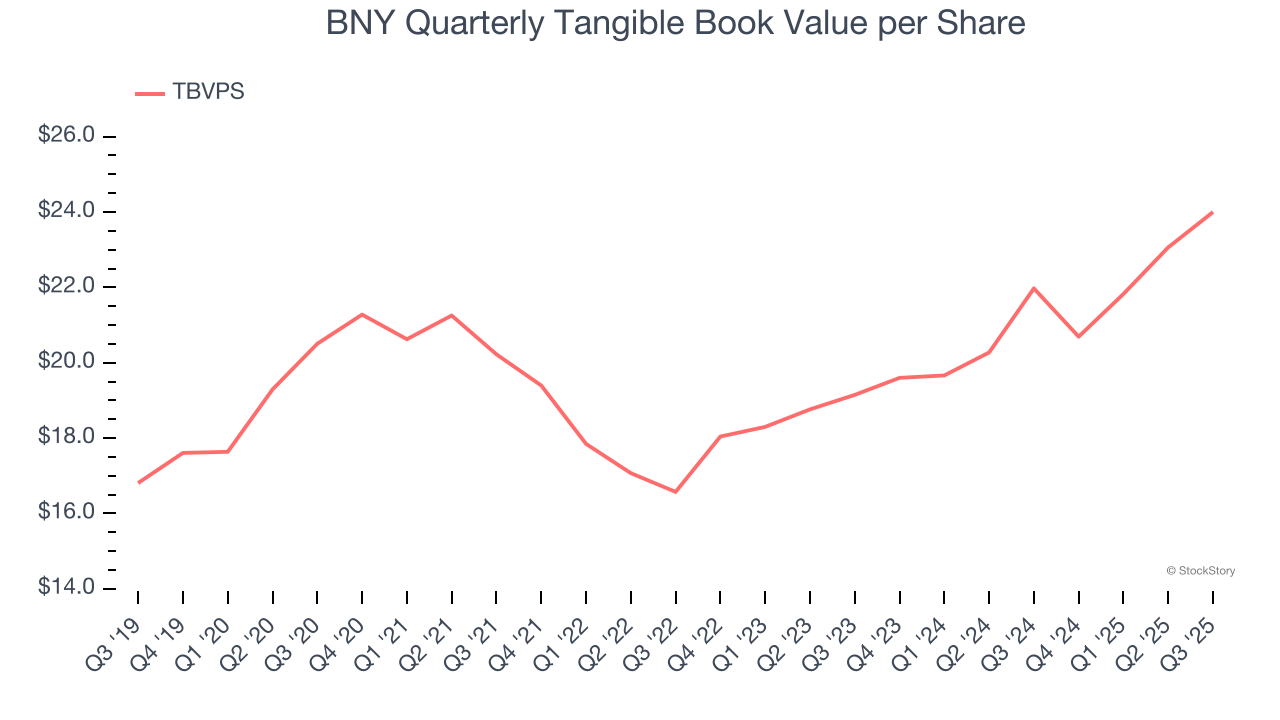

2. Steady Increase in TBVPS Highlights Solid Asset Growth

Tangible book value per share (TBVPS) serves as a key indicator of a financial institution’s strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during economic distress.

Although BNY’s TBVPS increased by a meager 3.2% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at a solid 12% annual clip over the past two years (from $19.15 to $24.00 per share).

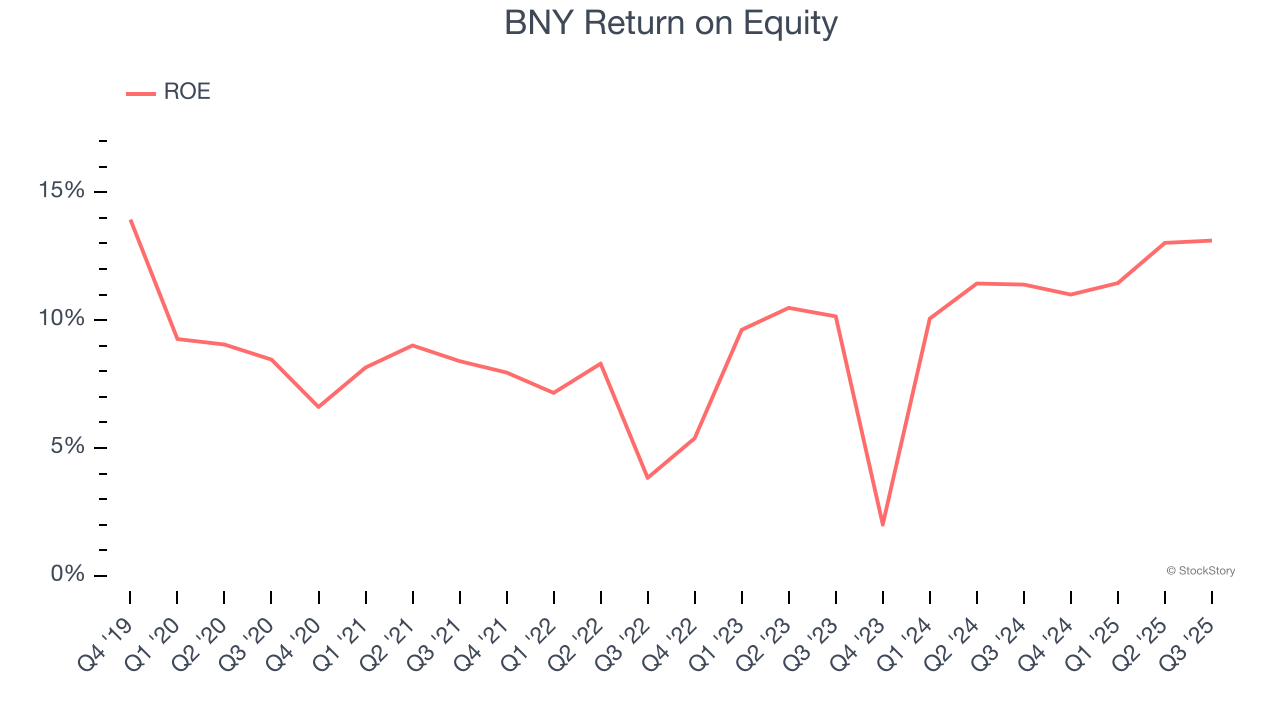

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, BNY has averaged an ROE of 8.9%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

BNY isn’t a terrible business, but it doesn’t pass our bar. With its shares beating the market recently, the stock trades at 14.7× forward P/E (or $117.00 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than BNY

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.