Ride sharing service Lyft (NASDAQ: LYFT) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 10.7% year on year to $1.69 billion. Its GAAP profit of $0.11 per share was 53.6% above analysts’ consensus estimates.

Is now the time to buy Lyft? Find out by accessing our full research report, it’s free for active Edge members.

Lyft (LYFT) Q3 CY2025 Highlights:

- Revenue: $1.69 billion vs analyst estimates of $1.70 billion (10.7% year-on-year growth, 1.2% miss)

- EPS (GAAP): $0.11 vs analyst estimates of $0.07 (53.6% beat)

- Adjusted EBITDA: $138.9 million vs analyst estimates of $139.8 million (8.2% margin, 0.6% miss)

- Q4 Guidance: Gross Bookings of approximately $5.01 billion to $5.13 billion, up approximately 17% to 20% year over year (beat)

- Operating Margin: 1.4%, up from -3.7% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 20.7% in the previous quarter

- Active Riders: 28.7 million, up 4.3 million year on year

- Market Capitalization: $7.89 billion

Company Overview

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

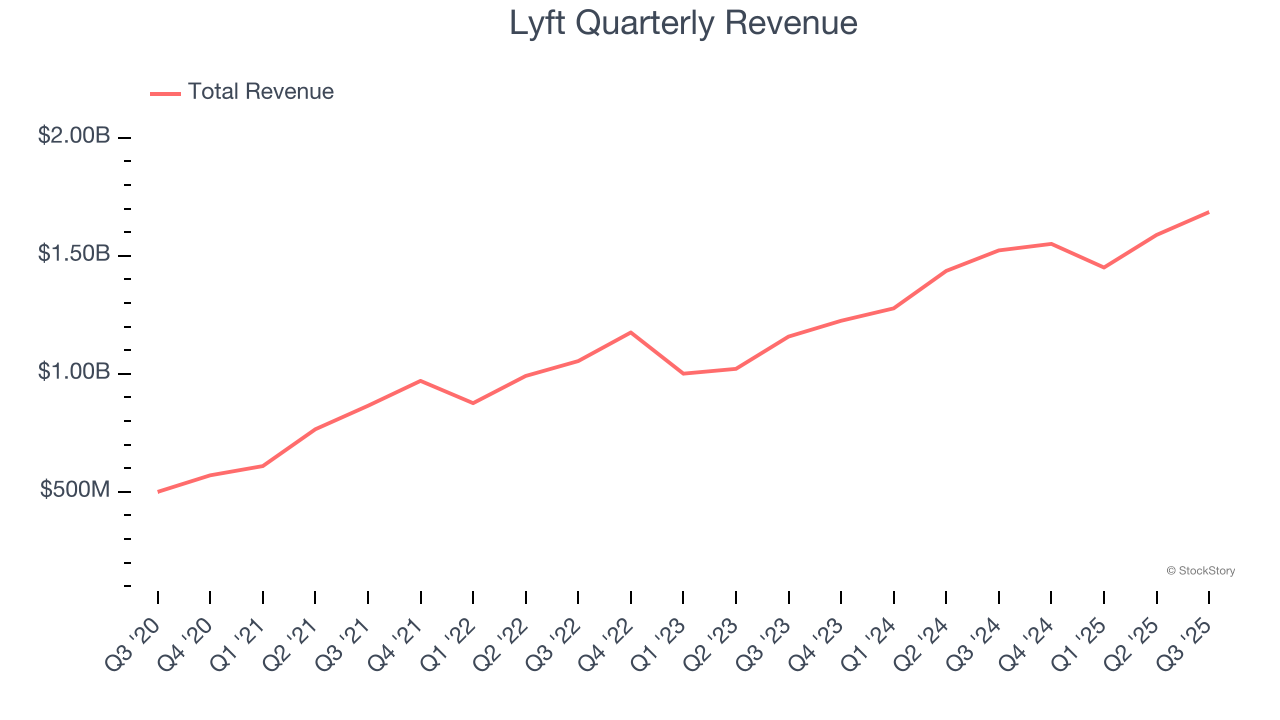

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Lyft’s sales grew at a solid 17.3% compounded annual growth rate over the last three years. Its growth beat the average consumer internet company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Lyft’s revenue grew by 10.7% year on year to $1.69 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and implies the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Active Riders

User Growth

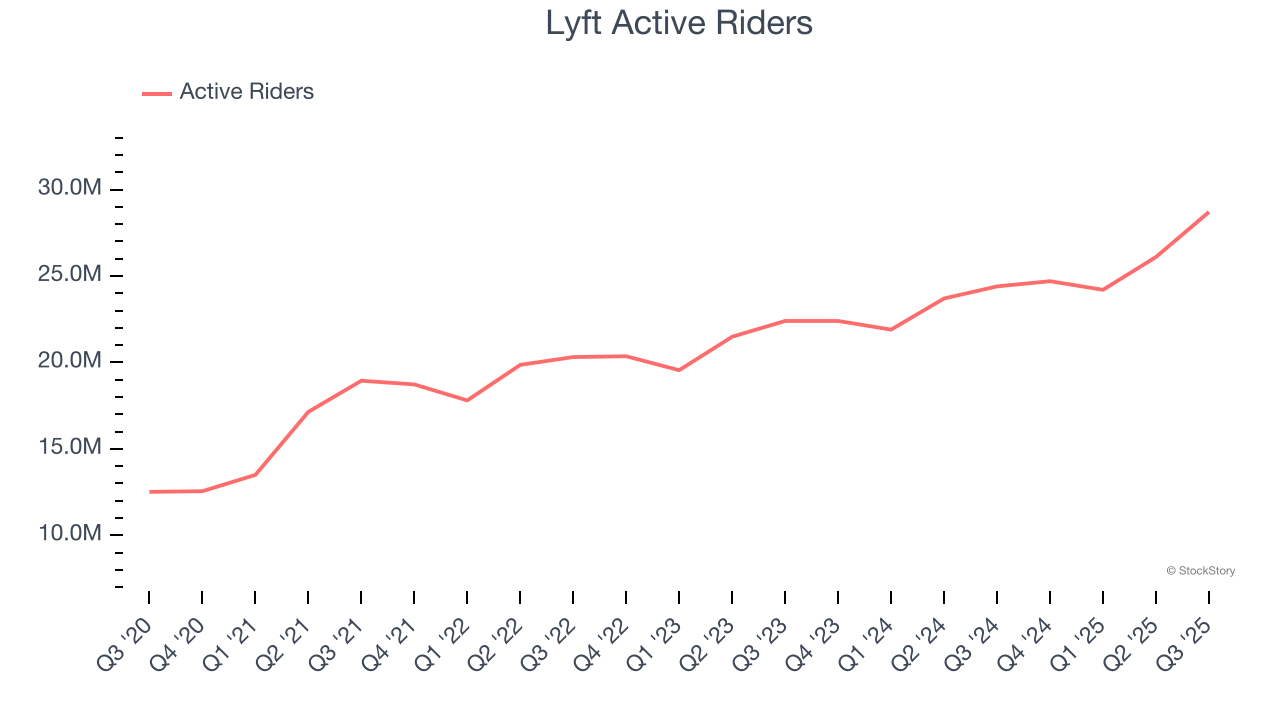

As a gig economy marketplace, Lyft generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, Lyft’s active riders, a key performance metric for the company, increased by 11.2% annually to 28.7 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q3, Lyft added 4.3 million active riders, leading to 17.6% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

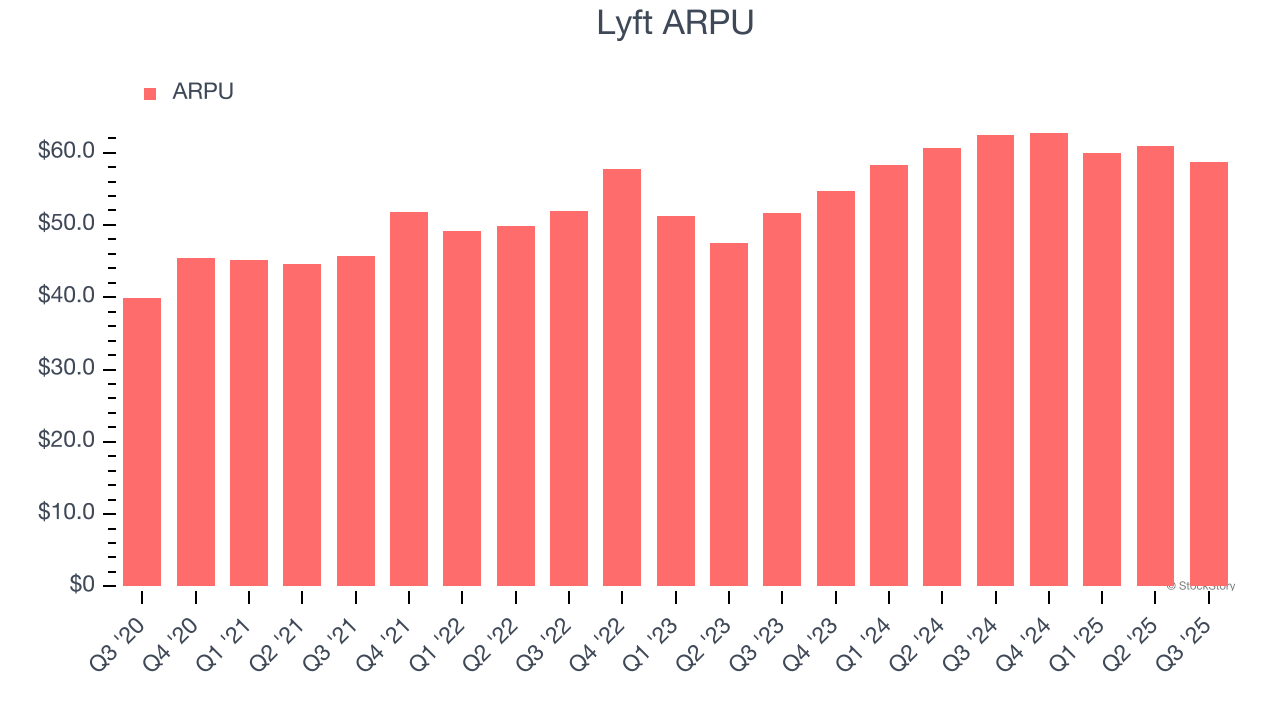

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. This number also informs us about Lyft’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Lyft’s ARPU growth has been impressive over the last two years, averaging 8.6%. Its ability to increase monetization while quickly growing its active riders reflects the strength of its platform, as its users continue to spend more each year.

This quarter, Lyft’s ARPU clocked in at $58.72. It declined 5.9% year on year, worse than the change in its active riders.

Key Takeaways from Lyft’s Q3 Results

It was encouraging to see Lyft beat analysts’ number of active riders expectations this quarter. We were also glad it expanded its number of users. Looking ahead, Q4 guidance for gross bookings came in ahead of expectations. On the other hand, its revenue slightly missed Wall Street’s estimates. Overall, this was still a solid quarter. The stock traded up 2.5% to $20.62 immediately after reporting.

So do we think Lyft is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.